Days of stock market negativity can teach you a lot about what will happen when naysayers run out of worries to hold over the stock market. On Thursday, the not-so-reliable ADP private sector job report in the US came in at a huge 497,000 jobs, when economists expected 228,000! This set off alarm bells that the Fed could keep going hard on interest rate rises and stocks were dumped.

This is how the AFR’s Tom Richardson reported Thursday’s action: “The best-performing share market sector was utilities, which finished down 0.7 per cent. The three worst performers were the interest rate-sensitive tech, real estate and consumer discretionary sectors, which finished down 2.2 per cent, 2.6 per cent and 2.4 per cent, respectively.”

While Tom’s revelations could be useful to a short-term player, the lessons from legends of the market tells us that when rate rises are over, the sectors that would be back in favour are bound to be tech, real estate and consumer discretionary. I reckon tech will be the first ‘train’ to leave the stock market station.

The likes of legendary investor, Warren Buffett, would also advise “to be greedy when others are fearful”, and given the likelihood that we’re closer to the end of rate rises than at the beginning, it might pay to be both greedy and brave in the not-too-distant future with your investing. Maybe after Wednesday’s CPI in the US, it might be the right time to be greedy/brave.

Back to data that influences markets, and the better-than-expected official US jobs number on Friday of 209,000 jobs was not only less than the 240,000 the Dow Jones survey of economists tipped, it was also a lot less than the 339,000 created in May!

This raised question marks over the ADP job numbers, which now look decidedly dodgy.

That fall in job creation was progress, though the wages per hour numbers might keep the Fed worried.

As I’ve said, next Wednesday in the US, we see the latest CPI, which could either restart the market negativity we saw on Thursday or KO it. You know what I’m rooting for!

Now, back to what we can learn from legends. I was intrigued about the observations of some of the experts from US investment giant JPMorgan (JPM).

These companies have been challenged by the rise of passive ETFs, but JPM says active ETFs, which they create, are set to kick goals going forward. I liked the news because I have an interest and an investment in Associate Global Partners (formerly Contango Asset Management), which oversees the impressive US fund manager WCM.

They exist here in an actively managed ETF-style listed product, with the ticker code WCMQ. It also appears as a listed company with the ticker code WQG.

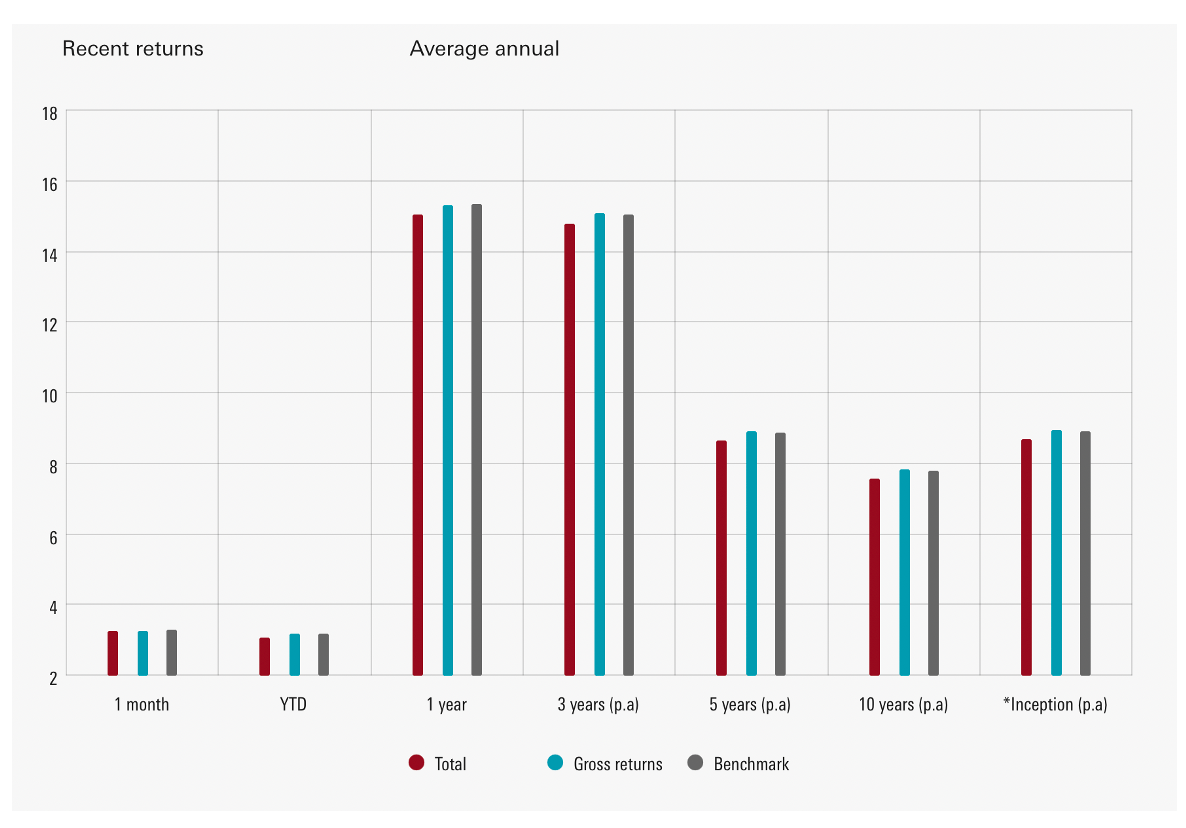

WCM has been a long-term good performer, a bit like Magellan’s Global Fund, but both have been hit by the rapid rise in interest rates and the market’s disdain for growth/tech stocks, but both are on the comeback trail, as this chart shows, with respect to WCM.

Interestingly, Magellan’s Global fund has also been on the rise, but advisers have been deserting the fund, maybe over-influenced by the dramatic fall in the company’s share price. This has been affected by a myriad of factors, including advisers dumping the fund, but given recent returns they shouldn’t have done so. Legends of investing would not have been so quick to desert an historically good performer, especially given the odd impacts of unbelievably rapid rate rises. (Dumping the share was OK as the company has a number of management issues, but the investment funds had a lot more potential.)

Many advisers clearly have been influenced by short-term issues when they should have been mindful of the long-term performance of the fund. (We kept our financial planning clients in the Magellan Global fund on the basis that its poor returns in 2022 were linked to the tech/growth stocks sell-off because of rapidly rising interest rates.)

The hedged version of the Global Fund was up 13.4% for the year, so I rest my case!

Interestingly, this is JPMorgan’s view on what’s happening now: “The rapid rise in interest rates and big swings in stock market leadership have renewed interest in active management, which could shake up the exchange-traded fund space,” the bank’s key players told CNBC. “The ETF industry has long been dominated by passive funds, which track indexes or themes and have seen prices driven to rock-bottom levels. But active funds are growing quickly and beginning to close the gap…”

JPM’s most-supported fund is an income-oriented one, which is bound to remain popular as investors search for yield, as rates rise and eventually peak.

Passive ETFs do well because history shows that two-thirds of U.S.-centric active funds fell short of their relevant indexes in the first half, according to a report from Morningstar. But interestingly in recent times, active ETF funds did fare better than passive funds in many categories, like small cap growth.

Legends of investing don’t dump historically good performers on the basis of one bad year — that’s what amateurs do. I’m not a bond fund fan for my own personal investing but I know for my financial planning clients, it’s wise to have some defensive investments, except for 2022, which was the worst year ever for bonds!

However, the expert view is that these bond investment options are on the comeback trail and history supports this view.

The greatest lesson I’ve learnt about investing is that you can make money out of being a contrarian — buying when most are selling — provided what I’m buying is a quality conveyance.

I bought Macquarie in 2008 at $26 during the GFC and was a little worried at $18, but today at $172, I’m glad I received a good market education, and I learnt those important investing lessons.

I think 2024 will be a great year for growth stocks and I’m investing now — being greedy — especially when short-termers and amateurs are being fearful.

By the way, during Boom Doom Zoom, I was asked about Vanguard’s High Yield fund and whether I think it’s still a good play. This is a rival for my own Switzer Dividend Growth Fund, and I think both are good income collectors and can ride up with a rising stock market.

This chart shows why VHY has the history that says don’t let one bad year change your mind on an investment so quickly.

And note how the Switzer Dividend Growth Fund rebounded out of the Coronavirus crash. This chart from Market Index shows that.

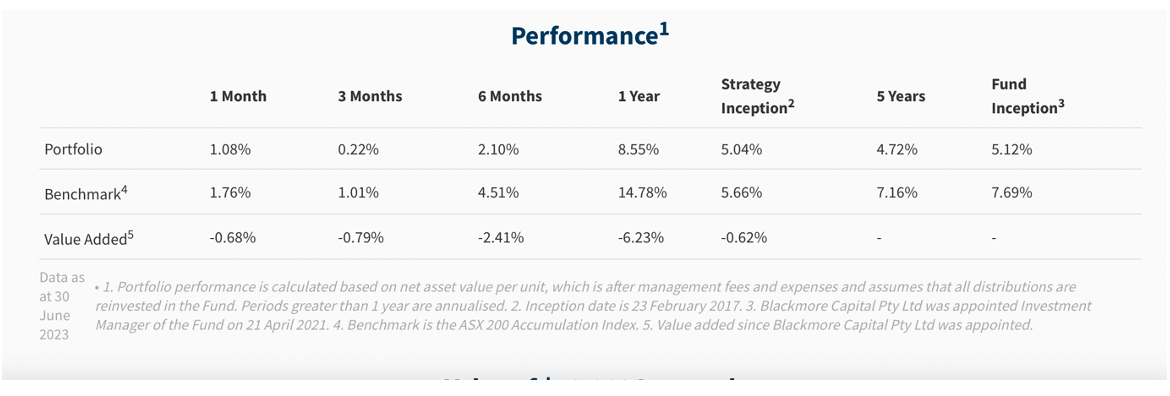

Here’s the latest performance. That 8.55% return for one year looks OK for a largely defensive-income play. The benchmark it compares to has more capital gain but would be a lower income-payer.

Both VHY and SWTZ sacrifice capital gain for more reliable and higher income, which can suit many investors.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances