With so much global and electoral support for climate change reactive policies, can you seriously contemplate going long oil and coal stocks? Interestingly, they certainly look like a short-term play, at the very least.

Personally, I’ve been happy to keep holding Woodside Energy Group (WDS) only because I got into it on the cheap, but I’ve also always believed the political changing winds were going to mean that WDS and my super fund would have to part company.

However, given my recent research, that time’s not in the near future.

As I say, oil and energy stocks aren’t my happy hunting ground when it comes to investing, but I hold a few for diversification reasons and I invest on the theory that I buy quality assets when the market takes a set against them. Of course, the key question is, are energy companies quality assets?

Last week, AGL (another “not my company” stock) rose 5.1% over the week, as the impact of rising retail energy prices were seen as a plus for this often-troubled business. Three out of five analysts are negative on the company but not excessively against the business’s prospects. Meanwhile the most positive is Ord Minnett, whose analyst sees 6% upside. I can’t be talked into this one.

On the other hand, if the outlook for oil and gas is promising, I could give the perennial disappointment — Santos (STO) — one more try. But before I look at what the analysts think of the company, let’s check out what the experts on oil are predicting.

A couple of weeks ago I interviewed Michael Knox, chief economist at Morgans, who argued that the oil price, based on his model, was heading up in the second half of this year. You can see that interview here: https://switzer.com.au/the-experts/peter-switzer/time-to-buy-oil-stocks-and-banks-plus-3-stocks-to-buy/ .

If you want to know what might go on with oil, the best source for that kind of information comes from International Energy Forum. In its latest report, the news is that oil prices are set to rise in the second half of 2023.

The current picture is that demand for oil has rebounded to pre-pandemic levels “but supply is having a tougher time in catching up,” said Joseph McMonigle, secretary general of the International Energy Forum to CNBC. “So, for the second half of this year, we’re going to have serious problems with supply keeping up, and as a result, you’re going to see prices respond to that.”

If you want to doubt McMonigle, you might want to argue that his China story could be out-of-date after last week’s softer GDP numbers for the world’s second biggest economy. But China isn’t the only big consumer of oil. “India and China combined will make up 2 million barrels a day of demand pick-up in the second half of this year,” the Secretary General said. “We’re going to see much more steep decreases in inventory, which will be a signal to the market that demand is picking up. So, you’re going to see prices respond to that.”

