It seems like we’re in a stock market twilight zone, which the Oxford Dictionary defines as “a conceptual area that is undefined or intermediate.” Right now, it’s hard to be categorical about whether this current trading period is a prelude to another leg up or another leg down.

Being certain about either possibility gives you a chance to make money, if you’re right in believing that it’s time to buy or time to cash up ahead of a sell-off, which in turn will create a buying opportunity.

Of course, those old enough to remember that great TV show called The Twilight Zone know that it invokes fear when you remember some of those scary episodes that became permanently embedded in our mental hard-drives.

On that point, the stock market currently doesn’t worry me as a long-term investor but I know many of you hate to cop a sell-off after loading up on what should prove to be a good play, say by this time next year. By that time, inflation should be sliding faster than now and the Fed could be cutting rates, or at least giving the signals that rate rises are done and dusted.

I must confess that I’ve moved early on one inevitably good investment for the future but I do have that Twilight Zone feeling that if US inflation doesn’t keep falling at an acceptable rate for the Fed, the rate rises that it imposes could see me lose money, short term.

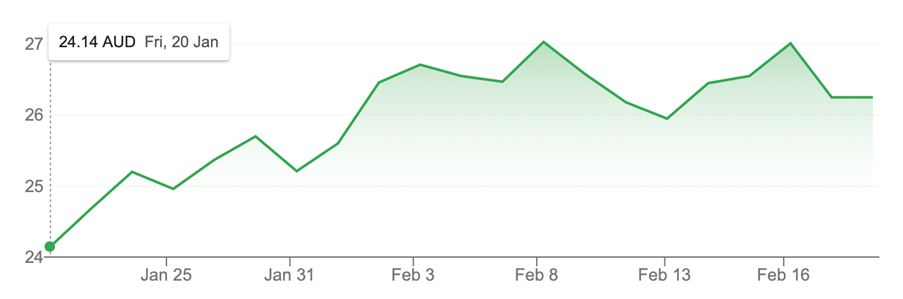

That investment is that kind of risky HNDQ, which dropped 2.81% on Friday but is up 8.74% for the month, which is about as long as I’ve been invested in it. For those who have forgotten, I talked about this BetaShares play on the top 100 stocks in the Nasdaq, which seems like a neat way to buy some of the best tech and growth stocks in the S&P 500 and Nasdaq.

HNDQ

But the bet/investment is based on rate rises stopping and tech/growth stocks coming back into favour. This is why the course of US inflation is critically important.

I guess if a sell-off comes along because inflation remains sticky or slow falling, then I might have to double cost average and hope that good times will show up for the overall tech sector by year’s end.

Given we don’t know what will happen to inflation in the short term, and let’s imagine (like me) you’re willing to gamble that any sell-off will only be a prelude to a bounceback of the market later in 2023 (and definitely in 2024), what are some of the smarties saying about the outlook for US stocks?

My focus on Wall Street is based on the usual assumption that the New York Stock Exchange will set the scene for our stock market, especially when the outlook for our market is looking attractive anyway. China’s reopening and expectations for their demand for our resources has the pundits positive on our market.

This US fund manager, Barbara Doran at BD8 Capital Partners in the US, is running with the bulls and she’s not alone. “The market has gone up and there seems to be a real appetite [for stocks],” she told CNBC. “People are coming in; they started the year with a lot of cash. Part of that was just bear market positioning but with the breadth that we saw in January, this is feeling like the start of, dare I say, a bull market.”

Doran argues that there are “few discernible negative catalysts on the horizon: investors seem to be thinking more of opportunities rather than just risk. A bull market attitude is slowing emerging, albeit a fragile one.”

And she came across as a kindred spirit with this one: “If you’re a long-term investor, you stick to your guns and you wait for opportunities in names that may have gotten too expensive.”

For those of you who play the US market directly, Doran likes Uber, Walmart and Starbucks. Uber because it leads its sector and the modern world seems addicted to it (my view, not hers exactly). Walmart is a good recession play and is a “long-term winner” and that was her words. Meanwhile, she sees Starbucks as a China reopening play and names it as “…a compounder in the portfolio”.

By the way, Uber and Starbucks are in HNDQ, along with the likes of Tesla, Microsoft, Apple, Amazon, Alphabet and Meta and a whole lot more.

For a broad local play, based on what might rebound well, when tech/growth stocks fall back in favour in a falling inflation environment, a small cap ETF could give some interesting upside.

