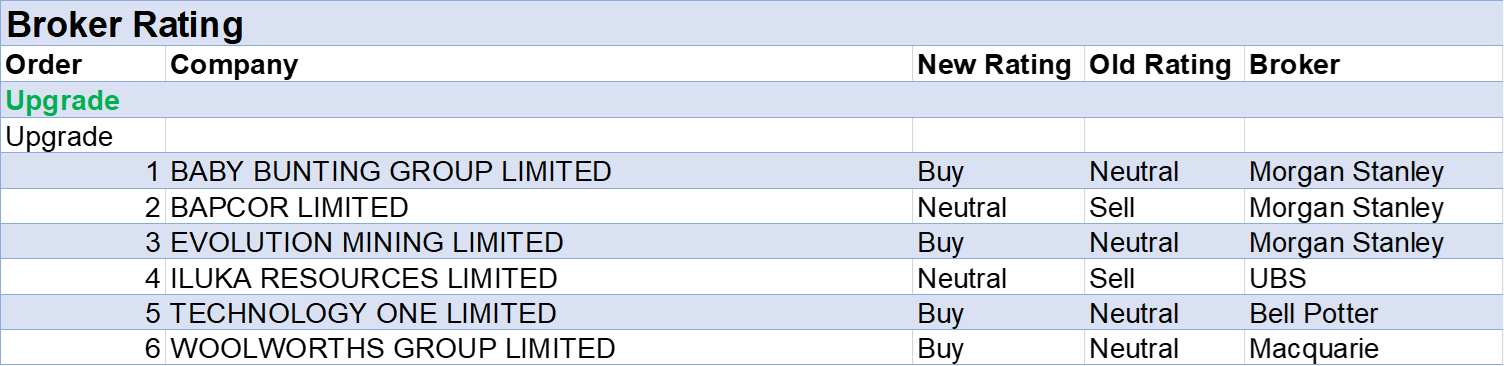

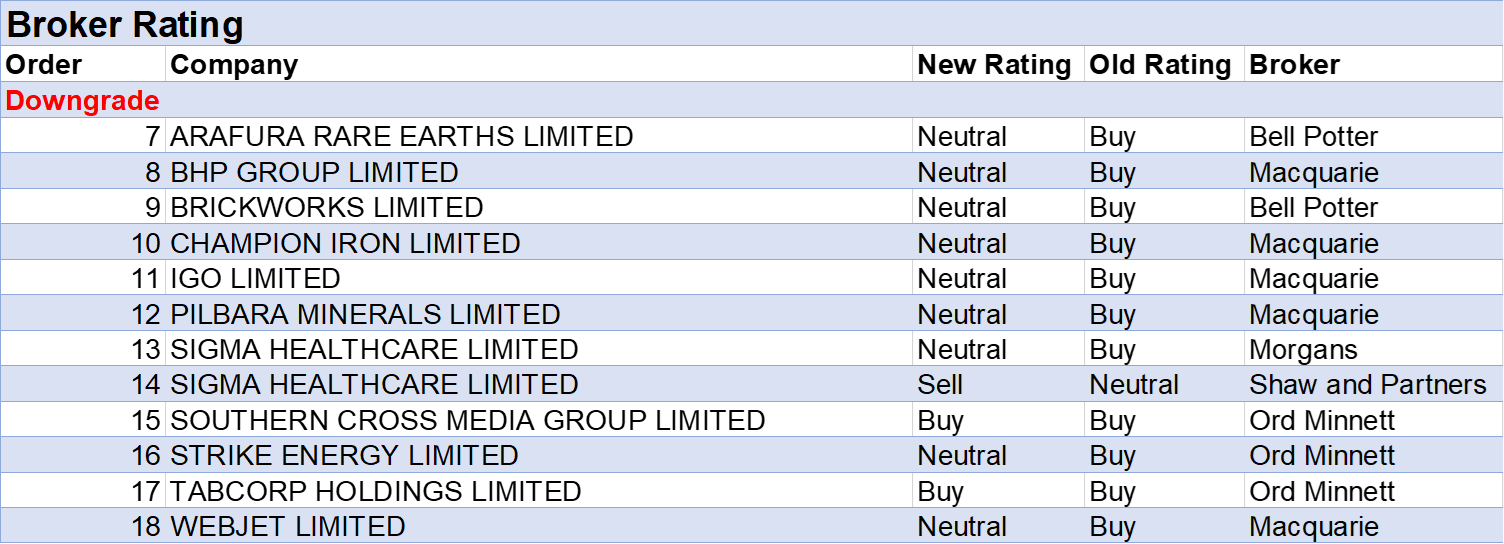

For the week ending Friday March 22, 2024, FNArena recorded six rating upgrades and twelve downgrades for ASX-listed companies by brokers monitored daily.

