Twelve months ago, I wrote an article entitled BOQ feels like a re-run of Westpac (see https://switzerreport.com.au/boq-feels-like-a-re-run-of-westpac/), concluding that “If you want “outperformance” in the next 12 to 18 months, BOQ is unlikely to be the stock.” And that’s exactly how it has turned out – BOQ has gone nowhere, while the major banks have rallied strongly.

BOQ – 4/18 to 4/23

Source: nabtrade

With Suncorp Bank being swallowed up by ANZ, Australia is down to two regional banks. My approach to the regionals has been to consider investing only if they are outstandingly cheap compared to the major banks. Being cheap relative to the market isn’t sufficient by itself.

Decades after Paul Keating tried to shake up the banking industry by inviting 15 well-capitalised foreign banks to open their doors in Australia, the four major banks still control more than 80% of the Australian banking market. The oligopoly is essentially untouched (apart from Macquarie), with as much market power today as it had back in 1985. Further, market leadership and arguably much of the product innovation comes from the “Big 4”, not the other 140 regional, community and fintech banks. There is just not enough differentiation on product or service.

As a firm believer in investing in “leaders” rather than “tier 2” or “tier 3” players, the regional banks (BOQ and Bendigo & Adelaide), which are definitely “tier 2”, only grab my attention when they are “super cheap”. If I want to invest in banks, I stick with the majors.

Last Wednesday, BOQ released its first half results. Let’s see if anything has changed and if there is any value in the regional banks.

BOQ’s half year result

Cash profit for the half year ending 29 February 2024 of $256m was down 31% on the corresponding period in 2023. Underlying profit, which is measured before loan impairment expenses, was down 33%.

The main driver was lower net interest income. Margins continued to crunch, with the net interest margin (NIM) falling from 1.79% to 1.55%, a decline of 24bp. The loan book also went backwards, falling by $1.2bn. Operating expenses grew by 6%.

Sequentially (first half 2024 vs second half 2023 or February 2024 half year vs August 2023 half year) it was a little better: volumes down by $0.4bn, net interest margin (NIM) down by 3 basis points and expense growth of 2%. That said, this is a bank going backwards.

The pain was felt most in the Retail Bank due to competition in the home loan market and pressure on deposit rates, with underlying profit down 63% to just $73m. The Business Bank, which includes BOQ Specialist (a business it bought from Investec which services professionals) recorded a profit of $192m which was 12% lower.

Like Westpac a few years ago, BOQ is still talking about “simplifying”, “digitising” and “optimising” – things it should have been actioning a decade ago. It is a result of chronic under-investment in technology and technical skills, poor leadership, and stupid acquisitions. The ME Bank acquisition standouts. BOQ paid way too much and was hopelessly positioned to integrate the Bank.

For shareholders, the interim dividend was cut from 20 cents per share to 17 cents per share, the latter equivalent to a payout ratio of 65%.

Looking ahead, BOQ expects revenue and margin pressure to moderate in the second half of 2024. While deposit competition is expected to continue, compression in the home lending margin should stabilise. Some growth is expected with business banking. On costs, the Bank expects “low single digit cost growth”. It hasn’t abandoned (yet) its financial year 2026 targets of ROE (return on equity) of greater than 9.25% (currently 5.8%) and CTI (cost to income) of 50% (currently 65.9%,) and is “considering additional ways to deliver” these.

What do the brokers say?

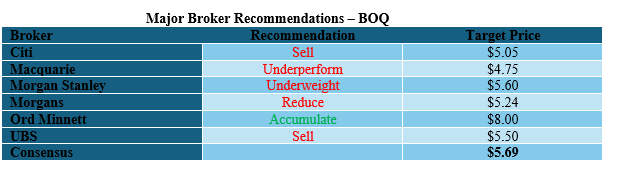

Apart from Ord Minnett (Morningstar), who is the outlier, the major brokers are negative on BOQ. According to FN Arena, there are 5 “sell” recommendations and 1 “buy” recommendation (Ord Minnett).

The table below shows individual broker recommendations and target prices

The consensus target price of $5.69 is 7.3% lower than Friday’s ASX closing price of $6.14. If Ord Minnett’s target of $8 is excluded, the consensus reduces to $5.23.

FN Arena’s precis of Macquarie’s commentary on the result is a good summary of market sentiment:

Macquarie was disappointed by Bank of Queensland’s 1H result which lacked positive catalysts, and management seemed to be conceding the difficulty of achieving FY26 targets.

The resulted highlighted to the analyst weak balance sheet growth, while the underlying margin fell by -6bps. Deposit funding costs remain under pressure from competition and low mortgage returns will result in management reducing involvement in this area.

The broker highlights the difficulty for management in achieving the twin tasks of reducing expenditure and improving profitability while also trying to invest for the future.”

On multiples, the brokers have BOQ trading on a multiple of 13.6 times forecast financial year 2024 earnings and 13.2 times forecast financial year 2025 earnings. A total dividend of 35 cents is expected to be paid for financial year 2024, implying a prospective dividend yield of 5.7%.

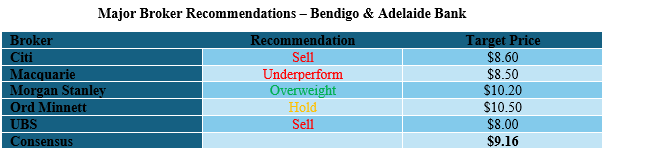

The major brokers are marginally more positive on Bendigo & Adelaide Bank (BEN), although the consensus target price still implies downside and there are more sell recommendations than buy recommendations. The consensus target price is $9.16, 5.2% lower than Friday’s closing ASX price of $9.66.

What’s the bottom line?

I can’t see any compelling reason to buy the regional banks, and in particular, BOQ.

On earnings multiples (one measure that can be used to compare value), the regionals are not that much cheaper. ANZ is trading on a multiple of around 12.5 times forecast earnings, Westpac 13.4 times, NAB around 14.5 times and CBA around 19 times. BOQ is in the 13’s and BEN the low 12’s. Sure, they are a lot cheaper than CBA, but so are the other three majors.

Looking ahead, it is hard to see earnings for the regionals picking up much. They don’t have the asset growth, costs are proving harder than expected to take out and bad debt (loan impairment) expenses are by historic standards currently quite low.

The regionals do offer slightly higher dividend yields, but they have come back to the pack as they have cut dividends (due to the crunch in earnings), whereas the majors have been able to maintain or offer small increases.

Underperform.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.