Wall Street digested another good jobs report but it wasn’t enough to stop big market influencers from continuing to dump stocks. But the only positive worth noting was that the negativity on Friday was less than what we saw on Thursday when the Dow was down over 1,000 points, making it the worst day since the pandemic lockdowns of 2020.

But the question is: how serious is this?

For the US market, it’s a serious pullback and a bear market for the tech-heavy Nasdaq, but it was overbought, as this chart below shows you.

Nasdaq

The Coronavirus crash took the slope of the increase in this index steeper and steeper after late March 2020, which signalled the start of the market rebound powered by a historical drop in interest rates.

And it’s no surprise that it’s the raising of interest rates by the Fed that’s now rocking the socks off tech stocks in particular, but some respected experts think we’re getting close to the bottom of this sell-off.

I won’t hazard a guess because history shows markets overreact in both directions but I do like that one of my preferred expert market watchers i.e. Professor Jeremy Siegel from the University of Pennsylvania, thinks we’re close to the bottom.

He says the S&P’s P/E ratio is now near 18, which is a good level on a historical basis. And if you take tech out, it’s more like 15, which is a good number to encourage the buying of stocks. That said, I reckon we are in for this negatively-inclined volatility until there’s a run of unchallengeable good news, which will come.

Right now, ridiculous predictions of what will happen to interest rates in a short period of time are actually being taken seriously by commentators and even the bond market, which, over time, should prove to be dumb, with a capital D!

Even in Australia, the bond market says the cash rate will go to 3% by year’s end. And even Chris Joye, who I interviewed yesterday for Monday’s TV show, agreed this was unbelievable! If the RBA, Dr Phil Lowe, the Fed and Jerome Powell end up following the predictive scripts coming out of the bond market, we’d end up in a recession.

Rates will rise but it won’t be silly stuff that will swap arguably a temporary inflation problem for a recession disaster.

Siegel told CNBC that “I like stocks long term” but predicting markets short term is too hard. He did say the Fed (and I’d add our RBA) are behind the curve in beating inflation but they can play catch up and it’s not just raising interest rates that will help.

The Penn University academic pointed to two months of money supply reduction from the Fed that have been meaningful in containing inflation. And he’s not alone, with the likes of CNBC’s Jim Cramer tipping the US market is close to a bottom and dip buying is starting to look logical, though as Keynes once observed: “Markets can stay irrational longer than you can stay solvent!”

My take on what I’m seeing is that this is an overdue period, where interest rates have to rise, tech stock valuations needed to pull back (though they’ve gone too far in many cases) and central banks are likely to do their best to avoid a recession.

Also, economies like the US and ours are doing pretty well, as my “What I liked” section below shows, and those US job numbers show there’s no recession happening in the States right now.

The April jobs report showed a rise of 428,000 jobs, which was more than the 400,000 expected by economists surveyed by Dow Jones. Unemployment was steady at a low 3.6%, which hardly screams “recession is coming”.

One disappointment in the numbers was the participation rate, which remained low. This needs to rise to reduce wage pressures that feed into inflation.

More workers looking for work will slow down wage rises and it’s inflation (and how many interest rate rises are coming to beat it) that’s behind this stock market sell-off.

What’s interesting about the current volatility is the fact that we saw two days (i.e. Tuesday and Thursday) in the US stock market generating completely opposite headlines in CommSec’s morning market report:

- US share markets recorded broad-based gains in volatile trade on Tuesday ahead of the Federal Reserve interest rate decision. (The Dow was up 67 points.)

- US share markets posted solid broad-based gains on Wednesday. While the Federal Reserve raised rates 50 basis points, Fed chair Powell ruled out a bigger 75 basis point rate hike at future meetings. (The Dow was up 932 points!)

- US share markets slumped on Thursday. Falls occurred across the board, led by technology, and reversing gains from the previous day. Investors expressed doubts on the ability of the Federal Reserve to get inflation under control. (The Dow was down 1,063 points!)

What we’re seeing is a reality check for the US stock market that paid too much for tech companies, but the sell-off is creating real buying opportunities for the patient. And it will be quality tech companies that will be the best buys going forward.

This week, Goldman Sachs included Shopify on its list of companies that have nice upside ahead. Shopify has always been seen as a quality tech company, which boomed in pandemic lockdown land.

Shopify

The take-off in Shopify’s stock price was crazy but so is its fall and it doesn’t surprise me that Goldman is seeing value in this company going forward.

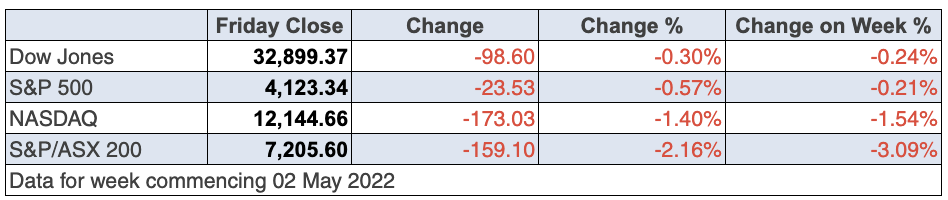

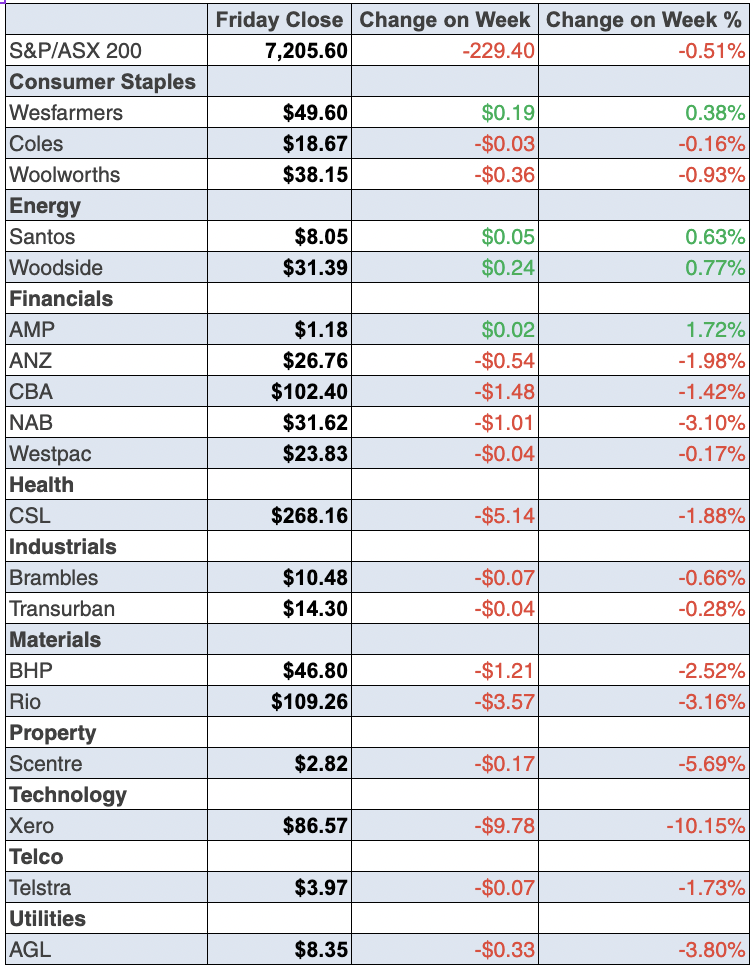

To the local story and our market copped it on Friday with the S&P/ASX 200 down 2.16% (or 159 points) following a shocker on Wall Street on Thursday. For the week, the loss was 3.09%, which is close to what we lost over the month and over the past six months, but year-to-date we are down 5%. The S&P 500 is off 13.5% over the same time period, which shows you that our market has a relative competitive advantage over many in 2022.

Our market can’t ignore the worldwide concerns of market influencers, who have a triple worry right now. These are:

- Is inflation out of control in the US?

- Will it mean the Fed could over-tighten?

- And could it lead to a recession?

The bond market is more worried about inflation and higher rates, which makes more sense than recession concerns. But no one really knows what lies ahead so it’s a guessing game with excessively negative inclinations. And who could be surprised about that?

