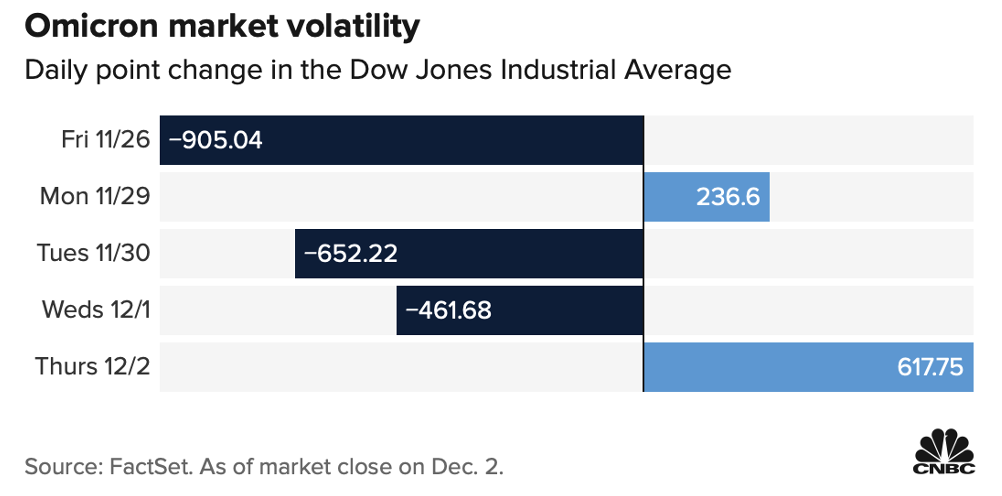

All week the stock market has been locked into a tennis rally between the expected very positive economic outlook for 2022 and the potentially negative implications of Omicron.

While the economic outlook seems easier to believe in, Omicron is all speculation until we get the word from the expert medicos and the big drug companies that will either give their current vaccines the thumbs up or tell us that some tweaking is necessary.

In my Weekend Switzer story today, I look at the current crop (or is it crap?) of media scare headlines and then make the point that there are other more positive takes on the threat of Omicron.

For example, did you see this? ‘Pfizer CEO Albert Bourla said he’s pretty confident the company’s new COVID-19 treatment pill will be effective against the Omicron coronavirus variant.’

It’s why I’m reserving my anxiety until we get more to work off than media hype merchants pedalling speculative negativity.

So let’s look at what happened overnight on overseas stock markets. European markets were down on Omicron fears, with the World Health Organisation telling us that the new strain has now been detected in 38 countries, up from 23 just two days ago. This shouldn’t surprise anyone who has been alive, breathing and thinking since March 2020, when the Coronavirus invaded our lives.

The virus spreads but we have to know how threatening it is and whether our current vaccinations will prevent excessive restrictions and lockdowns. That news will determine calculations on economic growth, future company profits and then share prices.

Not helping positivity overnight was a worse-than-expected jobs report in the US. Only 210,000 jobs showed up in November, which was a lot less than the 573,000 jobs guessed by economists in the Dow Jones survey.

Against that, the jobless rate fell from 4.5% to 4.2% but history and a lifetime of economic experience have taught me that you never overinflate the importance of one month’s figures, even if the weird little people on Wall Street can!

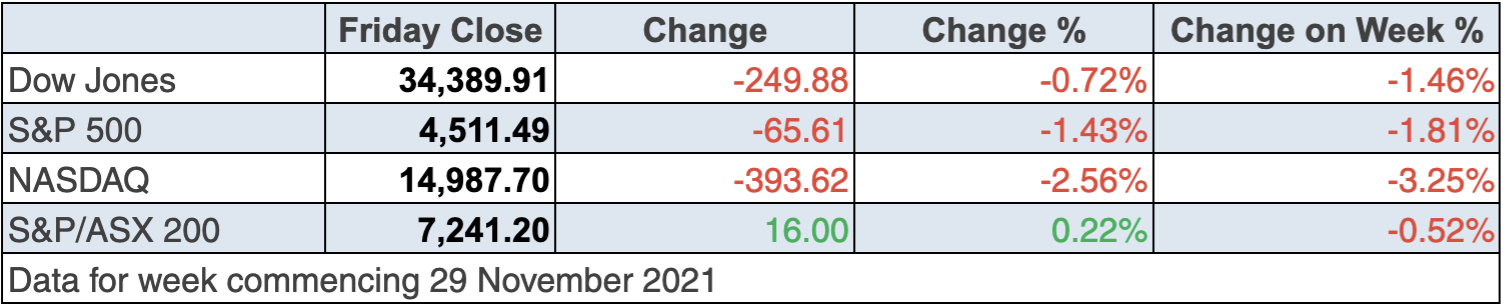

This chart actually shows the ‘tennis-like’ tussle between the positivity of the economic outlook and the negativity of Omicron, and with the overnight trade, it’s been a better week for the pessimists.

