Reserve Bank Governor Phillip Lowe could not have been any clearer. “The Board is not expecting to increase the cash rate (from 0.10%) for at least three years”.

And with the RBA buying 3-year government bonds at a yield of 0.10%, and announcing a program to buy $100bn of 5- to 10-year Government and State Government bonds over the next six months, yields starting with a big figure of “0” are now the norm.

For term deposit investors, this means an interest rate with the big figure of “0” is here to stay.

So what are the best term deposit rates? And if you are prepared to be a “thrill seeker” and take on more risk, what are some of the alternatives?

Of course, I am being somewhat flippant describing this as for “thrill seekers”, because there is no such thing as a free lunch and if you want a higher return, you need to take on more risk. Risk means both the potential for loss and the volatility of the return.

This is where diversification becomes important, because you don’t want to make the mistake of blowing all your capital on one bad investment. Typically, as investments get riskier, you invest less.

And owning low risk investments such as term deposits and higher risk investment in hybrids , corporate bonds or credit funds aren’t mutually exclusive. A balance between low risk and higher risk will typically deliver the optimum return.

Enough theory – let’s start with term deposits.

Best term deposit rates

Listed below are the latest term deposit rates on offer for the popular terms of 3 months, 6 months, 1 year, 3 years and 5 years. Rates are current on 9 November and are based on a deposit of $50,000 with interest paid on maturity, or annually for terms of 3 or 5 years.

Rates are shown for the 4 major banks and 13 regional/significant/on-line other banks. The major banks typically pay lower rates than the online banks and the regional banks.

Newcomer Judo Bank is also shown. It is paying 1.05% for 12 months, and 1.55% for 3 years.

Leaving Judo aside, the best rates are highlighted in green. CUA takes this honour for the shorter terms, while Rabobank has the best five-year rate at 1.00% pa. Some banks also have “specials”, with Westpac paying to personal customers 0.60% for six months.

Banks such as ING, Rabobank and UBank reward loyalty by paying an additional 0.10% pa when an investor rolls over the full amount of a term deposit to a new deposit.

And while it can be a hassle to change banks or open a new bank account, if you want that extra 0.25%, be prepared to shop around. Don’t be put off by security concerns because with the effective Commonwealth Government guarantee on deposits of $250,000 on a per client per financial institution basis through the Financial Claims Scheme, Bank A is as good as Bank B up to $250,000.

Rates as of 9 November 2020 for deposits of $50,000 and upwards. Interest paid on maturity, or annually for 3 and 5 year terms. Advance notice (31 day) products selected when offered.

Higher risk alternatives

- Hybrid Securities

ASX listed hybrid securities, which are typically issued by banks, are popular with many investors. As the name implies, they are a “cross” between an equity and a debt security. They have “equity” features in that they count as capital for the issuing banks and rank almost at the bottom of the food chain. If the issuing bank gets into financial trouble or there is an industry wide financial crisis, investors could lose some or all of their capital.

They have “debt” like features in that they pay a regular quarterly distribution. When redeemed, similar to a bond, investors should get back the capital value of $100. With the distribution, it floats at a fixed margin over a benchmark interest rate, usually the 90 day bank bill rate. If the fixed margin is 3% and the 90 day bank bill rate is 0.10%, investors will receive a gross distribution of 3.1% for the quarter. If the bank bill rate subsequently increases to 1%, investors will receive a gross distribution of 4% for that quarter.

These securities are complex investments and as the old adage goes, “never invest in something you don’t understand”. To learn more, see ASIC’s MoneySmart website: https://moneysmart.gov.au/investments-paying-interest/hybrid-securities-and-notes

Like many securities, hybrid securities were punished during the March Covid-19 market meltdown as panicked investors rushed for the exit. They then rallied hard, with the trading margin going under 3% on some of the major issues as investors searched for yield.

New supply has hit the market over the last couple of weeks, and trading margins have moved higher. Bendigo has launched a $460m issue of Bendigo Capital Notes paying a margin of 3.8%. To trade under the ASX code of BENPH, it has approximately 6.5 years to the call date and 8.5 years to the expected redemption date. The offer closes on 24 November.

