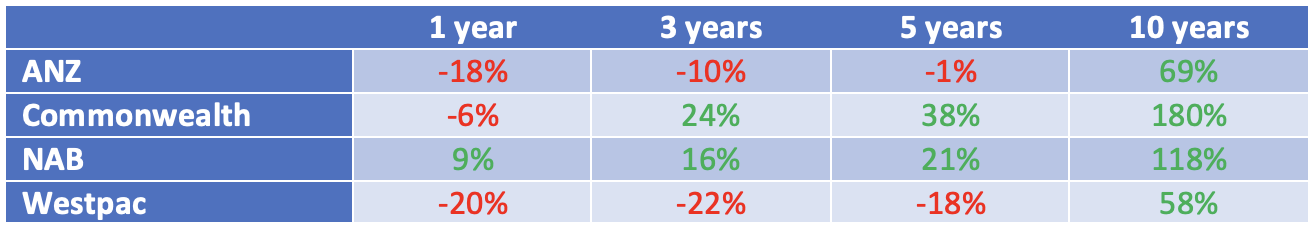

One of the most interesting charts in CBA’s profit result yesterday was a comparison of the major banks’ shareholder returns. This shows the total return over 1 year, 3 years, 5 years and 10 years to 30 June 2002. In typical “bank speak”, CBA refers to its competitors as ‘Peer 1’, ‘Peer 2’ and ‘Peer 3’, so I have “decoded” this in the table below.

Total Shareholder Return to 30/6/22

CBA has delivered the best total return over 3 years, 5 years and 10 years. In 21/22, it lost the crown to NAB, but it still comfortably outperformed ANZ and Westpac. Over 10 years, the difference is stark. An investor who put $100 into Westpac 10 years ago has earnt $58 – that’s dividends and capital. If that same $100 had been invested in CBA shares, the investor’s return would have more than trebled to $180.

The table helps to explain the market’s reaction to CBA’s profit result, which saw CBA’s share price ease a touch, and moderate gains for the other banks. The profit result was solid, but not outstanding. And when you are trading at such a big premium, there will be bouts of profit taking and switches into the cheaper banks.

CBA’s full-year cash NPAT of $9.6bn beat forecasts by about $200 million and was up 11% on FY21. However, this was largely due to the writeback of loan impairment expenses booked during the Covid pandemic. Overall loan impairment expenses were -$357 million (they added to profit), and a net improvement of $911 million on FY21.

Operating performance, which excludes “one-offs” and loan impairment expenses, was up 3.1% on FY21. This was thanks to improved volumes, offset by a declining net interest margin. The second half was weaker than the first half, but after adjustment for three fewer days in the period, was up about 1%.

Home loans grew by a net $36.4bn, business loans by $15.4bn and household deposits by $40.9bn. In the second half, home lending slowed as interest rate competition heated up, but still grew by a net $16.1bn.

The net interest margin continued to decline, with a fall of 5bpts (basis points) in the second half to 187 bpts. However, the margin is expected to improve as the impact of the RBA’s recent increases to the cash rate takes effect.

A strong area in the result was expense growth. Despite a big increase in staff expenses, lower remediation expenses and productivity gains allowed CBA to record an overall fall in expenses of 1.5% for the year. Half on half, the second half was broadly flat.

Shareholders were rewarded with a final dividend of $2.10 per share, taking the full year dividend to $3.85, up from the $3.50 paid for FY21. This represents a payout ratio of 68%, below CBA’s target range of 70% to 80% of cash NPAT. The Bank said that when it “normalised” for long-run loan impairment expenses, the payout ratio was 75%.

Capital remained strong with a ratio of 11.5% at 30 June, comfortably in front of APRA’s “unquestionably strong” benchmark of 10.5%.

What do the brokers say?

Going into the result, the brokers were negative on CBA, viewing it as too expensive compared to its peers. (This isn’t new – they have been negative on CBA for the last two decades – and comprehensively wrong!)

