Wall Street was “all green on the screens” on a shortened trading session, with most Americans enjoying a four-day holiday and all three major indexes up over 11% for November. Imagine what might’ve happened if the Yanks had performed better in beating the virus!

European share markets hit nine-month highs, with the pan-European STOXX 600 index up 0.9%. Optimism about vaccine roll-outs, coupled with hopes of an ending of lockdowns in France, buoyed investors earlier in the week. Oil and gas led the gains. And the German Dax Index is only 400 points off its pre-Coronavirus high, buoyed by news that the German economy grew 8.5% in the September quarter.

This positivity has been helped by Wall Street being relaxed about the US election outcome, with the Republicans set to control the Senate and vaccine news doing its trick to make the case that economies will embrace more normalcy over 2021 and probably at a faster rate than was expected nine months ago.

US shares advanced on Tuesday, with the Dow Jones index breaking 30,000 points for the first time. And the Trump team formally permitting the transition process to taking office in January 2021 was also good for the market vibe.

The Dow ended the session up only 0.1%, falling short of the 30,000 level it beat earlier in the week, but you can’t easily stop profit-takers. The Index was up 2.2% for the week and a huge 12.9% for the month, but we could easily see a bit of this profit pocketing by traders and fund managers in coming weeks. You often see some early December negativity until those Santa Claus rallies arrive as Christmas Day looms. The irrepressibly positive American is even harder to go negative at this time of year. And don’t forget the entire November to April period is historically great for stocks. This chart says it all.

Source: CNBC

For nine months I’ve been arguing that a vaccine would be a market and economy gamechanger and as per normal, stocks ran ahead of the economic bounce-back some six months or so ahead of a new norm.

And the Russell 2000 (the small-cap index) being up 20% in November (the best monthly performance ever) screams that a lot of companies left behind in the stay at home trade will now have to take a backseat to businesses/stocks that will benefit from the reopening, or as I call it, the back-to-normal play.

Value stocks do well out of recessions and market crashes but they’ve been out of favour for some time. The iShares Russell 1000 Value ETF (IWD) is up 14.6% this month. Its growth counterpart, the iShares Russell 1000 Growth ETF (IWF) has gained 10.1% in that time. (CNBC)

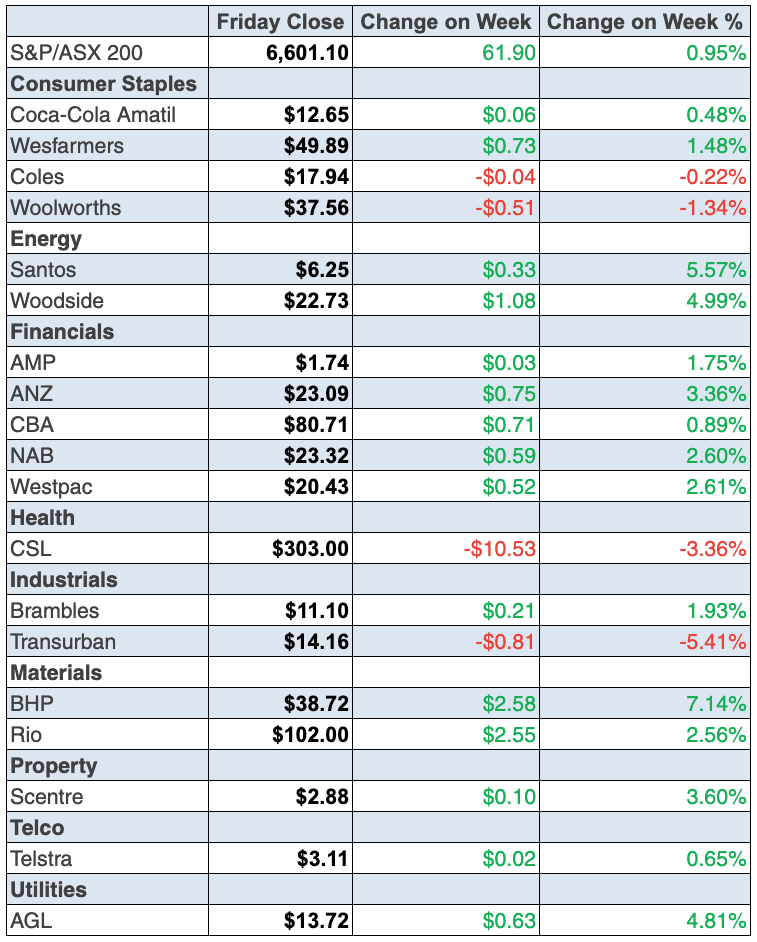

To the local story, and the S&P/ASX 200 Index rose 61.9 points (or 0.9%) to 6601.1 this week. Friday was negative, losing 35.3 points (or 0.5%), but we do look poised to see the Index have its best month since 1988, as long as Monday keeps it positive.

Poor old Treasury Wine Estates lost 6.7% to $9.23, with Friday’s 11.3% fall linked to the Beijing bad boys slapping a 212.1% tariff on its products. Other producers saw tariffs as low as 107.1% but anyone unnamed and exporting to China will cop the higher tariff!

Meanwhile, BHP was up 7.1% for the week to $38.72, with the iron ore price reaching $US130 a tonne. Fortescue put on 9.6% to $18.57, while Rio Tinto was 2.6% higher, finishing at $102. Keeping the faith with our miners, who are expected to pay a good dividend, has paid off so far.

And bank believers (which Paul Rickard and myself have been) are coming through on the reopening trade tailwinds, with CBA up 0.9% to $80.71, Westpac added 2.6% to $20.53, ANZ rose 3.4% to $23.09 and NAB was up 2.6% to $23.32.

For those wondering why oil, gas and coal producers have done so well, the best explanation is that crude oil is at an eight-month high. Origin Energy gained 11.1% to $5.19, Beach Energy 6.6% to $1.77, Santos 5.6% to $6.25 and Woodside 4.2% to $22.73.

Other reopening trade beneficiaries with local border news on the up were Webjet up 7.8% to $5.69, Flight Centre 7.7% higher to $17.40 and Qantas rising 4.7% to $5.52.

And tech stocks copped it, with NEXTDC off 6.3% for the week, while both Nearmap and Appen also lost around 6%. Tech stocks were once again out of favour, as investors preferred domestic cyclicals. Afterpay has lost 6% since Wednesday.

What I liked

- Alterations and additions on properties climbed by 5.1% in the quarter – the fastest growth in 2½ years – to a 2-year high of $2.42 billion. For the private sector, renovations lifted 4.6% in the quarter to be up 4.5% on a year ago.

- According to the Commonwealth Bank (CBA), card spending in the week to November 20 lifted by 12% on a year ago, compared to an 11% lift for the previous week. Spending on services rose 1% from a year ago (previously: flat). But the annual growth rate of goods spending climbed 22%. Annual growth in spending in South Australia fell to 9% last week (previously: 15%) due to the virus lockdown.

- The IHS Markit ‘flash’ PMI for manufacturing rose from 54.2 to a 35-month high of 56.1 in November. The services PMI lifted from 53.7 to a 4-month high of 54.9. The composite PMI rose from 53.5 to a 4-month high of 54.7. Readings above 50 indicate an expansion in activity.

- In the full 12 months to October, the underlying cash balance was $174,601 million (8.8% of GDP). The budget deficit for the four months to October was $3.6 billion lower than the ‘profile’ deficit because we’re growing better than expected because of our success containing the virus.

- The fourth estimate for investment in 2020/21 was up 6.3% on the third estimate.

- In original terms, the value of exports of goods rose by 6.3% to $30.5 billion in October to be 2.9% lower than a year ago. The value of goods imported was up 8.3% to $25.7 billion and was 10.4% lower when compared to a year ago.

- In the year to October, the goods trade surplus (exports less imports) was $70.3 billion, down from the record high of $87.3 billion in April.

- The value of iron ore exports hit a record high of $10.9 billion in October. Rolling annual exports of iron ore (metalliferous ores and metal scrap) hit a record $136.6 billion. The value of coffee, tea and spice exports climbed to $448 million on a rolling annual basis in October – also a record high.

- Datium Insights reported that wholesale used car prices rose by 2.6% in the past week, after falling 1.2% in the previous week.

- The S&P/Case-Shiller home prices index for the US rose 1.2% in September (survey: 1%) to be up 6.6% over the year. The FHFA house price index lifted 1.7% in September (survey: 0.8%) to be up 9.1% on the year, despite virus problems!

What I didn’t like

- After a record 11 successive weeks of gains, the weekly ANZ-Roy Morgan consumer confidence rating fell by 2% to 104.5 (long-run average since 1990 is 112.6). Sentiment is still up by 60% since hitting record lows of 65.3 on March 29 (lowest since 1973).

- New business investment (spending on buildings and equipment) fell by 3% in the September quarter to be down by 13.8% over the year. Economists had tipped a 1.5% fall in the quarter. The only plus is that it came from the September quarter where Victoria’s problems wouldn’t have helped business investment.

- Construction work done fell by 2.6% in the September quarter (consensus: minus 2%). The value of construction work done is down by 4.2% on a year ago to a decade low of $51.2 billion.

- The Conference Board consumer confidence index in the US fell from 101.4 to 96.1 in November (survey: 97.8).

- The Richmond Federal Reserve manufacturing index fell from 29 to 15 in November (survey: 20).

The “What I dislike” list has grown but note most of them are linked to older data over the September quarter, which takes in July, August and September, when Victoria was in lockdown. Meanwhile, the US news that’s going off the boil is second-wave infection affected, and it makes the vaccine news all that more important to the stock market.

Short term, the market could give into profit-taking negativity but I’ll be looking for bargains because I believe 2021 will be a good one for stocks.

Important information:

- The Switzer Small & Micro-Cap Virtual Investor Day is on next Tuesday and Wednesday. Click here for more information and to register.

- Our final webinar of the year is on next Friday at 12:30pm AEDT. Click here to register and submit your question.

- Join the Rich Club is on sale for 50% off from the Switzer Store for Black Friday and Cyber Monday. Pick up a copy before the sale ends on Monday.

The week in review:

- Warren Buffett says he assesses the stocks he buys on the quality of the business itself, not whether certain events cause up and down movements in their share price. This week, I subjected 8 stocks to the Buffett test.

- Ord Minnett summarises Lend Lease well: “the potential rewards are high for those willing to go the distance”. What is Paul Rickard’s current view on LLC?

- Tony Featherstone put forward 2 auto-related small caps that are long-term plays.

- James Dunn looked at 4 renewable energy stocks that investors have to choose from on the ASX.

- For our “HOT” stock of the week, Julia Lee selected Aristocrat Leisure.

- In Buy, Hold, Sell – What the Brokers Say this week, there were 8 upgrades and 20 downgrades in the first edition, and downgrades continued to outnumber upgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered questions about a potential contrarian buying opportunity for tech, playing the global energy recovery, four ETFs for the long term and whether Southern Cross Media and Sky Network Television are a buy.

Our videos of the week:

- Boom! Doom! Zoom! | November 26, 2020

- Why is Mesoblast blasting higher again & 3 new stocks that are hot! | Switzer TV: Investing

- Why Joe Biden will be good for Australian house prices | Switzer TV: Property

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday November 30 – Private sector credit (October)

Monday November 30 – Business indicators (September quarter)

Tuesday December 1 – Corelogic home value index (November)

Tuesday December 1 – Reserve Bank Board meeting

Tuesday December 1 – Building approvals (October)

Tuesday December 1 – Balance of payments (September quarter)

Tuesday December 1 – Government finance statistics (September quarter)

Wednesday December 2 – National accounts (September quarter)

Wednesday December 2 – Reserve Bank Governor Lowe testimony

Thursday December 3 – Lending indicators (October)

Thursday December 3 – International trade (October)

Friday December 4 – Retail trade (October)

Overseas

Monday November 30 – China purchasing manager indexes (November)

Monday November 30 – US Pending home sales (October)

Monday November 30 – US Dallas Fed manufacturing index (November)

Tuesday December 1 – China Caixin manufacturing index (November)

Tuesday December 1 – US ISM manufacturing index (November)

Tuesday December 1 – US Construction spending (October)

Wednesday December 2 – US Federal Reserve Beige Book

Wednesday December 2 – US ADP employment (November)

Thursday December 3 – China Caixin services index (November)

Thursday December 3 – US ISM services index (November)

Friday December 4 – US Non-farm payrolls (November)

Friday December 4 – US International trade balance (October)

Friday December 4 – US Factory orders (October)

Food for thought:

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.” – Benjamin Graham

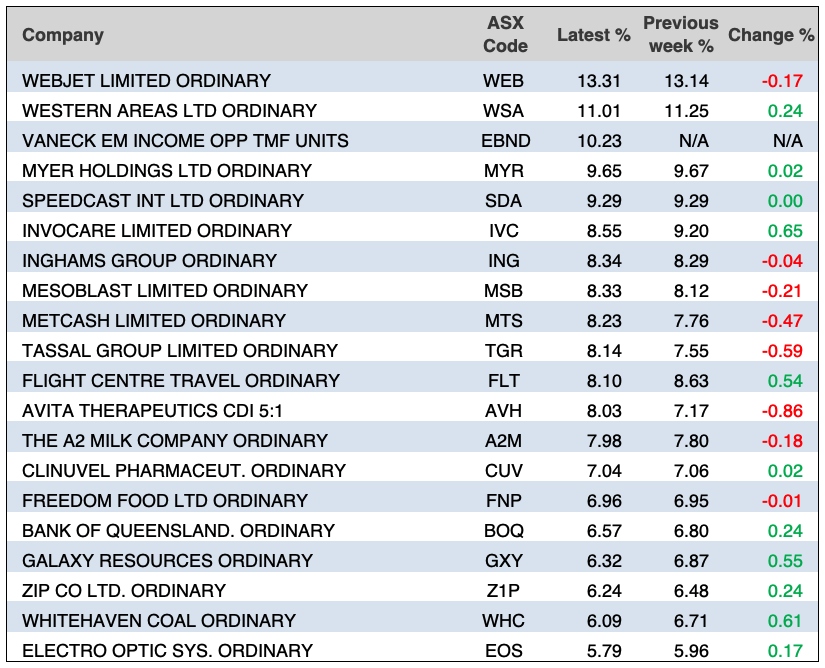

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

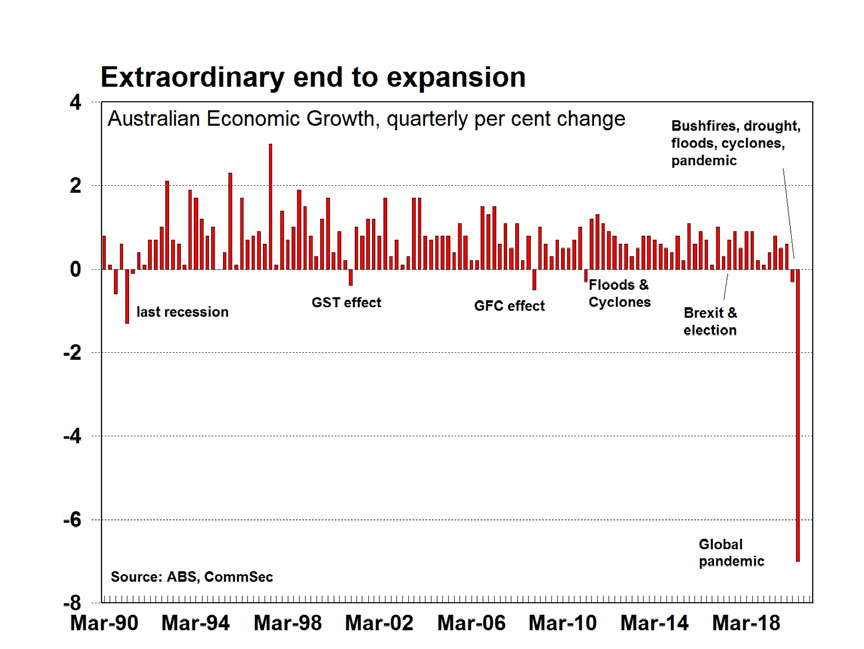

Chart of the week:

Following the 7% fall in GDP for the June quarter as seen in the chart from CommSec below, CBA economists are predicting that the National Accounts released on Wednesday will show a 2% rebound in the September quarter.

Top 5 most clicked:

- Would Warren Buffett buy these 8 stocks? – Peter Switzer

- Gearing up with 2 auto-related small caps – Tony Featherstone

- Is Lend Lease a good long-term buy? – Paul Rickard

- 4 renewable energy stocks – James Dunn

- My “HOT” stock – Maureen Jordan

Recent Switzer Reports:

- Monday 23 November: Would Buffett buy these 8 stocks?

- Thursday 26 November: 2 auto-related small caps

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.