Bank of Queensland is also in the market with a $250m issue of BOQ Capital Notes 2. To close on 17 November, its terms are very similar to Bendigo: fixed margin of 3.8%, approximately 6.5 years to call date and 8.5 years to redemption date.

The pick of the issues (albeit it pays a lower fixed margin of 3.4%) is Westpac’s Capital Notes 7. The jumbo issue (of at least $750m) will trade under the ticker WBCPJ and has a term of 6.3 years to the call date and 8.3 years to the expected redemption date. The offer is scheduled to open on 13 November and close to Westpac securityholders and broker firm participants on 30 November.

National Australia Bank is also expected to launch an issue, saying last Thursday that “NAB is considering an offer of a new ASX listed capital security alongside the repayment of NAB CPS II (ASX: NABPB)”.

An alternative to investing in hybrids directly is Betashares Active Australian Hybrids Fund (ASX:HBRD). Chris Joye’s Coolabah Capital Investment is the investment manager. Management fees are 0.55%pa plus the potential for a performance fee.

- Credit Funds

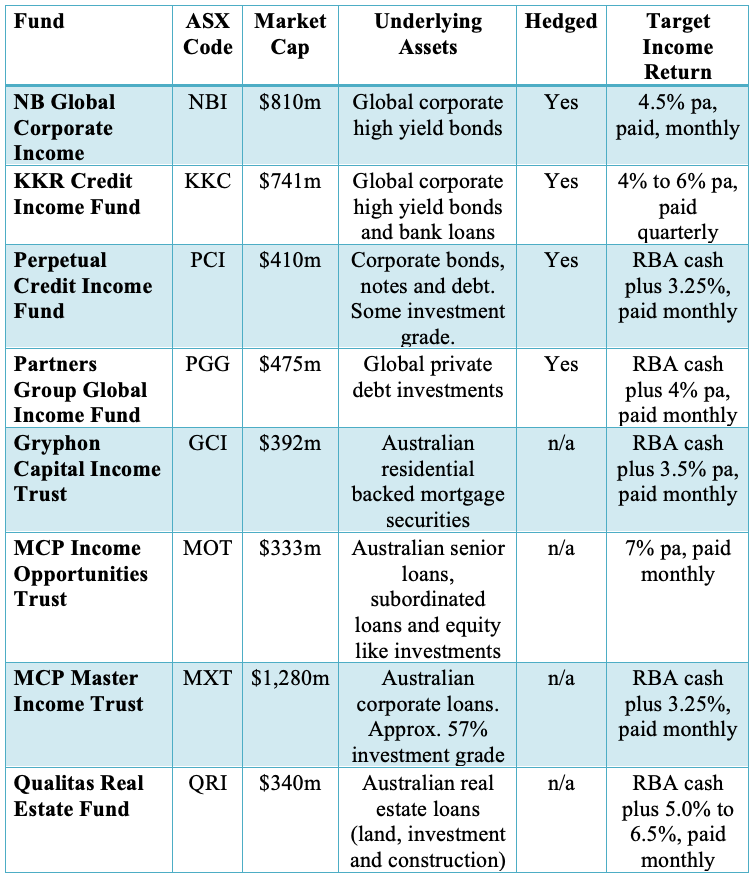

Higher risk, but with the potential for higher returns, are listed credit funds. There are 8 funds listed on the ASX – 4 that invest offshore in corporate bonds, loans and other investments and then hedge back into Australian dollars, and 4 that invest locally. Each has a target distribution return, often expressed as a margin over the current RBA cash rate. Distributions are typically paid monthly (see table below).

To achieve the higher returns, some of the funds invest in “non-investment grade” securities and debt. More colloquially referred to as “high yield” or sometimes unkindly “junk” bonds, this means that the probability of capital loss is higher, so the manager’s approach to portfolio construction, security selection, risk management and diversification become critical.

If investing in higher yield funds, diversification across manager and asset type is generally recommended.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.