One of the poorer performing stocks in 2024 is supermarket leader Woolworths (WOW). Opening the year at $37.20, it has lost almost 14% closing on Friday at $32.32.

Suggestions about price gouging, five separate inquiries into pricing practices and how it deals with suppliers, crazy ideas from the Greens (supported by the National Party) about legislation threatening to break it up, losing its CEO and a disappointing sales update. These have taken their toll on the company and its share price.

Woolworths (WOW) – 3/23 to 3/24

Source: nabtrade

Interestingly, most of the fall has occurred in the weeks following the 4 Corners program and after Peter Switzer predicted in late January that the share prices of the big supermarkets would fall (see https://switzer.com.au/the-experts/peter-switzer/supermarkets-to-be-shamed-to-price-fairly-their-share-prices-will-fall/ )

The inquiries are ongoing and it’s likely Woolworths will be subject to further “naming and shaming”. Naming and shaming is one thing, but will it really have much impact on Woolworths long-term profitability and is this already priced into the stock?

I can’t see these inquiries having much impact. There’s a reason why Woolworths and Coles have a combined market share of 70% – they provide a service that customers value – so customers are not going to walk and there’s no one to walk to. Woolworths and Coles may need to be a little “nicer” with some of their suppliers, and a little more mindful of price increases, but that will be the extent of the financial damage. Woolworths’ EBIT margin might be squeezed a touch, but it will remain a highly profitable business.

That’s my take.

The market’s take might be a little different. That’s because it is prone to react to events and the news cycle, and in doing so, tends to go to the extremes of being either too positive or too negative. It is hard at the moment to get a read of where it really is on Woolworths.

Over the years, I have observed a number of company “crises” (which you could argue Woolworths is in) and a key takeout for me has been that they tend to last a lot longer than expected. So just six weeks into this “crises”, I am inclined to think that it is too early to declare a bottom and fear that there may be more pain ahead for Woolworths shareholders.

But at some point, Woolworths will be a great buy.

What do the brokers say?

Most of the major brokers reduced their target price for Woolworths following the release of its first half results in February. The typical reduction was around $2. Consequently, the consensus target price now sits at $34.03, a 5.3% premium to Friday’s closing price of $32.32. The range is a low of $27.50 (from Ord Minnett/Morningstar) through to a high of $39 from Citi.

Sentiment is marginally negative, with 2 “buy” recommendations, 2 “neutral” recommendations and 2 “sell” recommendations. Macquarie upgraded last week to an “outperform” saying that it was an opportunity for investors to build a position at current share price levels.

Macquarie says “investors will be rewarded for embracing regulatory uncertainty and buying ahead of six regulatory inquiries into Australian supermarkets over 2024, the impacts of which are likely reflected in valuations already”.

On multiples, the brokers have Woolworths currently trading on a multiple of 22.7 times forecast FY24 earnings and 21.3 times forecast FY25 earnings. The prospective dividend yield is 3.2%.

A lower risk switch option?

Switching, that is selling one stock and using the proceeds to buy Woolworths shares, is arguably a lower risk option. Normally, you would consider stocks within the same sector, for example, Coles or even Metcash, to minimise industry risk. But Coles or Metcash don’t look that expensive to make the switch really worthwhile.

Going outside the sector, Adam Dawes from Shaw & Partners suggested Wesfarmers, that is, selling Wesfarmers to buy Woolworths. While they are from different sectors (Woolworths is consumer staples, Wesfarmers is consumer discretionary), both are largely consumer facing businesses, both are industry leaders and they are direct competitors in discount retailing (Woolworths with BigW, Wesfarmers with Kmart/Target).

Wesfarmers is trading just below its all-time high, and on a multiple basis, on 29.5 times forecast FY24 earnings and 27.1 times forecast FY25 earnings. The prospective dividend yield is 3%.

