I recently read a great line from a CEO about the work-from-home trend. He told staff that if their job can be done from home all week, it can also be done by artificial intelligence (AI) or outsourced overseas. Ouch!

My bet is his staff will think twice about resisting calls to return to the office, and that the work-from-home trend will fade faster in 2025. That’s good for Australian Real Estate Investment Trusts (A-REITS) that own office property.

The work-from-home trend won’t die completely. Rather, companies will continue to provide workplace flexibility, albeit more limited. The bottom line is more employees spending more of their week in the office and less at home.

Three factors support my argument. The first is job cuts. Trump’s mass firings this year of US public servants will send ripples through other government workforces.

Even the Victorian government is proposing big job cuts to its bloated public service. Unlike New South Wales, Victoria resisted calls last year to force public servants back to the office for the whole working week – a weak decision if ever there was one, judging by the need to revitalise Melbourne’s CBD.

Channelling Trump, Opposition leader Peter Dutton recently mulled public-service job cuts in Canberra if elected. Newspaper reports suggest he will target public-service jobs Labor added since elected.

In my experience, nothing gets people back to the office faster than the threat of job cuts. Working from home too much is a bad move when corporate consultants at office HQ decide who to cull. Office visibility is precious.

The second factor is again Trump-related. Right or wrong, Trump’s crackdown on diversity, equity and inclusion (DEI) policies in the US public sector is influencing corporates. Some US companies have already ditched their DEI policies.

Again, this suggests the pendulum is swinging back towards employers and away from employees – at least in terms of the workplace conditions and policies. I might be reading too much into this, but the bargaining power of workers to resist spending more time in the office is rapidly declining.

The third factor is AI. There’s no doubt AI will change how many companies do business. For some, it will mean a massive restructuring of their workforce. For others, it means integrating AI deeply into day-to-day workflows.

Either way, it’s hard to see how companies can integrate AI more into their operations if half their workforce is at home during the week. Workplace collaboration on AI will be vital and is best done face-to-face, at least at the start.

These factors should provide some respite for office tower owners who battled higher vacancy rates as more people worked from home. This change will take time but expect gradual improvement in office demand and rents.

I wrote positively about A-REITs in this report in late January, principally on expectations of interest-rate cuts. At the time, I preferred retail trusts that own shopping centres, such as Vicinity and Scentre Group, and global REITs via the VanEck FTSE International Property (AUD) hedged ETF.

I was more cautious on office property, principally because of the work-from-home trend and its implications for office demand. My view on office property has changed. I’ve seen enough in the past month – particularly around the push for massive jobs cuts in the public sector – to get interested in office property.

Reporting season opportunities

That brings me to the latest reporting season, which winds down by week’s end. Overall, results were slighty than the market expected, although deteriorated towards the end of the season.

Earnings from key office A-REITs confirmed conditions are improving. GPT Group, owner of 27 office towers, 69 logistic centres and 10 shopping centres, reported a slightly better-than-expected 2024 full-year result.

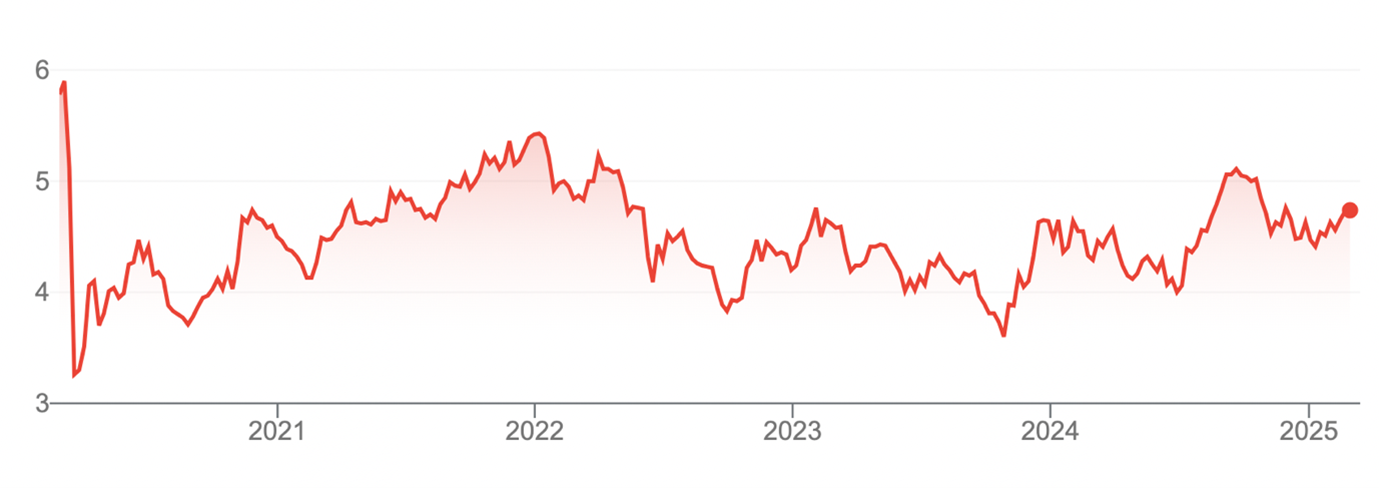

GPT shares have fallen from around $5.40 at the start of 2022 to $4.70. The main headwinds have been market concerns about office demand as more people worked from home, and the speed and magnitude of rate cuts.

