Just when the Americans were starting to worry about inflation, along came a worse-than-expected jobs number, which has hosed down hotting up fears that interest rates might rise faster than predicted by the Federal Reserve.

Allegedly experts on how the US jobs market is performing, the economists tipped 900,000 to 1 million jobs but only 266,000 showed up! Unemployment rose from 5.8% to 6.1%, which coincided with a surprising lack of workers. The March figure was revised from 916,000 to a lower 770,000, which puts the economic comeback into a new perspective, which was less worrying for Wall Street. But there are persistent complaints about a shortage of workers, with economists explaining that the Coronavirus has forced some workers to sit it out until the coast is clear or they (or most of the country) are vaccinated.

Friday’s jobs report “could indicate that labor shortages are becoming a significant drag,” Michael Pearce, senior U.S. economist for Capital Economics, wrote in a note. (finance.yahoo.com)

Despite the poor jobs number, both the Dow Jones and S&P 500 indices ended in record territory. The reason is these slower-than-expected stats for the US labour market reduces concerns about interest rate rises that could KO this stock market rally. “Overall, it is difficult to judge how much weight to put on this report at a time when most of the other evidence suggests economic activity is rebounding quickly, but it is a clear reminder that the recovery in the labour market is lagging the rebound in consumption,” Pearce added. “For the Fed, we suspect that means it will be many months before it judges the economy has made ‘substantial further progress’ towards its ‘broad based and inclusive’ full employment goal. That means any talk of tapering, let alone rate hikes, is still some way off.”

And so tech stocks had a great day, which should give our tech stocks a break on Monday, which might help offset a recent set against the stocks in the sector.

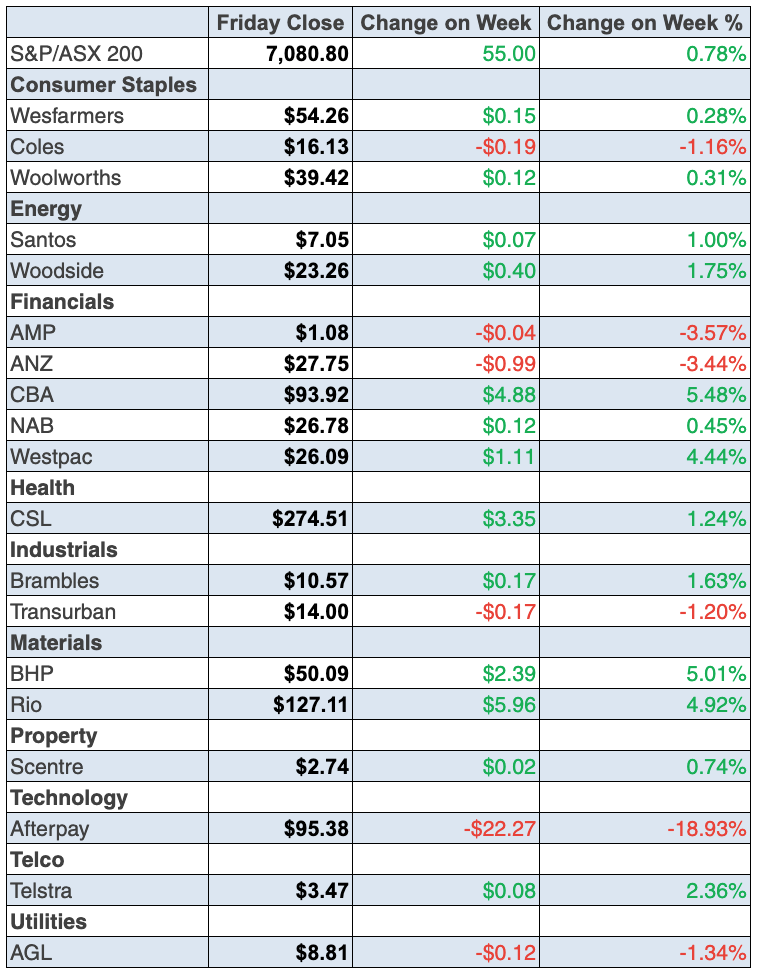

To the local story this week and the S&P/ASX 200 put on 55 points (or 0.8%) to finish at 7080.8 and we saw the market hit the best level in 14 months! And it was driven by the quality end of town — banks and miners.

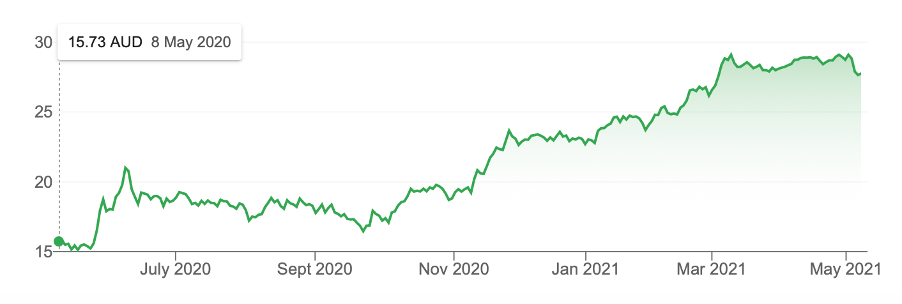

For those who have been bank believers (Paul and I have been stickers), Westpac was up 4.4% to $26.09 and NAB rose 0.5% to $26.78. ANZ actually fell after reporting well but not well enough for a highly expectant market. It lost 3.4% to $27.75 but it has had a nice ride, as the chart below shows.

ANZ one year

A rough estimate tells me that’s a 76% gain in a year! Doesn’t this make you wish you heeded Warren Buffett and his “be greedy when others are fearful” counsel? And it’s easier when you’re talking about going long beaten-up blue chip companies.

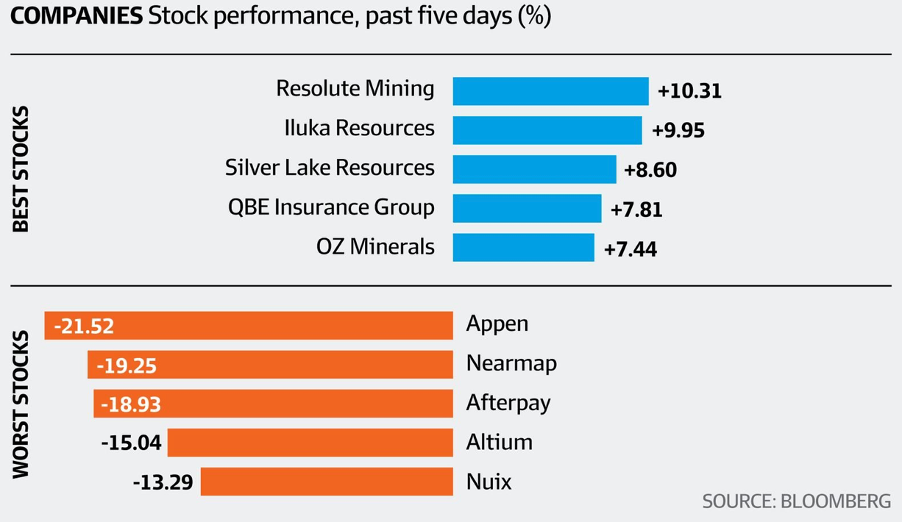

On that subject, look at the losing companies for this week: Appen, Afterpay, Altium and Nuix. Are they really that bad or just out of favour with the momentum fund managers who really drive the stock market? That’s a subject for a longer story, which I will address pretty soon.

And a similar story could be made for the reopening trade travel stocks as overreaction has possibly created a buying opportunity for the patient, long-term investor.

The AFR’s William McInness summed up the travel losers over the week this way: “Qantas fell 7.4 per cent to $4.77, Flight Centre dropped 7.4 per cent to $15.51, Webjet declined 4.4 per cent to $4.78 and Corporate Travel Management lost 3.5 per cent to $17.86.”

