With BHP down again today, it’s timely that I take a long hard look at my favourite individual stock plays for 2025 and that would be BHP, followed by CSL. Both of these conform to my criteria for going long and hard on investments.

What criteria? First, it’s a quality investment or company. Second, the market is beating up on the stock.

Third it’s the kind of investment you always want in your portfolio, preferably bought at a great price.

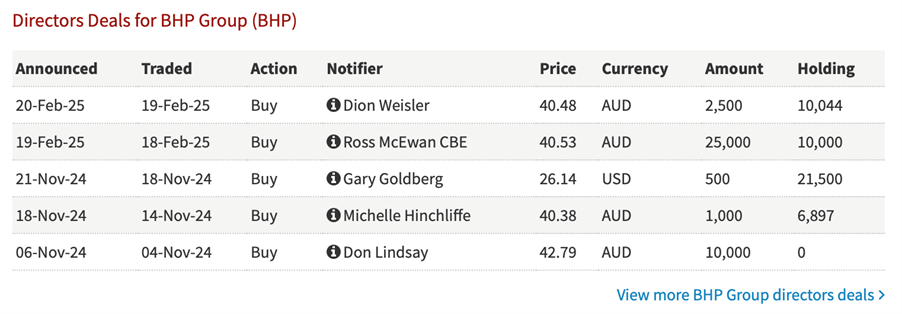

If there’s one thing I love about a stock I’m backing, it’s when I see the directors of that company buying stock in their company.

I recently stumbled on this information that showed BHP’s directors were in a ‘buy, buy, buy’ state of mind.

Keeping to the positive, this is what the analysts on FNArena are thinking about the company — the target price is $44.93, which implies a 10.6% upside. I don’t mind making over 10% in a year on arguably the best mining company in the world.

And the long-term chart for BHP’s share price shows it has a bounce back inclination after a sell-off.

BHP

Below is the table showing the individual views of analysts, with both Morgan Stanley and Morgans very bullish on the company, with their calculations coming up with 19% and 18% gains respectively.

But let’s dig deeper and see what the standout arguments for the company are.

This is what FNArena’s team reported on each analyst:

- UBS

In a report issued yesterday, UBS gave an early review on BHP Group’s first half result released on the same day. The broker noted earnings were in line with consensus and there is no material change to unit cost or production guidance.

- Morgan Stanley

BHP Group delivered underlying net profit in the first half that was ahead of Morgan Stanley’s estimates.

- Ord Minnett

BHP Group’s first half of 2025 earnings were ahead of market expectations, but the interim dividend represented the lowest payout ratio in more than 10 years, Ord Minnett highlights.

- Morgans

First half results from BHP Group were largely in line with expectations. Morgans has some concerns regarding the company’s ability to pursue US$20-30 billion in new copper growth projects globally. The main issue is whether such growth can be supported as well as an above-market dividend yield, along with potential acquisitions, such as Anglo American. The broker considers it a “better than average probability” that a fresh approach will be made for Anglo American.

- Macquarie

Following immaterial changes to BHP Group forecasts following its first half results, Macquarie maintains its $42 target and outperform rating. At first glance, BHP Group’s first half results were in line and the dividend exceeded Macquarie’s estimates. Cost and production guidance are unchanged, and the cash flow appeared “solid”.

- Citi

BHP Group’s first half earnings (EBITDA) met consensus expectations and were 3% ahead of Citi’s forecast, while underlying profit beat the broker’s estimate by 4%. The US 50 cent dividend was in line.

What’s the summary here?

There’s nothing really annoying about BHP’s prospects, but the dividend drop could explain why the share price has had recent pressure, aside from other ‘big picture’ concerns.

These were captured in a piece in the AFR by Alex Gluyas under the foreboding headline: Investors dump iron ore stocks as big miners enter a new era.

Here are Gluyas’ main points:

- Lower profits.

- Reduced dividends.

- Fund managers are downbeat on iron ore miners.

- Iron ore prices to fall to $US80 a tonne from the $US106 of late.

- Supply from Africa and mine restarts could put pressure on prices.

“We’re not even close to the end of these sorts of results,” warned Perennial fund manager and resources analyst, Sam Berridge. “The slump in iron ore prices over the past 12 months is largely a result of weak demand from China … we haven’t even had a meaningful increase in supply yet.”

While that’s the negative stuff, Gluyas did look at the other side of the argument. Here it is:

- Cyclone Zelia in WA and heavy rains in Brazil will keep supply down, which is good for prices.

- Beijing will have more stimulus at March’s Two Sessions meeting of Chinese lawmakers.

- BHP is aiming to increase its own supply,

- BHP chief executive Mike Henry said he was seeing “early signs of recovery” in the Chinese economy.

China is critical in this BHP story and the impact of Donald Trump and his tariffs can’t be discounted as potentially both negative and positive for global economic growth and the demand for iron ore.

Benjamin Franklin once said that “there are three things extremely hard: steel, a diamond and to know oneself.” I’d add that a fourth would be knowing when BHP’s share price will rebound but as long as I’m investing in the best miner in the world, I can be patient.

That said, history has taught me the wait is often not long with a quality company, provided you buy at their lows.

One last point: our market was down over 3% last week but BHP was up 0.83%, while CBA tumbled 8.29%, NAB 14.42% and JB Hi-Fi 9.7%! That might be a good omen.