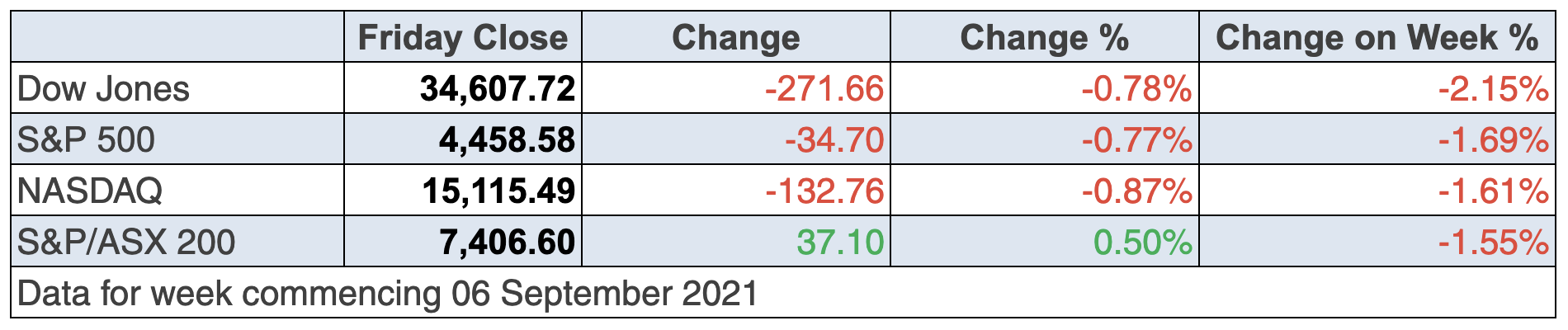

The Dow did five days on a slide but those who are hanging on to their energy shares will be happy that the oil price was on the rise, which could be a sneak preview on what lies ahead, provided the world learns how to live with the Delta variant of this persistent pandemic.

By the way, with an hour to go in the trading day, the S&P 500 was only down because of Apple (the biggest component in the Index) which lost a court case, which means video game maker Epic Games and other developers can’t be forced by Apple to put links only to their lucrative App Store. Apple typically takes a 15% to 30% cut of gross sales!

It means Epic Games and others could direct purchasers to their own website rather than the App store, which is a huge plus for businesses such as Epic and a kick in the guts for Apple. The company’s share price was down 3% on the news.

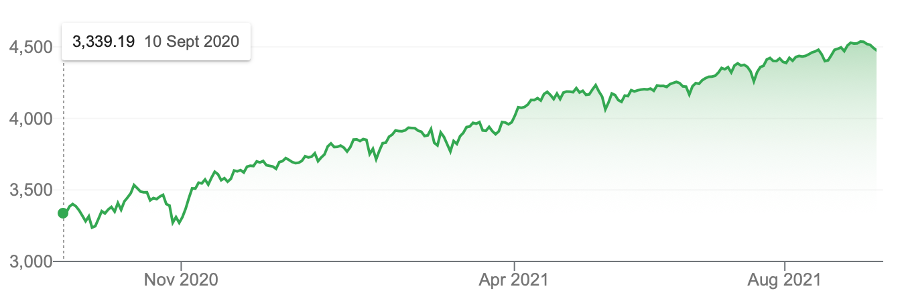

S&P 500

Back to the overall market, and right now we’re in a pullback and around 40% of stocks in the S&P 500 are around 10% off their all-time highs, but it has been a huge year for US stocks.

If you look at the chart above, you can see a 34% rise in a year (or a 21% rise year-to-date), but see how there’s been drops or pullbacks all the way along. Ultimately, the battle of Delta versus vaccinations will produce an economic and business outcome that will determine the depth of this current pullback and how long it lasts.

But it’s not just virus concerns. Inflation had European markets nervous overnight after the ECB said it was going to lighten its bond purchasing as inflation and growth was coming in higher than expected. The US also have those concerns, on top of supply problems, which is another source of inflation.

Remember, the current market debate centres on the question: “Is the spike in inflation temporary?” The Fed and its central bank buddies, including our own Dr. Phil Lowe says yes, but the big players on Wall Street and other financial markets have their doubts.

This is just another reason why some share players are taking profit now or shorting winning stocks or the overall market. But note, the four-day pullback for the US market is only 1.3%, while ours is just 1.55%.

“It’s been a week that’s really taken its cue from the delta variant,” said Jack Ablin, Cresset Capital Management’s founding partner and CIO to CNBC overnight. “Investors are wringing their hands over growth but are seeing higher inflation at the same time.”

I suspect we’re going to need shock good or bad news to jump start a significant market move, but you have to remember that the US major market indexes are not far off record highs, so I’m hoping for good news but maybe bad is more likely.

Interestingly, President Biden got tougher calling for more Americans to get jabbed and the country’s leading Coronavirus medico, Dr Anthony Fauci, is calling for children to be vaccinated. That would be a positive game changer.

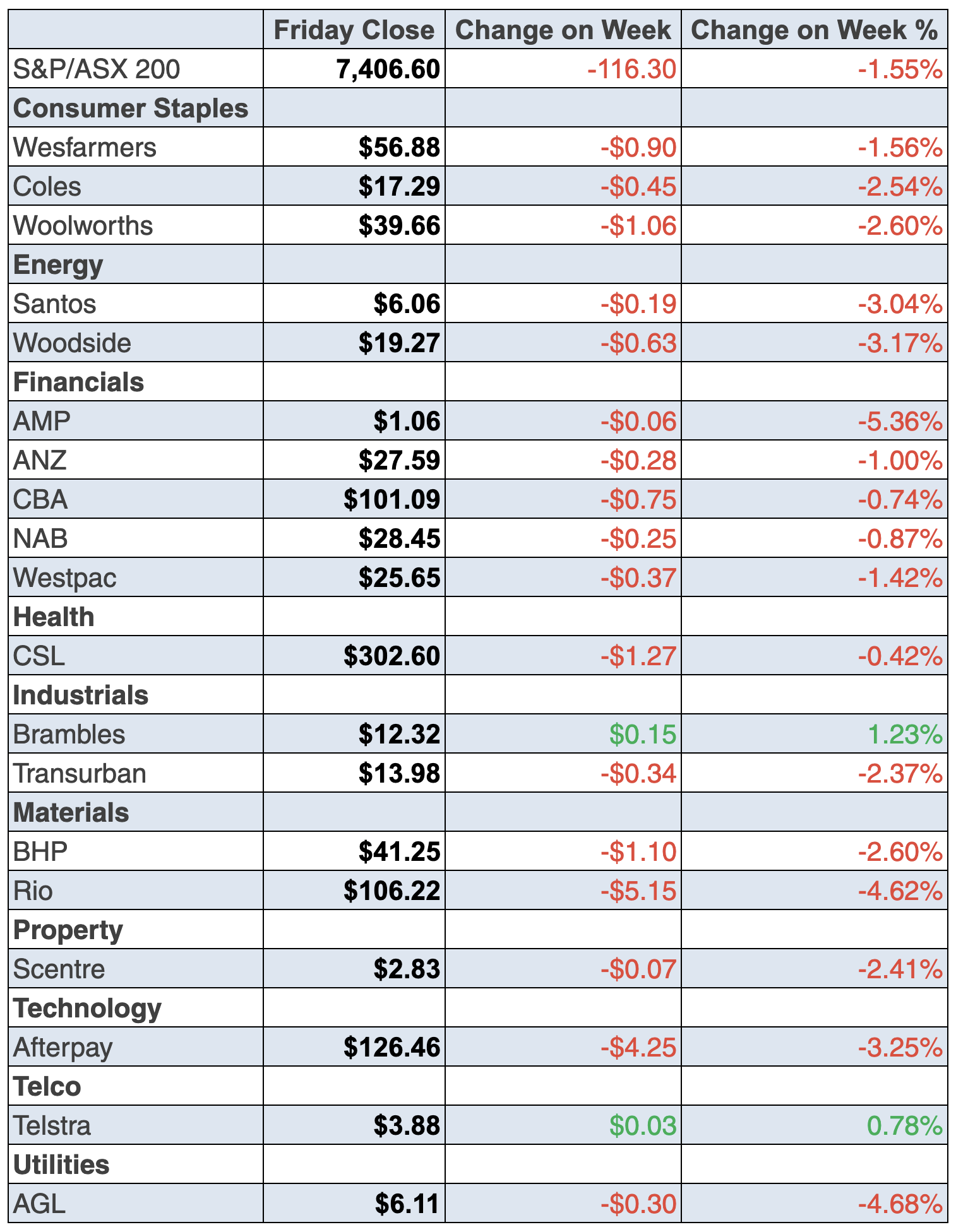

To the local story and our market lost 116.3 points (or 1.55%) with the S&P/ASX 200 finishing at 7406.6. But at least we finished Friday on a high, with a 0.5% or 37-point jump. That sell-off could be a sign that volatility overseas is on the way but it did seem like an overreaction, but we can do that!

