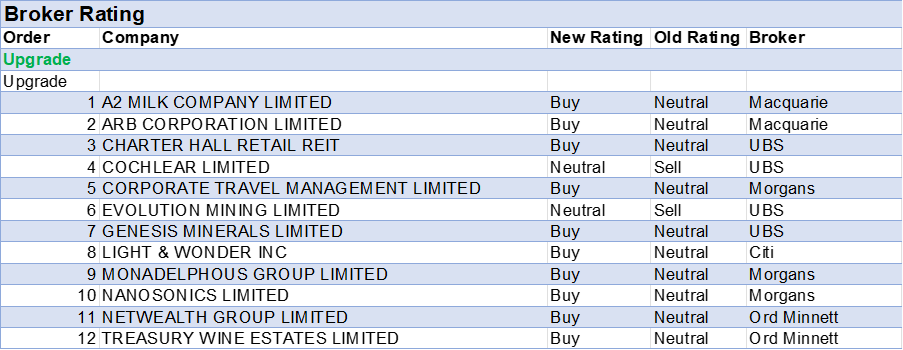

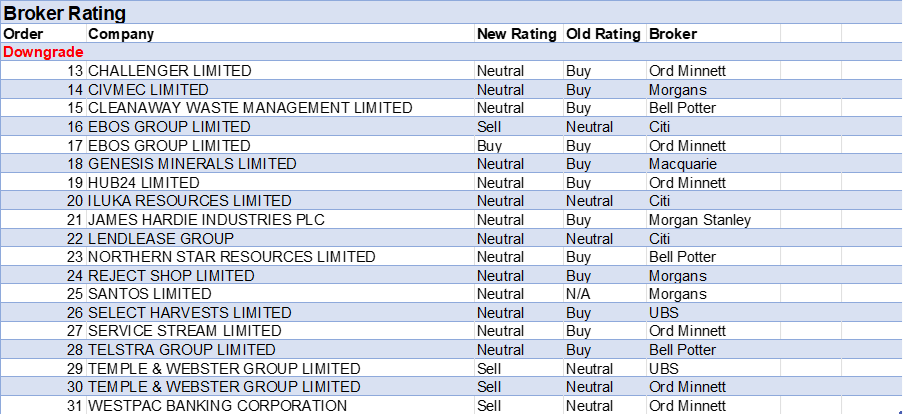

The third week of the February reporting season ended on Friday, February 21, 2025, with FNArena tracking twelve upgrades and nineteen downgrades for ASX-listed companies from brokers it monitors daily.

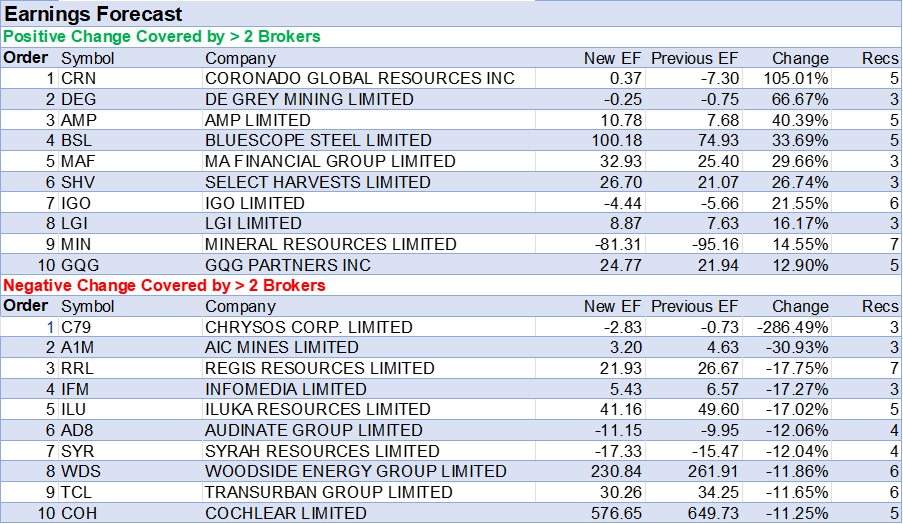

Percentage increases in analysts’ average earnings forecasts modestly outpaced declines, as shown in the tables below, while average target price rises were significantly larger than falls.