These are reacting to not just the local lockdown in Sydney but the threat that India’s Covid containment problem and what it means for the ease with which international travel resumes.

That said, gee there looks like some value there for those who don’t have to impress fund investors each quarter!

What I liked

- The staggering list of stats I liked this week, which you’ll see below!

- The latest from the RBA: “The economy is now tipped to grow 9.25% over the year to June (previous 7.75%). The jobless rate is expected to fall to 4.75% over the next year and to 4.5% the year after.” (CommSec)

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.3% to 112.7 (long-run average since 1990 is 112.6). The measure of whether it was a ‘good time to buy a major household item’ gained 0.2% to a 14-month high of 21.1 points.

- The value of new loan commitments for housing rose by 5.5% to a record high $30.227 billion in March. Owner-occupier loans were up 3.3% to a record high $22.413 billion in March. And investor loans were up by 12.7% to a 3½-year high of $7.814 billion. Renovation loans rose 2% to 11-year highs of $328.9 million.

- The CoreLogic national home value index rose by 1.8% in April after rising 2.8% in March (biggest rise in 32 years). Home prices are up 7.8% on the year.

- The AiGroup Performance of Manufacturing index rose by 1.8 points in April to 61.7 points (the strongest level since March 2018) indicating a stronger pace of expansion. And the ‘final’ IHS Markit Manufacturing Purchasing Managers’ index rose from 56.8 points in March to a record 59.7 points in April. Readings above 50 points indicate an expansion in activity.

- Council approvals to build new homes rose by 17.4% to 23,176 units in March – the most in three years. Approvals are up 47.4% on a year ago – the strongest annual growth rate in 11 years. Private sector house approvals were up 0.1% to an all-time high of 14,117 units. The value of alterations & additions approved was up by 7.3% in March to a record $1,072.5 million.

- New vehicle sales totalled 92,347 units in April – the highest number of sales for the month of April on record. Sales are up 137.2% on a year ago. In the 12 months to April, sales totalled 1,000,676 (a 13-month high) to be up 1% on a year ago

- The Australian Industry Group (AiGroup) and HIA (Housing Industry Association) Performance of Construction index (PCI) eased from a record high of 61.8 in March to 59.1 in April. But the underlying PCI activity index climbed 5.1 points to a record high of 62.8, with engineering construction activity at all-time highs of 63.8. And the PCI selling prices index rose by 1.5 points to an historic high of 73.3. Readings above 50 indicate an expansion of activity.

- The ‘final’ IHS Markit services purchasing manager index rose from 55.5 in March to a record 58.8 in April. The composite index, which measures combined services and manufacturing output, rose from 55.5 to an historic high of 58.9. Readings above 50 indicate an expansion of activity. Data collection began in May 2016.

- The UK IHS Markit manufacturing purchasing managers’ index rose from 58.9 in March to an almost 27-year high of 60.9 in April (survey: 60.7).

- The Bank of England raised its forecast for UK economic growth in 2021 to 7.25% from February’s estimate of 5%.

- US factory orders rose by 1.1% in March (survey: 1.3%).

- Initial jobless claims fell by 92,000 to 498,000 last week (survey: 538,000). Job cuts, as reported by Challenger, fell from 30,603 to 22,913 in April, which is the lowest since June 2000 (survey: 25,000). Productivity grew at a 5.4% annual rate in the March quarter (survey: 4.3%), while labour costs fell 0.3% (survey: -1%).

- Treasury Secretary Janet Yellen clarified the comments she made about rising interest rates the previous day on higher interest rates, saying this wasn’t something that she was “predicting or recommending”.

- The ISM services index in the US fell from 63.7 to 62.7 in April (survey: 64.3) but it’s still in expansion territory and the ‘final’ Markit services index rose from 60.4 to 64.7 in April (survey: 63.1).

- New figures showed a lift in vaccinations against the Covid-19 virus in Europe. And there was a lift in Euro zone business activity, according to the IHS Markit survey.

What I didn’t like

- Underlying inflation in Australia is expected to remain below 2% for the next two years.

- The trade surplus decreased from $7.595 billion in February to $5.574 billion in March (consensus: $8.2 billion). Australia has posted 39 successive monthly trade surpluses, and while it was down, it was still good on an historical basis.

- The ‘dumb’ interest rate comments by US Treasury Secretary Janet Yellen.

You have to like this

The speech this week by Guy Debelle, Deputy Governor of the RBA, which was entitled “Monetary Policy During Covid.” Guy concluded: “The recovery in the Australian economy has significantly exceeded earlier expectations, reflecting the sizeable fiscal and monetary policy support, as well as the favourable health outcomes. But significant monetary support will be required for quite some time to come.”

This is RBA-speak for “we’re not raising interest rates for a real long time.”

And this was Chris Joye’s reaction to it: “For all the doomsayers upset by the (predictable) housing boom, and who claim it is precipitating unacceptable inequality, Debelle had a brutal rejoinder: ‘would you rather the much higher unemployment and far greater income inequality that would result from millions of additional Aussies on the dole?’”.

Debelle stressed that cheaper money, expanded purchasing power, rising asset prices, additional construction and higher household incomes, consumption, employment, confidence and wealth are all essential elements of the RBA’s stimulus in practice.

Love an RBA that sticks it to its critics. Who knows, one day it might give its greatest critic, Paul Keating, a ‘return fire’ reply to his many barbs directed at the bank? Nah, that’s only wishful thinking.

And check out the stories of the week from this Report below. Anyone wondering whether banks are still a buy and what the share price outlooks for best-of-breed companies are, should do some catch up reading this weekend.

The week in review:

- The highly successful US fund manager WCM has a unique way of selecting high performing companies. Knowing that their methodology works, I scanned the ASX 200 list of companies and came up with 13 businesses that are best-of-breed in their industry. While they’re all good, one in particular really stands out: Audinate (AD8).

- Paul Rickard is a big fan of using the major exchange traded funds (ETFs) to quickly adjust exposure to the Aussie share market. But there are alternatives to ETFs, particularly the broad-based listed investment companies (LICs). At times they can be better than ETFs. Here is Paul’s run-down on the ETFs, the LICs, the best in each class, and when to use one or the other.

- Which of the big banks stands out more than the others? And is it time to take profits on bank stocks? Read Tony Featherstone’s analysis in his article this week.

- James Dunn wrote that the electric vehicle (EV) wave is one of the major thematics in the global investment markets, as the world starts the move from fossil-fuel based engines to electric engines.

- Our Hot Stock of the week was Aristocrat Leisure (ALL) selected by Michael Gable from Fairmont Equities.

- There were 11 upgrades and 6 downgrades in the first Buy, Hold, Sell – What the Brokers Say this week, and 8 upgrades and 7 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answered questions about the best companies for hydrogen and iron ore, whether Telstra (TLS) is a buy, ‘catching a falling knife’ with AGL (AGL) and concerns about Electro Optic Systems (EOS).

- Don’t miss the recording of yesterday’s Switzer Report webinar!

Our videos of the week:

- Webinar: What are the big investing themes that will drive outperformance which you should care about?

- Are these stocks in the buy zone: MP1 AD8, QAN, APX, NXT? + Why WCM is one of the best funds in OZ! | Switzer Investing

- Value ASX stocks with plenty of upside + 3 hottest regions to invest in! | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday May 10 – NAB Business survey (April)

Monday May 10 – Retail trade (March)

Tuesday May 11 – Federal Budget

Tuesday May 11 – Weekly consumer sentiment (May 9)

Tuesday May 11 – Weekly payrolls and wages (April 24)

Thursday May 13 – Consumer inflation expectations (May)

Thursday May 13 – Overseas arrivals/departures (March)

Friday May 14 – Preliminary overseas travel (April)

Overseas

Tuesday May 11 – US Small Business Optimism index (April)

Tuesday May 11 – US JOLTS job openings (March)

Tuesday May 11 – China Inflation (April)

Tuesday May 11 – China credit, money supply (April)

Wednesday May 12 – US Consumer prices (April)

Wednesday May 12 – US Monthly Budget statement (April)

Thursday May 13 – US Producer prices (April)

Friday May 14 – US Retail sales (April)

Friday May 14 – US Industrial production (April)

Friday May 14 – US Trade prices (April)

Friday May 14 – US Consumer sentiment (May)

Food for thought:

“Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” – John Maynard Keynes, as quoted by Warren Buffett in last week’s Berkshire Hathaway Annual Meeting.

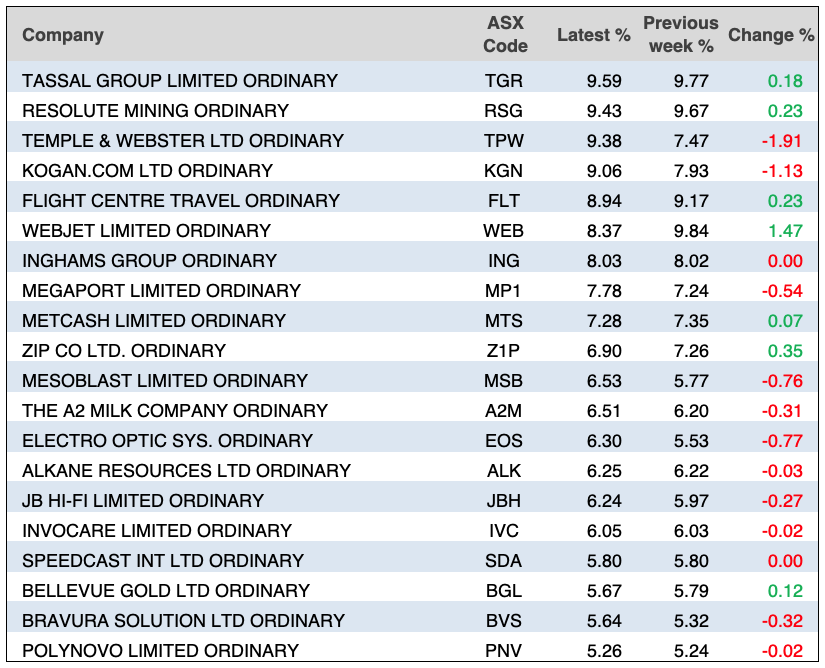

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

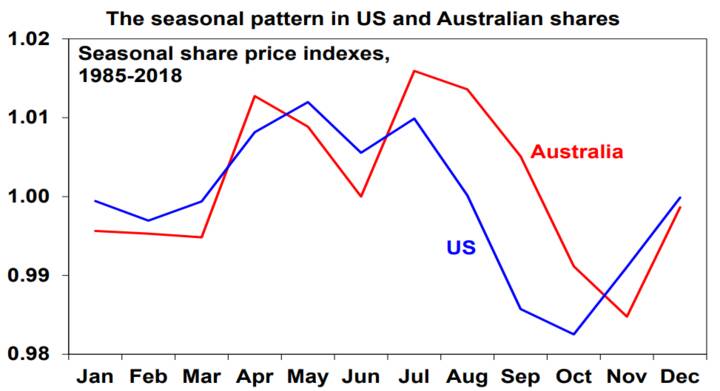

Chart of the week:

AMP Capital’s Shane Oliver shared the following chart that shows May is usually the beginning of a seasonally softer period for shares (‘Sell in May and go away’):

Top 5 most clicked:

- Could this stock have a HUGE future? – Peter Switzer

- Should you buy or sell our big 4 banks? – Tony Featherstone

- The best and easiest way to invest in the share market – Paul Rickard

- Want to ride an important trend? Try electric vehicles – James Dunn

- HOT STOCK: Aristocrat Leisure (ALL) – Maureen Jordan

Recent Switzer Reports:

- Monday 3 May: Could this stock have a HUGE future?

- Thursday 6 May: Should you buy or sell our big 4 banks?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.