If we didn’t have enough headwinds already with Ukraine, China, inflation and the Fed’s interest rate rise program (with the fear that this could lead to a recession), we now have to factor in locally this huge kick in the pants for the Coalition. And it’s made even harder to play, with the Independents possibly holding 10 seats!

Here’s the history of stock market reactions post elections, according to CommSec’s Craig James: “In the 11 elections held since 1990, the All Ordinaries Index climbed by an average of 1.2 per cent in the 15 trading days after poll date. In fact, the All Ordinaries Index has risen in the 15 trading days following every one of the eight federal elections held since 1998”.

But wait there’s more: “In the 15 trading days after federal election poll dates, the Aussie dollar, on average, rose by 1.3 per cent. In eight of the 11 federal elections held since 1990, the Aussie rose in the 15 trading days after poll date”.

So we might see a 1.2% rise in the next 15 days, but remember, this is an average, and all averages have big and small outlier results that get lost when you focus on the average.

And we’re only talking 15 days, so let’s dig a little deeper.

Looking longer-term after elections, there does seem to be a pattern of rises that only get reversed by major events. The only Government to cop losses from day one was the Rudd Government, but the Global Financial Crisis (GFC) started on the first trading day in November and Kevin 07 was elected on November 24.

In the John Howard victories of 2001 and 2004, the stock market had nice rises for a sustained period. Even the Gillard minority Government saw stocks rise 13% between August 2010 (when Labor resumed power) and the sell-off in March 2011, which was around the time when the US lost its AAA-rating and the market didn’t like that!

Tony Abbott’s win in 2013 brought a 14% rise between September of that year and April 2015.

But the biggest jump after a federal poll was a 20% or so boost when Malcolm Turnbull won in 2016, while Scott Morrison saw a 10% gain for the All Ords before the Coronavirus crash sent stocks down over 35%.

Since 2000, both the short and longer-term reaction of the stock market to an election out of the way and a new government in place has been positive. That said, major calamitous events such as the US losing its AAA-rating, the GFC, the declaration of a pandemic and global lockdown can ultimately influence what stocks do.

The new Labor Government will have to deal with the headwinds I mentioned at the start of this piece, and it will be the Reserve Bank’s monetary policy that will determine how the stock market performs in coming months and years.

I expect volatility to be driven out of the Fed in the US and the reaction of Wall Street and the bond market in coming months, but I do expect a stock market rebound and a rotation out of defensive stocks and into growth plays, including tech stocks. I expect to see promising signs no later than October and if I don’t, I will recommend we take cover and go defensive in our portfolios.

My positivity rests on my belief the Ukraine war will get settled in some way before the end of the year and that China gets out of lockdown after June 1 and supply problems reduce, helping inflation fall. These positive developments will mean central banks will go easy on interest rate rises and the stock market will re-evaluate their sell-offs.

Last week, Fed Chairman Jerome Powell told us that he needs to see “clear and convincing” signs that inflation is coming down before halting rate increases. And that’s why China and Vladimir Putin are important to stocks.

The Fed will go hard and could raise the official interest rate to 2.75-3% by the end of the year (that rate is currently about 1%). But if inflation shows the right signs, the central bank will declare “mission complete” and the stock market should like that in 2023 rolling into 2024.

Add this to the US presidential years and their relationship with Wall Street and it might be a leg up for investing over 2023 and 2024. “The presidential election cycle theory, developed by Stock Trader’s Almanac founder Yale Hirsch, posits that equity market returns follow a predictable pattern each time a new U.S. president is elected,” Investopedia’s Jennifer Cook explained. “According to this theory, U.S. stock markets perform weakest in the first year, then recover, peaking in the third year, before falling in the fourth and final year of the presidential term, after which point the cycle begins again with the next presidential election.”

Research by Charles Schwab going back to 1950 found the following market moves over the four years of a US president:

- Year after the election: 6.5%.

- Second-year: 7%.

- Third-year: 16.4%.

- Fourth-year: 6.6%.

And if you need more data to give us a positive feeling about the third year of a US president, which of course will be 2023, then read this: “However, averages alone don’t tell us whether a theory has merit; it’s also a question of how reliable it is from one election cycle to another. Between 1950 and 2019, the stock market experienced gains in 73% of calendar years. But during year three of the presidential election cycle, the S&P 500 saw an annual increase 88% of the time, demonstrating a notable consistency. By comparison, the market gained 56% of the time and 64% of the time during years one and two of the presidency.” (Investopedia.com)

And how about this?: “According to the 2021 Dimensional Funds report, the market has been favourable overall in 20 of the 24 election years from 1928 to 2020, only showing negative returns four times.”

