The Dow Jones Industrial Average was up over 1,000 points in three days, driven by positive reports by many US star companies, particularly banks and big financial players. This explains why Wall Street was wowed. Shares of Bank of America rose 4.5% after reporting better than expected, and the same applied to Morgan Stanley (2.5%) and Citigroup (0.8%), following their show-and-tell for investors this week.

On Friday, Goldman Sachs followed suit. These reports reduce the negative headwinds that said perhaps the US economy is slowing rather than getting ready for a booming 2022. “The banks painted a strong and healthy picture of the US consumer,” noted Edward Moya, senior market analyst at Oanda. “Wall Street can’t turn negative on the economy after seeing reserve releases, moderating trading revenue, mixed loan growth, and a consumer willing to take on debt.” (CNBC)

And a better-than-tipped retail story (up 0.7% in September compared to a forecast of 0.2% from economists) also rammed home the more positive economic outlook for the world’s biggest and most important economy.

It’s early days, with Factset looking at the 41 companies that have reported third quarter earnings so far in the US with 80% having beaten expectations.

If you need to worry, the IMF trimmed its forecast for 2021 global growth from 6% to 5.9%, but this August body is not a great forecaster. It says Australia will grow at 4.1% next year but Westpac’s Bill Evans says it’s going to be more like 7%! See below for more details on this.

I admit we have to watch China’s Evergrande problem but Evans thinks Beijing’s leadership will manage it to avoid a significant economic slowdown effect. But it remains a headwind that needs to be monitored.

For the courageous, Bitcoin went over $61,000 overnight on the news that regulators in the US will allow a bitcoin futures ETF! The ProShares Bitcoin Strategy ETF is set to kick off on Tuesday but regulators can still pull the pin on the innovation as late as midnight on Monday!

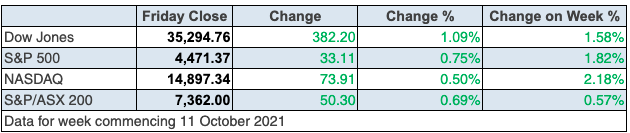

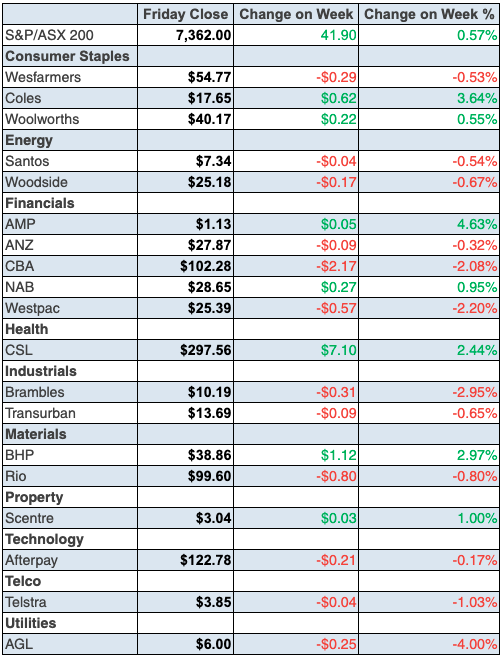

To the local story and it was a positive one, with the S&P/ASX 200 index rising 41.9 points (or 0.6%) over the week to close at 7362. Better-than-expected US earnings was a shot-in-the-arm for stocks.

Happily, my faith in our big miners paid off, with Fortescue up 1.39% to $14.60, BHP was 2.94% higher to $38.86, though Rio actually lost 0.4% to $99.60 after downgrading its iron ore export target.

The big winners were the small miners, with S32 up 7.91% for the week, Lynas 6.92% higher to $6.95 and Pilbara Minerals up 6.12% to $2.08.

Another promising sign was the comeback for tech stocks. Many of you know I’ve always questioned the market reaction to rising bond yields and the dumping of tech stocks.

Sure, I know the market does this (i.e. sell tech stocks as bond yields rise) but if economic growth drives up the revenues of these companies, share buyers will return to the ‘scene of the crime’ and buy, as we saw this week.

Nuix was up 3.61% for the week, Nearmap put on 7.49% to $2.01, Megaport rose 6.78% to $17.48, Xero was up 7.86% to $144.35 and Next DC climbed 4.98% to $12.23.

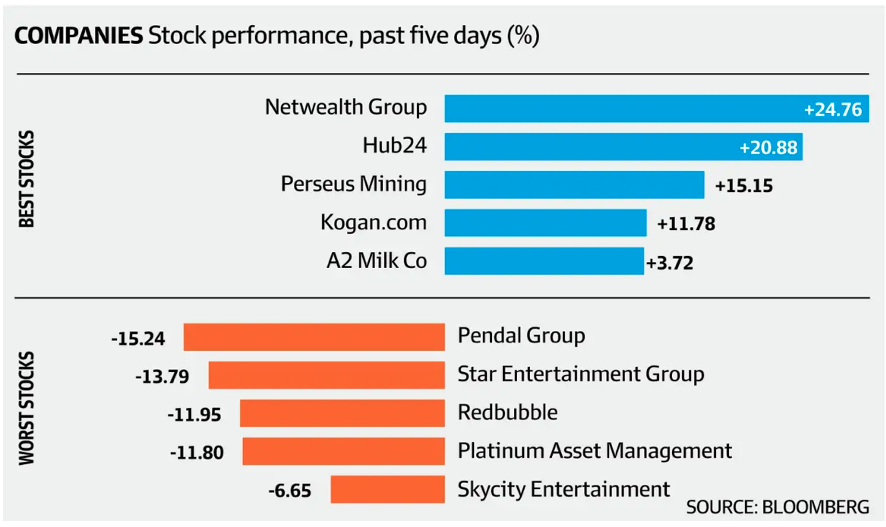

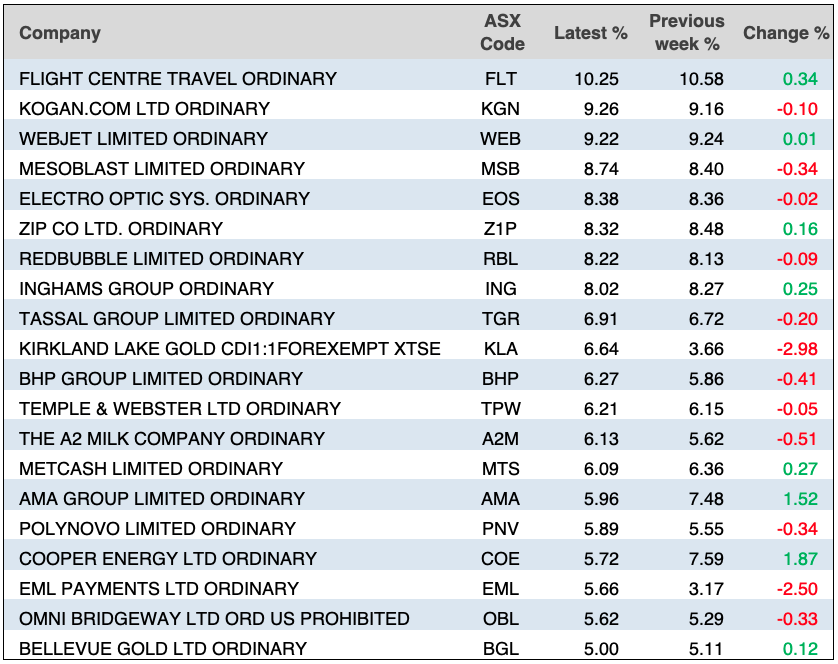

Here are Bloomberg’s big winners and losers for the week.

The best news this week for A2Milk shareholders was the positive revenue report from Bubs Australia that made the market reassess the potential for A2M.

Bubs was up 31.9% to 48 cents and A2M put on 12% to $6.72.

