I’m a little hesitant to recommend another capital raising to fund an acquisition because most of the recent raisings have struggled to perform on the ASX. The weight of new shares issued has led to indigestion in the market and stock prices have suffered. In some cases, by-passing the capital raising and buying the shares on market would have been a better strategy.

So, in considering Treasury Wine Estate’s US$900m capital raising to fund the purchase of US luxury wine brand DAOU, I will keep a “wary eye”.

About DAOU vineyards

Treasury Wine Estates (TWE) is acquiring DAOU for an upfront consideration of US$900m plus an additional earn out of US$100m if certain pre-agreed sales growth targets are met from calendar year (CY) 25 through to 27.

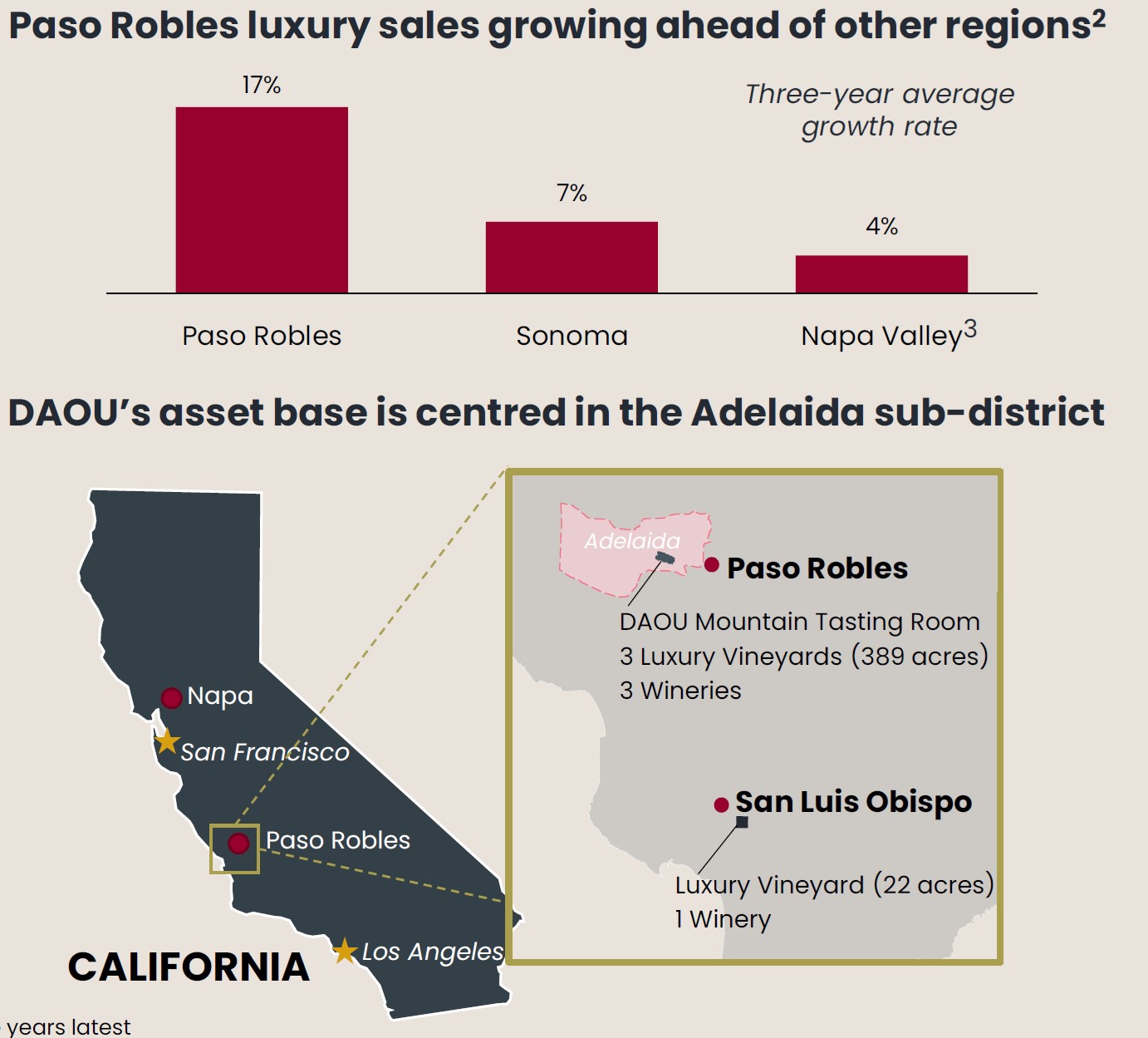

Founded in 2007 by brothers Georges and Daniel Daou, DAOU is a highly acclaimed and fast-growing luxury wine business. Daou is based in Paso Robles California, with a strong presence in the luxury growing sub-district of Adelaida.