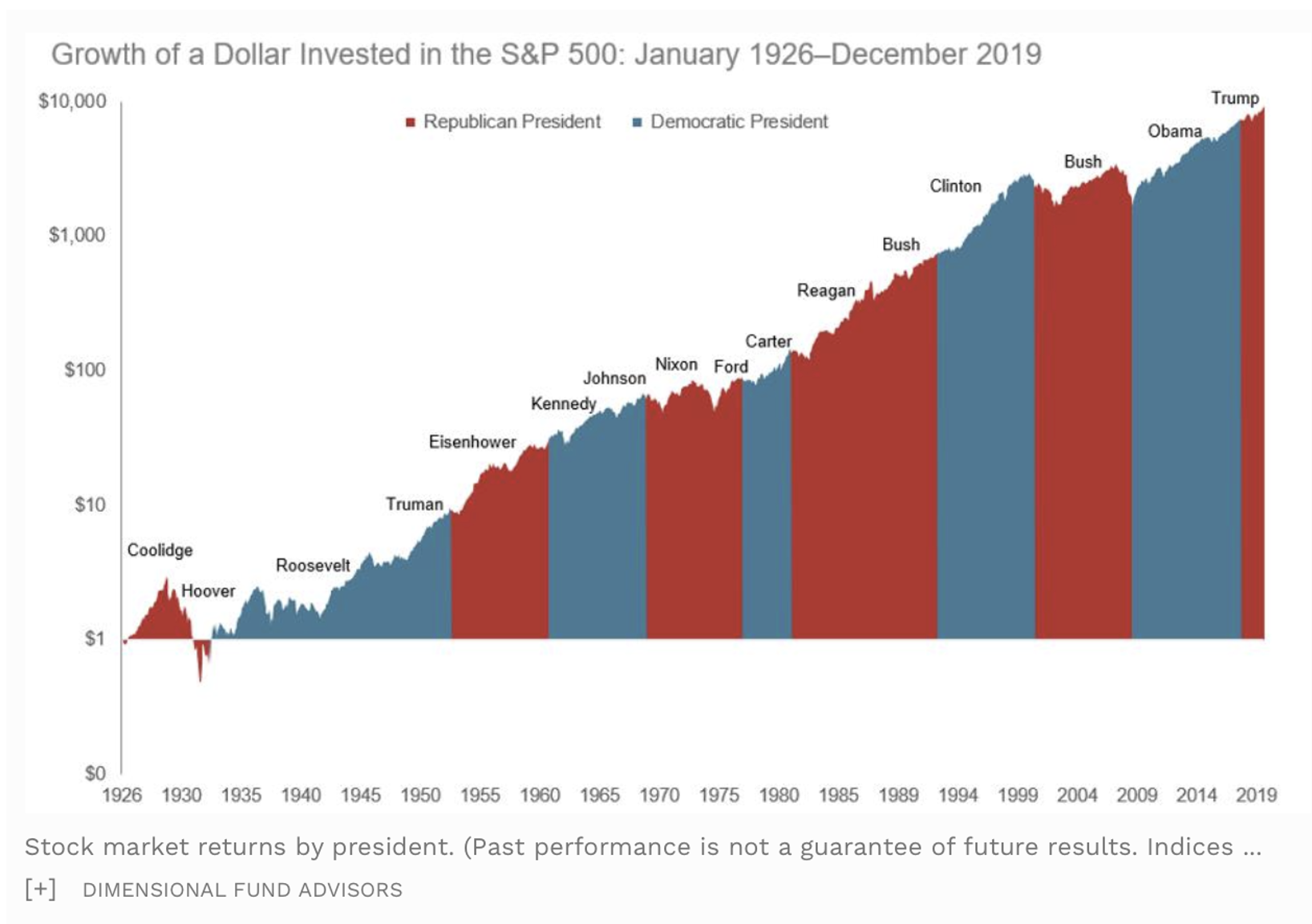

This chart shows how US presidents and rising stock markets go hand in hand over the four or eight years of their time in power, unless a GFC or dotcom crash comes along.

One interesting election-influencing investment strategy has been to go long the stock market on October 1 before the mid-term election in year two of a presidency and stay invested to December 1 of the fourth year. And that’s just after the new President is announced.

As you can see, there’s a lot of history saying it would be crazy to be out of stocks with year three of Joe Biden’s term coming up, but we do need China, Putin, inflation and the Fed to play ball.

I’m hoping Prime Minister Anthony Albanese and his Treasurer Dr Jim Chalmers, along with RBA boss Dr Phil Lowe, don’t make it hard to make money out of stocks in the year or so ahead.

And with the role that independents are bound to play, we now have another few rows to negotiate in that proverbial wall of worry we climb when we invest in stocks!

How do you invest for the year ahead?

The safe way is to play the index via ETFs such as VAS, IOZ, STW or A200. The riskier play is to use these ETFs as a core but add tech and healthcare stocks such as Xero, SQ2 (Afterpay), CSL and so on.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.