Over the next few months and maybe years, I will increase my exposure to foreign stocks.

Why? Well, firstly, I think the recent set against tech stocks will provide some buying opportunities for many of these businesses of the future.

Another reason is that I was informed by one of the portfolio managers of WCM Global that the digital age is only in its infancy, so many of the big names of now will be much bigger names in the future. (WCM has a couple of products listed on the ASX and many of you might know I have a shareholding link to the company, Contango Asset Management, that brought this impressive US fund manager to Australia. In fact, here’s a story about WCM published over the weekend in the Australian Financial Review by journalist Tony Boyd in his Chanticleer column.)

Want an example of a digital company with a big future? Try Zoom!

Zoom Video (NASDAQ:ZM)

Going into the pandemic shutdown, Zoom Video was a $US90 stock. It peaked in October around US$560 and as the rotation out of tech and stay-at-home stocks proceeded, it has fallen to $US316. That’s a 43% slump, which makes me think “Buying opportunity!”

You might be asking if this zoom thing was only a Coronavirus response thing. Well, consider this from Satya Nadella, CEO of Zoom’s biggest rival, Microsoft, with its Microsoft Teams: “Hybrid work represents the biggest shift to how we work in our generation…And it will require a new operating model, spanning people, places, and processes.” (LinkedIn)

Tesla is another ‘tech’ stock that has seen the highs and lows of the stock market in recent times.

Tesla (NASDAQ:TSLA)

Tesla has fallen 35% since its February high of US$900 but was up 255% in a year! Anyone who sees the electric car theme as one that should be ignored and doesn’t see the advantage of being with the market leader, hasn’t been reading the Switzer Report!

But of course, all these stocks of the future could fall more and some might have individual company challenges that make them tricky for individual investors. That’s why I think a good and safer way to play the future of tech is via a good quality fund.

Now I already have exposure to high-quality tech via my WCM investments WCMQ and WQG. But if I want even more tech exposure, I could invest in the local ETFS FANG+ exchange traded fund.

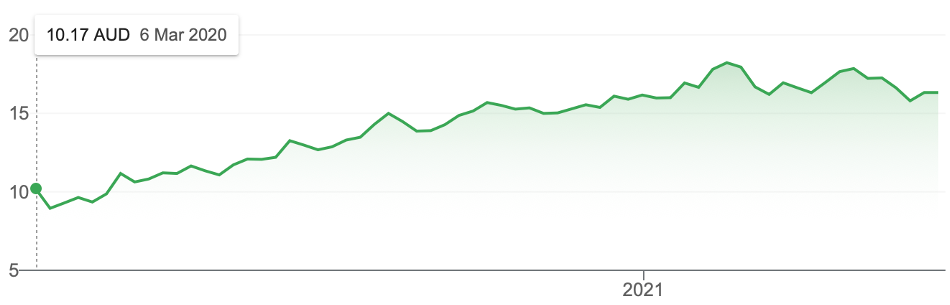

ETFS FANG+ (FANG)

Since listing in March 2020, FANG+ was up 80% to February this year. It’s now down only 10%, which shows the benefits of being diversified and having a ‘many-stock exposed’ position rather than putting it all on one play.

This ETF captures the famous FANG stocks of Facebook, Apple, Amazon, Netflix and Google (Alphabet) in one ETF but has extras that give someone a broader exposure to top tech businesses.

Below are the Top 10 holdings of ETFS FANG+

- ALPHABET INC-A: 11.5%

- NVIDIA CORP: 11.5%

- FACEBOOK INC-A: 11.1%

- APPLE INC: 10.8%

- AMAZON.COM INC: 10.7%

- NETFLIX INC: 9.9%

- ALIBABA GRP-ADR: 9.2%

- TESLA INC: 9.1%

- TWITTER INC: 8.4%

- BAIDU INC-SP ADR: 7.6%

And if you want to be diversified and have a bigger throw at the tech play stumps, you could consider Cathie Wood’s ARK Innovation ETF (ARKK). This is an aggressive tech fund.

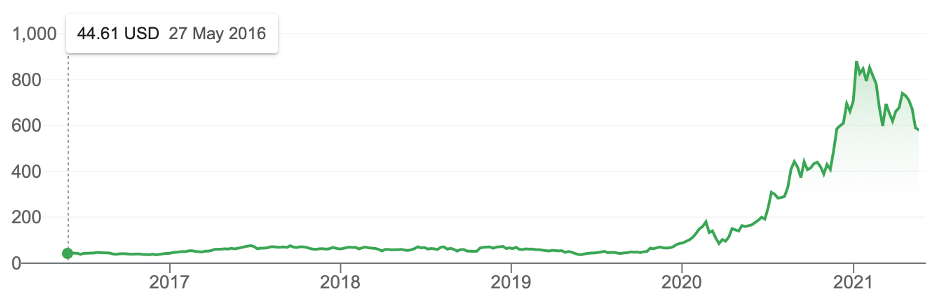

ARK Innovation ETF (NYSE:ARKK)

Source: finance.yahoo.com

From March last year ARKK was up 211% until February when tech stocks were slammed. It’s now down 23% and it could fall further but Wood, who’s a big bitcoin holder, has a huge collection of companies well-positioned for a tech-oriented future.

Her are her top holdings:

- Tesla Inc: 11.00%

- Teladoc Health, Inc.: 6.24%

- Roku, Inc. Class A: 5.24%

- Square, Inc. Class A: 4.77%

- Shopify, Inc. Class A: 3.69%

- Zillow Group, Inc. Class C: 3.53%

- Spotify Technology SA: 3.47%

- Zoom Video Com, Class A: 3.45%

She’s a believer in bitcoin and CNBC told us last week that Wood “…purchased $US38 million worth of Coinbase in various funds on Wednesday, after the crypto currency exchange’s stock dropped 6% amid bitcoin’s rout. Wood’s purchase is based on Coinbase’s Wednesday closing price of $US224.80 per share.”

In case you didn’t know, Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency.

Wood has been into bitcoin since 2015 and thinks it will go to, wait for it, $US500,000!

FANG+ is the less racy way to play tech, while ARKK is fast lane stuff. However, there will be some who will do a bit of both.

I see one of WCM’s funds — WCMQ or WQG — plus FANG+ plus ARKK as a good way to diversify your foreign holdings of companies of the future and best-of-breed in the tech space.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.