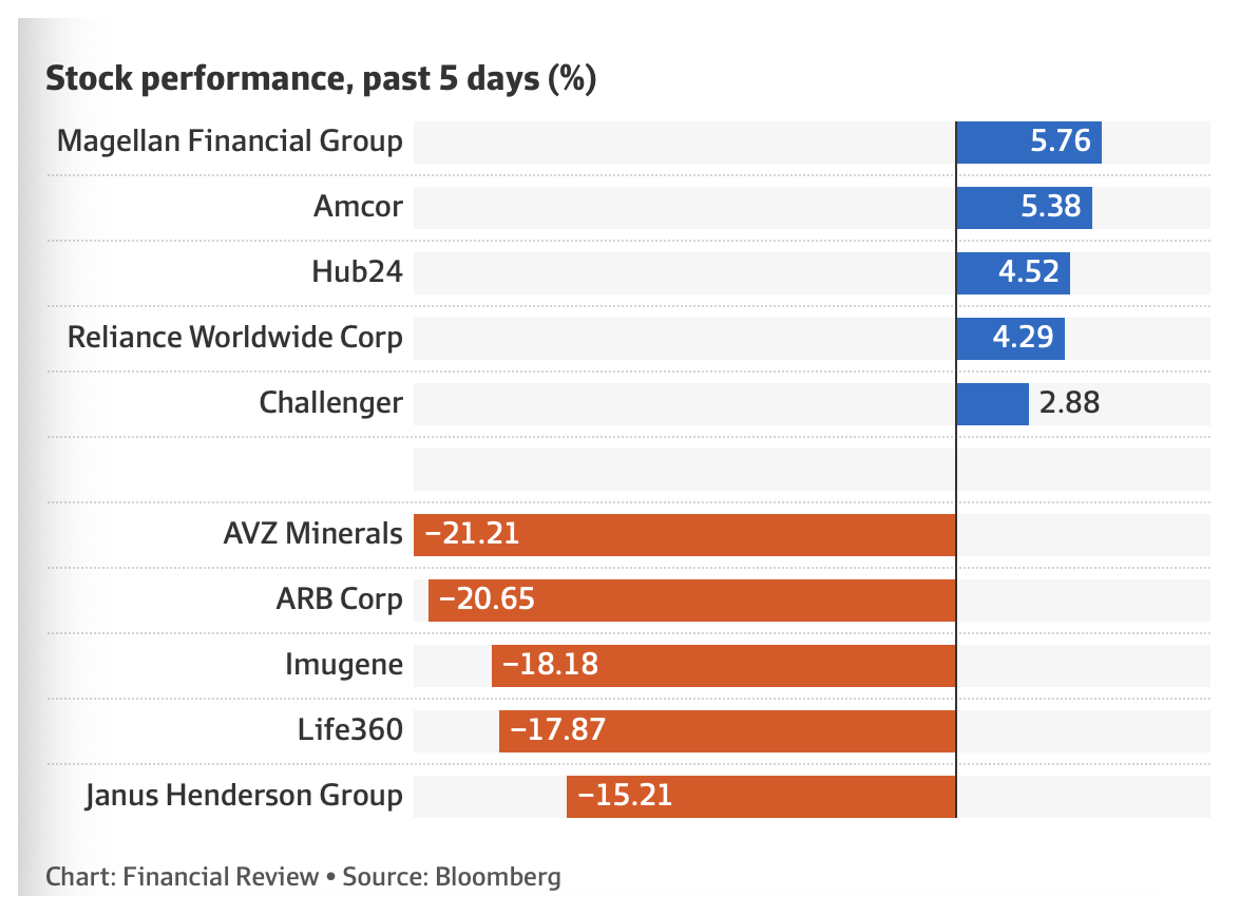

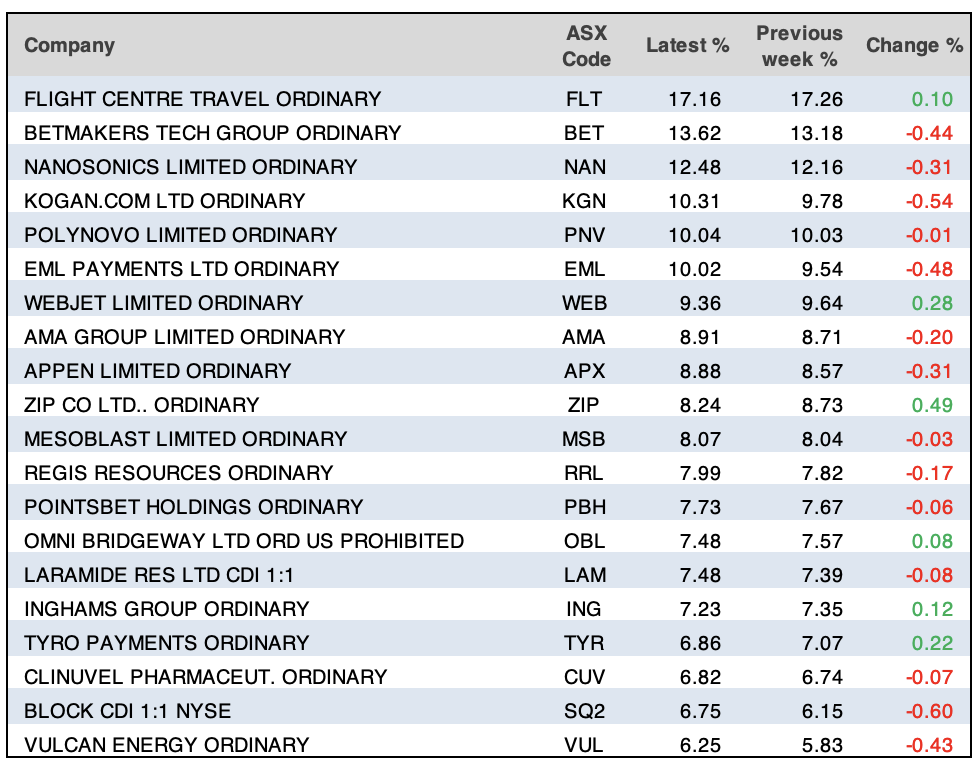

Here are the winners and losers for the week but the winners aren’t biggies.

The surprise story was Macquarie’s 7.78% fall after a good report (net profit up 56%) but the CEO wouldn’t give a firm outlook statement and the market didn’t like that. I bet its share price doesn’t stay down for too long.

The banks were largely off this week, despite a good report from the NAB and an OK one from ANZ. NAB lost 2.11% for the week, CBA was off 0.68%, ANZ gave up 0.93% and Westpac (which reports on Monday) actually went up 0.29%!

Meanwhile, BHP and Rio lost 2% plus for the week, in a week when it was easy to be negative about most stocks. A lot of selling was indiscriminate dumping to avoid losses by short-term players.

If I didn’t think the economies of the world were positioned to bounce back, I wouldn’t be talking about buying opportunities, but economies are likely to stage a comeback, provided central banks don’t go too far and too fast with rate rises.

The data below shows how well our economy is doing, as did the US job numbers overnight.

What I liked

- The Melbourne Institute monthly headline inflation gauge edged lower by 0.1% in April – the first decline in 11 months – to be up 3.4% on the year. But the ‘underlying’ or trimmed mean measure lifted by 0.3% to be up 2.6% on the year.

- In April, ANZ job ads fell by 0.5% to 242,536 available positions, easing from a 13½-year high of 243,645 ads in March (highest since July 2008). Job ads are up 26.3% on the year and are 57.3% above pre-Covid levels in January 2020. It was a fall but it was from a 13½-year high.

- According to the Australian Bureau of Statistics (ABS), new home loans rose by 1.6% in March to be up by 11.1% on a year ago. The average home loan stood at $612,946.

- The ABS reported that retail trade rose by 1.6% in March after rising 1.8% in February and after lifting by 1.6% in January. Retail trade was up by 9.4% on a year ago to a record $33.6 billion.

- The final S&P Global Australia Services Purchasing Managers’ Index (PMI) rose from 55.6 in March to 56.1 in April – the third consecutive month in which business activity rose. A reading above 50 denotes an expansion in activity.

- The Reserve Bank (RBA) lifted the cash rate for the first time in 11½ years, which is a sign the economy is strong enough to cope with it.

- The trade surplus rose by $1.9 billion to $9.31 billion in March. Australia has posted 51 successive monthly trade surpluses. Exports to China rose by 13.2% in March to $14.7 billion.

- US factory orders rose by 2.2% in March (survey: 1.1%)

- The US Federal Reserve (‘the Fed’) hiked its target range for the federal funds rate by 50 basis points to 0.75-1.00%, the biggest increase since May 2000 and the first back-to-back meeting hikes since 2006. But Fed Chair Jerome Powell quelled investor concerns about the potential for a 75 basis points increase in the federal funds rate to combat inflation in the coming months, saying that it’s “not something that the committee is actively considering”.

What I didn’t like

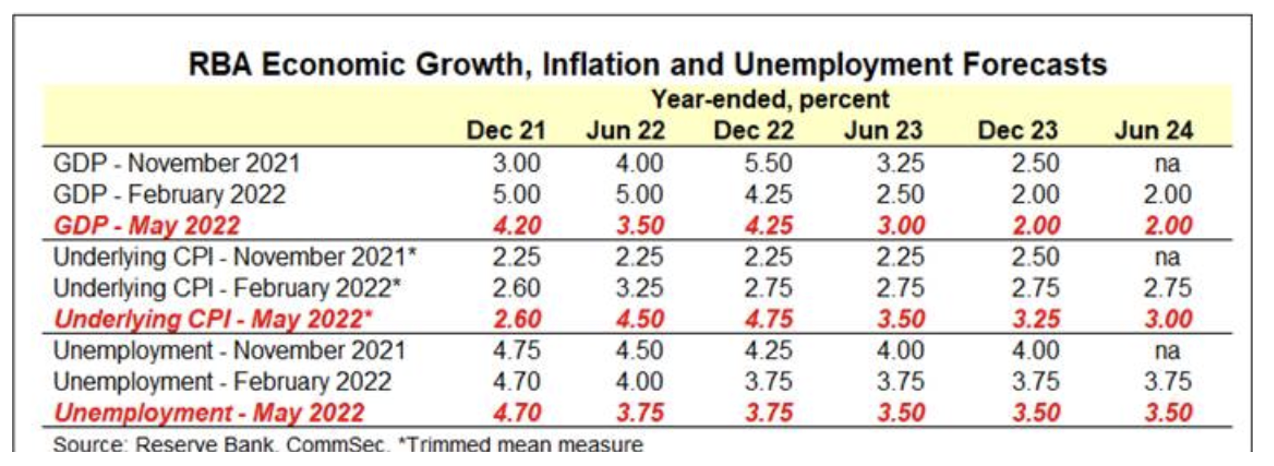

- The RBA says the underlying or “core” inflation is tipped to exceed the top of the 2-3% target band through to December 2023.

- According to the Federal Chamber of Automotive Industries, new vehicle sales totalled 81,065 units in April, down 12.2% on a year ago.

- The RBA says the economy, as measured by GDP, is expected to expand by 3.5% over the year to June 2022 (previous: 5%) before picking up to a 4.25% annual growth rate in December 2022. (I like that number.)

- Dwelling approvals fell by 18.5% in March. Approvals for apartments dropped by 37.7%. Approvals are down 35.6% in March on a year ago. Approvals had increased by a record 42% in February. These numbers are jumping around but we must look for a trend that could be influenced by fears of too many interest rate rises.

- Unit labour costs in the US rose by 11.6% in the March quarter (survey: 9.9%), while the Bank of England lifted its key bank rate by a quarter of a per cent to 1%.

In case you’re worried about the future

The latest forecasts of the RBA show real GDP growth to be down to 3.25% in the year to June but it spikes to 4.25% by year’s end. This correlates well with my view that we will see stocks rebound in the second half of 2022.

My last word is this: don’t let this current negativity stop you from keeping the faith!

The week in review:

- This week in the Switzer Report, I look at the data that might suggest if you’re investing locally, it might pay not to get too spooked. And if like me you see buying opportunities, I can show you what I think is good buying during this volatility?

- Four months into the year, the Switzer Model Portfolios are in the black. They’re benefitting from the performances of the major banks and miners, and in the case of the income portfolio, having no exposure to IT stocks. In his first article, Paul (Rickard) checks out how the overall market has fared and how our portfolios are outperforming the benchmark S&P/ASX 200 index. Paul then stays true to his colours as one not too impressed by improvements heralded by ANZ, and explains that there is value lying elsewhere in the financial sector.

- This week Paul and I asked Tony (Featherstone) if he could nominate some favoured ETFs that invest in sectors or themes. Tony says he prefers to use thematic ETFs to position portfolios for an extended period of higher inflation and slowing global economic growth and has picked 5 for you to consider.

- James Dunn says that perhaps it’s time to take a look at 3 payments companies: Block (formerly Afterpay), EML Payments and Tyro. How are these payment companies going and are they in the buy zone?

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks Pilbara Minerals (PLS) is a buy.

- In Buy, Hold, Sell— What the Brokers Say, there were 6 upgrades and 8 downgrades in the first edition, and 3 upgrades and 11 downgrades in the second edition.

- And finally, in Questions of the Week, Paul Rickard answers subscribers’ queries about why Magellan is issuing free options; Whether the share market reaction to Megaport is overdone; what is meant by “taking a profit”?; What’s the last day to buy NAB shares for the 73 cents dividend?

Our videos of the week:

- The link between noise pollution and dementia | The Check Up

- Xero’s MD of Australia & Asia on a company many experts like + XRO, CSL, QAN, SEK, and more! | Switzer Investing

- How many interest rate rises are coming? & has ANZ shocked its number 1 doubter, Paul Rickard? | Mad about Money

- Is the stock market heading for a crash? + Will house prices crash this year as interest spikes? | Switzer Investing

- Boom! Doom! Zoom! | 5 May 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday May 10 – NAB business survey (April)

Tuesday May 10 – CBA Household Spending Indicator (April)

Tuesday May 10 – Weekly consumer confidence (May 8)

Tuesday May 10 – Retail trade (March & March quarter)

Tuesday May 10 – Business turnover (May)

Wednesday May 11 – Consumer confidence (May)

Thursday May 12 – Overseas arrivals & departures (March)

Thursday May 12 – Weekly payroll jobs and wages (April 16)

Friday May 13 – New home sales (March)

Friday May 13 – Speech from Reserve Bank official

Overseas

Monday May 9 – US inflation expectations (April)

Monday May 9 – China international trade (April)

Tuesday May 10 – US Business optimism (April)

Tuesday May 10 – US Economic optimism (May)

Wednesday May 11 – US Consumer Price Index (April)

Wednesday May 11 – China inflation (April)

Thursday May 12 – US Producer Price Index (April)

Thursday May 12 – China lending data (April)

Friday May 13 – US import & export prices (April)

Friday May 13 – US Consumer sentiment

Food for thought: “Your attitude, not your aptitude, will determine your altitude.” – Zig Ziglar, author and motivational speaker

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

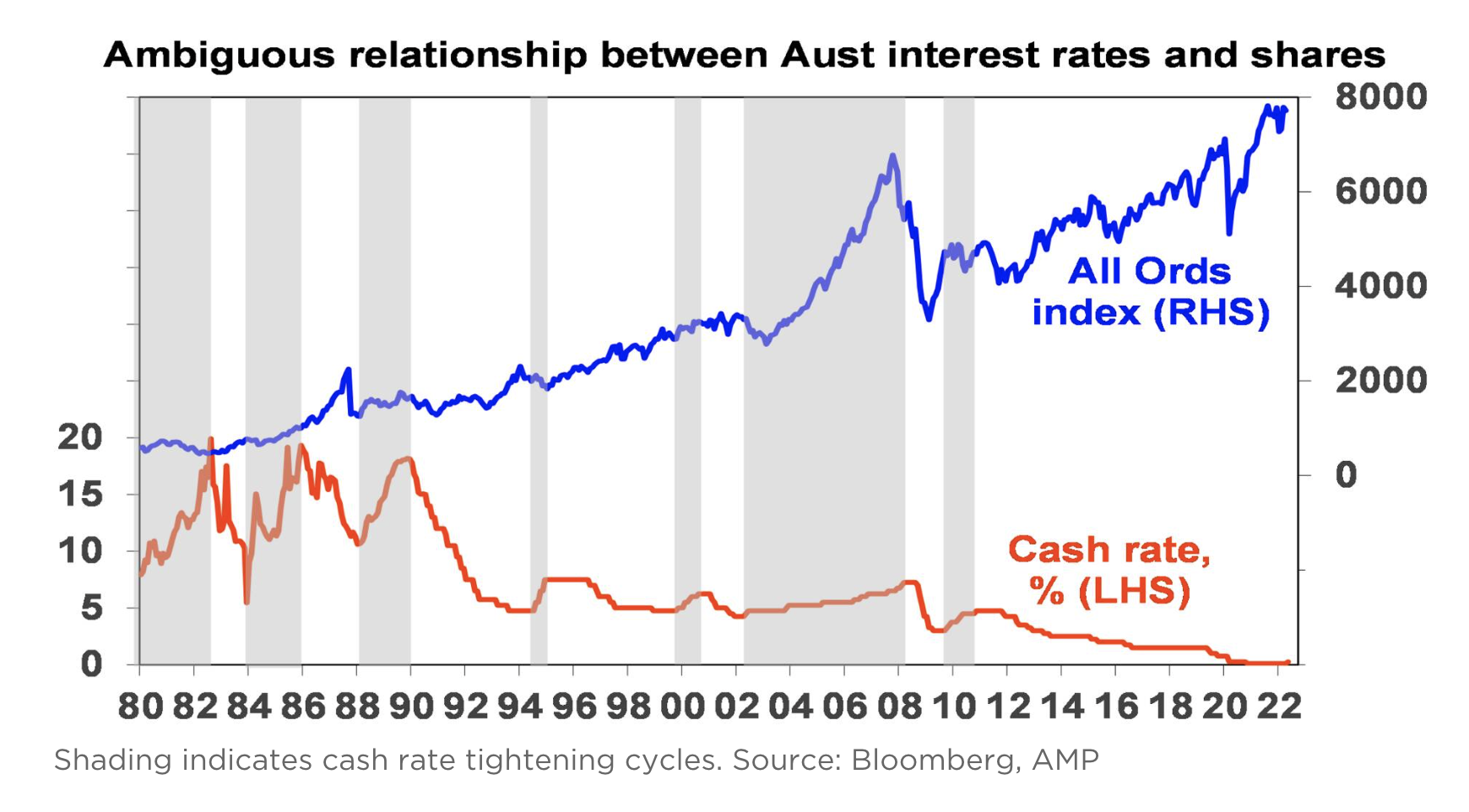

Chart of the week:

In our chart of the week, Shane Oliver of AMP Capital discusses what impact the interest rate rises announced by the RBA this week will have on our share market.

“There is an ambiguous relationship between rising interest rates and the Australian share market. While higher rates place pressure on share market valuations by making shares appear less attractive, early in the economic recovery cycle this impact is offset by still improving earnings growth. The chart below shows the official cash rate and share prices in Australia since 1980, with cash rate tightening cycles shaded. Sometimes rising interest rates have been bad for shares, as in 1994 for example, but at other times this has not been the case. For example, between 2003 and 2007 shares went up as interest rates rose with shares only succumbing in 2008, after multiple rate hikes over several years and with the GFC,” Oliver said.

Top 5 most clicked:

- Is this sell-off the buying opportunity we had to have? And what would I buy? – Peter Switzer

- Our model portfolios are in positive territory and outperforming! – Paul Rickard

- Are these 3 payment companies in the buy zone? – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- 5 thematic ETFs to consider as inflation and interest rates rise – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.