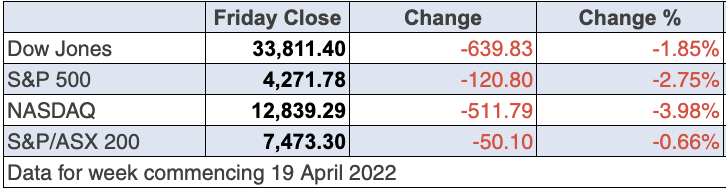

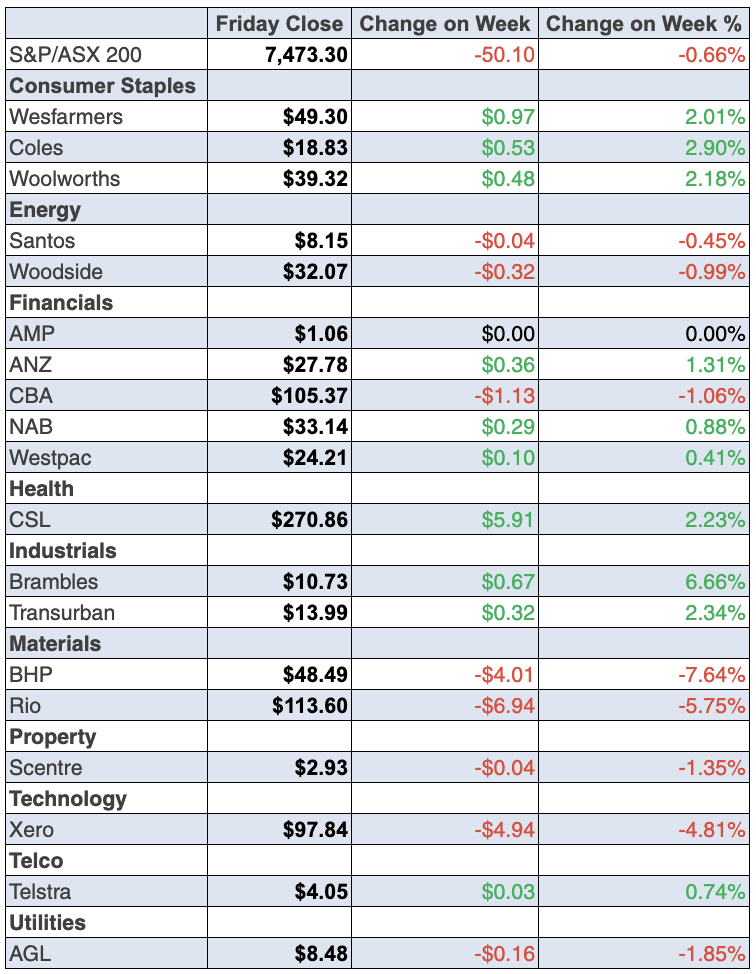

NOTE: Change % is for Change on Week from Thursday 14 April 2022.

The battle between interest rate rise fears and the positivity of US earnings saw the former trump the latter, with the market embracing negativity following US Federal Reserve chair Jerome Powell telling an IMF audience that a 50-basis point rate hike will be “on the table” at the May policy-setting meeting.

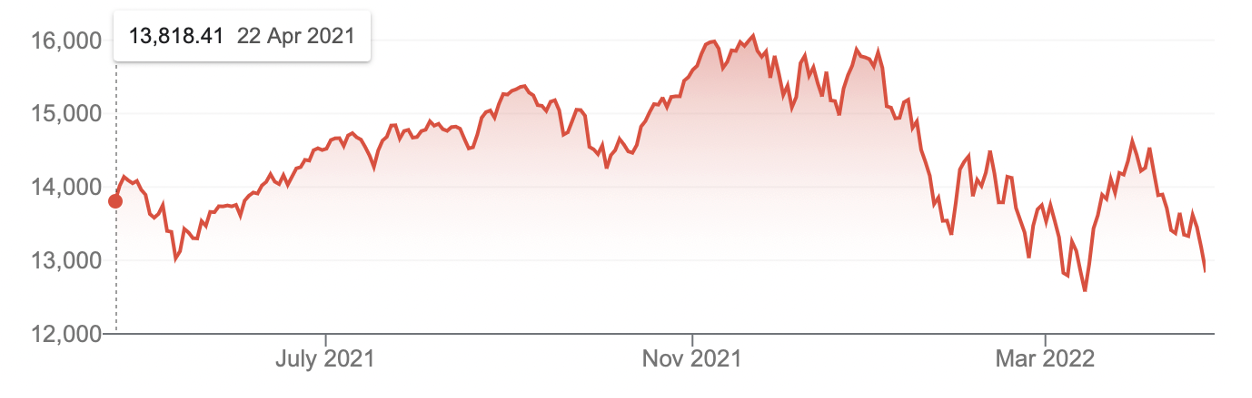

An hour before the close and all three US indexes (the Dow, the S&P 500 and the Nasdaq) were down about 2.5% and the latter moved into bear market territory, off over 20%.

Nasdaq Composite

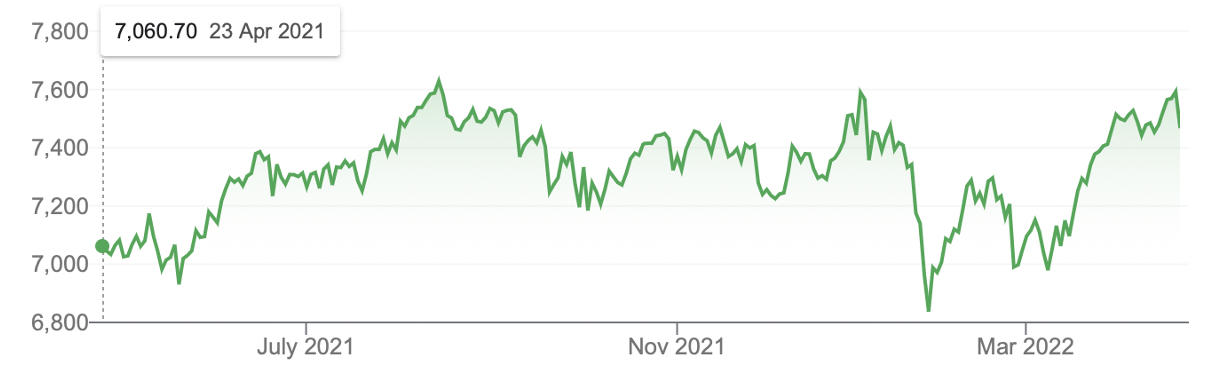

In contrast, over the same timeframe, our market is up!

S&P/ASX 200

That said it’s only a 1% rise but it’s better than a 20% fall for the tech-heavy Nasdaq. Over the same time, the S&P 500 is off 8%, showing that the catch-up of our stock market that I predicted last year about 2022 is working out to be correct.

It has been clearly helped by the Ukraine war’s impact on commodity prices, but even if this tragedy didn’t happen, the global economic bounce-back would still be driving commodity prices higher, which has been a big help to our Index.

Behind this negativity is the concern that the Fed’s interest rate policy creates a recession next year, which the US central bank would clearly want to avoid. But it also has to get on top of inflation, that’s why the 50-basis points rise in May is “on the table”.

One voting member of the Fed board said a 0.75% rate increase wouldn’t be out of place, so you can see why market nervousness is on the rise. And all this fear wasn’t helped by the IMF’s downgrading of world growth from an expected 4.4% for 2022 to 3.6%. This is a lot lower than last year’s 6.1% growth!

Why the negativity, which has spilled into stocks? Well, try this from US.com: “The International Monetary Fund on Tuesday downgraded the outlook for the world economy this year and next, blaming Russia’s war in Ukraine for disrupting global commerce, pushing up oil prices, threatening food supplies and increasing uncertainty already heightened by the coronavirus and its variants.”

This is why an end to this war will be a huge plus for stocks and the 2023 economic outlook, which will drive stock prices later in the year. But first, we need to see an end to this terrible Putin-created nightmare.

Ironically, this is what CommSec’s note on Wall Street earlier this week said: “US share markets rose on Tuesday in response to positive earnings results. Shares in Johnson & Johnson rose by 3.1% after its quarterly profit result beat expectations. Technology led the gains.”

Tech was loved on Tuesday and dreaded on Friday, and only Jerome Powell’s observations were in-between.

This from Brian Price of the US-based Commonwealth Financial Network on CNBC sums up a lot of these stock market jitters: “Investors appear to be moving away from the TINA (i.e., ‘there is no alternative’) narrative as of late when it comes to equities. This is the second straight week of significant outflows from equity mutual funds and days like today are unlikely to change the sentiment moving forward.”

I’m not going to say that a buying opportunity is looming, but many of you are probably thinking that I’m thinking that. And I am, but we have to be patient.

