The growing market in locally listed exchange-traded funds (ETFs) is offering Australian investors an ever-expanding range of options to gain international diversification for their portfolios cheaply and easily.

Of course, investing in offshore markets has been a fairly thankless task over much of the past decade – due to the strong rise in the Australian dollar and our booming resources sector. Note: a rising Aussie dollar tends to dampen the returns, in Aussie dollar terms, from unhedged offshore investments.

That said, even with the hindsight of recent underperformance, there’s still a case for offshore exposure on the grounds of diversification alone. Australia’s market is very top heavy in banks and resource companies and underweight in technology and consumer stocks. And with the Aussie dollar and export commodity prices looking toppy, it’s probably not a bad time to dip one’s toes into international waters.

But what are the best products?

There are now just over 20 international exchange-traded funds listed on the local market, providing exposure to a range of markets including the United States, Europe, Japan and China. There are also more broadly diversified regional ETFs providing exposure to developed and/or emerging markets, or global industries such as health care, consumer staples and telecommunications.

To narrow the field, I’ll concentrate on some of the more popular international ETFs providing broad global diversification.

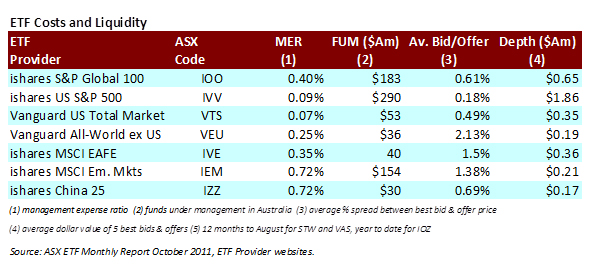

As seen in the table below, iShares’ S&P 500 ETF (IVV) is the most popular international ETF on the local market, with $290 million in funds under management at the end of October 2011. It is almost the second cheapest, with a management expense ratio of only 0.09% per year. Only Vanguard’s US offering (VTS) is cheaper, with an MER of 0.07%. Due to its greater size, however, IVV retain moderately better liquidity, with a tighter average bid-offer spread and greater market depth.

Another popular choice is the iShares Global 100, which provides exposure to both the US and non-US developed markets, although it is somewhat less liquid than IVV.

iShares’ emerging markets ETF (IEM) is also popular, with $154 million in funds under management, but it can still suffer from wide bid-offer spreads due to the difficulty traders face in hedging their risks for markets that’s don’t trade in the Australian time zone.

There remain a few holes in the local ETF marketplace. For starters, there are as yet no hedged international ETFs – meaning, for good or bad, investors must accept the currency risk of the markets in which they invest.

There remain a few holes in the local ETF marketplace. For starters, there are as yet no hedged international ETFs – meaning, for good or bad, investors must accept the currency risk of the markets in which they invest.

Oddly, there’s also no single ETF that provides broad exposure to both the US market, non-US developed markets, and emerging markets. Investors need to mix and match these themselves. Indeed, a difference between the non-US international ETFs – IVE and VEU (in the table above) – is that the latter holds an almost 30% exposure to the emerging markets, whereas the former is focused on developed non-US markets alone. iShares S&P Global 100 (IOO) provides exposure to both the US and non-US developed markets, but not emerging markets.

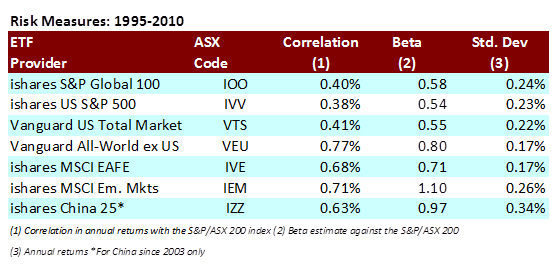

In terms of risk, US market Aussie dollar returns have tended to be relatively less correlated to Australian market returns over the past decade or so, due likely to its different sectoral composition and the Aussie’s tendency – especially against the greenback – to rise and fall in line with global markets. Interestingly, US ETF risk alone has not been materially different to that of the broader Global S&P 100.

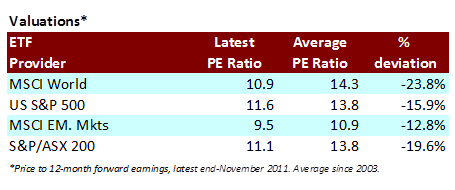

In terms of valuations, the good news is that most markets – both here and abroad – appear relatively cheap based on recent historical price to earnings averages. And if you believe the Australian dollar is heading for a fall, it only enhances the expected returns from offshore markets.

In terms of valuations, the good news is that most markets – both here and abroad – appear relatively cheap based on recent historical price to earnings averages. And if you believe the Australian dollar is heading for a fall, it only enhances the expected returns from offshore markets.

All up, good options for offshore exposure seem to be iShares’ S&P 500 index (IVV) due to its low cost and good liquidity, which could be complemented with Vanguard’s non-US market ETF (VEU), which is also reasonably cheap and covers both non-US developed and emerging markets. Otherwise, investors can combine IVE and IEM to generate non-US international exposure, and tailor their desired exposure to emerging markets (IEM) to suit their risk preferences.

Note: the downside of broadly diversified international ETFs – such as VEU – is that they can suffer from relatively wider bid-offer spreads due to the difficulties in hedging price risk during the Australian time zone. This means they are best used as long-term portfolio diversifying investments rather than short-term trading vehicles.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: This rally could have legs

- Charlie Aitken: Don’t pile into fixed interest

- Tony Negline: Is your lifetime pension financially sound?

- Andrew Bloore: How to move large sums of money into super