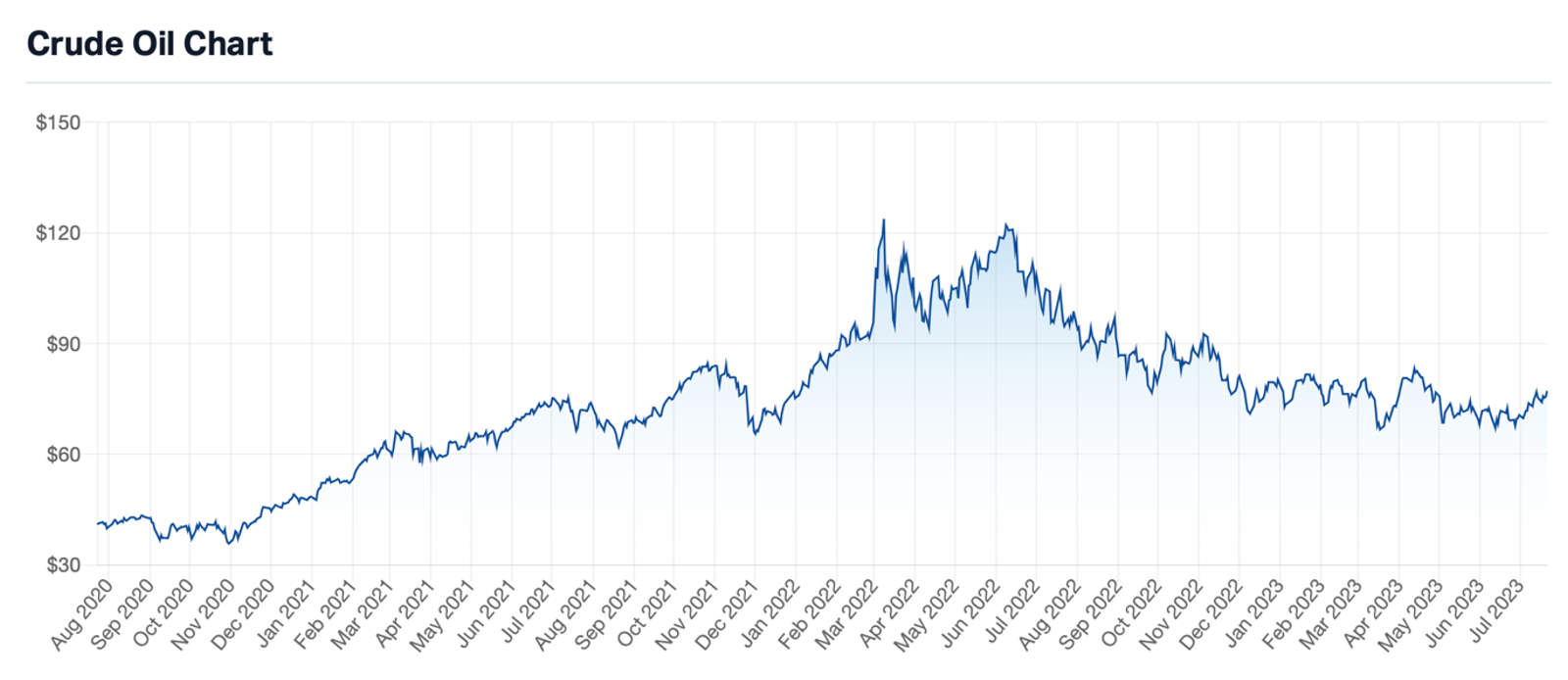

He says oil at $US100 a barrel is expected and currently hovers around $US77. This chart from marketindex.com shows you how elevated oil’s price has been and provided China and India grow as expected, another spike is believable.

Interestingly, McMonigle isn’t expecting OPEC+ to over-exploit the supply shortfall for too long, which is good news for those of us who want a global economic recovery in 2024 to help stock prices head higher.

“They’re [OPEC+] being very careful on demand. They want to see evidence that demand is picking up, and will be responsive to changes in the market,” he said.

This good news for oil investors is expected to be a plus for gas producers and investors as well and should be a plus for Santos.

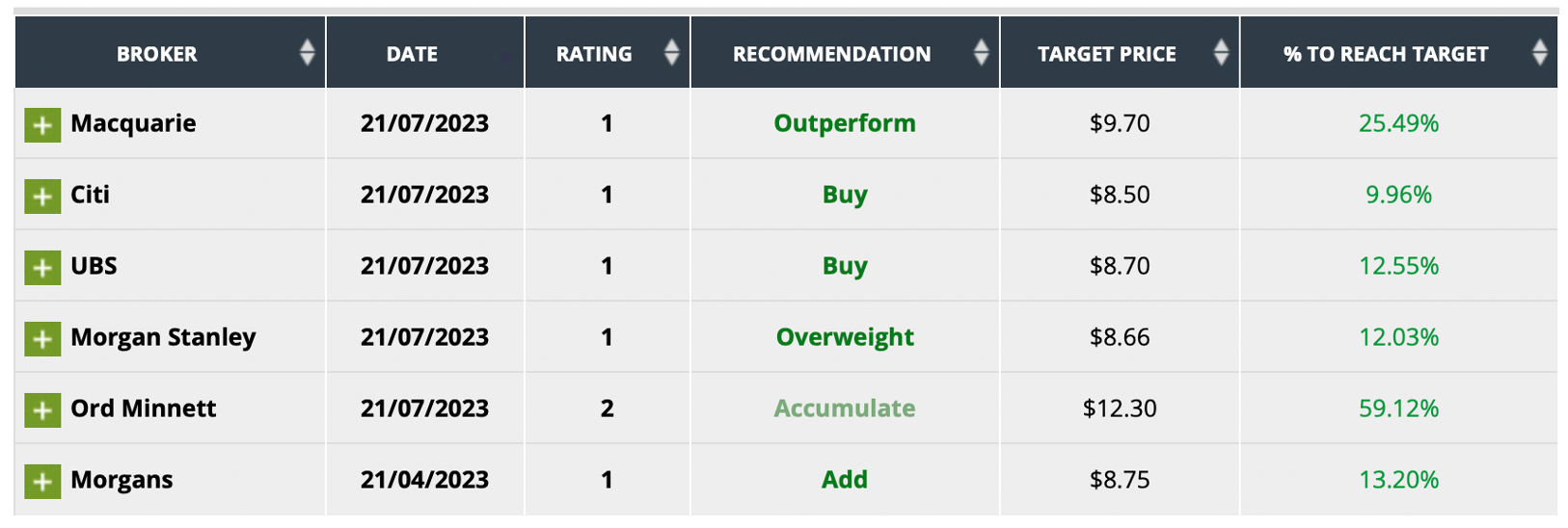

Right now, the analysts are really in Santos’s corner with the consensus all predicting a 22% rise in share price. In addition, six out of six analysts like the company, with the most supportive being Ord Minnett with a 59% upside call.

I must admit I do find Ord Minnett to be a little too enthusiastic at times but Macquarie, which has a good track record when it comes to resources, tips a 25.4% rise for the oil and gas producer.

But what about the number one player in this space — Woodside?