This from Brian Price should be thought about too: “The one positive takeaway may be that sentiment has become too bearish and we could see a countertrend rally at some point in the coming weeks”.

If you’re wondering when the Federal Open Market Committee (FOMC) convenes for its next meeting, it’s on May 4-5, so expect volatility on a downtrend for US stocks at least until then.

Right now, the market and those mutual funds mentioned above don’t have confidence that a recession can be avoided but that’s an economic call that will rely on the number of Fed rate rises, the size of those hikes, the duration of the Ukraine war and the lockdowns in China.

If any of these, or better still all of these, turn out better than expected, then stock market sentiment will turn on a dime.

Locally, we weren’t helped by the Reserve Bank Board minutes out this week that noted that a pickup in inflation and wage growth “have brought forward the likely timing of the first increase in interest rates”.

That made banking economists bring their first interest rate rise forward from August to June — just after the federal election.

If you need reason to believe our market can keep on outperforming US stocks for a lot of this year, understand that commodities are seen as an inflation hedge, and commodity prices are powering a lot of local companies’ profits and share prices.

To the local story and these interest rate fears rattled our market after five days of rises. Yesterday, the S&P/ASX 200 gave up 119.5 points (or 1.6%) to finish at 7473.3, meaning the drop for the week was 0.7%.

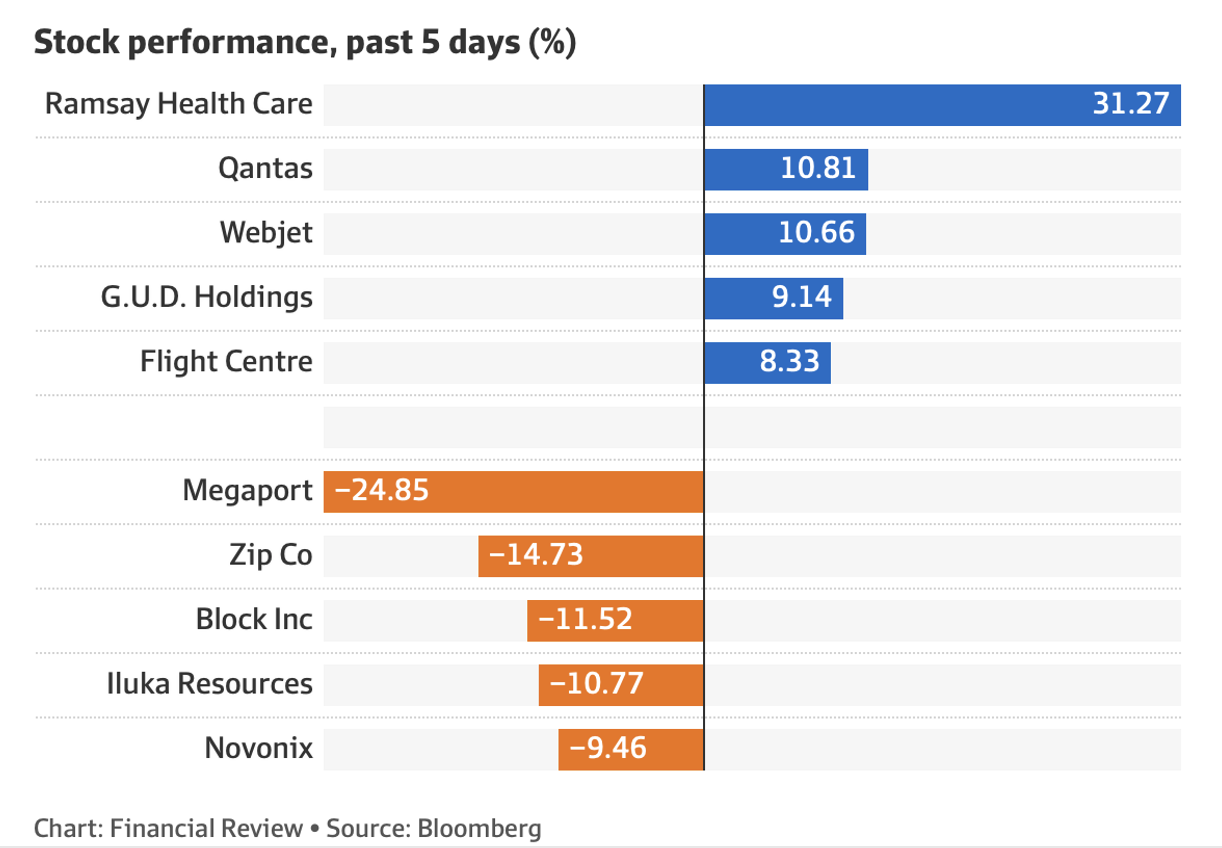

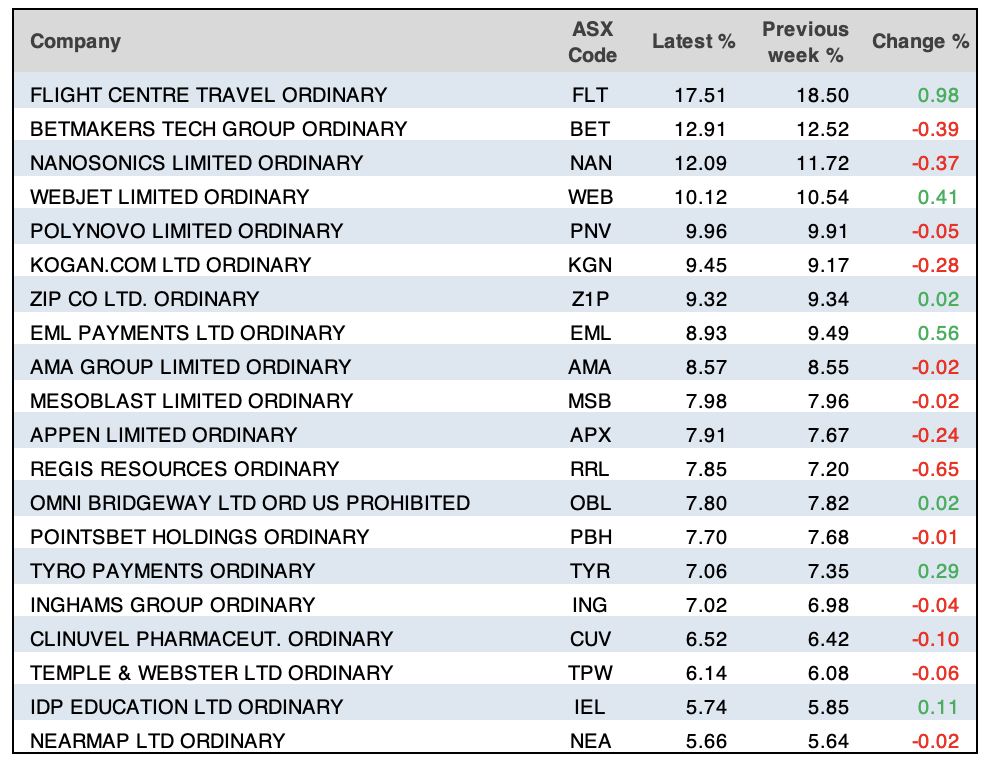

Here’s the big ‘winners and losers’ list, and tech stocks again are the whipping boys, while travel stocks have spiked following news that masks will no longer be mandatory on US airlines.

Not surprisingly, the takeover offer for Ramsay from KKR helped its share price and gave the overall healthcare sector a bit of a positive shot in the arm.

CSL was up 3% for the week to $270.86, while Resmed was up 1.89% to $32.30.

Megaport had a mega-sell off after disappointing the market with its latest update. This will be a subject I’ll be exploring next week on my TV show. Interestingly, all the companies’ key numbers increased but they were an underwhelming performance.

This was the take on the numbers from marketindex.com.au : “Megaport’s narrative isn’t as extreme [as Netflix’s] but the third quarter result was the company’s slowest revenue growth rate since March 2021”.

What I liked

- The ANZ-Roy Morgan consumer confidence index rose by 2.3% to 96.8 in the past week. Confidence has lifted for three straight weeks and now stands at a 6-week high.

- In the coming financial year (2022/23), the federal government expects net overseas migration to lift by 180,000, up from just 41,000 in the current year but short of the 224,000 average pre-Covid

- The leading index in the US rose by 0.3% in March (survey 0.3%).

- The US Federal Reserve Beige Book reported that economic activity expanded at a moderate pace since mid-February and “inflationary pressures remained strong since the last report”.

What I didn’t like

- The bond market for the US has, wait for it, 10 interest rate rises priced in, which I bet doesn’t happen. But when the bond market gets spooked, it’s like Freddy Kruger has come to Elm Street and it’s nightmare time for stocks. (It’s worth remembering that Freddy isn’t real and many of the bond market’s nightmare calls don’t become a reality. I’m expecting to be scared about some stock trends but I know there will be a happy ending.)