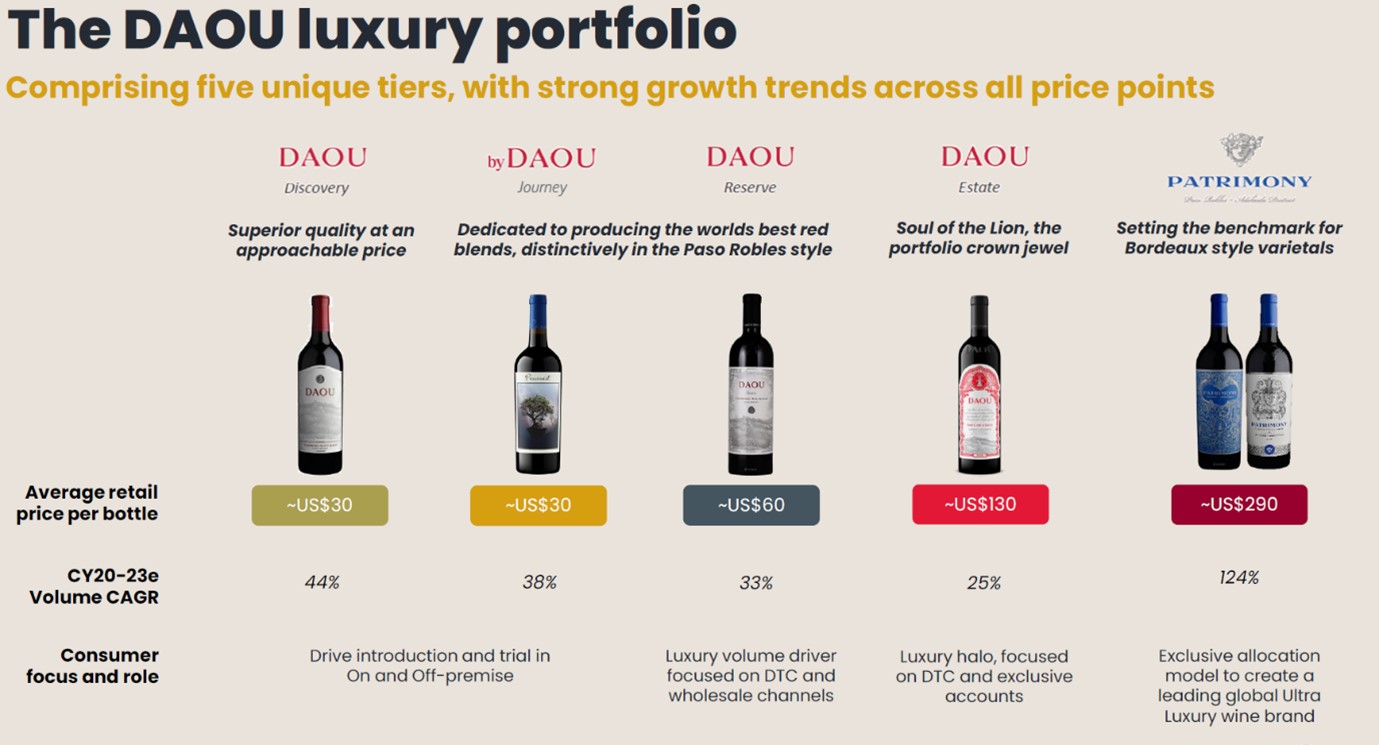

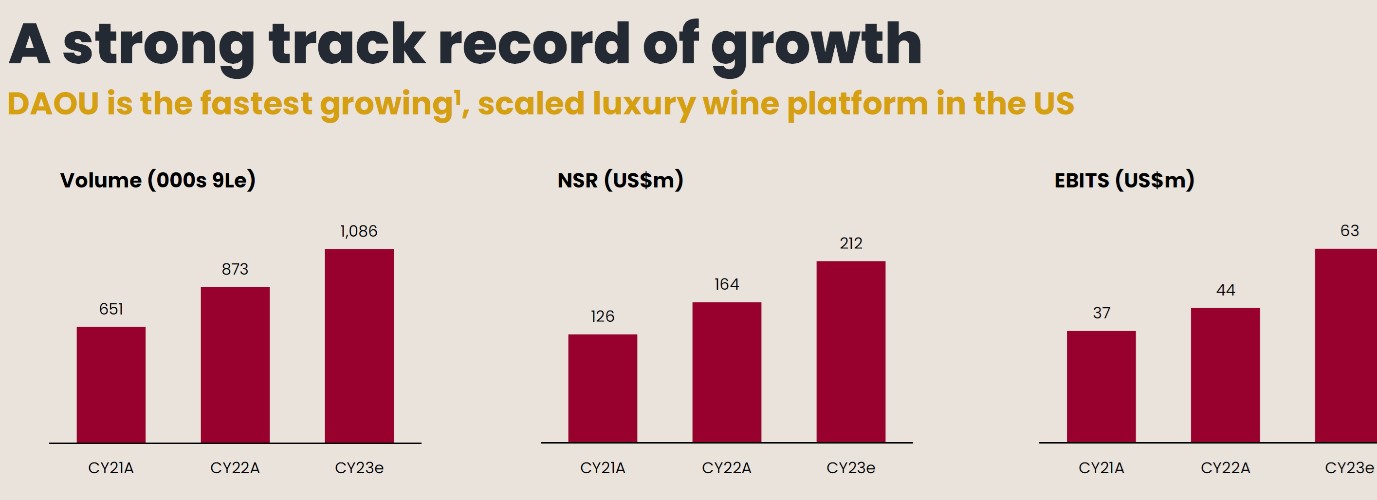

In 2023, it produced 1,086,000 cases of wine, generating net sales revenue of US$212m. Its portfolio of wines stretches from retail price points of US$20 through to US$500 per bottle.

Employing 250 permanent staff, DAOU is the fastest growing luxury wine brand in the US. Sales have grown at a compound annual growth rate of 45% over the last three years and earnings at 61%.

What’s the strategic rationale?

Treasury Wines (TWE) says that the acquisition will accelerate its luxury-led premiumisation focus, with the luxury portfolio contributing approximately 50% of global group sales post-acquisition. ‘Luxury’ wine is defined as wine that is sold at a retail level above US$20 per bottle, while ‘premium’ wine retails for US$8 to US$20 per bottle and ‘commercial’ below US$8 per bottle.

Post the acquisition, ‘luxury’ will increase to 49% of TWE’s portfolio (from 43%), premium to 38% and ‘commercial’ falls to 13%. Since 2020, TWE has been pursuing a “premiumisation” strategy, maintaining that premium wines have stronger growth rates. Premiumisation is being driven by the emergence of the ‘drink better’ trend and by younger customers who desire premium tastes and exclusive experiences.

Secondly, the acquisition solidifies Treasury America’s position in the highly attractive US luxury wine market, providing the scale to support a future standalone Treasury Americas luxury division. It will be become the leading provider of luxury wine in the USA, the world’s biggest luxury wine market, with a market share of 11.1%. The acquisition also addresses a key portfolio gap for Treasury Americas in the US$20 to US$40 per bottle price point.

Financially, the acquisition is expected to deliver mid-to-high single digit EPS (earnings per share) accretion in FY25, the first full year of ownership. The transaction multiple is 12.8x EBITDAS, which drops to 8.9x EBITDAS inclusive of US$20m pa. of run rate cost synergies (bottling and packaging, procurement and logistics, sourcing and winemaking etc) and US$100m of tax benefits. TWE argues that this is “a significant value creation opportunity”.

Here are the cons…

The main concerns regarding the acquisition come from investors/analysts who cite TWE’s chequered history in the USA. It was only back in April that TWE issued a marginal downgrade to sales and earnings (which led to a sharp sell-off), citing “challenging conditions for entry-level premium wine in the United States.”.

Some have also questioned the sustainability of DAOU’s sales growth rates, which far outstrip market growth rates. Is TWE buying in at the “top of the market”?

About the capital raising

The acquisition of US$900m is being funded as follows:

- An A$825m equity raising by way of an underwritten pro-rata entitlement offer;

- A $157m placement of new TWE shares to the existing owners of DAOU at an issue price of $11.97 per share;

- A new debt facility of US$350m.

The entitlement offer is on the basis of 1 new share for every 9.45 shares owned, at an issue price of $10.80 per new share. This represented a 9.8% discount to TWE’s theoretical ex-rights price (based on a closing price of $12.10 immediately prior to the announcement of the transaction).

The first part of the entitlement offer to institutions has been completed. Approximately $604m shares were issued with a take up rate of 78%. Entitlements not taken up were sold and cleared in a shortfall bookbuild, at a price of $11.50 per share (a premium of 70c to the offer price).

The offer to retail shareholders is now open. It is due to close on Thursday 23 November.

The offer is renounceable, meaning that the entitlement can be transferred to another person. A market in the entitlements is trading on the ASX under the ticker code TWER. Trading in the entitlements stops a week before the closing date on Thursday 16 November.

If the entitlements are not taken up, they will be auctioned through a ‘retail offer shortfall bookbuild’ on 28 November. If there is a premium over the offer price of $10.80, that premium will be paid to those retail shareholders on 8 December.

What do the brokers’ say?

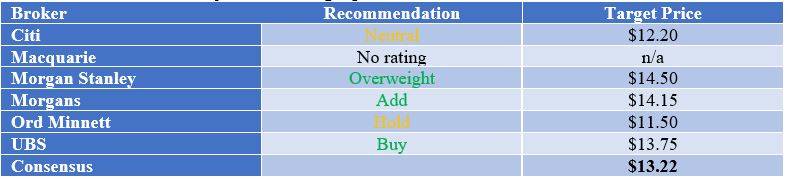

The major brokers are largely supportive of the acquisition and are positive on TWE.

Ord Minnett says: “After accounting for dilution, Ord Minnett considers the deal to be broadly neutral and considers the entitlements to be attractive on valuation grounds”.

Morgans says; “Not only does the move align with the company’s premiumisation and growth strategy, it also strengthens a key gap in the Treasury Americas portfolio”.

Morgan Stanley says: “Earnings upside supports financial merits of the deal, however the relative infancy of the brand and recent growth raise some concerns’.

The current broker consensus target price (according to FN Arena) is $13.22, about 20.6% higher than Friday’s ASX close of $10.96. As the following table shows, the range of target prices is a low of $11.50 from Ord Minnett through to a high of $14.50 from Morgan Stanley.

Major broker target prices and recommendations

Based on an ASX price of $10.98, the major brokers have TWE trading on a multiple of 20.6x forecast FY24 earnings and 17.9x forecast FY25 earnings. They forecast a full year dividend of 36.2c, putting TWE on a prospective dividend yield of 3.2% (fully franked).

Treasury Wine Estates (TWE) – last 12 months

What’s the bottom line?

I “buy” the deal and I “buy” TWE. I think this is a well-run company that was remarkably agile in developing new markets when China imposed its ban on Australian wine.

I am nervous about how TWE is trading during the offer period, and while the participation rate in the institutional offer at 76% was “ok” and the clearance rate of $11.50 was strong, the fact that it hasn’t traded above this price since suggests there is stock in “loose hands”.

For long-term holders, the entitlement offer is attractive. But patience might be required.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.