One of the requests I get often from investors is to name some top “income stocks” (other than the banks or Telstra). Here are five candidate stocks, based on the following criteria:

- No banks or Telstra;

- No resource companies (because they are ‘price-takers’ and have almost no influence over the revenue they earn);

- ASX top 150;

- Reasonably defensive (as demonstrated by a low beta and qualitative assessment);

- Expectation that earnings and dividends should continue to grow;

- Forecast dividend yield higher than 3.0%;

- Preference for franking; and

- Variety of industry sectors to support diversification objectives.

All of the stocks have gone up in price this year and a couple are getting a tad expensive. But that is a function of a bull market and the never-ending search for yield. They may be the sort of stocks you add to your watchlist with a view to waiting until the right opportunity emerges.

In alphabetical order, here are the five.

1. Amcor (AMC)

Sector: Materials

Last price: $16.43

Broker Target Price: $18.27 (Source: FNArena)

FY22 Forecast Dividends 65.4c FY22 Forecast Yield: 4.0%, unfranked

FY23 Forecast Dividends 68.3c FY23 Forecast Yield: 4.2%, unfranked

Beta: 1.09

Leading packaging manufacturer Amcor might sound like a strange choice for an income stock, particularly with a 3 year historical beta of 1.09, but since acquiring the US-based Bemis Company in 2019, earnings reliability has increased and the stock has been less volatile.

Amcor provides packaging solutions (flexible packaging and rigid plastics) for the global food, beverage and pharmaceutical sectors which are in and of themselves quite defensive sectors. It operates in more than 40 countries, with 230 manufacturing sites, 47,000 employees and sales of over $US12.5bn.

Its primary listing is on the New York Stock Exchange, and as such, reports quarterly and pays dividends quarterly. The analysts forecast these to total AUD 65.4c in FY22 and 68.3c for FY23, putting it on a yield of 4.0% for FY22 and 4.2% for FY23. With the vast bulk of earnings being derived in the US and Europe, the dividend is unfranked.

Last week, Amcor reported its Q1 earnings that showed sales growth of 10% or 1% in constant currency terms. However, EPS (earnings per share) growth was 12%, with the quarterly dividend increasing to US12c or AUD16c per share. Importantly, it maintained full-year guidance of EPS growth of 7% to 11% and sufficient free cash for a buyback of $US400m of shares.

At $16.43, Amcor is trading on the relatively undemanding multiple of 15.0 times forecast FY22 earnings and 14.4 times FY23 earnings. The dividend payout ratio looks sustainable near 60%.

Amcor (AMC) – 11/16 -11/21

Source: nabtrade

Risks include currency (if the AUD appreciates, Amcor’s earnings will be impacted), and environmental with the headwind of sustainable, less voluminous packaging. Amcor says that it is investing in what it calls “responsible packaging”, and is committed to making all its packaging recyclable or reusable by 2025.

2. Charter Hall Long WALE REIT (CLW)

Sector: Real Estate

Last price: $4.89

Broker Target Price: $5.34 (Source: FN Arena)

FY22 Forecast Dividends 31.0cc FY22 Forecast Yield: 6.3%, unfranked

FY23 Forecast Dividends 31.7c FY23 Forecast Yield: 6.5%, unfranked

Beta: 0.88

Charter Hall Long WALE REIT is a $5.7bn property trust that owns a portfolio of high quality real estate assets with a long WALE (weighted average lease expiry). The WALE is currently 13.2 years.

There are 472 assets across industrial and logistics, retail, office, telco exchanges and agri-logistics. By value, approximately 23% is in industrial, 32% in retail (BP service stations, pubs and bottle shops, David Jones), 25% in office and the balance of 20% in telco exchanges and agri-logistics. The portfolio occupancy is 97.8%.

Portfolio credit quality is high with 61% of tenants (by income) independently rated ‘investment grade’. Of the balance, this includes names such as Brisbane City Council, Myer, Endeavour Group, Metcash, David Jones and Arnott’s.