As you know, I’m a dip buyer but without the best information about this variant of the virus, I know it’s more speculation than I like, but I’m not alone.

CNBC reports that Barclays told clients on Friday to stay the course and buy the market on dips. “We remain of the view that overall macro and liquidity conditions are supportive of equities, and advise to add on weakness, looking for the bull market to carry on,” said Emmanuel Cau, who is the Managing Director at Barclays Capital Securities in London.

Not helping stocks this week was Fed boss Jerome Powell, who seems to have gained more courage since having his job renewed for another four years. This new contract assuring him of his future income seemingly has made it easy for him to forget about other peoples’ incomes!

US share markets fell on Tuesday after Fed Chair Powell discussed an earlier wrap-up of bond buying than the market was expecting. Now I get it that central bankers have to call their monetary policy without fear or favour but when you have the head of Moderna stupidly speculating that his vaccines “were unlikely to be as effective against Omicron as they are against Delta”, then maybe Powell could’ve held his tongue until he sees how this new threat to the economy plays out.

Why? Well if Omicron proves worse than I hope, then Powell might have to delay his tapering of the Fed’s bond buying, which gives his virus-infected economy some economic protection from recession. This is pretty important for stock prices as well!

So how come tech stocks were belted overnight after a weak jobs report? This is tricky but the report was so confusing that some experts think the Household Survey’s take on job creation is more believable — and it was very bullish, which makes sense when we saw overnight that unemployment fell from 4.6% to 4.2%, while the participation rate increased.

“This report is a tale of two surveys,” said Nick Bunker, economic research director at jobs placement site Indeed. “The household survey shows accelerating employment gains, workers returning to the labor force, and low levels of involuntary part-time work. The payroll survey shows a significant deceleration in job growth, particularly in COVID-affected sectors.”

It comes as most of the Fed Governors who vote on US monetary policy are fearing inflation and are starting to talk about an interest rate rise sooner than later. Only an Omicron catastrophe would change their thinking.