A third of the ratings downgrades, and several earnings and target price changes, related to resource companies after Macquarie updated earnings estimates across the sector.

The broker’s iron ore and spodumene forecasts across 2026/27 were cut by -14/-27% and -10%/-29%, respectively, resulting in rating downgrades for BHP Group, Champion Iron, IGO Ltd and Pilbara Minerals.

Macquarie’s 2024/25 forecasts for copper, gold, zinc and nickel were raised by 11%/4%, 4%/6% and 7%/5%, respectively. For the longer-term, alumina, zinc and copper forecasts were raised by 18%, 4% and 1%, respectively.

Overall, the broker holds an Underweight view for iron ore and thermal coal and an Overweight outlook for aluminium, nickel, lithium, copper, and metallurgical coal.

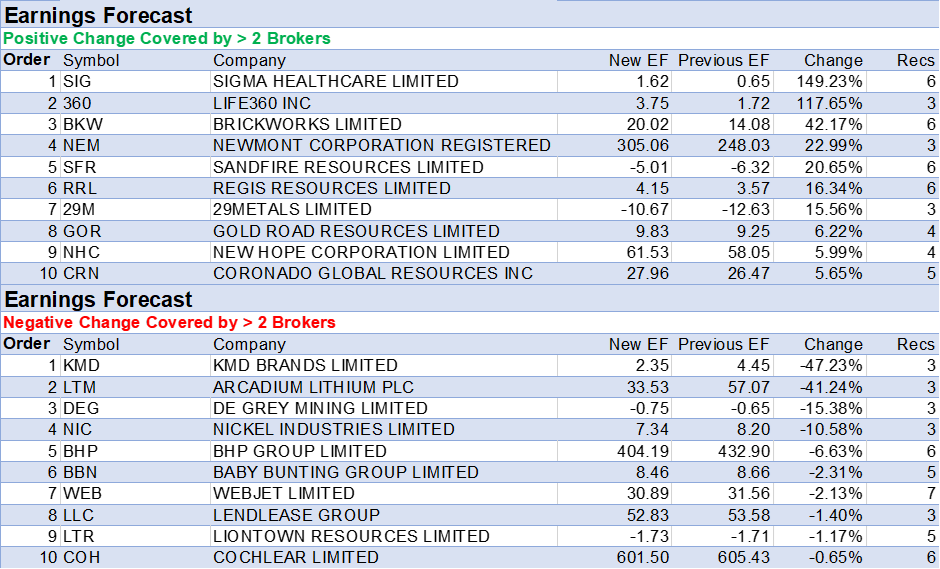

Sigma Healthcare headed up the earnings upgrade table after FY24 earnings came in at the top end of management’s guidance range, though Macquarie noted these results were largely a sideshow when set against the ongoing reverse takeover by Chemist Warehouse Group.

While Sigma had been targeting a completion of the merger in the second half of 2024, a detailed review being undertaken by the ACCC has added to difficulties in determining a timeline, explained Citi.

According to Shaw and Partners, the valuation for Sigma is full, suggesting the market is treating ACCC approval as a foregone conclusion. This broker’s rating was downgraded to Sell from Hold, while Morgans also downgraded to Hold from Add on valuation.

Life360 sits next on the earnings upgrade table after joining Morgan Stanley’s list of stocks where the broker has high conviction for both earnings and the outlook, based on strong subscriber growth and upside from a potential new advertising stream.

Management recently announced an advertising offering for the non-paying user base of more than 50m monthly active users. The Life360 app not only has high-frequency usage but also highly affluent users, highlighted the broker.

Unlike subscriptions, the analysts pointed out advertising monetises users from the moment of sign-up, implying revenue generation for all new users straight away, as opposed to just those who choose to subscribe.

Brickworks also received a material upgrade to earnings forecasts last week.

While first half earnings declined across three of Brickworks’ four operating segments, Ord Minnett envisaged longer-term upside, particularly via the Property segment due to demand for high-quality Industrial property. This segment is also expected to benefit from further increases in rental income in the medium term.