Overall, the consensus target price stood at $88.48, 12.4% below Wednesday’s closing price of $101.00. Morgans was the most bearish with a target price of just $77.00, while UBS had a target of $105.00. Individual recommendations and target prices are set out in the table below.

The brokers had CBA trading on a very heady multiple of 19.1 times FY22 earnings and 18.2 times forecast FY23 earnings. Westpac and ANZ, by contrast, are respectively trading on multiples of 11.7 times and 10.9 times forecast FY23 earnings.

Yesterday’s result is unlikely to lead to material revisions to earnings forecast or target prices.

Bottom Line

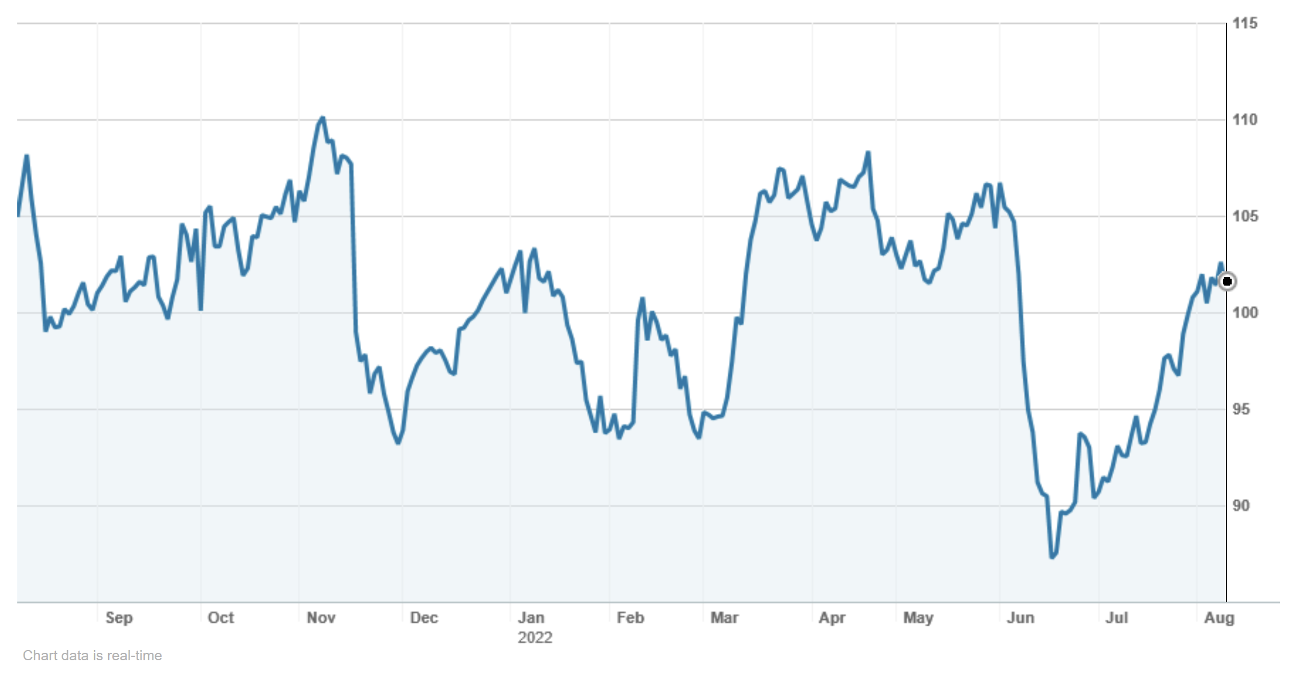

The recent rally in bank share prices has demonstrated that institutions will go to the ‘best’ (CBA) when they buy. It is their core stock, supplemented by one or more of the other banks. They may not want to buy it much over $100, but they are not in any hurry to sell.

Commonwealth Bank (CBA) – Aug 21 to Aug 22

And that’s the way I think you should play it. For investors, it is a hold. For “would be” investors, don’t be too greedy because pullbacks will be bought. Traders can wait – there are probably better stocks to trade.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.