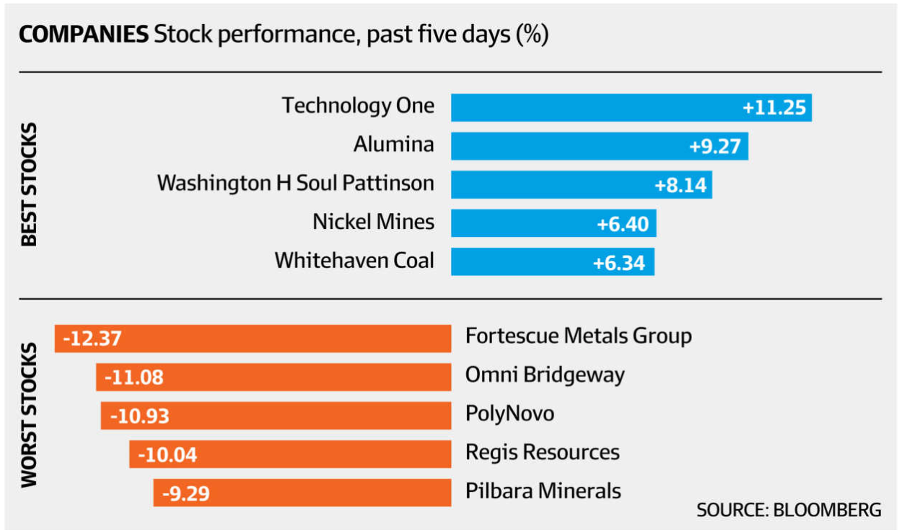

The table of Bloomberg’s winners and losers features a lot of stocks that many wouldn’t own (apart from Fortescue), which always reacts the most out of our big miners when iron ore prices slide, as they did this week. The question about FMG is: am I looking at a buying opportunity for 2022? More on that in my Monday story.

BHP was down 2.60% to $41.25, while Rio lost 4.62% to $106.22. The banks were weaker but were only off around 1%.

Other blue chips were weaker, with Woolworths down 2.60% to $39.66 and Wesfarmers was off 1.56% to $56.88. But one blue chip that didn’t disappoint this week was Macquarie, which was up 2.98% to $174.23. Promising a record profit and earnings to go close to doubling will do that! (I talk about my lifelong brush with Macquarie in my Weekend Switzer story today. Check it out here.)

Anyone wondering why Alumina was up so much, you can thank higher aluminium prices, which hit a 13-year high. Is this a sign of manufacturing demand aimed at a big boom year in 2022? More on that on Monday.

What I liked

- The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) yesterday released a report estimating that the national winter crop harvest is expected to reach 54.8 million tonnes in 2021/22, up 17% from its June forecast. A record canola crop of 5.037 million tonnes is expected in 2021/22, up 20%.

- The AiGroup Performance of Services Index (PSI) employment sub-index lifted from 51 to 53.4 in August, which was good as the overall services index actually contracted. (see What I don’t like below)

- Used vehicle prices rose by 17.7% in the year to August, down from 27.2% in the year to July. Second-hand car prices were up 18.5% on a year ago, with truck prices 13% higher.

- USinitial jobless claims (for unemployment benefits) fell by 35,000 to 310,000 last week (survey: 335,000).

- The European Central Bank (ECB) said it would slow its emergency bond purchases implemented during the pandemic over the coming quarter, which President Christine Lagarde said was not tapering, but refrained from detailing how it plans to end its €1.85 trillion Pandemic Emergency Purchase Programme (PEPP). I like Europe growing and I think inflation is temporary.