Management is bullish on the longer-term, believing Australia is on the verge of a property boom due to record immigration levels and population growth. It’s felt the current “air pocket” for the Australian Building Products segment will last until the start of 2025, before migration and an under-supply of housing leads to a new demand cycle.

There are now two Buy recommendations for Brickworks in the FNArena database and four Hold (or equivalent) ratings after Bell Potter last week downgraded to Hold from Buy, on valuation.

Both Newmont Corp and Sandfire Resources were beneficiaries of Macquarie’s higher 2024/25 forecasts for gold and copper mentioned above.

Newmont was assisted by higher gold leverage and copper exposure, while Sandfire is the broker’s preferred key copper exposure, with the Motheo operations ramping-up on time and on budget.

From among Ord Minnett’s research coverage of resources, Sandfire Resources and Evolution Mining are preferred on a near-term view, while AIC Mines and Aurelia Metals are seen as representing the best opportunities in the medium-term.

Last week, this broker pointed to a valuation disconnect between current equity trading for copper companies on the ASX and recent transactions multiples. It’s thought investors will benefit as the disconnect unwinds and the appetite for small cap exposures improves.

The average target price for copper-focused base and precious metals mining company 29Metals increased by 13% last week, the highest jump in the FNArena database, after Macquarie raised its target to 54c from 29c on the broker’s changes to commodities prices forecasts.

KMD Brands appeared atop the tables below for reductions in average earnings forecast and target price after brokers were (yet again) disappointed by first half results.

As the retailer has missed earnings expectations several times, Morgan Stanley now lacks confidence medium-term targets can be achieved. The near-term outlook for the Kathmandu brand is considered challenging due to past execution issues and a more competitive backdrop.

While earnings in the half were slightly better than UBS expected, as management pulled back on operating expenses, finance costs provided a nasty surprise, dragging the net profit below expectations. There was no interim dividend for shareholders.

The hand of Macquarie’s commodity price changes was behind a material fall in average earnings forecast for Arcadium Lithium, though, prima facie, reduced earnings forecasts for De Grey Mining didn’t appear to tally with Macquarie’s higher gold price forecasts.

The Macquarie analyst explained the company’s forecast earnings failed to benefit from near-term gold price upgrades (as De Grey is not yet in production) and suffered from a slightly lower gold price forecast in FY28.

The average earnings forecast for Nickel Mines fell by nearly -11% last week as management lowered first quarter earnings guidance to a range of between US$65-75m (down from US$137m) due to mining licence delays.

Bell Potter explained the Hengjaya mine in Indonesia was left unable to sell ore during January and much of February, as the company awaited renewal of its Rencana Kerja dan Anggaran Biaya mining licences.

These delays were driven, in part, by enhanced regulatory scrutiny arising from the recently completed Indonesian presidential elections, explained Macquarie.

Ore sales have recommenced at record rates, and Bell Potter declared any share price weakness off the back of the delayed licence news should be viewed by investors as a buying opportunity.

In the good books

Upgrades

BAPCOR LIMITED ((BAP)) was upgraded to Equal-weight from Underweight by Morgan Stanley .B/H/S: 2/4/0

Morgan Stanley has a more upbeat outlook for the consumer in Australia, citing positive jobs growth, lower taxes, migration, and flat interest rates that will eventually fall. All these tailwinds are relevant for the Bapcor outlook, note the analysts.

The rating is upgraded to Equal-weight from Underweight and the target increased to $5.75 from $5.00. Industry view: In-Line.

Given the 8% year-to-date share price rally for Bapcor, the broker believes the market is willing to forgive near-term earnings weakness and apply a more generous multiple.

The broker was not willing to upgrade all the way to Overweight due to a lack of conviction around near-term earnings and the growth trajectory.

BABY BUNTING GROUP LIMITED ((BBN)) was upgraded to Overweight from Equal-weight by Morgan Stanley .B/H/S: 3/2/0

Morgan Stanley sees scope for a re-rating of Baby Bunting shares due to a better macroeconomic backdrop, accelerated technology adoption and a stronger, simpler customer value proposition. The latter includes a simplified loyalty program, note the analysts.

The broker upgrades its rating to Overweight from Equal-weight and increases the target to $2.20 from $1.65. Industry view: In Line.

Already the inventory position (a former headwind) has improved considerably, according to Morgan Stanley, and birth-rate indicators have turned positive.