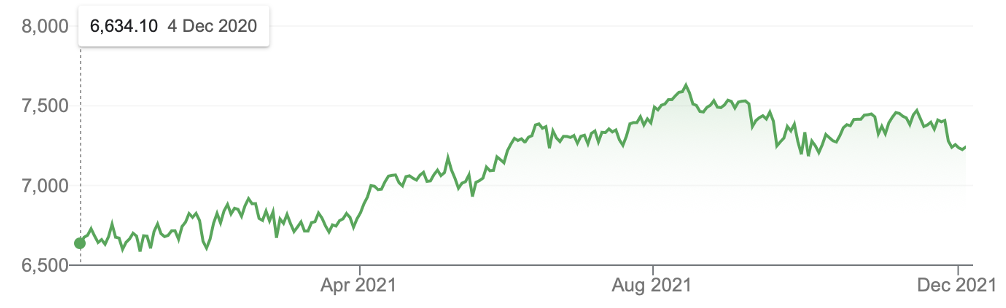

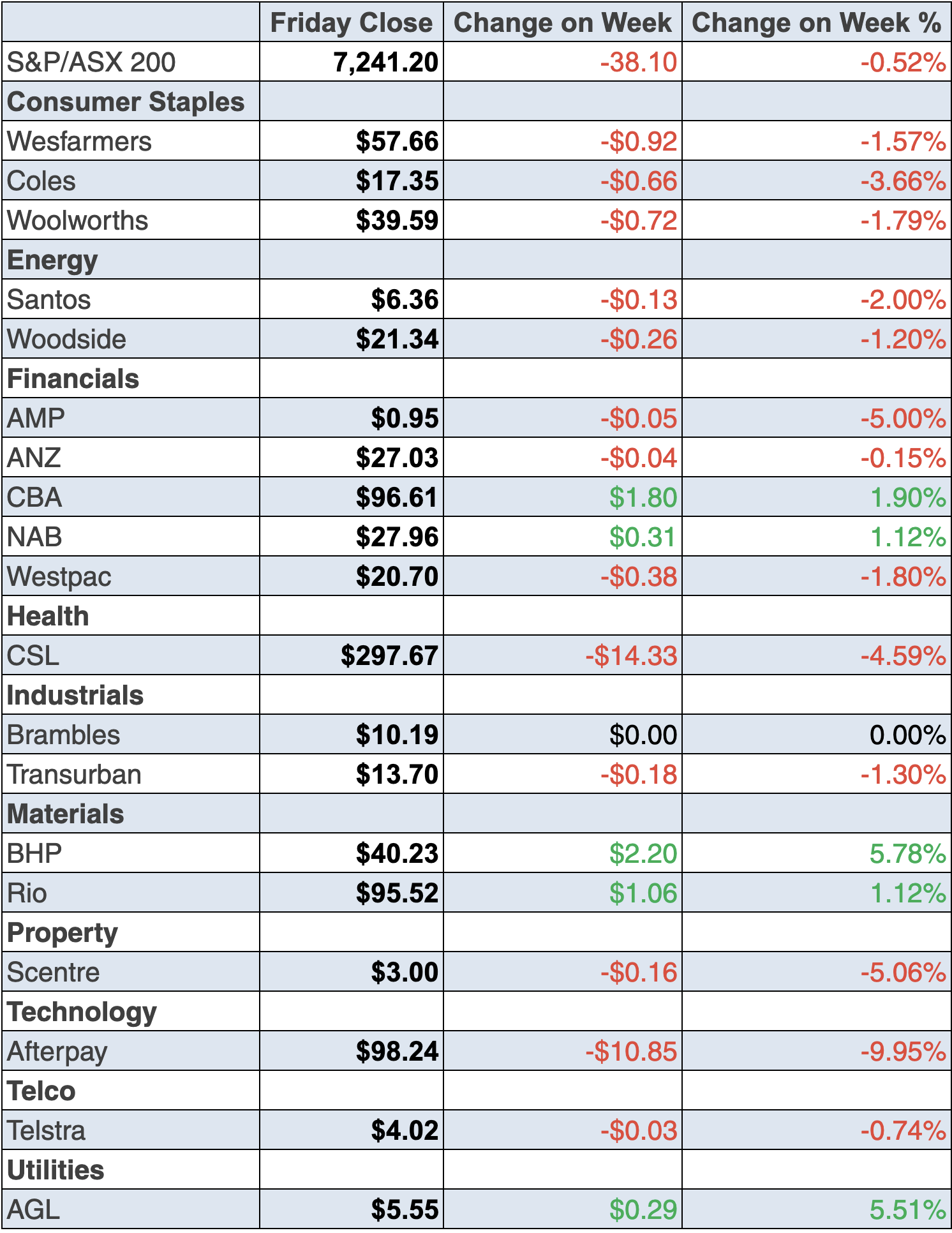

To the local story and the S&P/ASX 200 Index lost 0.5% for the week to end at 7241.23. The market has done little since the middle of the year but it has had a few challenges, such as long lockdowns, the Delta virus, the China trade intransigence, iron ore challenges and now Omicron. And recall that we learnt this week that our September quarter was a negative 1.9% growth number.