- Joe Biden and China’s President Xi Jinping talked on Friday by telephone, which the market saw as a plus. Improving relations between China and the US would also help our relationship with China too, which would be good for stocks such as TWE and A2Milk, which would love more normalised trade and tourism situations in 2022.

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 1.8% to the neutral 100 level (long-run average 112.5 since 1990). Sentiment dropped 5.3% in Sydney and fell by 0.8% in Melbourne.

- Consumer inflation expectations over the next two years hit a 33-month high of 4.7% last week.

- The AiGroup Performance of Services Index (PSI) fell from 51.7 to an 11-month low of 45.6 in August, denoting a contraction in activity (index below 50).

- The Bureau of Statistics (ABS) reported that national payroll jobs fell by 0.7% over the fortnight to August 14, with total wages down 1%.

- European share markets advanced on Monday after US jobs data on Friday indicated the US Federal Reserve may have to keep monetary policy loose for longer, while speculation has risen over additional policy stimulus in Japan and China.

- The US Federal Reserve Beige Book noted a “downshift” in US economic activity “to a moderate pace”. Inflation was characterised as “steady at an elevated pace”.

- Consumer credit rose by US$17 billion in July (survey: US$25 billion)

- US share markets retreated on Wednesday as investors reassessed valuations amid rising economic risks, including the reduction in central bank stimulus.

Darth Vader’s investing tip: use the force!

This week I saw the shares of US-based Lululemon Athletica soar 10.5% after providing a strong annual forecast. Why would you be surprised, with most women in athletic gear in lockdown!

And then Moderna shares jumped 7.8% after the drug maker said that it’s developing a single dose vaccine that combines boosters against Covid and the flu. That’s going to be big in 2022 to lockdown lives and economies without lockdowns!

And the Reserve Bank released payment system data for July, showing credit cards continue to fall from favour, together with ATM use, but debit card use is growing and cheques continue to be used! And a lot of people are using BNPL services such as Afterpay and Z1P.

Not surprisingly this week, PayPal bought the Japanese BNPL Paidy for $US2.7 billion! The modern forces out of our recent experiences with the Coronavirus and other new age trends shouldn’t be ignored.

As Darth Vader said to Luke Skywalker: “Use the force. Luke, use the force!” This is a great investing tip.

The week in review:

- Out of the recent Coronavirus crash, value stocks have surged, and they tend to do that for quite a long time. This week, I went digging for examples of value stocks and while I’m still unearthing more, here are eight to consider.

- Bank shareholders will have noted a flood of capital note issues recently from Macquarie Group (MQG), Westpac (WBC) and Suncorp (SUN). But should you invest? Read Paul Rickard’s article from this week to find out his thoughts.

- James Dunn looked at three global unhedged ETFs with attractive exposures: BetaShares Global Quality Leaders ETF (QLTY), Market Vectors Morningstar Wide Moat ETF (MOAT) and Van Eck Morningstar International Wide Moat ETF (GOAT).

- Tony Featherstone wrote that Air New Zealand (AIZ) and Auckland International Airport (AIA) are set to climb when Covid is conquered.

- In our “HOT” stocks this week, Raymond Chan from Morgans chose Ausnet Services (AST) and Michael Gable from Fairmont Equities highlighted National Australia Bank (NAB).

- In the first Buy, Hold, Sell – What the Brokers Say of the week, there were 11 upgrades and 15 downgrades, and in the second edition there were 6 upgrades and 3 downgrades.

- And in Questions of the Week, Paul Rickard answered your questions about Macquarie Group (MQG), Wesfarmers (WES), the quarterly rebalancing of the ASX indices and uranium stocks.

Our videos of the week:

- Webinar: It’s time for value stocks

- Don’t miss these great value stocks & top reporters: QAN, SGR, OML, QBE, WTC, HUB, RHC & more! | Switzer Investing

- Hunting value stocks with upside: RHC, BAP, WPL & MORE + why properties for sale will surge in Nov | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday September 14 – Overseas arrivals/departures (July)

Tuesday September 14 – Speech by Reserve Bank Governor

Tuesday September 14 – NAB business survey (August)

Tuesday September 14 – Residential property indexes (June quarter)

Wednesday September 15 – Consumer confidence (September)

Thursday September 16 – Reserve Bank Bulletin

Thursday September 16 – Employment/unemployment (August)

