I have been wrong about A2 Milk (A2M). I guess I didn’t fully appreciate the impact of Covid-19 on the sales of infant milk formula in China. But I also didn’t know about an inventory problem, and I didn’t understand that the then-management team were horribly optimistic when they conveyed the situation to the market. Four downgrades later, A2 Milk has lost two-thirds of its value.

Last week, A2M held an investor day where it outlined a recovery plan under new CEO David Bortolussi. It also provided a trading update, which while it didn’t provide any fresh “bad news”, there wasn’t much “good news” either, so the market took it as a reason to sell it down.

FY21 was a horror year for A2 Milk. Revenue fell from NZ$1.73bn to NZ$1.21bn, EBITDA by 77% to NZ$123m and NPAT to NZ$80m. Explaining the problems in FY21, A2M said this:

“Cross border trade was disrupted by Covid-19, creating substantial demand/supply volatility, which caused excess inventory, exacerbating the issue.

“As a result of the disruption, A2M experienced a significant decline in its English label infant milk formula (IMF) sales through both daigou/re-seller and e-commerce channels.

“At the same time, the China infant nutrition market suffered a decline in volume terms, a trend that became clear following the release of 2020 birth numbers which showed a reduction in birth numbers”.

Revenue for English language-branded tin sales, which is the smaller part of the Chinese market but much higher margin, collapsed from NZ$1,081m to NZ$520m. Chinese language branded tin sales actually rose – from NZ$338m to NZ$390m, and A2M’s market share from 2% to 2.5%.

A2M also markets fresh milk in Australia/New Zealand and the US, but its story is essentially about the sale of infant milk formula to Chinese consumers.

To turn A2M around, Bortolussie and his team are essentially banking on brand, marketing and distribution initiatives to drive sales growth. He is targeting lifting sales to NZ$2bn within 5 years.

Potentially, this involves doubling Chinese language market share from 2.5% to 5% and an extra NZ$400m in sales, regaining half of the English language sales decline from FY20 to FY21 (worth NZ$300m), a further NZ$300m from growth in new markets and categories (such as UHT milk for the Chinese market), and NZ$200m from increased milk and product sales in Australia and the US. Offsetting this is NZ$400m decline due to expected pricing pressures.

On paper, going from NZ$1.2bn to NZ$2.0bn in sales over 5 years doesn’t sound that ambitious, particularly given the company’s track record in distribution, marketing and brand building. The total Chinese market for infant milk formula is estimated to be worth NZ$47bn. However, working against A2 Milk in China is the decline in the birth rate. Although the Government has announced a plan for “three children” families, the birth rate fell during Covid and could fall further. The fall is more accentuated in the major cities – hence A2M’s plan to increase distribution activities in some of the provinces and lower-tier cities.

What do the brokers say?

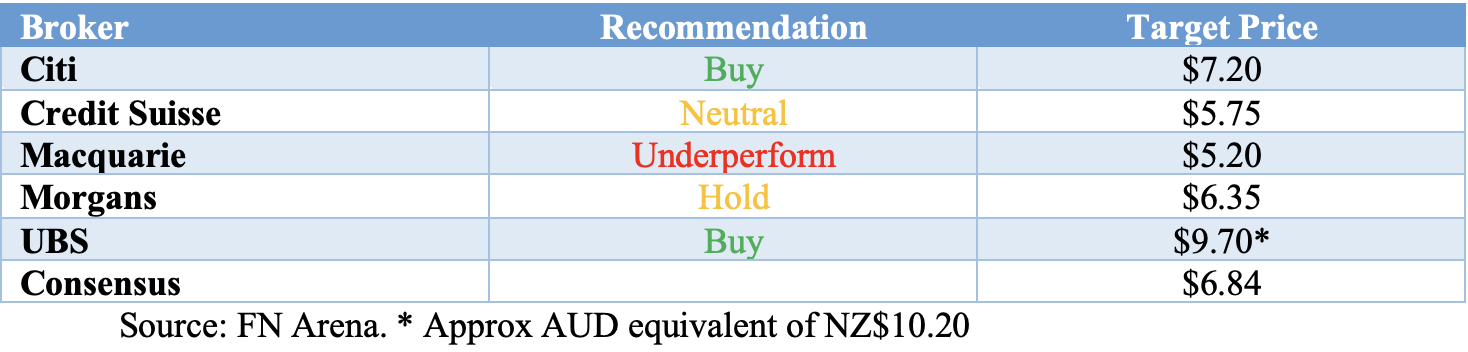

The brokers are divided over A2 Milk. Noting that their target prices have been “following the market” down, they range from $5.20 to a high of NZ$10.20 (approx. A$9.70). The consensus of $6.84 is approximately 9.4% higher than Friday’s close of $6.25.

UBS is the most bullish with a target price of NZ$10.20. They say: “A2 Milk should experience a meaningful recovery over the next 3 years resulting in a 122% rise in EPS (earnings per share) on FY22 levels by FY24, after incorporating losses from Matura Valley Milk. They note that investors are cautious, the share price only factoring in limited recovery.”

Macquarie is the main bear: “The medium-term margin outlook appears materially weaker and while this is likely to be the final material downgrade, there is significant risk and uncertainty around the growth path.”

Morgans notes, “ongoing regulatory and earnings uncertainties” but sees “corporate activity as the key upside risk”, Credit Suisse sees “risk with the company’s ambitions in China from a reduction in newborns”, while Citi says that there are signs that that “the brand is more resilient than previously believed”.

Bottom line

I am going to back management and hang on. I think most of the downside pain has been felt. That said, I don’t expect any material increase in share price (unless a corporate buyer emerges from left field) because it will be months – at least 3 months and more likely 6 months – before A2 Milk can demonstrate whether its distribution and marketing strategy is making progress.

Definitely one for the patient investor.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.