Separate to impacts from the flood of interim and final reports, Select Harvests features in the positive tables for both earnings and targets following a mixed AGM trading update, where a lower-than-expected FY25 crop volume estimate was outweighed by confirmation of further strength in almond prices.

While FY25 almond production guidance of 27,500-29,000t (at an average price of $9.2/kg) is below the previous estimate of around 29,500t, Bell Potter raised its FY25 and FY26 profit forecasts by 7% and 32%, respectively, driven by higher US dollar almond price assumptions and a weaker Australian dollar.

Highlighting the impact of price changes on forecasts, Ord Minnett only raised its price estimate to $9.0/kg, yet the broker’s FY25 earnings forecast rose by 21% to $108m, with the net profit estimate rising sharply by 37% to $51m.

UBS raised its earnings forecasts but noted the stock has climbed 34% since the November result (September year-end), now trading at fair value relative to peers, leading to a downgrade to Neutral from Buy.

Elsewhere, UBS research resulted in De Grey Mining’s average FY25 earnings forecast rising by 66%, while Syrah Resources’ forecast declined by -12%.

This broker raised its gold price forecasts, increasing the year-end target by US$200/oz to US$3,100/oz and long-term by US$250/oz to US$2,200/oz. New price forecasts are well above consensus.

The updated view comes as expectations for US rate cuts are pushed out and is driven by ongoing official sector buying, haven buying, lack of positioning, and ongoing liquidity issues.

The analysts have Buy ratings for Northern Star Resources ((NST)), Perseus Mining ((PRU)), De Grey Mining ((DEG)), Gold Road Resources ((GOR)), SSR Mining ((SSR)), and Bellevue Gold ((BGL)).

Last week, the broker also upgraded Genesis Minerals ((GMD)) and Evolution Mining ((EVN)) respectively to Buy and Neutral, leaving Regis Resources ((RRL)) with the only Sell rating.

For Syrah Resources, UBS resumed research coverage after a long hiatus with a 30-cent target, down from 80 cents, and downgraded its rating to Neutral from Buy due to ongoing headwinds at both a company and industry level.

The company’s primary asset, the Balama Graphite mine in Mozambique, remains under force majeure due to civil unrest in the country, triggering events of default with Syrah’s creditors.

The broker’s lower target was driven largely by cutting sales price and volume forecasts at Balama by up to -40% and -25%, respectively.

While graphite prices have likely bottomed, the analysts don’t anticipate any near-term fundamental catalysts for a price re-rate, with Chinese synthetic capacity remaining an overhang.

Regarding impacts from the reporting season evident in the tables below, Ebos Group and Temple & Webster received two ratings downgrades apiece from brokers due to valuation, after respective misses and beats against consensus expectations.

Reading this Corporate Results Monitor helps explain the reasoning behind in-line results for both MA Financial and Coronado Global Resources, despite both companies registering the largest percentage moves in average target prices in the tables below.

While the earnings miss for Chrysos tallies in general with the largest earnings downgrade by brokers below, the Monitor explains the miss was marginal, highlighting the percentage decrease was magnified due to small numbers involved.

Apart from MA Financial, brokers awarded the largest rises in average target prices to Corporate Travel Management, Fletcher Building, Hub24, Judo Capital and a2 Milk co.

In the good books

Upgrades

A2 MILK COMPANY LIMITED ((A2M)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 4/3/0

The first half results from a2 Milk Co beat expectations amid strong cash flow conversion. FY25 revenue guidance has been lifted and the EBITDA margin outlook is stronger.

Macquarie upgrades to Outperform from Neutral, noting the English label market remains positive for sales and margin. There are limited downside catalysts envisaged for the near term and the target is raised to $7.85 from $5.70.

ARB CORPORATION LIMITED ((ARB)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 4/1/1

Following a “solid” result in tough operating conditions, Macquarie raises its target for ARB Corp by 4% to $45.40 and upgrades to Outperform from Neutral.

The highlight, according to the analyst, was the Export segment with 1H sales growth of 15% year-on-year (US:Ex-US was 19%:14%), while Australian Aftermarket outperformed a soft market for new vehicle volumes.

Gross margins rose by 150bps year-on-year to a record 59.3% due to price rises and lower freight costs, explains the broker, and management expects a steady 2H gross margin percentage.

COCHLEAR LIMITED ((COH)) was upgraded to Neutral from Sell by UBS .B/H/S: 0/5/0

UBS notes Cochlear’s cochlear implant (CI) unit growth was 6% year on year in 2H with stable pricing, and the company continues to expect 10% growth for FY25 implying uplift in 2H. The broker sees 10% unit growth as sustainable mid to long-term as penetration of the adult population increases slowly and steadily.

The broker sees continued strong CI sales (mid-term revenue growth forecast of 9%) as offsetting a lower services base from FY27 onward.

Target price rises to $285 from $270, and rating upgraded to Neutral from Sell.

The broker’s upside and downside scenario points to $335 and $210 target price, respectively based on long-term CI revenue growth of 12% or 5%.

CHARTER HALL RETAIL REIT ((CQR)) was upgraded to Buy from Neutral by UBS .B/H/S: 4/1/0

Charter Hall Retail REIT reported 1H25 earnings per unit broadly in line with UBS’ expectations.

The NTA valuation for the REIT advanced 10.6% over six months, with 99% of the portfolio revalued, the broker explains.

Management reaffirmed guidance for operating EPS of 25.4c and a distribution of 24.7c.

UBS upgrades Charter Hall Retail REIT to Buy from Neutral incorporating Hotel Property Investments ((HPI)) into forecast earnings with a target price of $3.69, from $3.79.

CORPORATE TRAVEL MANAGEMENT LIMITED ((CTD)) was upgraded to Add from Hold by Morgans .B/H/S: 4/3/0

Morgans highlights Corporate Travel’s 1H25 result was weak, but better than expected, with highlights being strong earnings growth from North America and Australia/NZ.

The company lowered FY25 EBITA guidance to $197.2n from $209.9m which was unsurprising but better than the broker feared. The broker is confident this should be the last downgrade and has greater conviction in the company’s growth outlook.

The broker’s new upgraded FY25 EBITDA forecast is in line with guidance while the FY26 forecast of $239.0m is slightly below. Target price rises to $18.72 from $13.50, and rating upgraded to Add from Hold.

EVOLUTION MINING LIMITED ((EVN)) was upgraded to Neutral from Sell by UBS .B/H/S: 1/3/1

UBS has revised its gold price forecasts higher, increasing the year-end target by US$200 to US$3,100/oz and long-term by US$250 to US$2,200/oz, keeping the broker well above consensus.

The updated view comes as expectations for US rate cuts are pushed out and is driven by continued: 1) official sector buying, 2) safe haven buying, 3) lack of positioning and 4) ongoing liquidity issues.

Evolution Mining’s target rises to $6.50 from $5.45, upgrade to Neutral from Sell.

GENESIS MINERALS LIMITED ((GMD)) was upgraded to Buy from Neutral by UBS .B/H/S: 5/1/0

UBS has revised its gold price forecasts higher, increasing the year-end target by US$200 to US$3,100/oz and long-term by US$250 to US$2,200/oz.

Genesis Minerals generated $60m of cash and equivalents in the Dec Q even as it invests to grow production toward its targeted 325kozpa by FY29, UBS notes.

On the higher gold price and including more potential for production growth, UBS upgrades to Buy from Neutral. Target rises to $3.90 from $3.00.

See also GMD downgrade.

LIGHT & WONDER INC ((LNW)) was upgraded to Buy from Neutral by Citi .B/H/S: 6/0/0

Light & Wonder announced the acquisition of US Grover Charitable Gaming for -US$850m in cash and up to -US$200m in earn-out payments based on revenue over the next four years, Citi details.

The broker notes Grover operates electronic pull tabs for charitable organisations in five states and will add this exposure to Light & Wonder’s portfolio, generating US$135m in revenue in 2024.

The acquisition is subject to regulatory approval, with completion expected in 2Q25. Light & Wonder will use cash and debt financing.

Citi raises EBIT forecasts by 7% in FY25 and 17% in FY26 due to the acquisition and slightly higher estimates for the existing business.

Citi upgrades the stock to Buy from Neutral, lifting the target price to $200 from $156.

MONADELPHOUS GROUP LIMITED ((MND)) was upgraded to Add from Hold by Morgans .B/H/S: 2/3/0

Monadelphous Group has maintained guidance for high single-digit revenue growth in FY25 and a continued improvement in operating margins.

Morgans assesses material outperformance is dependent on recapturing margins not seen since FY19. A return to this level of profitability has occurred in the first half and this could be a major turning point, the broker adds.

Critically, there were no benefits from one-offs. The order book provides confidence in the growth outlook and, as a potential upgrade cycle begins, the valuation is considered undemanding.

The rating is upgraded to Add from Hold. Target is raised to $17.50 from $14.80.

NANOSONICS LIMITED ((NAN)) was upgraded to Add from Hold by Morgans .B/H/S: 1/2/0

Morgans upgrades Nanosonics to Add from Hold and raises the target price to $4.50 from $3.75 post what was believed to be a 1H25 that assisted with improving sentiment around the company.

The broker highlights the growth in the new stall base of 1,050 units over the period, noting a decline of -5% year-on-year but better than forecast, inferring pressure on hospital budgets is tempering.

Revenue came in slightly better than expected, and the analyst drew some optimism around the launch of Coris, which may be sooner than anticipated.

Management lifted FY25 guidance, another positive. Morgans raises net profit after tax forecasts by 14% and 9% for FY25/FY26.

NETWEALTH GROUP LIMITED ((NWL)) was upgraded to Accumulate from Hold by Ord Minnett .B/H/S: 1/6/0

Netwealth Group’s interim result was excellent, in Ord Minnett’s view, driven by a stellar revenue performance and further boosted by a lower tax rate. Looking forward, the operating environment remains fertile and the company’s product and service proposition remain class-leading.

Positive equity markets, an active adviser market and a very strong product and service proposition are combining to drive the fertile new business environment for Netwealth, the broker suggests.

The growth outlook is very strong and Ord Minnett is forecasting a compound annual earnings growth rate of 26% over three years. Upgrade to Accumulate from Hold. Target rises to $33 from $31.

TREASURY WINE ESTATES LIMITED ((TWE)) was upgraded to Buy from Hold by Ord Minnett .B/H/S: 6/0/0

Treasury Wine Estates has downgraded FY25 earnings guidance because of reduced sales forecasts for lower-priced wines.

A stronger performance from the luxury portfolio, particularly Penfolds, allowed group earnings to be in line with expectations.

Ord Minnett observes the lower-priced division weakness (Treasury Premium Brands) is an issue that affects all makers of alcoholic beverages, a trend that only accelerated during covid.

The higher priced wines are grouped under ‘Luxury’.

The broker assesses the PE multiple is inexpensive and there is potential upside to the target, which increases to $12.00 from $11.50. Rating is upgraded to Buy from Hold.

In the bad books

Downgrades

CHALLENGER LIMITED ((CGF)) was downgraded to Hold from Buy by Ord Minnett .B/H/S: 5/2/0

Ord Minnett was disappointed with the life insurance and investment performance in Challenger’s first half result, although underlying earnings largely matched expectations.

The COE margin narrowed nine basis points to 3.11%, the broker notes, even as the company maintained the increasing proportion of longer-duration annuity sales should boost margins.

Ord Minnett reduces EPS estimates for FY25 by -1% and FY26 by -3%. Target is lowered to $6.65 from $6.85. The company is expected to struggle to grow the life book and margins appear to have peaked, leading to a downgrade to Hold from Buy.

CIVMEC LIMITED ((CVL)) was downgraded to Hold from Add by Morgans .B/H/S: 1/1/0

Civmec delivered a “disappointing” first half result as Morgans assesses both revenue and margins eased considerably quarter on quarter. The outlook commentary also appeared more negative with the order book declining to $633m from $800m in the first quarter.

The company has observed a shift in market conditions, which is driving delays in the awarding of key projects and also contributing to rescheduling. This should result in lower levels of activity during the second half with the potential to extend into the first half of FY26.

Morgans downgrades to Hold from Add and lowers the target to $1.10 from $1.40.

CLEANAWAY WASTE MANAGEMENT LIMITED ((CWY)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 3/2/0

Bell Potter lowers its target for Cleanaway Waste Management to $3.00 from $3.30 and downgrades to Hold from Buy.

While 1H earnings (EBIT) only missed the broker and consensus forecasts by -2% and -3%, respectively, and management expects to achieve the midpoint of FY25 earnings guidance, the analyst has concerns further out.

For the FY26 EBIT target to be exceeded, the broker believes commodity prices will need to remain supportive.

Execution risks are also noted around management’s planned 2H uplift for the Liquid Waste & Health Services (LW&H) and Industrial & Waste Services (IWS) divisions and landfill volume recovery.

EBOS GROUP LIMITED ((EBO)) was downgraded to Accumulate from Buy by Ord Minnett and to Sell from Neutral by Citi .B/H/S: 3/0/1

Ebos Group produced a first half result that was in line with forecasts. Ord Minnett observes the business is executing well on its revenue and cost initiatives and now forecasts FY25 EBITDA of $592m and net profit of $269m.

The business is “quality”, the broker adds and should emerge from the transition period in FY25 with a well-established and diversified business model. Target rises to $37.00 from $35.50. Rating pulls back to Accumulate from Buy after the recent re-rating.

Citi downgrades Ebos Group to Sell from Neutral due to full valuation at a price-to-earnings ratio of 24x FY26 earnings estimates.

The company reported 1H25 EPS below consensus expectations by -2% due to higher finance costs, while underlying EBITDA was in line with forecasts.

Management reconfirmed FY25 EBITDA guidance, which the broker views as “conservative.”

Citi lowers EPS estimates by -2% to -4% from FY25-FY27.

Sell. Target price cut to $32 from $33.

GENESIS MINERALS LIMITED ((GMD)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 5/1/0

Macquarie downgrades Genesis Minerals to Neutral from Outperform with an unchanged target price of $3.30.

The broker notes 1H25 results were in line with expectations, with net profit guidance provided in the 2Q25 update.

Management retained FY25 guidance, with year-to-date production at 47% of the mid-point. The analyst highlights the Laverton restart commenced halfway through 2Q25.

Net cash of $130m was below Macquarie’s estimate due to higher-than-expected lease liabilities, likely related to equipment for Laverton.

Macquarie tweaks EPS estimates.

See also GMD upgrade.

HUB24 LIMITED ((HUB)) was downgraded to Hold from Buy by Ord Minnett .B/H/S: 2/5/0

Ord Minnet lifts Hub24’s target price to $84 from $73 but downgrades the rating to Hold from Buy on recent share price strength.

The company’s 1H25 EBITDA was 6% ahead of consensus on, with strong flow and funds under administration (FUA) growth complemented by operating margin expansion across both divisions.

Among the highlights was an upgrade to FY26 FUA target to $123-135bn vs the broker’s $128bn estimate.

The broker highlights headcount growth is likely to re-emerge in 2H, driving the cost run-rate up marginally.

The broker reiterates it remains a very strong supporter of the Hub24 business.

ILUKA RESOURCES LIMITED ((ILU)) was downgraded to Neutral High Risk from Buy High Risk by Citi .B/H/S: 2/3/0

In a second look at the 4Q update by Iluka Resources, Citi lowers its target to $5.60 from $6.10 and downgrades to Neutral High Risk from Buy High Risk.

The FNArena summary of Citi’s earlier research is as follows.

Citi observes a disappointing December quarter report from Iluka Resources, with mineral sands revenue falling -17% below the analyst’s estimate and zircon, rutile, and synthetic rutile volumes down -12%.

Pricing was mixed, with average zircon sand premium and standard prices below Iluka’s guidance, down -4.8% on the prior quarter. Citi notes zircon prices declined from 3Q, while rutile and synthetic rutile saw slight increases.

Management plans to remove 130 roles, which Citi estimates will deliver a -$20m cost reduction for 2025.

The company indicated proposed tariffs on Chinese imports to Europe and other regions in 1H25 may benefit Western pigment producers.

JAMES HARDIE INDUSTRIES PLC ((JHX)) was downgraded to Equal-weight from Overweight by Morgan Stanley .B/H/S: 5/2/0

Morgan Stanley downgrades James Hardie Industries to Equal-weight from Overweight and lowers the target to $55 from $60.

The rise in US mortgage rates is considered a negative for US demand, particularly in terms of renovations which drives around 65% of the company’s volumes in North America.

This is likely to push out an earnings recovery and create downside risk for FY26, the broker asserts. Despite this the longer-term structural growth opportunity remains intact. Industry view is In-Line.

LENDLEASE GROUP ((LLC)) was downgraded to Neutral from Buy by Citi .B/H/S: 1/3/1

Citi downgrades Lendlease Group to Neutral from Buy due to heightened short-term uncertainty around earnings.

The analyst points to “limited” positive news in the company’s 1H25 earnings report despite management progressing well on the capital recycling strategy.

The company reported more writedowns of the development business, largely due to weakness in office-related projects, which points to a weaker construction result and lower development earnings in FY26.

Asset sales are becoming harder to achieve, and the buyback is dependent on them, the broker explains.

Until the earnings outlook improves or there is greater certainty on the buyback, Citi believes the stock remains cheap but also remains Neutral rated.

Citi lowers the target price to $7.50 from $80.

Citi downgrades Lendlease Group to Neutral from Buy due to heightened short-term uncertainty around earnings.

NORTHERN STAR RESOURCES LIMITED ((NST)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 2/4/0

Bell Potter downgrades Northern Star Resources to Hold from Buy due to stock price appreciation while retaining the $20 target price.

The miner’s 1H25 results presented no surprises, the analyst explains, with cash earnings of $1,146m, slightly above the broker’s forecast and up 63% on the previous corresponding period.

Net profit after tax was slightly below Bell Potter’s estimate. The company had a cash balance of $1,046m at the end of the period with $2.7bn in liquidity. Dividend of 25c per share was in line with expectations.

Hold. Target $20.

SELECT HARVESTS LIMITED ((SHV)) was downgraded to Neutral from Buy by UBS .B/H/S: 2/1/0

UBS downgrades Select Harvests to Neutral from Buy, with a higher target price of $5 from $4.40.

Due to the trend in almond prices to US$9.20/kg versus an estimate of US$8.50, the broker lifts earnings forecasts, offset by FY25 volume guidance, which is slightly lower at 27.5kmt-29kmt from 29kmt.

Management reconfirmed production costs as flat for the year.

UBS lifts earnings forecasts by 24% for FY25 and 14% for FY26 on higher almond price assumptions. EPS estimates rise by 12% to 32% for FY25 to FY27.

The stock has risen 34% since the November result and is now trading at fair value relative to its peers, the broker states.

SERVICE STREAM LIMITED ((SSM)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 1/2/0

Service Stream’s “strong” H1 result beat Ord Minnett’s forecast by 10%. A seasonally stronger contribution from the Telco segment and improving top line and margin growth within Utilities made up the difference, the commentary suggests.

Ord Minnett believes Service Stream remains well placed to service structural demand in the Utilities maintenance sector, underpinned by aging infrastructure and population growth.