EVOLUTION MINING LIMITED ((EVN)) was upgraded to Overweight from Equal-weight by Morgan Stanley .B/H/S: 5/0/0

Morgan Stanley upgrades its rating for Evolution Mining to Overweight from Equal-weight after raising the target price to $3.95 from $3.35. Industry view is Attractive.

From among the broker’s coverage of the Gold sector, Evolution Mining has the largest upside to spot gold prices, aided by only around 5% of gold production being hedged. The company’s implied gold price (around US$1,650/oz) is also the lowest under coverage.

Evolution’s copper exposure (around 30-35% of Morgan Stanley’s FY24 revenue forecast) could also benefit from current copper supply tightness, suggest the analysts.

ILUKA RESOURCES LIMITED ((ILU)) was upgraded to Neutral from Sell by UBS .B/H/S: 1/4/0

UBS raises its mineral sands price forecasts across 2024-26 by 6-12%, and also upgrades Iluka Resources’ production capacity across the same period, resulting in EPS upgrades of 7%, 29% and 69%, respectively.

The broker’s target rises by 12% to $7.50 and the rating is upgraded to Neutral from Sell.

By contrast, UBS lowers its neodymium and praseodymium (NdPr) price estimates by -18-30% across the curve and decreases the long-term forecast price to US$75/kg from US$95/kg.

The falling NdPr price has UBS questioning the value to Iluka of the company’s Eneabba rare earth refinery project.

TECHNOLOGY ONE LIMITED ((TNE)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 1/5/0

Bell Potter is eagerly awaiting TechnologyOne’s first half result in May, noting this will be the first result in a few years where the company’s net revenue retention will not receive a boost from significant software as a service “flips”.

With the company reporting a net revenue retention rate above 115% for each of the last two years, it will be interesting to see if it can maintain a similar result says Bell Potter, which would likely be well received by the market.

(Spoiler alert: the broker thinks the right answer is affirmative).

The rating is upgraded to Buy from Hold and the target price increases to $18.50 from $17.25.

WOOLWORTHS GROUP LIMITED ((WOW)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 2/2/2

Macquarie upgrades its rating on Woolworths Group to Outperform from Neutral, noting an opportunity for investors to build a position at current share price levels.

The broker believes investors will be rewarded for embracing regulatory uncertainty and buying ahead of six regulatory inquiries into Australian supermarkets over 2024, the impacts of which are likely reflected in valuations already.

The target is reduced by -3% to $35. Macquarie believes the key risk is potential for increased working capital from enforced changes to invoicing practices.

In the not so good books

Downgrades

ARAFURA RARE EARTHS LIMITED ((ARU)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 0/1/0

The Australian government has approved up to US$533m in funding to Arafura Rare Earths through debt facilities. As per Bell Potter, this includes the previously announced $350m alongside additional facilities intended for the ramp up and cost overruns at Nolans.

The broker feels funding risks remain for Arafura Rare Earths, and despite the new facilities providing support expects more is needed to get the project up and running. As of late December, the broker had estimated $1.83bn was needed in funding to advance Nolans.

The company remains committed to completing financing in the third quarter, but Bell Potter considers it more likely this will run into the fourth quarter.

The rating is downgraded to Hold from Buy and the target price of 19 cents is retained.

BHP GROUP LIMITED ((BHP)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 1/5/0

Macquarie updates resource company earnings estimates. Macquarie holds an Underweight view for iron ore and thermal coal and an Overweight outlook for aluminium, nickel, lithium, copper and metallurgical coal.

The broker’s rating for BHP Group is downgraded to Neutral from Outperform after earnings forecasts across FY26/27 are reduced by -9% and -24%, respectively. The target falls to $42 from $48. South32 and Rio Tinto preferred among the large cap exposures.

BRICKWORKS LIMITED ((BKW)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 2/4/0

Bell Potter has described a ‘robust’ first half from Brickworks, despite the company reporting a -$23.4m loss. This was partly due to the sale of the M7 property hub, which incurred a -$16.3m loss at the earnings line but also saw net debt reduce by -$27m.

As per the broker, the remaining 130 square kilometres of the Oakdale West development is set to be completed in the second half, potentially adding $30m to rents over the next 12-24 months, while recent approvals linked to Oakdale West represent a key milestone.

The rating is downgraded to Hold from Buy and the target price increases to $29.00 from $27.80.

CHAMPION IRON LIMITED ((CIA)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 1/1/0

Macquarie updates resource company earnings estimates. Macquarie holds an Underweight view for iron ore and thermal coal and an Overweight outlook for aluminium, nickel, lithium, copper and metallurgical coal.