Meanwhile, Star Entertainment Group copped a ‘crowning’ and was slugged because of money laundering allegations in the media. This had a knock-on effect on the share price of New Zealand’s Skycity Entertainment.

What I liked

- The IMF says the Australian economy is tipped to expand by 3.5% in 2021 and 4.1% in 2022. But Westpac’s Bill Evans says it will be way bigger than that! In my interview on my TV show Switzer Investing he goes for 7%. Check it out here.

- Dwelling starts soared by 23.2% in the June quarter – the biggest lift in 20 years.

- Reopening out of lockdown signs, with SEEK reporting a 6% lift in September job ads – the first gain in five months.

- The weekly ANZ consumer confidence index rose for the fifth straight week, up by 1% to a 13-week high of 105.6 points.

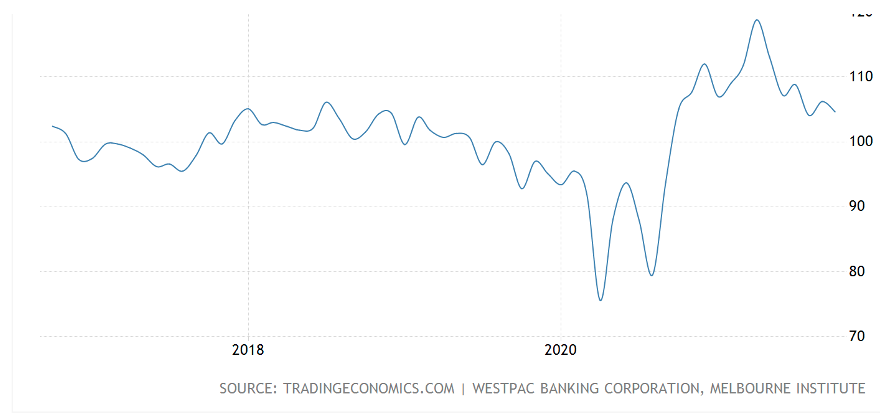

- The Westpac monthly consumer confidence reading fell 1.5% in October to 104.6. It’s still a good reading, as this 5-year chart of the index shows.

The Westpac-Melbourne Institute Index of Consumer Sentiment

- Business was more positive than consumers, with NAB’s business confidence index rising from -5.5 points to 13 points. Confidence lifted 42 points in NSW and 16 points in Victoria, thanks to reopening maps out of lockdown being made public.

- Initial jobless claims in the US fell by 36,000 to 293,000 last week (survey: 320,000)

- Producer prices rose by 0.5% in September (survey: 0.6%), the smallest increase this year. But prices are up 8.6% on a year ago because of supply chain problems and demand surges post-lockdowns and post-vaccinations.

What I didn’t like

- Employment fell by 138,000 in September. Part-time jobs fell by 164,700 but full-time jobs rose by 26,700. But let me say, given the lockdowns, these are OK numbers.

- The same goes for unemployment up only to 4.6% but that was caused by a jump in the participation rate.

- The fall in the participation rate from 65.2% to a 15-month low of 64.5%.

- CBA card spending data showed that with the vast majority of consumers in Australia’s south-east in lockdown over the winter months, retail spending fell by 6.1% over the three months to August.

- Consumer inflation expectations rose by 5.3% in September (survey: 5.3%) — better hope that proves wrong!

- In Europe,stocks were down on Tuesday on concerns about the Chinese property sector, after Evergrande missed another bond payment.

- Shares of British banks HSBC, Lloyds and NatWest all rose over 2% after ‘hawkish’ comments from Bank of England officials drove more bets on a November interest rate hike. I like UK bank share prices rising but I don’t like the idea of the Poms raising rates too soon.

Good signs for our future

Looking at credit and debit card spending, CBA Group economists reported that: “Spending rose over the fortnight to the week ending 8 October, according to CBA’s high-frequency card spending data. National spending is 12.6 per cent higher than the corresponding week in 2019, up around 3 percentage points from the 9.4 per cent pace a fortnight ago. The pickup mostly reflects a lift in services spending and an acceleration in spending in NSW and Victoria prior to an easing of restrictions.”