- The International Monetary Fund (IMF) has downgraded forecasts, now expecting the global economy to grow 3.6% in 2022, down from January forecasts of 4.4%. The World Bank also downgraded growth forecasts from 4.1% to 3.2%.

- The Philadelphia Federal Reserve manufacturing index fell from 27.4 to 17.6 in April (survey: 21).

An interesting insufficiently heralded plus!

On Tuesday, I attended a breakfast with Treasurer Josh Frydenberg, who pointed out that the IMF downgraded the world’s economic growth for 2022 but upgraded Australia’s! “In its latest world economic outlook, the IMF raised its forecast for Australian growth to 4.2 per cent in 2022 from 4.1 per cent previous, while slashing its global growth prediction to 3.6 per cent from 4.4 per cent,” AAP reported.

But on that day our media went hard, with the IMF telling the Government to start cutting the deficit to reduce the growth of public debt.

This stronger-than-expected growth is also a plus for our stocks going forward.

The week in review:

- This week in the Switzer Report, Tony Featherstone sounds like me when he asked these questions in his article on Thursday: Is it time to buy tech stocks? And after a heavy tech sell-off this year, are there bargains among the big tech names?

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks Pro Medicus (PME) is a buy.

- In Buy, Hold, Sell – What the Brokers Say, there were 2 upgrades and 0 downgrades from the 7 stockbrokers monitored by FNArena for the only edition of the week, given the public holiday on Monday.

- In Questions of the Week, Paul Rickard answers subscribers’ queries about why Ramsay Healthcare’s share price isn’t closer to the takeover bid price of $88?; with the demerger of BHP’s oil assets: firstly, how many Woodside shares do you get?; if I get shares in lieu of the payment of a fully franked special dividend, what are the tax consequences? And what are the implications from a capital gains tax perspective?

- And finally, Paul wrote a piece for the savers out there this week. As some term deposits hit 3%, he compares the best current rates offered by various banks in Australia including the big four, regionals, and online.

Our videos of the week:

- Should you increase your exposure in tech stocks + is it time to invest in healthcare stocks? | Switzer Investing

- What is regenerative medicine and why is it important? | The Check Up

- Ken Hancock from RLF AgTech Ltd | The CEO Masterclass

- They are set to travel in the US without masks but could Joe Biden get in the way? | Mad about Money

- Boom! Doom! Zoom! | 21 April 2022

Top Stocks – how they fared:

NOTE: Change on Week data compiled from Thursday 14 April 2022.

The Week Ahead:

Australia

Tuesday April 26 – CommSec State of the States

Wednesday April 27 – Weekly consumer confidence (April 24)

Wednesday April 27 – Consumer price indexes (March quarter)

Thursday April 28 – Trade price indexes (March quarter)

Friday April 29 – Producer price indexes (March quarter)

Friday April 29 – Private sector credit (March)

Overseas

Monday April 25 – US National activity index (March)

Tuesday April 26 – US Durable goods orders (March)

Tuesday April 26 – US House prices (Feb)

Tuesday April 26 – US Consumer confidence (April)

Tuesday April 26 – US New home sales (March)

Tuesday April 26 – US Richmond Federal Reserve index (April)

Wednesday April 27 – US Goods trade balance (March)

Wednesday April 27 – US Pending home sales (March)

Thursday April 28 – US Economic growth (March quarter)

Friday April 29 – US Personal income/spending (March)

Friday April 29 – US Consumer confidence (April)

Food for thought: “Wide diversification is only required when investors do not understand what they are doing.” – Warren Buffett

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

NOTE: No data released from ASIC for week commencing Tuesday 19 April 2022. As such, the above table has been compiled from the most recent data released by ASIC on Thursday 14 April 2022.

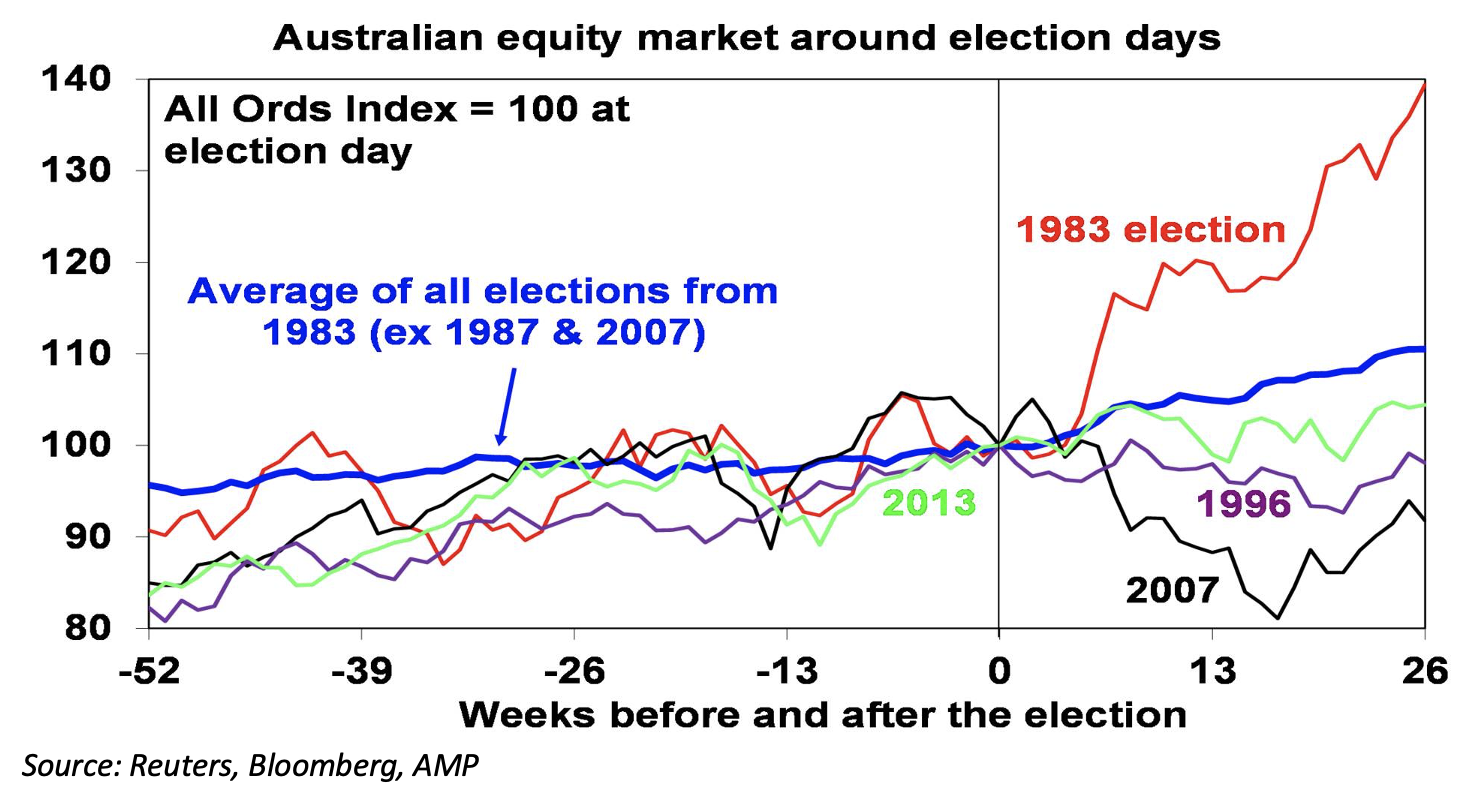

Chart of the week:

In our chart of the week, AMP Capital’s chief economist, Shane Oliver, gives a history lesson on how the Australian equity market has performed in the weeks leading up to and following a federal election.

“In terms of the share market, there is some evidence of it tracking sideways in the run-up to elections, which may be because of uncertainty. The next chart shows Australian share prices around federal elections since 1983. This is shown as an average for all elections (but excluding the 1987 and 2007 elections given the 1987 global share crash and the start of the GFC in 2007), and the periods around the 1983 and 2007 elections, which saw a change of government to Labor, and the 1996 and 2013 elections, which saw a change to the Coalition. The chart suggests some evidence of a period of flatlining in the run-up to elections followed by a relief rally,” Oliver said.

“However, the elections resulting in a change of government have seen a mixed picture. Shares rose sharply after the 1983 Labor victory but fell sharply after their 2007 win, with global developments playing a role in both. After the 1996 and 2013 Coalition victories, shares were flat to down. So based on history it’s not obvious that a victory by any one party is best for shares in the immediate aftermath, and historically moves in global shares played a bigger role than the election outcome. The next table shows that 10 out of the 14 elections since 1983 saw shares up 3 months later with an average 4.5% gain.”

Top 5 most clicked:

- Time to buy tech stocks? – Tony Featherstone

- Term deposit rates top 3%! – Paul Rickard

- “HOT” stock: Pro Medicus (PME) – Maureen Jordan

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.