The highlight of CBA’s profit result last week was the Board’s decision to declare a higher-than-expected fully franked final dividend of $2.40 per share. This was up from the $2.10 paid at the same time last year.

The full year dividend of $4.50 represented a payout ratio of 74%, near the middle of the Bank’s target payout ratio of 70% to 80% of cash NPAT. The Bank re-affirmed that it would continue to target a payout in this range.

In FY21, the payout ratio was 71%. Last year (FY22), CBA only delivered a payout of 68%, citing the fact that FY22 profits were inflated by the absence of loan losses and that when a “normalised” approach to losses was taken, the payout ratio was equivalent to 75%.

While loan losses are higher in FY23 (see below), they are still not back to long run “normal” levels (12bpts rather than 18bpts), so this dividend is “higher” than might have been expected. I think there are two factors driving this.

Firstly, “confidence” by the Board and Senior Management. Confidence about:

- Interest margins, while softening, aren’t coming under as much pressure as some had feared;

- Loan losses are still very low. Despite fears of a softening economy, there is no noticeable uptick in home loan arrears or businesses coming under pressure. Further, the Bank is extremely well provisioned;

- The Bank’s capital position; and

- The Australian economy and interest rates. Growth is softening, but it is no “doomsday” scenario and interest rates look like they are near their peak.

The other factor driving the dividend payout is that following the changes to franking credits by the Government (which effectively kills off-market buybacks), the only way companies can distribute surplus franking credits (or stop building up a surplus) is to pay higher ordinary dividends. Special dividends are a possibility, but the company must be very careful in implementing this.

My take on all this is that higher bank dividends (5% to 10% higher than currently expected) will be the order of the day. I expect the other banks to follow suit.

CBA’s profit result

Cash NPAT for the full year of $10.16 bn was up 6% on FY22. Loan losses increased from a writeback of $357m in FY22 to $1,108m in FY23 (a turnaround of $1,465m), so operating performance (pre-tax and excluding loan losses) improved by 18.7%. This was driven by a huge increase in the net interest margin of 17bp, from 1.90% to 2.07%.

The net interest margin fell in the second half by 5bp, from an average of 2.1% in the first half to 2.05%, but the decrease wasn’t as big as the market had feared. This was due to competitive pressures to pay higher rates on retail and business deposits, aggressive home loan pricing and increased costs for wholesale funding, offset by a higher return from investing the capital.

Second half cash profit of $5bn was 3% lower than the first half’s $5.15bn.

Highlights of the result included the performance of the business bank (profit up 32% to almost $4.0bn on the back of a 25% increase in income and flat costs), ongoing leadership in the delivery of customer facing digital applications, the highest customer satisfaction ratings and balance sheet strength. With the latter, CBA increased its provisioning to 1.64% of credit risk weighted assets (the other major banks range from 1.17% to 1.37% as at 31 March 2023) and a capital ratio of 12.2%. This translates to around $9bn of surplus capital over the APRA minimum, allowing CBA to announce a further $1bn on-market share buyback.

On the negative side, overall expense growth for the year of 5.5%, driven by the impact of inflation, higher volumes and technology investment, offset by productivity improvements.

What do the brokers say about CBA?

The major brokers remain bearish on CBA, feeling that it is too expensive relative to its major bank competitors. According to FN Arena, all the major brokers either have a ‘sell’ or ‘neutral’ recommendation (see table below) on the stock.

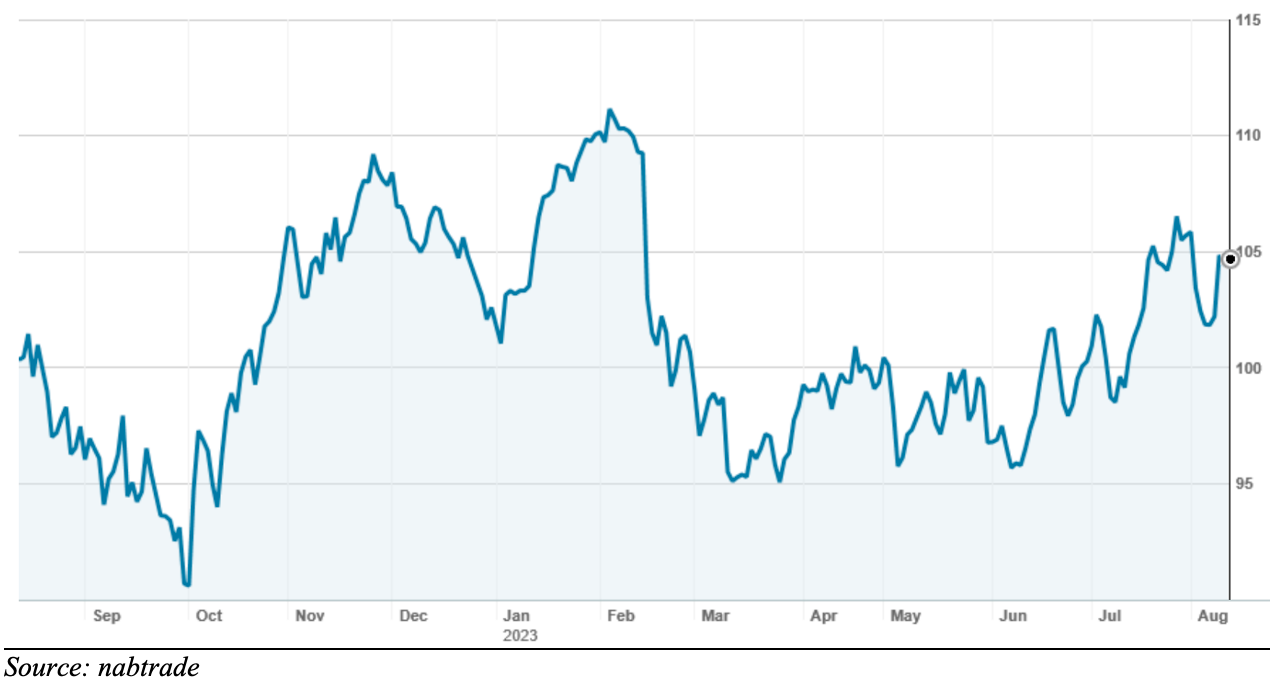

The consensus target price has moderately improved to $91.08 but is still 12.8% lower than Friday’s ASX close of $104.40.

On multiples, the brokers have CBA trading at 18.3 times forecast FY24 earnings and 17.7 times forecast FY25 earnings and paying a prospective yield around 4.5%.

CBA – last 12 months

Bottom line

With the other major banks trading on multiples of around 11 to 12 times, the analysts are 100% right when they say CBA is too expensive. However, CBA has been “too expensive” for such a long time. It has proved to be remarkably resilient and remains the institutions “go to stock” whenever the market sells off. There is nothing in this result to suggest this is about to change.

While I am not buying CBA at these levels, in a sell-off, I would have a good hard look. From a portfolio perspective, I continue to play the banks with the “best” and the “worse”, with CBA taking the top honour and Westpac the dunce cap. CBA’s result has given me the confidence to be marginally overweight the sector.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.