The target for Champion Iron falls by -18% to $7.50 and the rating is downgraded to Neutral from Outperform.

IGO LIMITED ((IGO)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 2/3/0

Macquarie updates resource company earnings estimates.

The broker’s earnings forecasts for IGO are lowered by -3-40% across FY26-28 due to the lower lithium price outlook. The rating is downgraded to Neutral from Outperform and the target falls to $7.90 from $8.60.

PILBARA MINERALS LIMITED ((PLS)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 1/2/3

Macquarie updates resource company earnings estimates. after raising 2024/25 forecasts for copper, gold, zinc and nickel by 11%/4%, 4%/6% and 7%/5%, For lithium, the broker prefers Arcadium Lithium and Mineral Resources over Pilbara Minerals and IGO.

While management at Pilbara Minerals has executed well, in Macquarie’s view, the current premium valuation restricts further upside giving the broker’s pricing outlook.

The rating is downgraded to Neutral from Outperform and the target lowered to $4.20 from $4.40.

SIGMA HEALTHCARE LIMITED ((SIG)) was downgraded to Hold from Add by Morgans and to Sell from Hold by Shaw and Partners .B/H/S: 0/4/2

Excluding merger-related costs of -$8.2m, Sigma Healthcare’s FY24 result (January year-end) revealed earnings (EBIT) at the top end of the guidance range, observes Morgans.

The broker doesn’t anticipate full completion of the merger transaction until the end of 2024/beginning of 2025 and incorporates Chemist Warehouse Group forecasts from January 31, 2025. After a roll-forward of the financial model, the target rises to $1.14 from $1.07.

The broker’s rating is downgraded to Hold from Add.

Shaw and Partners assesses “solid” FY24 results for Sigma Healthcare with revenue beating the broker’s forecast by 5.3%.

The broker attributes a -9.2% revenue fall, versus the previous corresponding period, to reduced rapid antigen test (RAT) sales and the sale of the Hospitals business, partially offset by wholesale revenue growth.

The valuation for Sigma is full, and suggests to the analyst the market is treating ACCC approval for the Chemist Warehouse Group transaction as a foregone conclusion. The rating is downgraded to Sell from Hold.

The target rises to $1.00 from 90c, well below the current share price, highlights Shaw and Partners.

STRIKE ENERGY LIMITED ((STX)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 1/2/0

Ord Minnett considers Strike Energy’s plans ambitious, particularly for a company of its size and with no earnings history.

Having raised nearly $200m in equity over the last decade, Strike Energy has amassed a net 1,022 petajoules of gas reserves and resources within the Perth basin. For Ord Minnett, the key question now is how well the company will be able to monetise this position.

The rating is downgraded to Hold from Accumulate and the target price increases to 26 cents from 22 cents.

SOUTHERN CROSS MEDIA GROUP LIMITED ((SXL)) was downgraded to Accumulate from Buy by Ord Minnett .B/H/S: 1/2/1

Ord Minnett has reweighted its valuation estimate now the Southern Cross Media board has received a revised offer from ARN Media/Anchorage for the business, still including a 25% probability of the deal falling through.

The fair value estimate has been cut to $1.20 from $1.70. The rating moves to Accumulate from Buy.

TABCORP HOLDINGS LIMITED ((TAH)) was downgraded to Accumulate from Buy by Ord Minnett .B/H/S: 4/1/0

The resignation of Tabcorp Holdings’ CEO, despite its immediate nature and the fact it has emerged during an investigation into allegations of inappropriate and offensive language being used in the workplace, has had no impact on Ord Minnett’s outlook for the company.

The broker feels the market has become overly concerned by this departure, noting it is related to personal behaviour rather than any mismanagement or business performance.

The rating is downgraded to Accumulate from Buy and the target price of $1.05 is retained.

WEBJET LIMITED ((WEB)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 5/2/0

At Webjet’s investor day, management set a FY25 target for total transaction value (TTV) of circa $5bn, and $10bn for FY30, while earnings (EBITDA) margins are expected to stay around 50%.

These targets imply to Macquarie an around 15% compound annual growth rate (CAGR) over FY25-30 and earnings margins remaining stable – they were 49.5% in FY23.

Management reaffirmed FY24 guidance for underlying earnings and TTV.

As the share price is approaching the broker’s $8.88 target, up from $8.37, the rating falls to Neutral from Outperform.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.