In September, CLW announced the acquisition of the ALE Property Group, which owns 78 high quality pubs that are leased to the Endeavour Group. The acquisition is part scrip/part debt funded, with CLW owning 50% along with super fund HostPlus. Following completion, CLW’s portfolio metrics will be 550 properties, $6.5bn in value, 98.4% leased, WALE of 12.6 years and 51% subject to triple net leases.

In FY21, CLW reported operating earnings of 29.2 cents per security, up 3.2% from FY20 and distributions per security of the same amount, representing a 100% payout ratio. This result was delivered against the backdrop of COVID-19 and the continued disruption that the pandemic caused to the economy and the property sector.

It has guided to no less than 4.5% growth in operating earnings in FY22, implying a distribution of at least 31c per unit for FY22. This puts CLW on a yield of 6.3% (unfranked).

The brokers remain favourably disposed. According to FNArena, of the 5 major brokers that cover the stock, there are 2 buy recommendations and 2 neutral recommendations (Macquarie is unable to rate it). The consensus target price is $5.34 (range $4.94 to $5.59), a 9.1% premium to the last ASX price of $4.89. The last reported NTA (net tangible asset value) per unit is $5.22 as of 30 June 2021.

Charter Hall Long WALE REIT (CLW) – 11/16 – 11/21

Source: nabtrade

Gearing (on a look-through basis) will increase to 42.5%, and while the fund has no debt facilities maturing in the next two years, if bond yields increase, this could put pressure on the unit price.

3. Coles (COL)

Sector: Consumer Staples

Last price: $17.80

Broker Target Price: $18.38 (Source: FN Arena)

FY22 Forecast Distribution 59.7c FY22 Forecast Yield: 3.4%, 100% franked

FY23 Forecast Distribution 64.9c FY23 Forecast Yield: 3.6%, 100% franked

Beta: 0.73

Experience says that eight out of ten times, you are better off sticking with the “market leader” rather than the “number two”. But Coles (COL) has pulled back as Woolworths (WOW) has rallied into its off-market share buyback, so there is more to like about Coles now. In the most recent quarter, the sales gap to Woolworths closed a touch, with Coles reporting ‘like for like’ sales growth of 1.4% compared to Woolworths 2.7%.

Coles (COL) -11/18 – 11/21

Source: nabtrade

Whether a discount on forward price multiples of almost 20% is sufficient (Coles is trading at a multiple of 24.1 times forecast FY22 earnings, Woolworths at 30.4 times forecast FY22 earnings) only time will tell, but for income seekers, Coles is pretty “rock solid” when it comes to the dividend. With most brokers forecasting dividends of 60c in FY22 and 65c for FY23, this puts Coles on a prospective dividend yield of 3.4% (fully franked).

While the payout ratio is high at 80% and capital expenditure needs are increasing as Coles invests in new distribution centres, technology and store refurbishments, the market believes Coles has the cash flow and balance sheet to support this.

Coles is a classic “income stock” – with predictable top line and bottom line numbers, low beta (market volatility), and for the shareholder, reliable and consistent dividends. Further, if Management can execute well, it has the opportunity to close the gap on the market leader.

4. JB Hi-Fi (JBH)

Sector: Consumer Discretionary

Last price: $50.18

Broker Target Price: $51.89 (Source: FN Arena)