This supports my view and that of Bill Evans: after lockdowns end, our economy will surge and that should be great for stocks.

The week in review:

- I relay what I deem to be quite a risky investment tip from Warren Buffet’s right-hand man Charlie Munger who added a significant holding of Chinese multinational giant Alibaba (HKD) to his portfolio.

- Paul Rickard takes a look at the Big Four banks and shares his reasoning for selling Commonwealth Bank (CBA) shares and buying NAB (NAB) or Westpac (WBC)

- James Dunn outlined 3 stocks he believes give ideal exposure to an ever-increasing global transition away from fossil fuels and into rare earths such as uranium and lithium.

- As technology becomes more and more entrenched in our lives, made more apparent by Covid lockdowns, Tony Featherstone explores two stocks in this space that are pioneers in keeping kids safe.

- For our “Hot” stocks this week, Raymond Chan of Morgans selected Data#3 (DTL), and Managing Director at Fairmont Equities Michael Gable looks at Harvey Norman (HVN).

- This week in Buy, Hold, Sell – What the Brokers Say, there were 9 upgrades and 1 downgrade in the first edition, and in the second edition there were 3 upgrades and 2 downgrades.

- And in Questions of the Week, Paul Rickard answered questions from subscribers about the new semiconductor ETF called SEMI, the reasoning behind Magellan Global Fund Closed Class Unit (MGF) always trading at a discount, what top 20 ASX stock he considers a core portfolio holding, and whether Mount Gibson Iron Limited (MGX) is a good buy.

Our videos of the week:

- Boom! Doom! Zoom! | October 14 2021

- Is it time to buy Magellan, Fortescue and Alibaba or a fund that give you Asian tech stocks?

- Three stocks with big upside — Appen, Nuix and Forestcue! Westpac’s Bill Evans says economy to BOOM!

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday October 18 – Speech by RBA official

Tuesday October 19 – Weekly consumer confidence (October 17)

Tuesday October 19 – Reserve Bank Board minutes

Tuesday October 19 – CBA Household spending intentions

Wednesday October 20 – Skilled job vacancies (September)

Thursday October 21 – Detailed labour force (October)

Thursday October 21 – Weekly payroll jobs and wages (Sep 25)

Friday October 22 – Speech by RBA Governor

Friday October 22 – ‘Flash’ purchasing managers survey

Overseas

Monday October 18 – China Economic growth (September quarter)

Monday October 18 – US Industrial production (September)

Monday October 18 – US NAHB housing market index (October)

Tuesday October 19 – US Housing starts & permits (September)

Wednesday October 20 – China loan prime rates (October)

Wednesday October 20 – US Federal Reserve Beige Book

Thursday October 21 – US Leading index (September)

Thursday October 21 – US Existing home sales (September)

Thursday October 21 – US Philadelphia Federal Reserve survey

Friday October 22 – “Flash” purchasing managers survey

Food for thought: “[Market] corrections are good, they keep us all humble … The strongest bull markets I’ve been in are built on walls of worry” – Cathie Wood

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

The following chart from Bloomberg News shows the S&P 500 on Friday marking its best-performing day since March. The primary influence for a rally on the index being healthy company earnings disclosed this reporting season which has “helped to temper fears that inflation stoked by surging energy prices and supply-chain snarls will hurt growth. Corporate profits have been a boon for the equity market throughout the pandemic. At the same time, the wider debate about whether a stagflation-like backdrop looms remains unresolved”.

Top 5 most clicked:

- This is the riskiest tip I’ve ever put forward! – Peter Switzer

- Sell Commonwealth Bank, Buy NAB or Westpac – Paul Rickard

- 3 stocks that give targeted exposure to a decarbonated world – James Dunn

- Two standout technology stocks that keep kids safe – Tony Featherstone

- “Hot” stocks: Data#3 – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.