Sandfire Resources (SFR) is an international copper mining company. It is the country’s largest pure play copper producer.

“We have tipped Sandfire Resources before because we expect a global shortage in copper, along with increasing demand in 2024, to put upwards pressure on the copper price,” Michael said.

“For those looking to take advantage of possible upside in the SFR share price, there is still time to get involved.

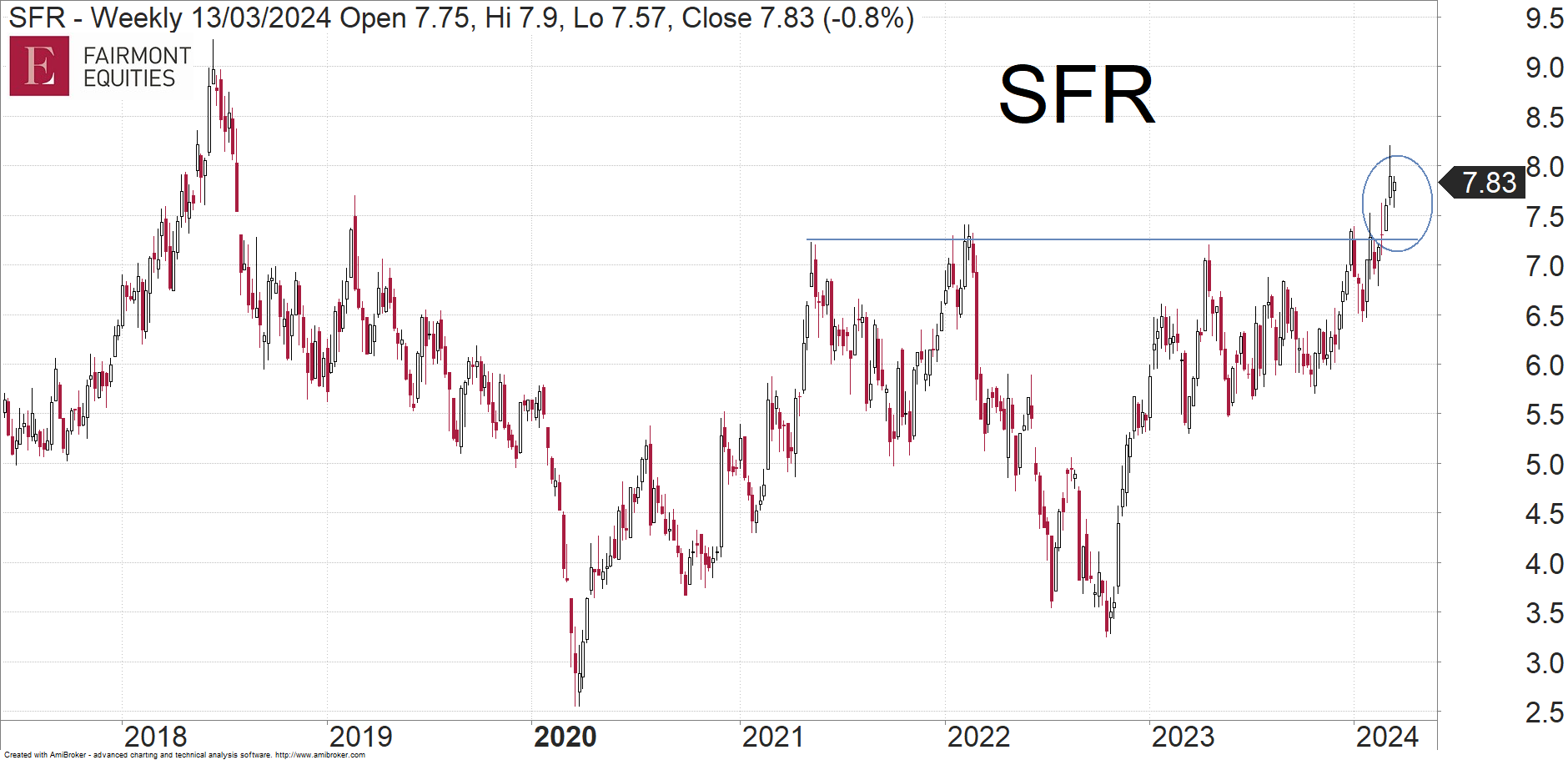

“When I lasted looked at Sandfire Resources in December, we tipped it to be on the cusp on uptrend, and that a break above $6.80 would see it rally towards $8.

“Now this has occurred, we have moved our targets higher.

“For almost three years, SFR has been forming a line of resistance near $7.30.

“It’s now breaking out of this larger pattern (circled in the chart below) and this is therefore another buying opportunity.

“We expect SFR to retest the 2018 high near $9.

“However, if we interpret the price action of the last three years as an “inverse head and shoulders”, then we could end up with a target closer to $11 later in the year,” Michael said.

Sandfire Resources (SFR)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.