Forecasts have been upgraded. The broker does highlight an element of risk/opportunity remains in Telco forecasts, with a major customer reviewing contractual arrangements across the sector.

Target lifts to $1.78 (up 7c), To take into account the extra risk factor, the rating has been pulled back to Hold from Accumulate.

SANTOS LIMITED ((STO)) was downgraded to Hold from Add by Morgans .B/H/S: 5/1/0

After updating oil price assumptions, Morgans expects a softer reporting season for oil & gas stocks yet envisages opportunities in those “unloved” names that have quality earnings and depressed valuations.

This does not include Santos (reporting February 19), where the broker has lowered its rating to Hold from Add as confidence falters ahead of the company’s declining balance sheet. The target is reduced to $7.20 from $7.40.

Morgans does maintain a positive view on the business but finds it hard to look past the share price performance, expecting a decline in the dividend.

TELSTRA GROUP LIMITED ((TLS)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 4/1/1

Telstra Group’s 1H25 revenue was in line with Bell Potter while underlying earnings were 1% ahead, driven by lower costs and a higher earnings margin. The increased dividend was in line a $750m on-market share buyback was announced.

Telstra reaffirmed all of its FY25 guidance metrics. Bell Potter has rolled forward PE ratio and sum-of-the-parts valuations so that FY26 is now the base year.

The net result is an increase in price target to $4.35 from $4.30. Given this generates a total expected return of less than 15%, Bell Potter downgrades to Hold from Buy.

TEMPLE & WEBSTER GROUP LIMITED ((TPW)) was downgraded to Sell from Hold by Ord Minnett and to Sell from Neutral by UBS .B/H/S: 3/1/2

Temple & Webster provided first half earnings that were well ahead of expectations with the operating earnings margin of 4.2% signalling a faster run rate compared with prior guidance.

Ord Minnett expects some of that margin will be re-invested via price reductions to ensure revenue meets or exceeds the market’s expectations for the second half.

EPS forecasts are raised by 19% for FY25 and by 9% for FY26 and this leads to an increase in the target to $13.15 from $11.50.

As the stock has nearly doubled in the last six months and with the attractive nature well discounted at current levels, this signals to Ord Minnett a reduction in the rating to Sell from Hold is in order.

UBS believes the jump in the Temple & Webster share price post the first half results is overdone, given the market was positioned for a strong trading update that, in its estimation, came in “slightly short”.

January is considered seasonally one of the strongest months for the company and the implications of a growth slowdown are “worthy of some focus”, in the broker’s view. An upcoming federal election also poses some potential disruption risk.

UBS cannot justify the current valuations and downgrades to Sell from Neutral, raising the target to $15.50 from $11.80. Forecasts and valuation incorporate a long-term 15% EBITDA margin target which implies the market has now priced in this outcome.

REJECT SHOP LIMITED ((TRS)) was downgraded to Hold from Add by Morgans .B/H/S: 1/2/0

Morgans downgrades Reject Shop to Hold from Add while retaining the $3.50 target price, with net profit after tax forecasts lowered by -4% in FY25 and -3% in FY26.

Gross margins rose 100bps above estimate to 41.6%.

Noting the positive reaction to the 1H25 results, the analyst highlights the company exceeded expectations, with net profit coming in above forecast by 13%, although sales growth was lower than estimated by -1% at 3% as the merchandising mix changes.

The broker highlights like-for-like sales growth remains well below other discretionary retailers, and although management is rebuilding general merchandise, the results will take time to evolve.

WESTPAC BANKING CORPORATION ((WBC)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 1/0/4

December quarter earnings from Westpac were down -9% on the average of the prior two quarters, with the broker commenting narrower interest margins and increased staff costs more than offset seasonally lower investment expenditure.

Ord Minnett is strongly of the view the bank should bring its accounts into line with the way its peers treat cash profit, as its differing policy makes comparison with market forecasts more difficult. Doing so could improve investor sentiment, in turn.

Rating is downgraded to Lighten from Hold, given the downside to the target of $27.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.