Here the consensus call is only plus 0.5% and only two out of six analysts have its future price higher. The most positive on the company is Ord Minnett, with a 23.6% upside call, while the most negative is Macquarie, with a 9.3% fall expected. Citi has the exact same forecast for WDS.

But what about despised coal producers, such as Whitehaven Coal?

Here the consensus call is 10% upside, but five out of seven analysts give the company the thumbs up!

The biggest negative is down 14.4% from Bell Potter, but the most positive call comes from Morgans, whose expert sees a near 37% gain ahead for the coal producer.

In the minds of many inexperienced people, when it comes to the big business of energy, they might think the world’s embracing of new-age energy alternatives (like solar, wind and others) means oil, gas and coal becomes unwanted and low-priced. However, the transition to alternatives means oil, gas and coal will have a significant role until the alternatives are able to be real substitutes.

This from Joseph McMonigle puts this transition into perspective. “We definitely have to keep pursuing the energy transition, and all options have to be on the table,” he told CNBC. “I’m worried that if the public starts to connect high prices and volatility in energy markets to climate policies or the energy transition, we’re going to lose public support. We’re going to be asking the public to do a lot of difficult and challenging things in order to enable the energy transition. We need to keep them on board.”

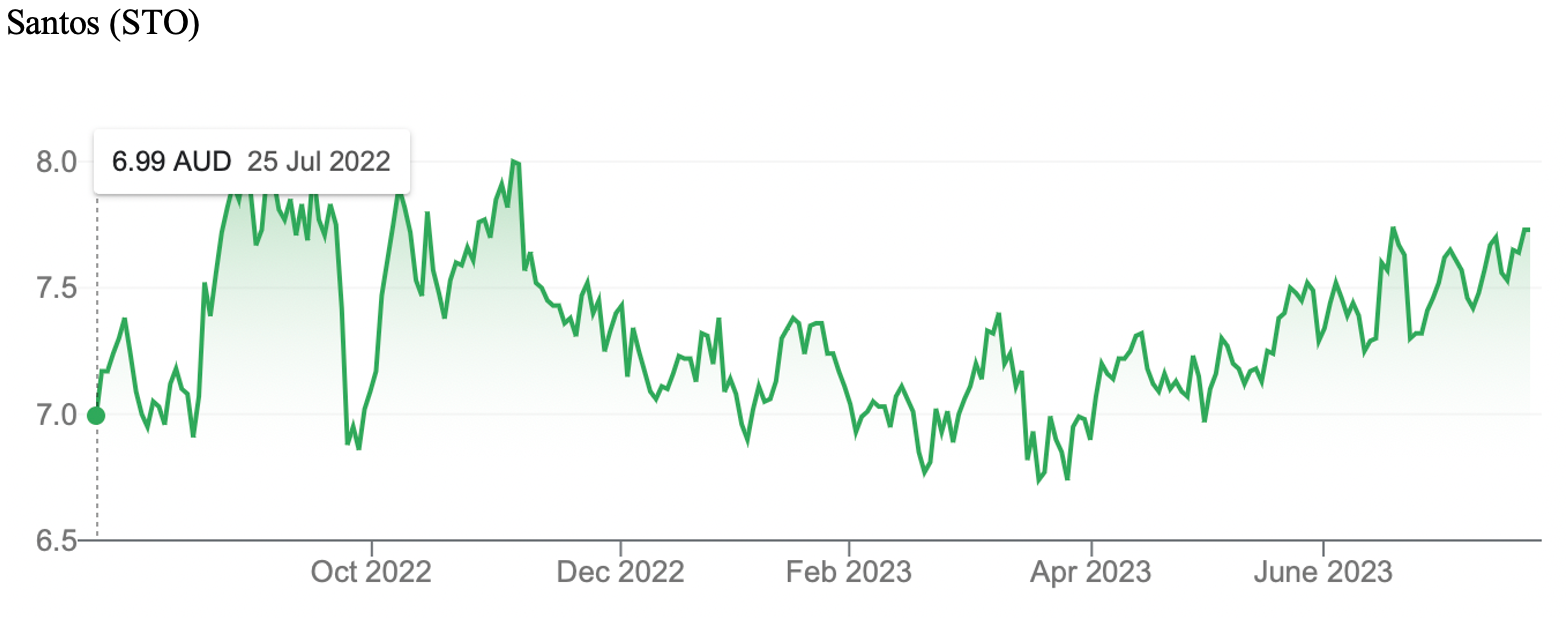

I think this is code for prices of oil, gas and coal aren’t going to dive big time any time soon. And for those wanting some technical reason to believe that Santos has potential, have a look at this.

This one-year chart does look positive. (Peter’s not the only one seeing potential for Santos (STO). See Raymond Chan’s comments in our “HOT” stock column below)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances