It’s strange times like these that someone has to make sense of markets when they go crazy negative. I’d never want any of my subscribers to do a John Lennon complaint, that “Nobody told me there would be days like these…” And as John recognised “…these are strange days indeed!”

However, it doesn’t mean you can’t invest wisely because we actually have been given the playbook for what should happen to stocks, when the three I’s — Iran, Israel, and Inflation — becomes less of a problem for Wall Street and global investors, who take their lead from the Big Apple’s stock market.

The short-term importance of Iran is such that I did something on Sunday morning that I never do — I went looking for news stories. Six days of that stuff is enough for me but for my Sky News business report at 7.10 am on Mondays, I needed to know if Iran was keen to keep fighting with Israel.

News sources referred to “…an explosion at an Iraqi military base housing pro-Iranian paramilitaries.” And official statements said one person was killed and eight others were wounded.

That won’t be good for markets if Israel is linked to the explosion. On the other hand, at least one news report said Iran regarded the attack on Isfahan akin to being threatened with toys, which implied Iran had little reason to return fire.

“What happened last night was not a strike,” the foreign minister, Hossein Amirabdollahian, said in an interview with NBC News’ Tom Llamas. “They were more like toys that our children play with – not drones.”

But these are strange days indeed and so markets will be on tenterhooks until it sees the Middle East threats to oil, trade, and global growth lessening.

Meanwhile, the other market monitoring exercise will be the US economic data drops to see if the Yanks will get an interest rate cut or two this year. In Saturday’s Report I ended with an important observation from an economist who I have a mountain of respect for — Wharton professor at the University of Pennsylvania, Jeremy Siegel.

This is what he told CNBC late last week: “We can all say at the beginning of the year the market was way optimistic with four or five cuts. Now it’s squeezed down to one. And I actually think that we might get two or three cuts by the end of the year.”

If the good professor is proved right, then US economic data would have been pointing to lower inflation, and if his scenario can meet a diplomatic solution to the Middle East crisis, which has to be a part of Joe Biden’s pitch to knock off Donald Trump for the US presidency, then stock prices will head skywards again.

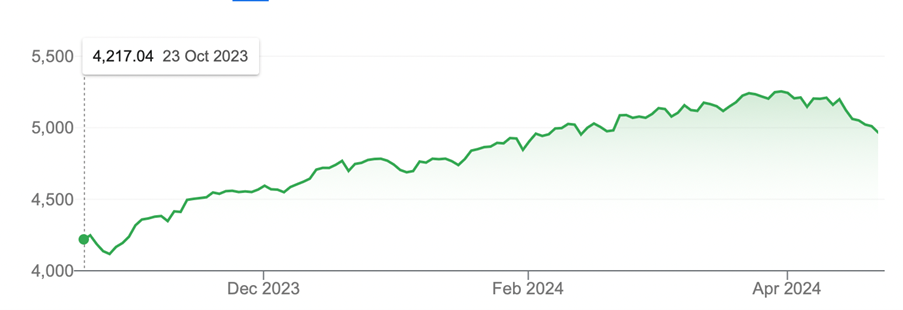

The beauty is that we’ve already seen what this market will do if they think rate cuts are on the way. This chart of the S&P 500 over the past six months is proof.

S&P 500 (six months)

The playbook of expected rate cuts driven by lower inflation meeting the potential for what AI is promising, all in a US economy that wasn’t heading to recession (despite 11 official interest rates rises and even with a Russia-Ukraine war on), all suggest that a market comeback is a good and sensible bet.

In the past I’ve told my financial planning clients and you, my subscribers that I was positive about stocks for 2024 but I could get more defensive in 2025. Right now, because of the three I’s, I’m toning down the gains from 2024, which I still think will be good, but I’m now going to delay my defensive inclination for my portfolio until say mid-2025.

I suspect we have temporary headwinds that will turn into tailwinds if Professor Siegel is right.

By the way, he isn’t alone being positive about investing.

Yahoo Finance reported this about Fundstrat’s Tom Lee a day ago: “Lee, one of the most bullish forecasters on Wall Street, predicted the S&P 500 could jump to 5700 by the end of the year, implying another 13% upside for the benchmark index. The market doesn’t need Fed rate cuts to do well, he said in a recent interview with CNBC, assuming that the economy remains strong, and inflation continues to cool.”

And then there was this from VanEck CEO Jan van Eck about China driving commodity prices higher, which is a good omen for our market. “The world economy started growing again,” van Eck told CNBC this week. “China which has been such a huge driver of growth and so negative for growth over the last year or two. Manufacturing PMI is now positive in China as of March.”

So how am I playing these current strange days? I’ll wait to see how the Israel-Iran issue plays out and I’m betting US inflation trends down over the next three or four months. If the market wants to turn this 4.1% pullback since March 28 into a 10% plus correction, I’ll be buying CSL, BHP, Xero, Macquarie, the ETF VAS, and a little more GEAR, which I always warn is for risk takers. Another one for the thrill-seekers could be HNDQ for the Nasdaq top 100 stocks but I think the S&P 500 index will do well once rates fall and so IHVV should work. It also should be helped by a rising dollar and that’s why I prefer the hedged version of IVV going forward.

What I’m really saying is that we’re in a ‘back to the future’ play. In October last year when the market took off, rate cuts were expected, tech and growth stocks took off, yields on bonds fell and our dollar went up.

Those days (and they won’t be so strange) will come again and stock prices will love it!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.