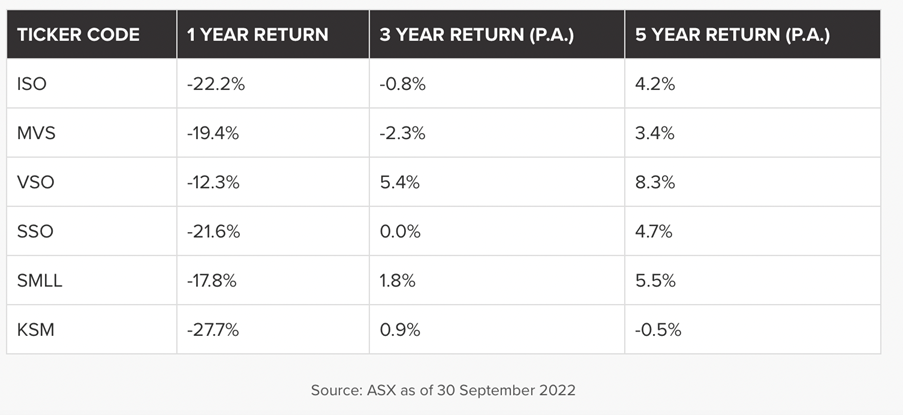

Here’s a list of some well-known small cap funds that have a lot of local tech and other smaller growth companies in their portfolios:

- iShares S&P/ASX Small Ordinaries ETF (ISO).

- SPDR S&P/ASX Small Ordinaries Fund (SSO).

- Vanguard MSCI Australian Small Companies Index ETF (VSO).

- VanEck Vectors Small Cap Dividend Payers ETF (MVS).

- BetaShares Australian Small Companies Select Fund (Managed Fund) (SMLL).

- K2 Australian Small Cap Fund (Hedge Fund) (KSM).

And here’s their track record and I think we should look at the five-year story (to 30 September 2022).

You could do a more sophisticated analysis to pick the small cap fund you’d like to invest with, by choosing Vanguard’s VSO with a 5.4% p.a. gain over three years and then 8.3% over five years. It looks compelling. Interestingly, the 12 months’ performance of VSO (down 11.74% to 31 December) makes you think (like tech stocks) it’s had a really tough year, but like the expected higher stock prices of these growth companies, VSO could be in for some blue sky and better returns. For only 30 basis points, it’s a cheap way to get exposure to a sector that eventually will produce some really good returns.

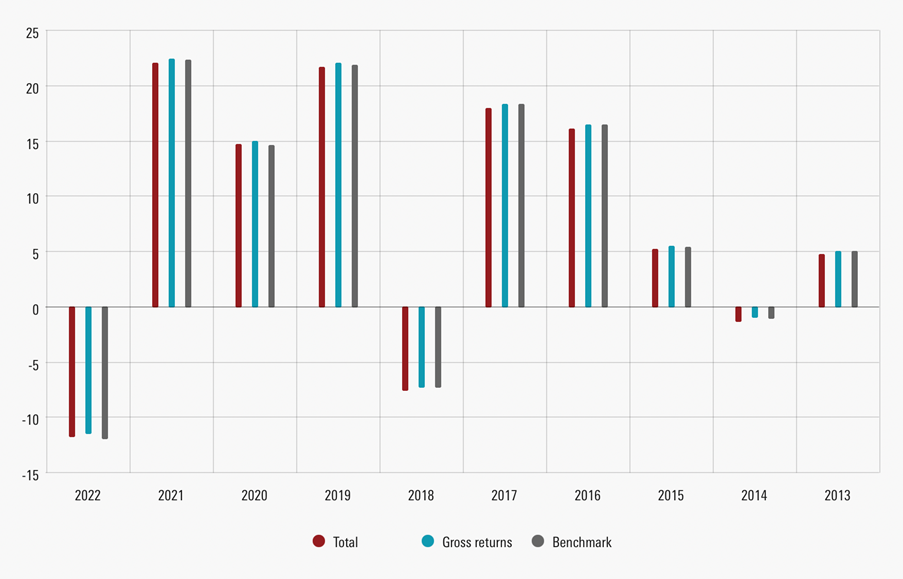

VSO

This chart above shows between 2013 and 2022, VSO has had seven up years, and four were 15% plus spikes! For that reason, I’ll be having a closer look at VSO.

By the way, the Oxford dictionary also tells me that a twilight zone is “the lowest level of the ocean to which light can penetrate” and it looks like my Switzer Report light has gone deeper than usual for some interesting ETF plays for the future.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.