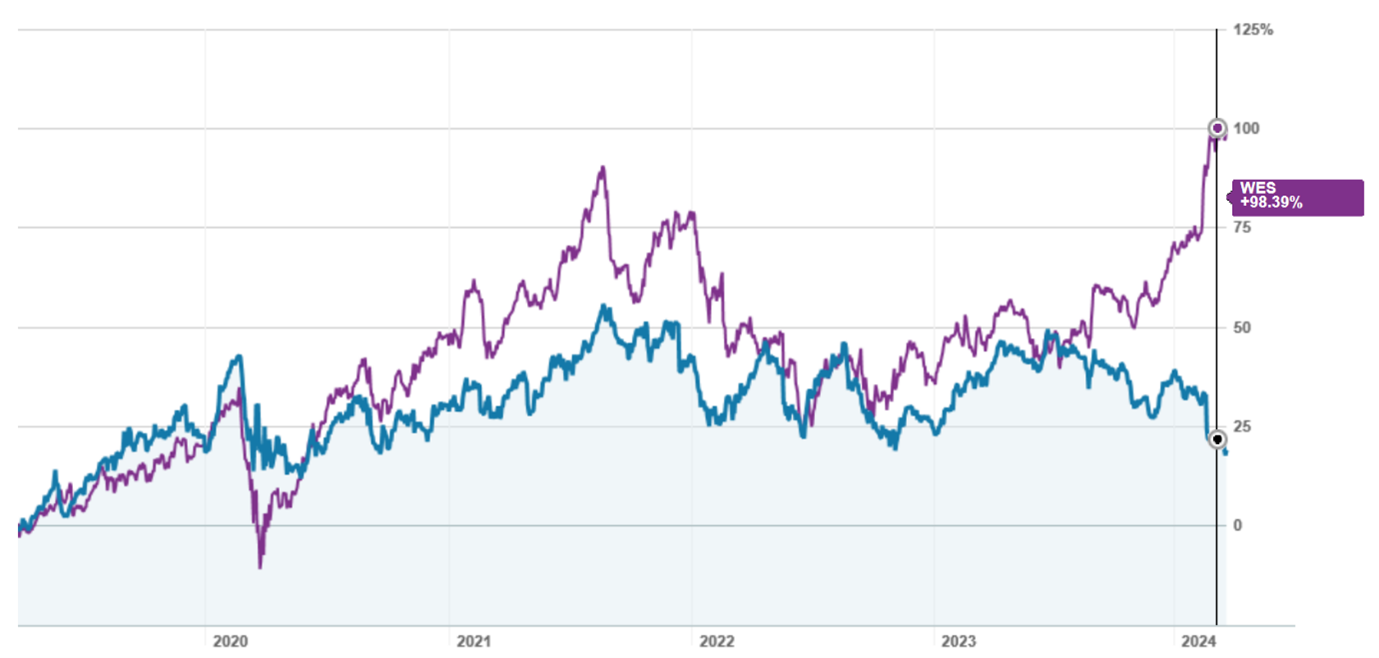

Interestingly, the correlation in the price of the two stocks has been quite strong … until the last couple of months when Wesfarmers has surged in price and Woolworths has tanked. The chart below shows the two companies over the last five years, using a common base and starting point. Woolworths is shown in blue, Wesfarmers is in purple.

Woolworths (blue) vs Wesfarmers (purple) – 3/19 to 3/24

Source: nabtrade

According to FN Arena, the brokers feel Wesfarmers is fully priced. There are 5 “neutral” recommendations and 1 “sell” recommendation (0 “buy” recommendations).

The consensus target price is $56.73, 15.3% below Friday’s closing ASX price of $67.01. The range is a low of $43 (Ord Minnett/Morningstar) through to a high of $62.30 (Morgans).

I like the look of the switch but acknowledge for many investors, the capital gains on the Wesfarmers shares would be a material issue. Further, there is nothing to say that the pricing gap can’t get wider first, so you may need to be patient. But certainly it’s worth considering.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.