FY22 Forecast Distribution 220.2c FY22 Forecast Yield: 4.4%, 100% franked

FY23 Forecast Distribution 212.4c FY23 Forecast Yield: 4.2%, 100% franked

Beta: 0.87

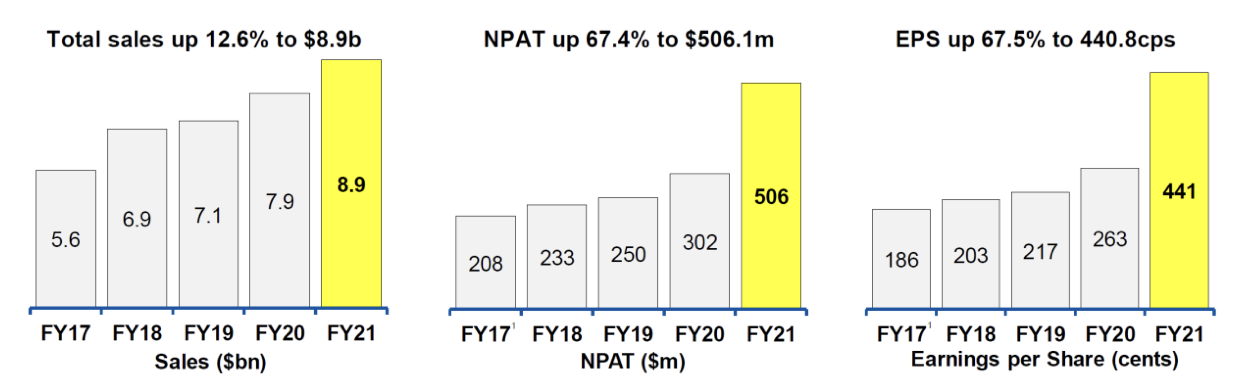

Unquestionably Australia’s best retailer, JB Hi-Fi is one of my favourite stocks. It has delivered in spades for shareholders, with year on year increases in sales, profit and earnings per share. This chart from their August profit report says it all.

Dividends have increased from $0.89 for FY15, $0.99 for FY16, $1.18 for FY17, $1.32 for FY18, $1.42 for FY19 and $1.89 for FY20. The dividend soared to $2.89 per share in FY21 on the back of a huge surge in “covid” driven sales.

With lockdowns easing and trading return to normal, the brokers expect the full year FY22 dividend to dip to about 220c and ease again in FY23 to 212c per share. This puts JB Hi-Fi on a prospective yield of 4.4% for FY22 (fully franked).

JB Hi-Fi (JBH) – 11/16 to 11/21

Source: nabtrade

Retailing is a tough game and the market can be savage on a company for a sales “miss” or margin deterioration. But, JB Hi-Fi is not trading on a particularly demanding multiple – about 15.0 times forecast FY22 earnings and 15.5 times forecast FY23 earnings. This provides a level of comfort.

5. Medibank Private (MPL)

Sector: Financials

Last price: $3.47

Broker Target Price: $3.50 (Source: FN Arena)

FY22 Forecast Distribution 12.8c FY22 Forecast Yield: 3.7%, 100% franked

FY23 Forecast Distribution 14.7c FY23 Forecast Yield: 4.2%, 100% franked

Beta: 0.71

Private health insurer Medibank Private has been at the top of my “income picks” for a couple of years now, but it is starting to look fully priced. This is reflected in the broker target prices and recommendations. According to FNArena, the consensus price is $3.50, just 1% higher than the last ASX price. Of the seven major brokers who cover the stock, there are jut two ‘buy” recommendations, with five “neutral” recommendations.

Medibank Private (MPL) – 11/16 – 11/21

Source: nabtrade

The thing I like about MediBank is that under past CEO Craig Drummond and his replacement David Koczkar, it has been able to grow customers, grow market share and become more efficient. When you are the market leader with a 27.3% market share and there are more than 40 competitors, any share increase is hard won.

In FY21, Medibank experienced net policyholder growth of 3.5% or 82,500 customers. It was the first time since 2013 that it grew customers in its main ‘Medibank’ brand (it also owns the discount brand ‘ahm’). Market share increased by 0.37% to 27.3%.

It also improved its management expense ratio, the proportion of each premium dollar that goes on administration and overhead, by 0.4% to 7.8%. Health insurance underlying operating profit increased by 6.6% to $541.6m.

For FY22, Medibank has guided to policyholder growth of about 3%, a 2.4% increase in average claims expense per policy unit (similar to 2H FY21) and a productivity target of $15m in management expenses.

Medibank paid total dividends of 12.7c in FY21, up from 12.0c in FY20. A payout ratio of 87% was at the top end of their target range of 75% to 85%. For FY22, brokers are forecasting total dividends of 12.8c per share, putting Medibank on a yield of 3.7% (fully franked).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.