The last two weeks of rises for the All Ords has taken it 5.4% higher, so am I on the money with my numerous suggestions that stock markets are trying to bottom? I’d say ‘yes’.

Given the instant inclination for traders to chase beaten-up tech stocks, my other tip that these tech spikes are a sneak preview of what happens when interest rate rises peter out as inflation falls, also looks like a good call.

But does that mean you can confidently go back into stocks? My answer to that key money-making question is this: ‘yes’, if you’re a thrill-seeker, and ‘no’ if you hate having to stomach worrying sell-offs.

I suggested last Saturday that the thrill-seeker could make seriously good money by Christmas, after the usual Santa Claus rally. But between now and then there could still be some scary days and weeks.

This week will be a good test of my proposition that we should expect some market dramas in coming weeks and even months, but by the December quarter there should be a happy ending.

This week the US gets a pretty big data drop, including house prices, consumer confidence, economic growth and income/spending numbers. These will be poured over by economists and market players for signs of inflation peaking or recession threatening. This could cause stock prices to move significantly.

But wait, there’s more market-important stuff coming out of the US. First, 120 of the big companies in the S&P 500 are due to report. These companies include the likes of Apple, Alphabet and Meta and their show-and-tell stories could send stocks soaring or plummeting.

So far Netflix and Citi have worked wonders for stock prices, but Snap snapped the positivity last week and share prices headed down. No one can say with certainty what will happen over the next two weeks of US reporting. The only plus is that with 21% of companies in the S&P 500 reporting, 70% beat expectations.

For a long time I’ve argued that the market influencers were being too negative on interest rate rises, the threat/severity of recession and what might happen to company profits. So the next two weeks in the States and the first two weeks in August here, when our reporting season hots up, will be critical to what overall market indexes will do.

I still think the June lows will prove to be the overall low, but that’s a guess. In two weeks, when US reporting season will be virtually over, I should be more assertive on my call. Then I’ll be hanging out for our reporting season, after which it will be clear if we should go long stocks without much fear.

But wait, there’s still more this week that will have a big bearing on stock prices going forward. It’s the Fed’s interest rate meeting. By Thursday, we’ll not only see an expected 0.75% official interest rate rise, we’ll also hear from Fed boss Jerome Powell. The decision will come with a lot of other data, forecasts and comments that will make markets rise or fall. So it’s huge week.

Everything I’ve outlined above explains why a careful investor will wait until mid-August before setting their share buying or selling sights. The risk taker makes a call and goes long or short or could simply go to cash, but either way it’s a gamble.

Staying long is also a gamble but if you’re a long-term investor, time is on your side. As I’ve argued, by the December quarter, we should see positives outweighing negatives. Why? Try these:

1. Inflation should be falling.

2. Commodity prices will ease to help inflation fall.

3. Interest rate rises will be over, for a time.

4. The threat of lockdowns will be behind us.

5. There will be clarity about a US recession, which many economists say will be mild.

6. Petrol prices are likely to be lower. Last week we saw the national average unleaded petrol price fall by 8 cents to 204.1 cents a litre. The wholesale price fell by 17.5 cents a litre.

7. China’s economy will be growing more strongly.

8. Hopefully a Ukraine war end will be closer.

Sure, there’s a lot of ‘ifs’ and ‘buts’ in this list but they’re all very possible, and when fund managers bought in hard in recent weeks, I don’t think they were simply powered to positivity by simply one good report from Citi or Netflix.

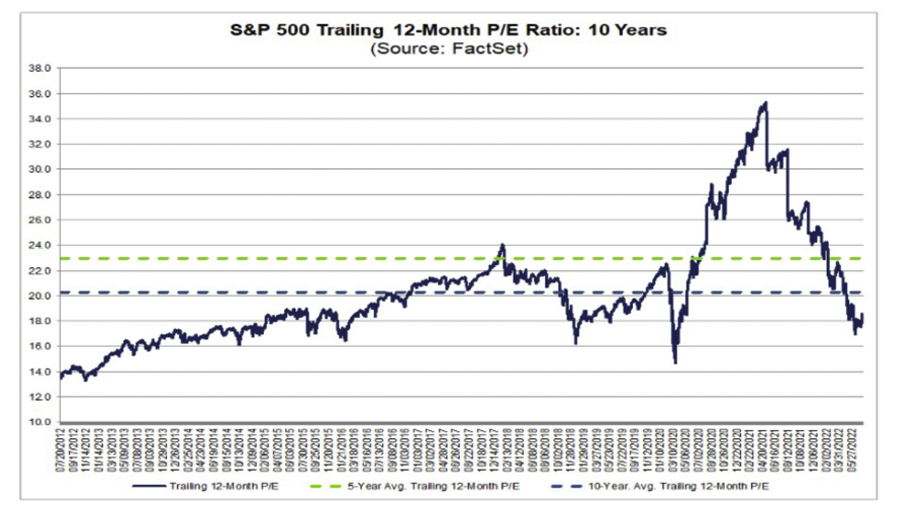

I also like this from Percy Allan, who looked at what the bulls like about the US market now. “On fundamentals, the bulls say the S&P 500 index is fairly priced, with its price/earnings (P/E) ratio of around 18 now below both its 5- and 10-year average trailing 12-month P/E ratios,” he wrote. See the chart below.

