If shareholders were to rate Australia’s best companies, at the top of their pecking order would be names such as CSL, Goodman Group, Commonwealth Bank and Macquarie Group. Each has delivered in spades over the long term.

Macquarie’s share price graph for the last 10 years says it all. Steadily rising, a trebling in price, the occasional pullback but with a strong sense that dips are buying opportunities.

Macquarie (MQG) – 10 years to 5/22

And so when Macquarie lost almost 15% earlier this week, investors took notice and asked the obvious question – is it in the buy zone?

The trigger for Macquarie’s “fall from grace” was the delivery of its full-year profit result last Friday. This wasn’t a poor result or a “miss” – in fact, it was an outstanding result – a clear “beat”. Macquarie lifted net profit by 56% to a record $4.7bn. The second half of the year (Macquarie’s financial year ends on 31 March) came in at $2.7bn, up 30% on the first half and 31% on the corresponding half of the previous year.

But investors sensed that this might be as “good as it gets” and Macquarie’s share price was hit, falling to a low of $176.10 on Tuesday before recovering to close yesterday at $182.12. This is still more than 10% down from its pre-result level.

Macquarie (MQG) – last 12 months

Looking at Macquarie’s profit, the markets facing businesses (Commodities and Global Markets, Macquarie Capital) contributed 56% of group profit, while the annuity-style businesses (Banking and Financial Services, Macquarie Asset Management) contributed 44%. The last year has been a boomer for trading – with wild swings in energy and commodity prices following the outbreak of the war in Ukraine and volatile equity and bond markets. Corporate activity, particularly in relation to mergers and acquisitions, has been strong. The market fears that with the external environment becoming more challenging as interest rates rise, markets-based businesses (such as Macquarie) will find it more difficult to generate revenue. Some investors have a major question mark about the sustainability of Macquarie’s earnings.

That’s despite Macquarie’s incredible success in truly becoming a global investment bank. 75% of its income comes from offshore, with the Americas contributing almost 50%. Of its 18,000 staff, 54% live outside Australia.

Analysts forecast Macquarie’s earnings to fall next year. From an effective earnings per share (EPS) of $12.71 in the year just completed (FY22), they forecast a fall to $10.57 per share in FY23 before rising to $10.95 in FY24.

The market was also disappointed with the final dividend of $3.50 per share which took the full-year dividend to $6.22. Although both were up from FY21, they represented a payout ratio of just 50%. This is at the bottom of Macquarie’s target range of 50% to 70%, and prompted speculation about why the Board was being so conservative – are tougher times coming?

The company’s forward guidance was cautious. Macquarie noted that commodities income is expected to be significantly down, transaction income for Macquarie Capital is expected to be down on a record FY22 and in regard to Macquarie Asset Management, there would be an increase in base fees but challenges with other income.

However, Macquarie has a history of being cautious with outlook statements. Like CSL and some of the other leading companies, it works on the mantra of “under-promise and over-deliver” and has a track record of consistently outperforming forecasts.

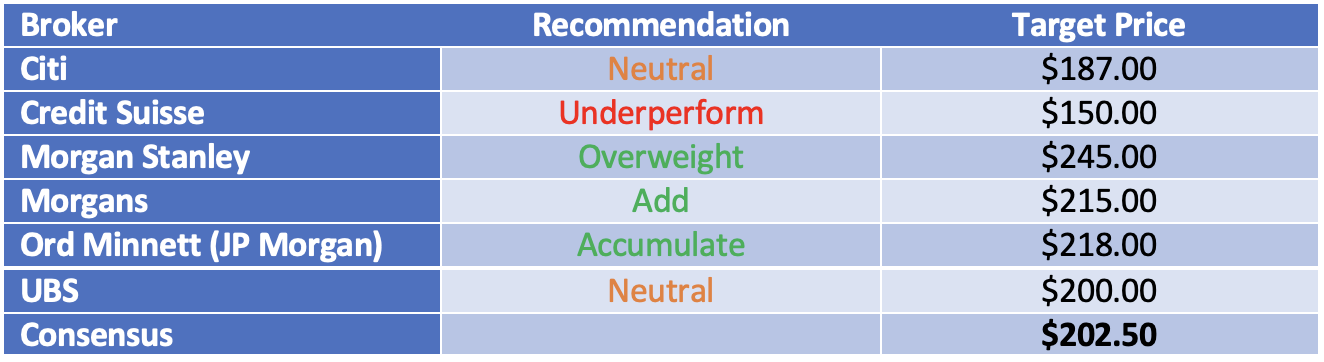

What do the brokers say?

Three of the major brokers changed their recommendations following the result. Credit Suisse downgraded to an ‘Underperform’ from ‘Neutral’, while Citi downgraded to ‘Neutral’ from ‘Buy’. Morgans went the other way, upgrading to ‘Buy’ from ‘Neutral’.

Overall, the consensus target price according to FNArena sits at $202.50, 11.2% higher than yesterday’s ASX close of $182.12. The range is relatively wide – from a low of $150.00 from Credit Suisse to a high of $245.00 from Morgan Stanley.

Major Broker Recommendations and Target Prices

Morgan Stanley argues that Macquarie has a strong pipeline, is re-investing for growth (hence the low dividend) and is well-positioned to benefit from the green theme. There may be cheap M&A opportunities available to Macquarie in the alternative asset managers’ market. On the other hand, Credit Suisse believes earnings have peaked and was disappointed by the Company’s guidance. Higher interest rates will lead to a more challenging environment, and the potential for stagflation could threaten investment values upon realisation.

On multiples, the brokers on consensus have Macquarie trading on a multiple of forecast FY23 earnings of 17.2x and 16.6x forecast FY24 earnings.

Bottom line

Follow the form guide and back history to repeat itself. Dips are buying opportunities. Management’s conservatism is understandable.

That’s not to say that if the turbulence in world markets continues, Macquarie won’t be hit. It will be hit and hit harder than most because it is classically a more volatile stock and is dependent on the external environment. But Macquarie should be considered a “core portfolio” stock and you have to buy it when others don’t want it.

— In the buy zone —

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.