Many reinforcing indicators of late are making me more bullish on what the stock market can deliver over this year! I add this because I’m not super confident that the recent market bounceback will be sustainable in the short run because we have to deal with the US Federal Reserve and its guessing game on interest rates.

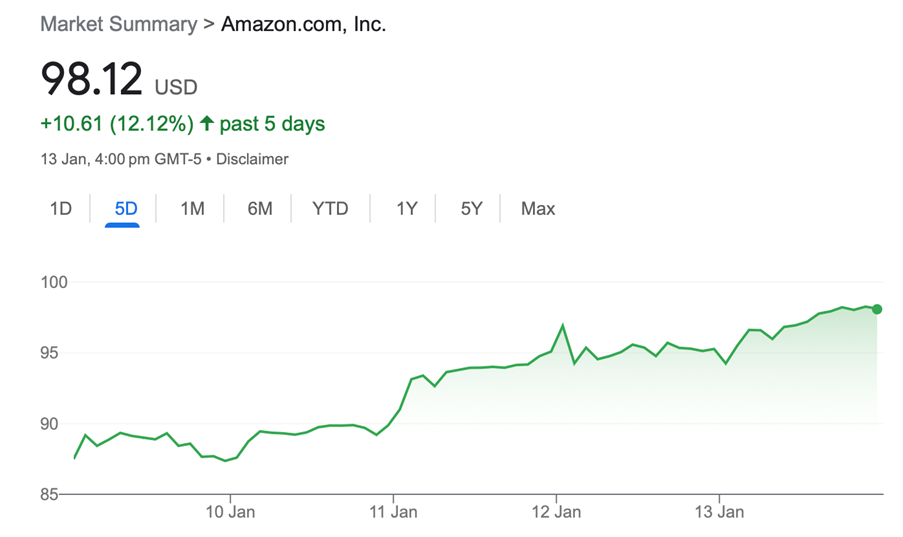

However, over 2023, I’m expecting both bond and stock markets to deliver good returns. For stock pickers, your job is to get the company and the timing of your buying right. Undoubtedly, there will be rotation out of some of the sectors that did well last year into ones that got clobbered, and it’s the Amazon’s story last week that convinces me that tech will make a welcome comeback over the course of this year.

Yep, 12.12% in a week tells us something and it coincided with US inflation coming in ‘down’ as expected, especially the important core rate, which ultimately will have a big bearing on what the Fed does this year. Remember, when the Yanks think rate rises are over or even suspect they could see rate cuts because of recession challenges, then this would be a big stimulus for tech stocks.

Personally, I’m betting with the CEO of Bank of America, Brian Moynihan, who told CNBC that: “Our baseline scenario contemplates a mild recession.”

A mild recession doesn’t imply that rate cuts happen this year, but they could come in 2024. The stock market would like that. That said, one of my favourite market experts, Jeremy Seigel, the finance professor at the University of Pennsylvania’s Wharton School, thinks US inflation has been nailed and the Fed should actually be thinking about no more rises! “The Fed is, at some time, going to be forced to realize that we’ve really solved the inflation problem,” Seigel said on CNBC. “That’s one reason the market has rallied.”

I don’t think the Fed will be so confident that inflation has been beaten but we are seeing what happens when the market thinks rate rises soon will stop. Siegel says: “The market knows better than the Fed what is actually going to happen.”

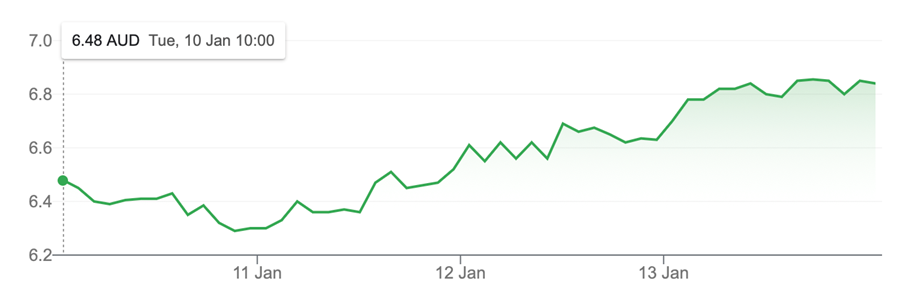

And locally we are starting to believe “the tech will rebound” story, with Megaport (a darling of the analysts) up 5.56% last week.

Megaport (MP1)

And boy, do they like this one for the year ahead, with the average consensus rise coming in at 49.5%. But the likes of Citi (up 104.68%) and UBS (up 106.14%) are true believers in this company.

Next week, I’ll run through the local tech companies that analysts really like, but you have to remember that picking companies is harder than going with themes and investing accordingly.

For my financial planning clients, I’ve been investing in VAS — the Vanguard top 300 stock ETF — to position them for the overall local market recovery that will be helped by the Chinese reopening, lower inflation, the halting of interest rate rises and my expectation that the US S&P 500 index and Nasdaq will rebound as tech companies get re-loved.

I’m putting my clients into IHVV — the iShares ETF that captures the gains of the S&P 500, with hedging — as I expect the Oz dollar will keep on rising.

And if you’re real thrill-seeker, BetaShares’ GEAR product gives you a similar movement of the S&P/ASX 200 Index but with a magnification effect. That said, it operates in both directions, so you have to invest or speculate in this with the knowledge that you can win or lose ‘big time’ with GEAR.

OK, I like stocks because of falling inflation, fewer or no interest rate rises and the reopening of China. And this is the third year of a US presidency, which is historically great for stocks, and for the US after a bear market for the S&P 500, as well as the Nasdaq, stocks usually surge. This chart below shows how after the dotcom bust of 2000-02, the GFC crash of 2008 and the Coroanvirus crash that stocks came back big time.

S&P 500

But what do others think?

- Prof Siegel: “Siegel’s big bet for 2023 is that equities have already priced in much of the bad news, be it China’s COVID policies or the Ukraine war, and are “10–15% undervalued on a long-term basis.” That, as he sees it, augurs “a very good year for equities.” He also bet on stocks over other assets in the revised edition of his book, “Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies.” (https://knowledge.wharton.upenn.edu/article/why-jeremy-siegel-is-cautiously-optimistic-about-2023/)

- Dr. Shane Oliver from AMP: “Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices, and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7600.

- Mike Santoli CNBC’s market expert used a legal approach to argue about a positive outlook for stocks. “Exhibit A placed in evidence could be the chart of the equal-weighted S&P 500 index, which is up close to 20% from its October low and has burst above its 200-day moving average,” he wrote. “It shows the core of the market, the rank-and-file, looking sturdier than the headline benchmark, which just on Friday barely nosed above its 200-day average and still must prove that it can surmount the downtrend line from the ultimate peak set a year and ten days ago.”

Breaking that purple 200-day moving average is good to see and might be a good omen for 2023.

Mind you, I wouldn’t be surprised if the Fed hits stocks in February with another rate rise, but if inflation signs keep saying prices are falling, it should be another good sign for stock market optimists.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.