That’s a big tumble and says the 2022 sell-off has done its work, taking the froth out of those stock prices that followed the Coronavirus crash rebound.

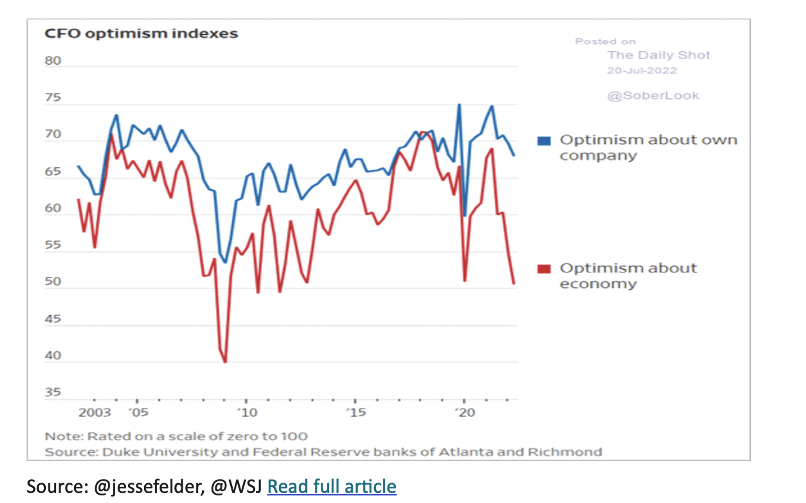

I love this from Percy, who tells us that US chief financial officers are negative on the US economy but not on their own businesses! How does that work? It could be saying that accountants are better at the small picture rather than the big picture!

The chart below shows the red line has dropped dramatically, which is the chief financial officers’ (CFOs) take on the overall US economy. But what about the blue line, which shows how positive they are about their own businesses?!

The optimism reading is above most years since the GFC! Positivity is making headway over negativity but the battle isn’t over yet. Bears think a US recession will bring down earnings and then share prices. History says they’re right but it does rest on the US going into recession.

The optimism reading is above most years since the GFC! Positivity is making headway over negativity but the battle isn’t over yet. Bears think a US recession will bring down earnings and then share prices. History says they’re right but it does rest on the US going into recession.

Last week I reported that the chief economist at Moody’s Analytics (this is the mob that rates credit-worthiness of economies), Mark Zandi, speculated that the US wouldn’t go into recession. “I don’t think we need a recession to get inflation back in,” he said recently on a podcast for Bloomberg. “Oil prices are going to roll over. Natural gas prices are going to fall. We’re going to see vehicle prices come down as supply-chain issues iron themselves out and we get more vehicle production. Commodity prices, goods prices more broadly, are going to come in.”

I liked this from him as well: “I talk to CEOs, CFOs, investors, friends, family – to the person, they think we’re going into recession. I’ve never seen anything like it. I’ve seen a lot of business cycles now. And no one predicts recessions. But in this one, everyone is predicting a recession. So when sentiment is so fragile, it’s not going to take a whole lot to push us in. I think with a little bit of luck, and some reasonably good policy-making by the Fed, we’re going to be able to avoid a recession. But I don’t say that with a lot of confidence.”

Like me, he’s positive but at the moment not confidently positive. That might take a few weeks or even months to happen.

However, I’m confident it will happen sometime this year, provided central banks don’t screw up. If they do, those June lows on the stock market will be tested.

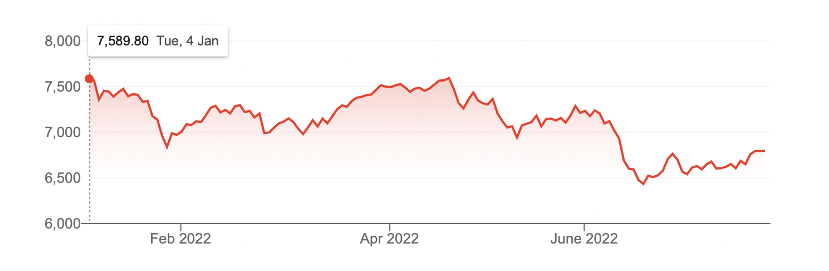

S&P/ASX 200

We’re up 5.6% since the June low and really bad news could easily wipe out that gain. That’s why the next four weeks of company reporting and rate rises will be vital for our portfolios.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.