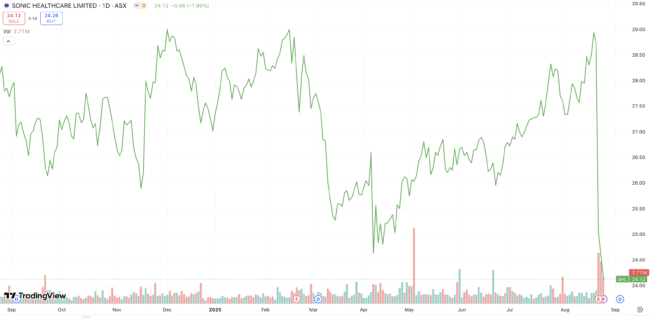

For our “HOT” stock today, Raymond Chan, Head of Asian Desk explains why Morgans maintains their BUY rating for Sonic Healthcare Ltd (SHL).

“Financial year 2025 underlying profit was soft,” Raymond said, “but tracked guidance, with net profit after tax (NPAT) impacted by higher D&A, net interest and tax, but normalised OPM improved on good cost control.

“Pathology growth slowed across most regions, but appears country specific not structural, while radiology showed strength on the trend towards higher value modalities and clinical services remains soft, but should improve on fee changes.

“We continue to view fundamentals as sound, with acquisitions (+5%) and FX (+4%) augmenting not masking underlying earnings growth (+6%).

“We adjust financial year 2026-2027 underlying estimates, with our target price decreasing to $29.33.

“We maintain our BUY rating,” Raymond said.