For my first communique for 2022, it’s timely to tackle the short-term challenges of the Omicron variant and try to focus on the long-term investment strategy that this health, economic and investment obstacle is posing for investors who are keen to rake in a great return this year.

That’s exactly what I expect is in the offing but it might require you have a strategy that’s likely to be advantaged by the key influencers of global and then our stock market indexes.

In simple terms, I expect to make 10% plus dividends and franking credits this year. It could well be even more if the economic rebound I expect comes to pass.

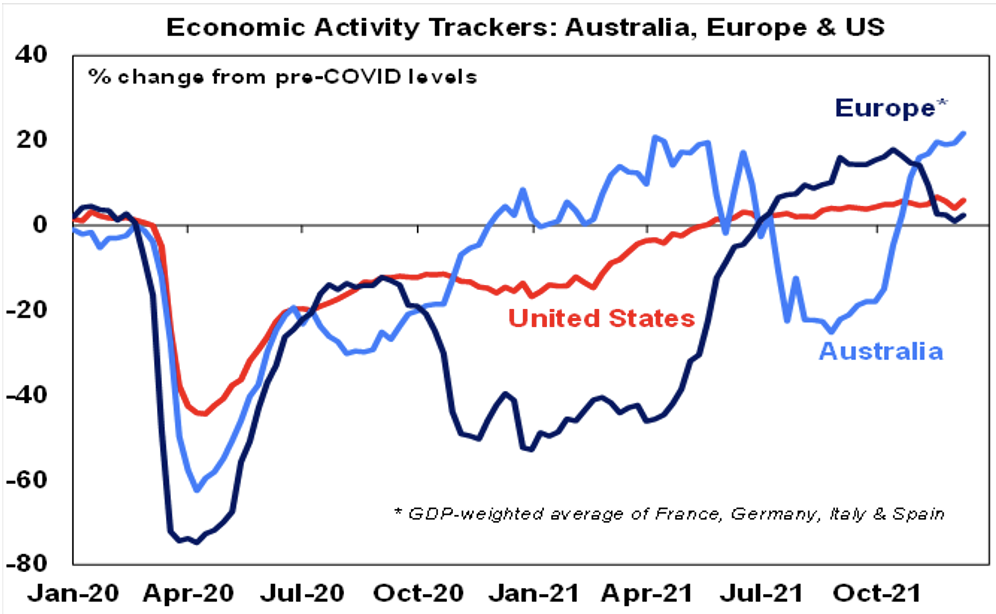

Why do I pluck 10% out of the world of numbers? Well, that’s simple — our stock market averages 10% per annum over a 10-year period but this year (along with lots of economists as well as the RBA) I’m expecting economic growth of over 5% as we come out of Omicron’s crushing of businesses, which we’re seeing right now. Rebounds out of Covid crises have been big, as this chart above from AMP Capital shows.

S&P 500

S&P/ASX 200

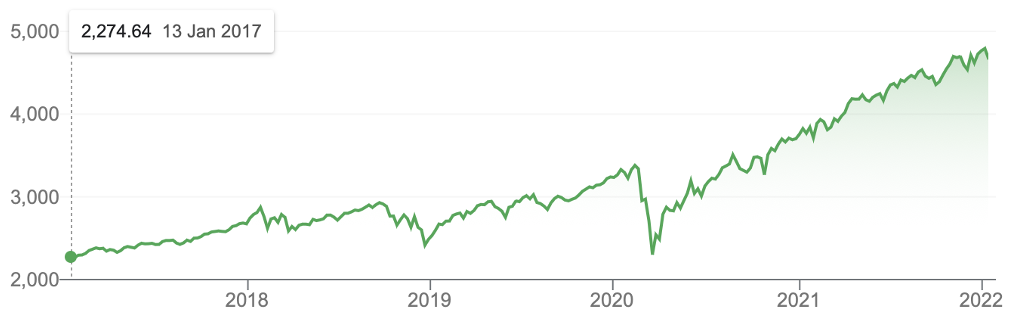

Meanwhile, looking at how much the US stock market has risen from the pre-pandemic high (40%!), while our market is up only 4%. These charts above show the difference in the rebounds of both markets.

Right now, US investment houses such as Goldman Sachs think the US stock market index will rise by 10% over 2022 and I can’t see any reason why we shouldn’t match that kind of rise. In fact, given that analysts suspect energy, commodity and financial stocks will benefit from the expected economic outlook, and given how important these stocks are in our index, I think my 10% call is relatively conservative.