Thursday September 16 – Population data (March quarter)

Friday September 17 – Tourism Satellite Accounts (June quarter)

Overseas

Monday September 13 – US inflation expectations (August)

Tuesday September 14 – US NFIB business optimism index (August)

Tuesday September 14 – US Consumer prices (August)

Wednesday September 15 – US Export & import prices (August)

Wednesday September 15 – US Empire State manufacturing (September)

Wednesday September 15 – US Industrial production (August)

Wednesday September 15 – China economic data (August)

Thursday September 16 – US Retail sales (August)

Thursday September 16 – US Philadelphia Federal Reserve index

Friday September 17 – US Consumer sentiment (September)

Food for thought:

“Your job as a smart investor is to separate the facts and the news from the fiction and the noise.” – Chamath Palihapitiya

Stocks shorted:

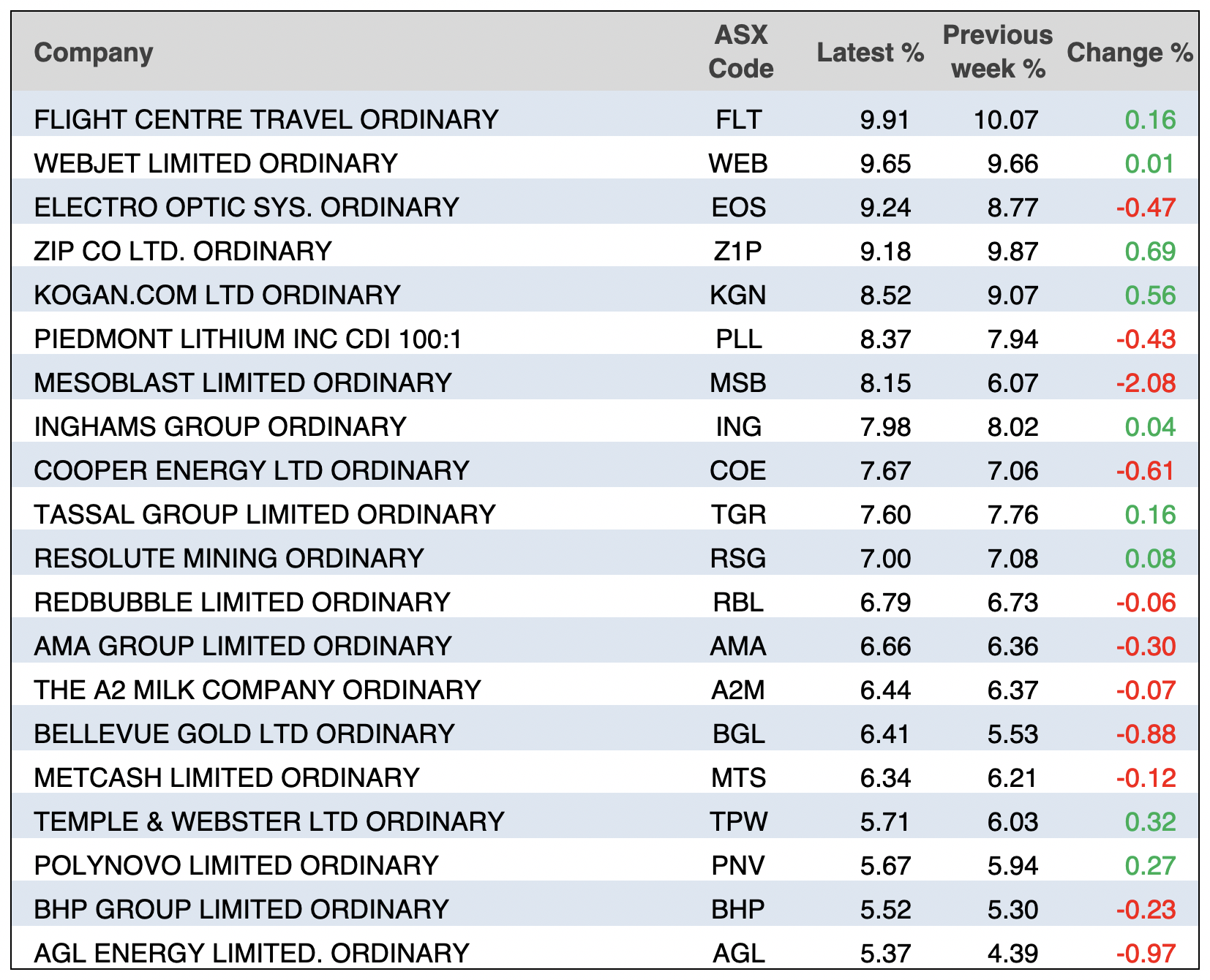

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

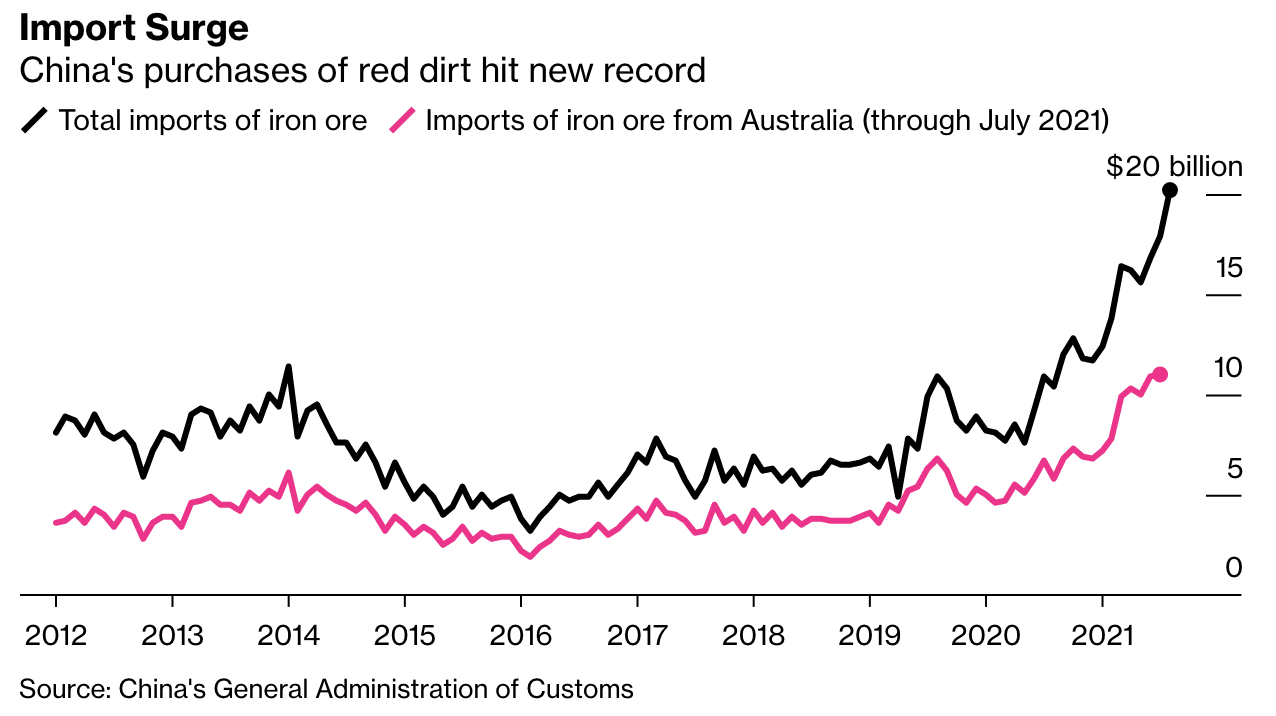

China imported a record US$20 billion worth of iron ore during August, a 10% increase on the previous month. While data for Australia is not yet available, Bloomberg noted that Australia typically makes up more than 60% of the supply to China:

Top 5 most clicked:

- My 8 ‘value’ stock tips – Peter Switzer

- 3 great global ETFs – James Dunn

- Capital notes: should you invest? – Paul Rickard

- 2 Kiwi travel-related stocks: solid long-term buys – Tony Featherstone

- “HOT” stocks: National Australia Bank (NAB) – Maureen Jordan

Recent Switzer Reports:

- Monday 6 September: My 8 ‘value’ stock tips

- Thursday 9 September: 2 Kiwi travel-related stocks: solid long-term buys

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.