S&P/ASX 200

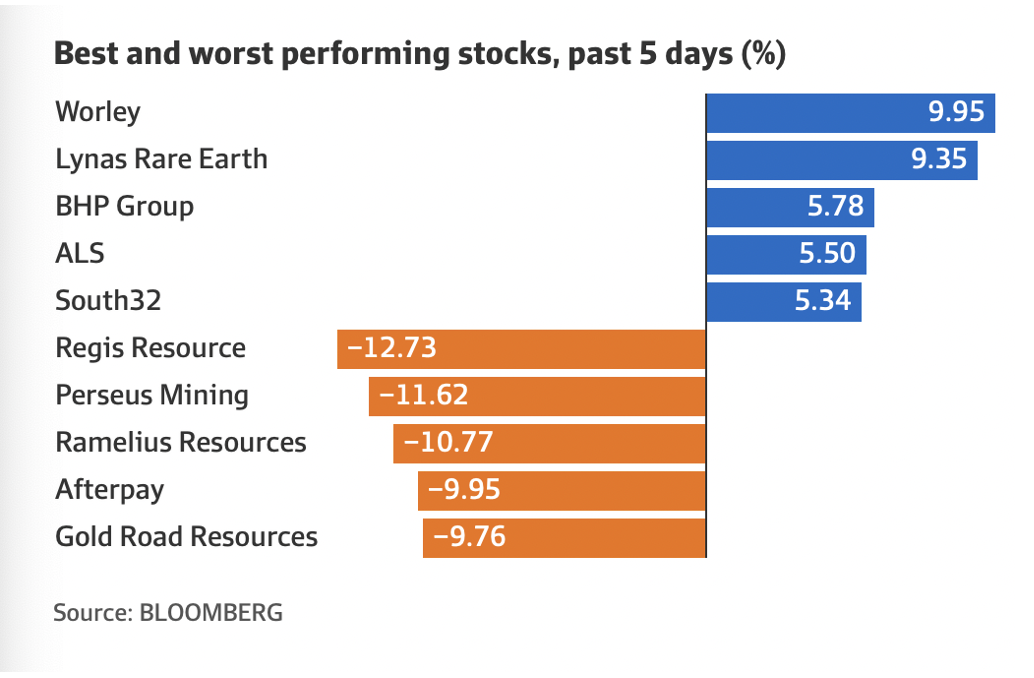

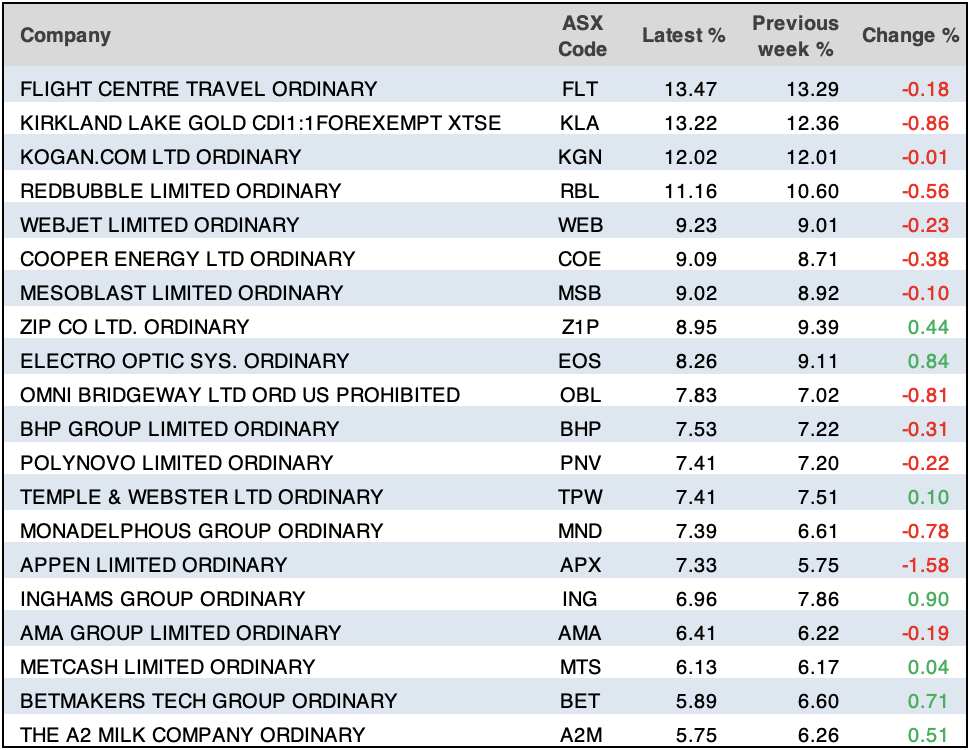

To this week’s winners and losers and this is how Bloomberg saw it:

Interestingly, energy had a good week but it has been a laggard for some time. Oil Search was up 3.86% for the week to $3.94 and Woodside 1.67% to $21.34.

Whitehaven Coal rose 2.95% to $3.83 and Bluescope Steel rose 2.92% to $20.47.

The iron ore miners rose on lower production forecasts from Brazil’s Vale, with BHP up 6.74% to $40.23, RIO put on 2.72% to $95.52 and Fortescue added 1.79% to $17.10, but it is up 20.59% for the month. I stuck my neck out on these companies a few weeks back and I’m glad to see them up even sooner than I expected.

CBA is creeping back up 3.47% for the week to $96.61, NAB rose 2.04% to $27.96 and ANZ was up 1.35% to $27.03. But Westpac still disappoints, down 0.48% to $20.70. It’s having a shocker!

CSL was down 4.59% to $297.67 on news of a very expensive takeover deal, with Swiss-based Vifor Pharma Group.

And then there was Novonix, the lithium battery business that has been up from $1 to $12.15 this year before a 32.43% fall on Friday on no news!!!! We must hear something next week about that.

What I liked

- Retail trade rose 4.9% in October to be up 5.2% on the year.

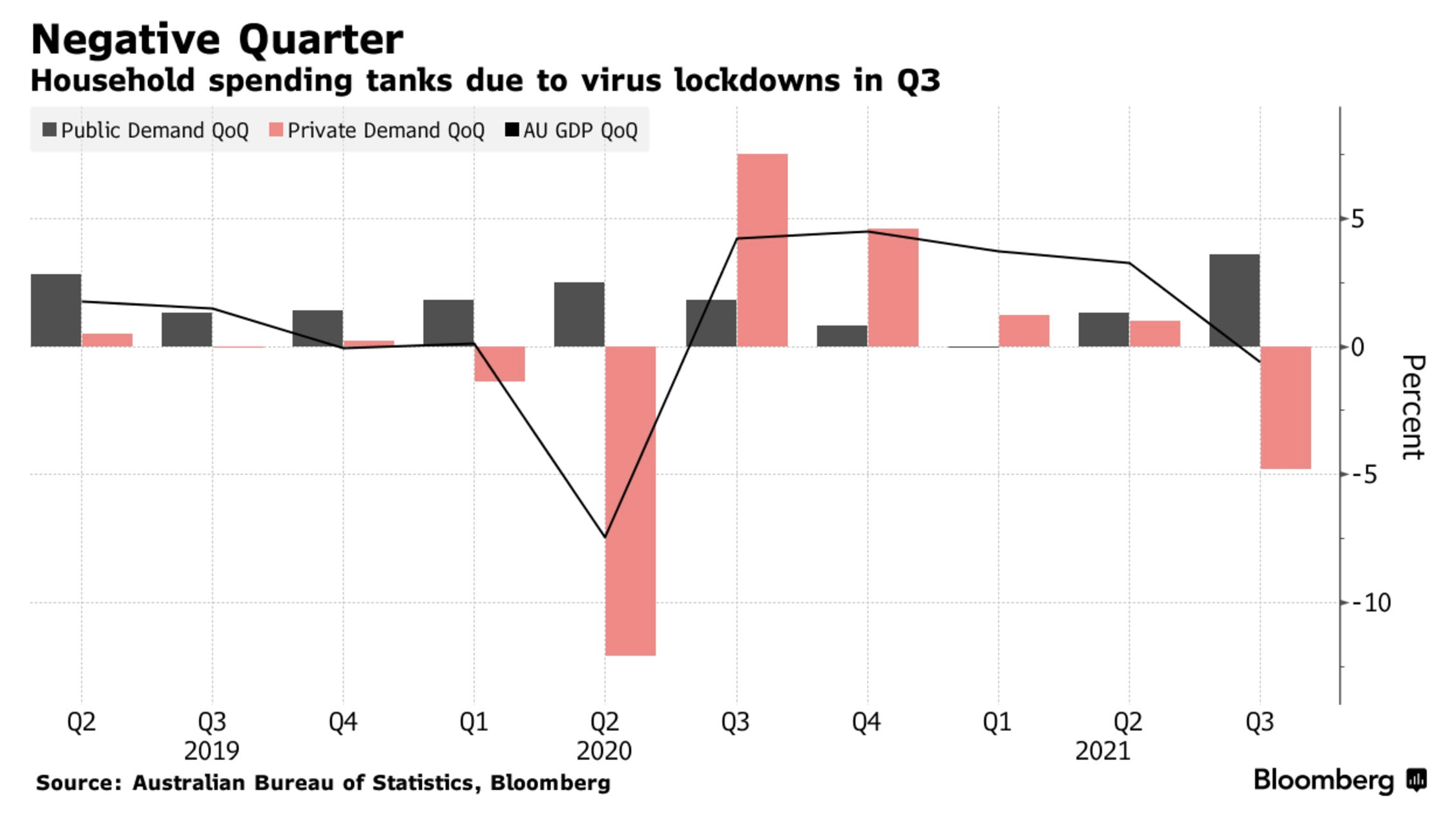

- The Australian economy contracted by a better-than-expected 1.9% in the September quarter, reflecting lockdowns (survey: -2.9%). The economy is up 3.9% on the year.

- The final Australian IHS Markit Services Purchasing Managers’ index (PMI) rose from 51.8 to 55.7 in November.

- The household saving rate jumped from 11.8% to 19.8%, with household gross disposable income up 4.6% – the strongest pace in 13 years.

- The current account surplus rose by $1bn to a record high of $23.9bn in the September quarter or about 5% of GDP.

- The AiGroup & HIA Performance of Construction index (PCI) eased from 57.6 to 57 in November. But any reading over 50 means expansion. Average capacity utilisation hit a record high of 85.7%, with commercial building activity at a record high of 68.8.

- The CoreLogic Home Value Index rose by 1.3% in October, the slowest growth in 10 months. Slowing price growth is a plus. National home prices are up 22.2% over the year – the strongest annual growth rate in 32 years.

- The AiGroup purchasing managers index (PMI) for manufacturing rose from a 12-month low of 50.4 in October to 54.8 in November. And the Australian IHS Markit Manufacturing PMI rose from 58.2 in October to 59.2 in November – the third-fastest rate on record. Readings over 50 denote an expansion of activity.

- Private sector credit (effectively outstanding loans) rose by 0.5% in October to be up 5.7% on a year ago – the strongest annual growth rate in 5 years.

- The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) today released a report estimating that the national winter crop production would reach a record 58.4 million tonnes in 2021/22.

- Commonwealth Bank (CBA) national credit and debit card spending is 24.2% higher for the week ending 26 November 2021 compared to the corresponding week in 2019.

- The S&P/Case-Shiller home price index rose by 0.8% in September to be up 19.1% on a year ago (survey: 19.3%).

- According to Challenger, job cuts fell by 34.8% in November to 14,875 – the fewest since May 1993 (survey: 23,000).

- The ISM manufacturing Purchasing Managers Index in the US rose from 60.8 to 61.1 in November (survey: 61).

- The Markit PMI in the US eased from 58.4 to 58.3 in November (survey: 59.1) but anything over 50 equals expansion.

- According to ADP, private sector payrolls rose by 534,000 in November (survey: 525,000).

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 1.3% to 106 — blame Omicron fears.

- According to the Federal Chamber of Automotive Industries, new vehicle sales totalled 80,639 units in November – the lowest number of sales for the month of November since 2008. Sales are down 15.3% on a year ago.

- Dwelling approvals fell by 12.9% in October – the biggest fall in 17 months – to be down 8.1% on a year ago. Approvals to build higher-density apartments plunged 36.1% – the biggest fall in almost four years. And NSW council consents dropped 29.4% – the biggest monthly decline in a decade.

- US consumer confidence fell from 111.6 to 109.5 in November (survey: 111).

- In testimony to Congress, Federal Reserve chair Jerome Powell said: “The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation.” Powell warned that that inflation may not be just transitory and that the Fed may have to “wrap up” the tapering of bond purchases earlier than planned.

- The Dallas Federal Reserve manufacturing index fell from 14.6 to 11.8 in November (survey: 17).

I’m not the only Omicron optimist

Hugely successful investor Bill Ackman says Omicron could actually give stocks a boost if symptoms turn out to be less severe. “While it is too early to have definitive data, early reported data suggest that the Omicron virus causes ‘mild to moderate’ symptoms (less severity) and is more transmissible,” Ackman tweeted last week. “If this turns out to be true, this is bullish, not bearish for markets.”

The week in review:

- This week in the Switzer Report, I couldn’t ignore the emergence of the Omicron variant on the market and its tennis rally it played with investors as sentiment fluctuated throughout the week. With the ASX down overall this week, I list five companies that are currently in great buying opportunities.

- Paul Rickard looks at the embattled Woodside Petroleum (WPL) and whether news of its latest project approval at Scarborough will lend this oil and gas behemoth to finally live up to its potential.

- We return to the hot topic of lithium mining once again, as James Dunn assesses the lay of the land in what is a heavily populated sector for investors as the push for ESG only grows. Considering the high prices, James gives his 2 “hot” lithium stocks & 1 for the speculators.

- Tony Featherstone has assured us in multiple Switzer Report editions that he is not a fan of investing in takeover targets in hopes that prices will pump after acquisition, labelling it as mere speculation. Despite this, there are companies out there that have solid fundamentals but are struggling in price, with larger companies sizing them up for a takeover, and Tony gives us six small-cap stocks that fall into this basket of opportunity.

- Superannuation expert Tim Miller issues a warning to those of you out there considering terminating your SMSFs, noting that: “Winding up an SMSF is in many instances a far bigger decision than establishing one because you are no longer dealing with a blank canvas and are now left with the likelihood of deconstructing many years of work.”

- In our “Hot” stocks segment this week, Michael Gable of Fairmont Equities looks at Australian heavyweight BHP Group (BHP) in its struggle with falling iron ore prices over the last couple of months, identifying a current breakout position that spells BUY.

- This week in Buy, Hold, Sell – What the Brokers Say, there were six upgrades and nine downgrades in the first edition, and two upgrades and two downgrades in the second edition.

- And finally, in Questions of the Week, Paul answers your questions on Bank of Queensland (BOQ), Washington Soul Pattinson (SOL), the Westpac (WBC) off-market share buyback, and Macquarie Group’s (MQG) Share Purchase Plan.

Our videos of the week:

- Is ageing a disease? | The Check Up

- What are the fund managers buying with the Omicron threat to stocks? Buy travel or tech stocks?

- Will Jerome Powell KO the stock market rally or will Omicron KO the stock market rally? | Mad about Money

- Stocks with upside: Ramsay, IEL, REA ,Woodside + US guru Peter Schiff on buy gold dump bitcoin!

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday December 6 – Melbourne Institute inflation gauge (November)

Monday December 6 – ANZ job advertisements (November)

Tuesday December 7 – Weekly consumer confidence (December 5)

Tuesday December 7 – Reserve Bank interest rate decision

Tuesday December 7 – Property prices index (September quarter)

Tuesday December 7 – CBA Household Spending Intentions (November)

Wednesday December 8 – Preliminary skilled job vacancies (November)

Wednesday December 8 – Labour account (September)

Thursday December 9 – Weekly payroll jobs & wages (November 13)

Thursday December 9 – Speech by Reserve Bank Governor Lowe

Friday December 10 – Monthly business turnover indicator (October)

Overseas

Tuesday December 7 – China International trade (November)

Tuesday December 7 – US Nonfarm productivity & labour costs

Tuesday December 7 – US International trade (October)

Tuesday December 7 – US Consumer credit (October)

Wednesday December 8 – JOLTs job openings (October)

Wednesday December 8 – US NFIB small business optimism index (November)

Thursday December 9 – China inflation (November)

Thursday December 9 – Wholesale inventories (October)

Friday December 10 – US Consumer prices (November)

Friday December 10 – US Uni of Michigan consumer sentiment (December)

Friday December 10 – US Monthly budget statement (November)

Food for thought: “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice.” – Adam Smith

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

It was a positive week for our economy following the release of the National Accounts, which revealed we experienced a smaller-than-expected contraction given the extensive lockdowns sweeping the nation. More specifically, “The economy shrank 1.9% last quarter, reflecting virus lockdowns across the heavily populated east coast, while beating an expected 2.7% drop as trade and fiscal stimulus helped cushion a slump in household spending. Gross domestic product rose an annual 3.9%, stronger than its pre-pandemic pace of around 2%,” Bloomberg reports. These numbers are likely to reinforce views that the RBA will taper or maybe even scrap its bond buying program early next year.

Top 5 most clicked:

- 5 ‘Buy the Omicron dip’ stocks – Peter Switzer

- 2 “hot” lithium stocks & 1 for the speculators – James Dunn

- Will Scarborough make Woodside “great”? – Paul Rickard

- 6 small-cap takeover targets – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.