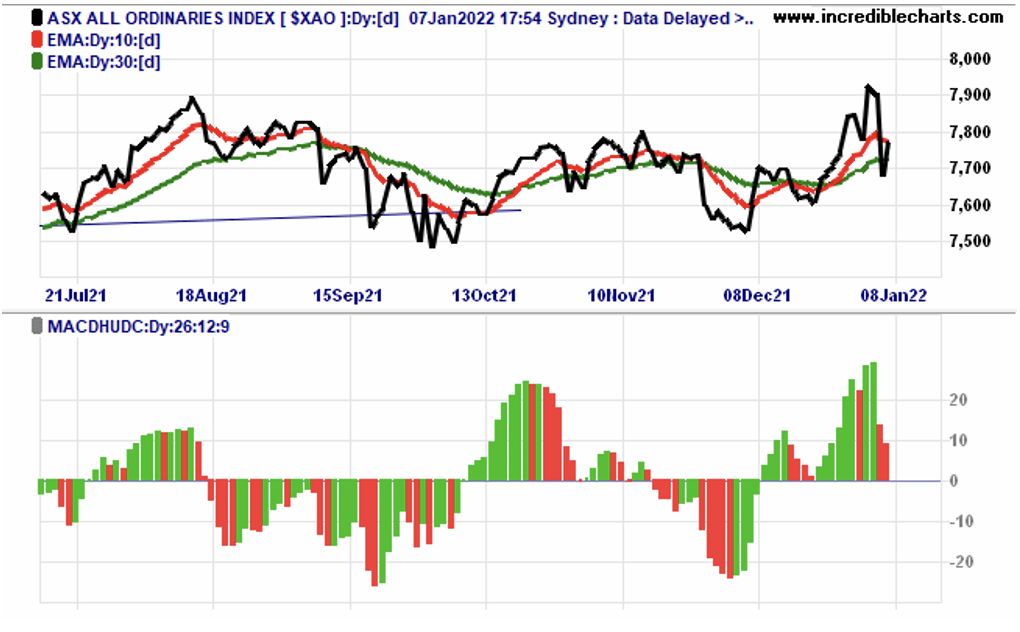

Former NSW Treasury Secretary Percy Allan regularly looks at the outlook for local stocks using the above charts, and right now they reinforce my positive view.

“The Australian stock market is bullish on short-to-medium-term trend analysis. The All Ords red 10-day trend line is above its green 30-day one. Its price momentum as measured by its MACD oscillator has been positive since the 9th December 2021,” Percy explained.

“The upturn in the monthly Coppock momentum indicator after October 2020 confirmed the end of the Australian share market crash of February-March 2020 (the first crash since 2007-09). But the Coppock index peaked at the end of August 2021 and has since been flagging though remains strongly positive.”

But wait there’s more from Percy and it’s important!

“There is a big buffer between the All-Ords index’s 30-day trend line and its 300-day one, meaning it would need to fall a long way before it became bearish on medium-to-long term trend analysis,” he pointed out.

Now I’m not saying that we won’t have challenging episodes this year because we will but I’d argue that they will be short-term market sell-offs.

Here’s what could make me look wrong in the short term:

- The US Fed will raise interest rates and start selling bonds.

- Omicron will cause a short-term slowing of economic growth.

- Omicron will worsen the supply-side problems that are already disrupting supply.

- The fall in inflation will also be affected by the Omicron threat.

- Rising interest rates will also negatively affect tech stocks, which will be a weight on the overall index rising.

- And there will be a Federal Election, which could create headwinds before the poll, but generally, there’s a bounce back after the result is known.

And while these annoying negatives will mean we have to deal with stock market volatility, against this we will have a strongly rebounding economy that should power a lot of corporate profitability.

Clearly, that will be my and my colleagues’ task to identify the stocks that should be winners this year while pinpointing those companies that might struggle.

Generally, cyclicals should underperform value stocks and reopening trade stocks should get a boost if the medical experts, who say Omicron will surge and then burn out quickly, are right. Obviously, that’s a gamble we have to take if you’re looking for the big returns stocks can deliver compared to term deposits and other safer investments.

So what are some stock plays worth thinking about right now?

An easy one is an ETF for the S&P/ASX 200 Index. If I’m right, there should be at least 10% but it could be plus dividend yield and franking worth about 5.5%. That’s a cool 15.5%!

A stock like Tyro (which I hold) has to be punished because the Omicron variant is hitting tourism and hospitality and it’s also linked to the payments sector, which is currently being dumped as market rotation favours other sectors.

FNArena’s consensus call says this company should see a 59.2% upside in 2022, which I’d clearly love to see. When it comes to Tyro, it might be wise to remember the old Warren Buffett maxim to be “greedy when others are fearful”, but given Omicron and its variant cousins, we could be waiting longer than I expect for normalcy in hospitality to reinstate itself.

If you want an energy play, Woodside is tipped to have a 17.3% upside. Morgan Stanley’s Chief Commodity Strategist Martijn Rats is a big fan of the oil play. “Within commodities, oil offers the best combination of valuations and fundamentals”. His team believes oil could top $90 a barrel in 2022 as rising demand meets relatively spare capacity.

Meanwhile, rising interest rates and its implication for financial stocks suggest QBE could be, at long last, in for a good year. The analysts’ consensus says a 16.1% rise is on the cards and based on the law of averages QBE is due for a good year.

One final point: you don’t have to move quickly but being a buyer on the dips still looks like a pretty smart play. And sometime this year, if Bob Dole of Crossmark in the US is right and we see a 10% correction on Wall Street (which would inevitably affect our market), I could be tempted to have a crack at that GEAR product from Beta Shares. This is a geared product that’s not for the fainthearted, but if I remain a 10% believer for the overall local stock market, this could deliver a fairly impressive return.

But be warned, this is not a “lay down misere” play, so be careful and do your homework if you have a punt on GEAR.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.