The pricing of the Origin Energy Notes indicates very strong demand – they’re priced at the 90-day bank bill rate plus 4%, and the issue size has increased to $800 million; read, Should you buy Origin Energy’s hybrid notes? With this much interest, some SMSF investors may care to consider some other existing higher yield investments. There will also be more new hybrid issues, however with Christmas fast approaching, you will have to wait until February for these.

Let’s look at a couple of secondary market issues.

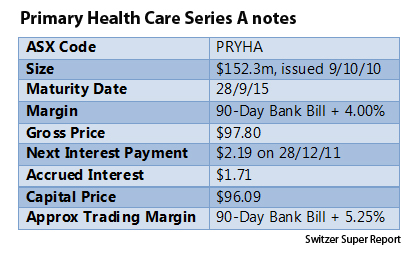

Primary Health Care Series A Notes (ASX:PRYHA) were issued in October 2010 and are unsecured debt obligations of Primary Health Care (ASX:PRY). Primary provides services to health care professionals, and also operates licensed and accredited day surgery facilities, specialist eye clinics and automated pathology laboratories.

Originally issued at a margin of 4% above the 90-day bank bill rate, these notes are currently trading in the secondary market at an effective margin of around 5.25%. They go ‘ex-interest’ shortly, with the next distribution of $2.19 payable on 28 December.

At Primary’s recent annual general meeting (AGM), the managing director delivered a fairly upbeat assessment of the company, outlining forecast earnings per share (EPS) growth of 15-20% in fiscal 2012. He also reconfirmed that Primary had refinanced $1.02 billion worth of bank debt to provide an extended maturity profile of between three and five years.

At Primary’s recent annual general meeting (AGM), the managing director delivered a fairly upbeat assessment of the company, outlining forecast earnings per share (EPS) growth of 15-20% in fiscal 2012. He also reconfirmed that Primary had refinanced $1.02 billion worth of bank debt to provide an extended maturity profile of between three and five years.

Primary’s share price has also been tracking fairly well. Why is the share price of the issuing entity important? Well, it’s no secret that most banks’ credit assessment methodologies place considerable emphasis on a company’s share price, as the stock market is (historically) reasonably good at sniffing out a company in trouble. With less than four years to maturity, at a margin of 5.25%, I think these Primary Notes represent very good value compared with the Origin Notes.

TIP: Watch the share price – if that starts to sink, it is time to exit the hybrid investment.

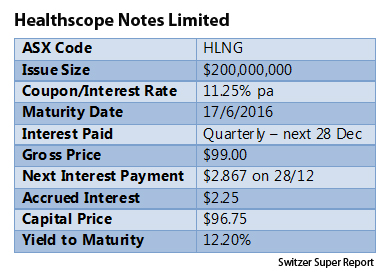

Another existing hybrid you can buy on the ASX is Healthscope Notes Limited (ASX:HLNG), a special purpose company which is part of the Healthscope Group. Healthscope is the second largest private hospitals operator in Australia and the third largest pathology services provider.

The notes are subordinated to the senior debt of the Group, and currently yield 12.2%. The next distribution of $2.25 is payable on 28 December, with the notes going ‘ex-distribution’ on 12 December.

As the prospectus prominently said, “The Healthscope Group has a substantial amount of debt” – so these notes are close to what we call “junk” (and hence the high yield). Unlike Primary, Healthscope Group is a private company, which means there is almost no information available for investors to get a handle on how the underlying business is performing and whether the interest on the debt (and notes) can be serviced. So, with this investment you are flying blind.

As the prospectus prominently said, “The Healthscope Group has a substantial amount of debt” – so these notes are close to what we call “junk” (and hence the high yield). Unlike Primary, Healthscope Group is a private company, which means there is almost no information available for investors to get a handle on how the underlying business is performing and whether the interest on the debt (and notes) can be serviced. So, with this investment you are flying blind.

Having said that, high returns come from taking risk. The golden rule of investing is to diversify and spread your risk, so within a diversified portfolio, there may be a place for a small investment in these notes.

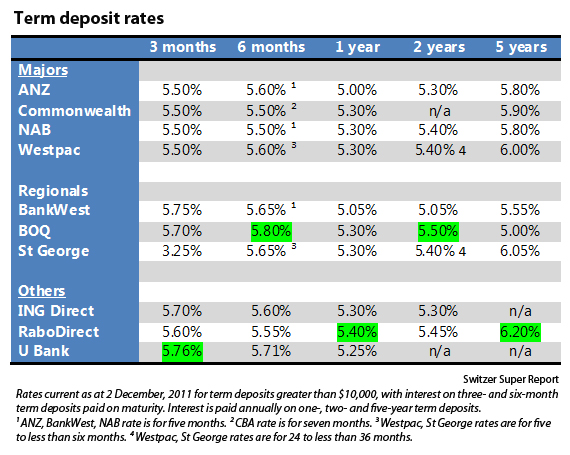

And if these investments don’t tempt you, there are always term deposits. Bear in mind, the government guarantees term deposits and bank accounts with authorised deposit-taking institutions up to the value of $250,000 on a ‘per investor, per institution’ basis, which means it is pretty hard not to argue that for most SMSFs, the only consideration should be the interest rate offered. Here are the latest rates:

Disclosure: The author’s SMSF has small investments in both Primary and Healthscope Notes.

Disclosure: The author’s SMSF has small investments in both Primary and Healthscope Notes.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: Why this week could be the decider

- Rudi Filapek-Vandyck: The broker wrap: Heavy downgrades

- Tony Negline: Six changes to super laws

- Jo Heighway: The ATO’s compliance ‘hit list’ for SMSFs