GPT reported 1.9% like-for-like net property growth in its office assets. The occupancy rate rose a bit over 2 percentage points to 94.7%. Leasing spreads, the difference between existing and new leases, were positive. The average gross incentive was slightly higher, suggesting the need to offer big incentives to encourage corporates to take leases is slowing. These are good signs.

GPT said in its result presentation: “Continued return to office and stabilisation of hybrid work models, coupled with ongoing flight to quality, will drive further demand for high-quality office space.” Also, that “current market conditions are anticipated to constrain the delivery of new office supply across markets in the near term”, and a “recovery of investor appetite is expected for Australian offices is expected as the leasing market improves, and valuation metrics stabilise”.

Morningstar’s fair value of $5.70 for GPT suggests it is materially undervalued at $4.70. I’m not quite as bullish but see value for long-term investors who can position for a modest recovery in office demand for CBD properties.

Chart 1: GPT Group (ASX: GPT)

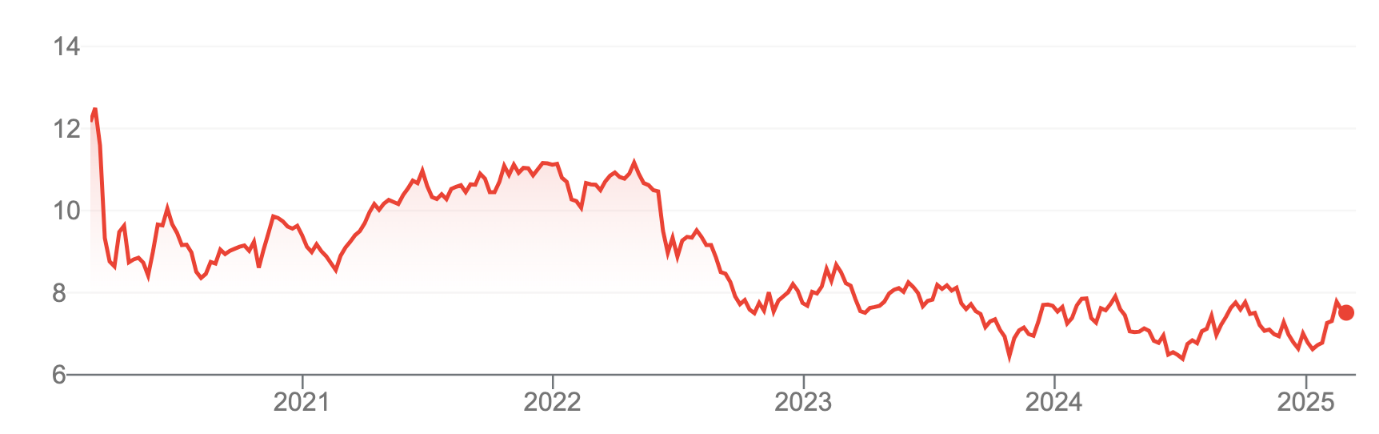

Dexus, another key office A-REIT, reported a half-year result for FY25 that broadly met market expectation. Like GPT, Dexus has been affected by market concerns about weaker demand for office property and the timing of rate cuts. Dexus owns 66 properties across key CBDs in Australia.

Office property FFO (funds from operations) declined slightly, although this was primarily due to property divestments. Occupancy was slightly lower in the half compared to the prior corresponding period, although well above its long-term average. Average incentives on lease deals were well down.

Like GPT, Dexus said office demand continues to improve while rising construction costs will keep office supply in check. Dexus sees potential for rental outperformance from existing office towers until the gap between supply and demand closes. Dexus notes that forecast office completions for the next five years in Sydney are expected to be around half that of the previous five years. Office supply in Melbourne is also expected to be well down on the last five years.

The upshot is firming office demand as more people return to work, amid constrained office supply. The result should be stronger rental growth and fewer costly incentives provided to attract tenants. These are solid tailwinds for Dexus.

A share-price target of $8.12, based on the consensus of 10 broking analysts, suggests Dexus is undervalued at the current $7.50. That looks about right. To my thinking, Dexus is modestly undervalued for long-term income investors.

As equity market strategists draw together trends from the latest property reporting season, an unfolding recovery in office property – and thus office A-REIT valuations – is a highlight for me. Although gains will take time, with likely setbacks along the way, the clouds for office property are starting to retreat.

Chart 2: Dexus (ASX: DXS)

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 26 February 2025.