The key indicator presently driving the share market is the number of new infections especially in America, which dominates global share exchanges. Until this plague wanes, the bears have the upper hand. In Asian countries that applied a lockdown early, the total number of infections seemed to plateau 45 to 60 days after the first 100 cases were identified.

Western Countries are only 17 days (Australia) to 30 days (Italy) into this crisis so may not see a respite before May.

America is only 20 days into this crisis, with New York State the epicentre. It lacks a national strategy since each state runs its own health service and President Trump has not convened a national cabinet of State Governors to coordinate their efforts. Instead he prefers daily TV briefings on what he thinks might happen (e.g. resurrection of the country by Easter) rather than let experts hold court. Hence America’s virus turnaround could take longer than in countries acting factually, decisively and cooperatively.

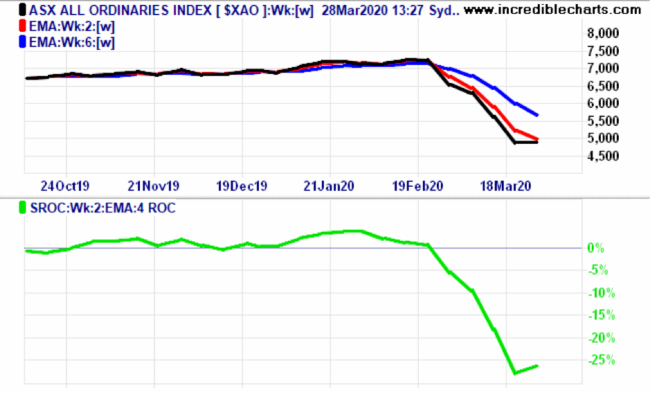

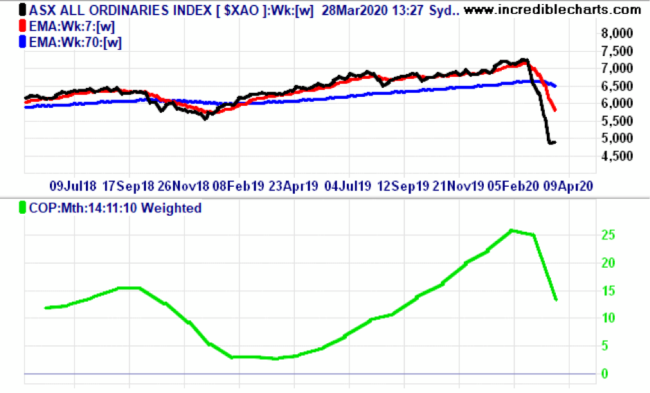

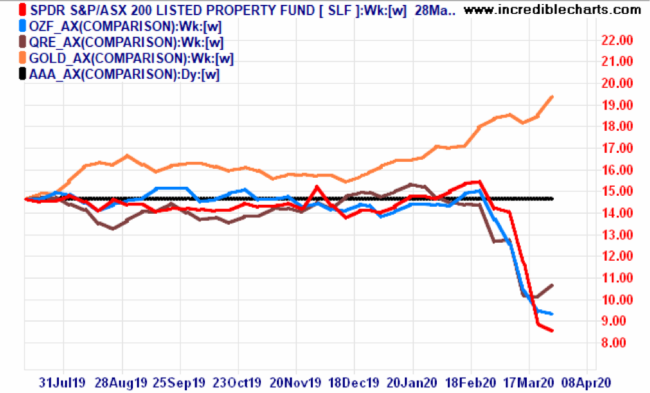

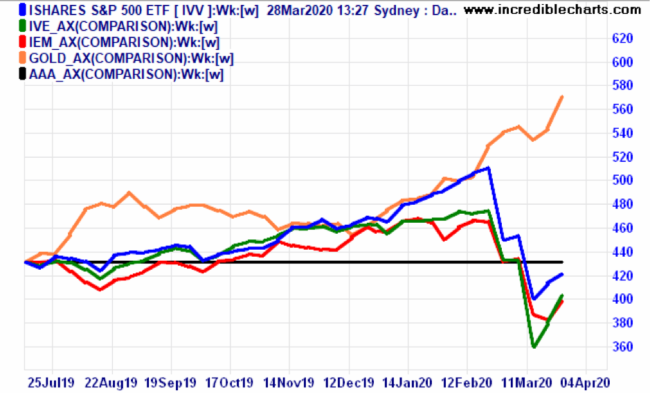

Here are the charts on where the market ended this Friday.

Australia’s Short-Term Position – bearish with the two week trend line still below the 6 week trend line and negative on two week momentum, notwithstanding a slight uptick in the All Ords last week.

Australia’s Long-Term Position – bearish, with the 7 week trend line below the 70 week trend line and long term momentum falling, but still not in positive territory.

Australian Sector Position – using 9-monthly price momentum Gold bullion (GOLD) is in still in front and rising while Property (SLF), Finance (OZF) and Resources (QRE) are in negative territory though their fall slowed last week. Cash (AAA) remains stable.

World Sector Position – using 9-monthly price momentum gold bullion (GOLD) is still in front and rising while the USA stock market (IVV), Other Developed Markets (IVE) and Emerging Markets (IEM) are in negative territory though showed some rebound last week. Cash (IAA) remains stable.

As always, this is a technical analysis of the market’s present trends and momenta, not a forecast of its future direction nor advice on trading or investing. I wish you and your family good health and economic security during this global pandemic.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.