Local tech and other growth stocks had a much better day on Friday, and while I won’t get carried away with the rises, it confirms two important things that I’ve been telling you.

The first important thing is that when the news flow gathers steam telling us inflation is falling, that interest rates won’t go as high as some have been predicting and a recession is becoming less likely, then tech and other growth stocks will charge up the stock markets here and overseas, especially in the US.

The second important thing is the market is still trying to create a bottom, which happens when buyers are outnumbered by sellers, which at this stage is the other way around. That said, there would be those profit-makers who did well out of the stock market’s slide (or went to cash), who now want to get set for what lies out there, namely, a market rebound.

I’m not saying that a rebound is close because lately, we’ve seen spikes in the market followed by more big sell-offs — that’s been the pattern typical of bear markets, which the S&P 500 and the Nasdaq have been in recently.

Interestingly, some of the reasons for a potential rise in stock prices are the bad news of a potential recession and the good news that it might be either a mild recession or a significant economic slowdown in the US, whose economic and market stories are driving a lot of the negative action in our market. What I’m saying here is that talk about a recession tells the market that interest rate rises would end. If the recession or slowdown is mild, that’s a great scenario for stocks to rise.

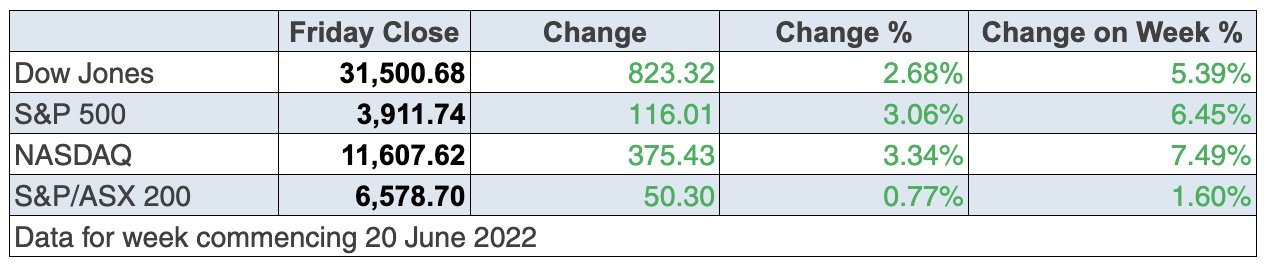

Reinforcing more positive omens for stocks was a strong trading session for Wall Street yesterday. The Dow finished over 800 points up and ended with all three stock market averages up for the week: the Dow up close to 5.3%, the S&P 500 some 6.7% higher and the Nasdaq on an 8.5% plus jump. And by the way, the S&P 500 moved out of bear market territory!

Some experts are calling it a bear market bounce, but others see it as the bottoming process in action, after an excessive sell-off of stocks. (I’ll look at this in my article in Monday’s Switzer Report.)

Ultimately, this positivity will be tested until there are unambiguous signs that inflation is falling, a serious recession is unlikely and interest rate rises will be less aggressive (or even over) for some time.

On these two issues, the record low reading for the University of Michigan’s consumer sentiment survey of 50, while worrying on one level, could be a solid sign that the rate rises from the Fed are working. The survey also showed a small fall in inflationary expectations, which is another plus for the Fed’s work so far.

The rally itself on Friday was broad-based, with 448 stocks out of the S&P 500 rising, which is another box ticked for what you want to see if you think the bottoming process is starting to happen.

And there’s other promising stuff.

Mike Santoli at CNBC noted something important: “Further deceleration in manufacturing and service PMIs join flagging housing activity, a rollover in commodity prices and slipping durable-goods demand to swing the focus toward economic slippage. This has quickly prompted the market to reduce its implied expectations for how far the Federal Reserve can and will go in jacking up rates.”

And Santoli also pointed out that the bond market is less excited about higher rates: “The Treasury market is reacting dramatically, surrendering all the upside in yields following the hot consumer price index report less than two weeks ago and the Fed’s 75 basis point bump last week. Two-year yield cracking under 3%, nearly a half-percent beneath the recent peak, removing the equivalent of two 25 basis point hikes from the Fed tightening outlook over the next two years. Market now sees short rates peaking late this year with cuts possible in 2023.”

Interestingly, the potential for fewer interest rate rises is a real help for beaten-up stocks. This is part of the story put to market this week by JPMorgan’s Marko Kolanovic, the company’s chief global markets strategist. This revelation came out yesterday and I had to share it with my Switzer Daily readers, but in case you missed it, this is the guts of his argument for a rising stock market. You might note that it mirrors what I’ve been saying for months. Here it is:

- His team expects the S&P 500 to end the year at 4800. That’s 27.7% above where the broad market index closed on Wednesday.

- This would be the S&P 500’s all-time high set on January 3.

- He thinks a geo-political solution to the Ukraine war will happen later this year.

- Inflation will fall.

- Moderating inflation will help the US avoid a recession.

- That would be good for US company profits.

- And that means stock prices have been over-smashed this year.

- If right, his scenario will also mean interest rates won’t have to rise as much as the most negative forecasters have been predicting.

Of course, he and I could be wrong, but he has won a number of awards for being a top stock picker on Wall Street and is a respected player, as his title at JPM shows.

Let’s hope he’s on the money!

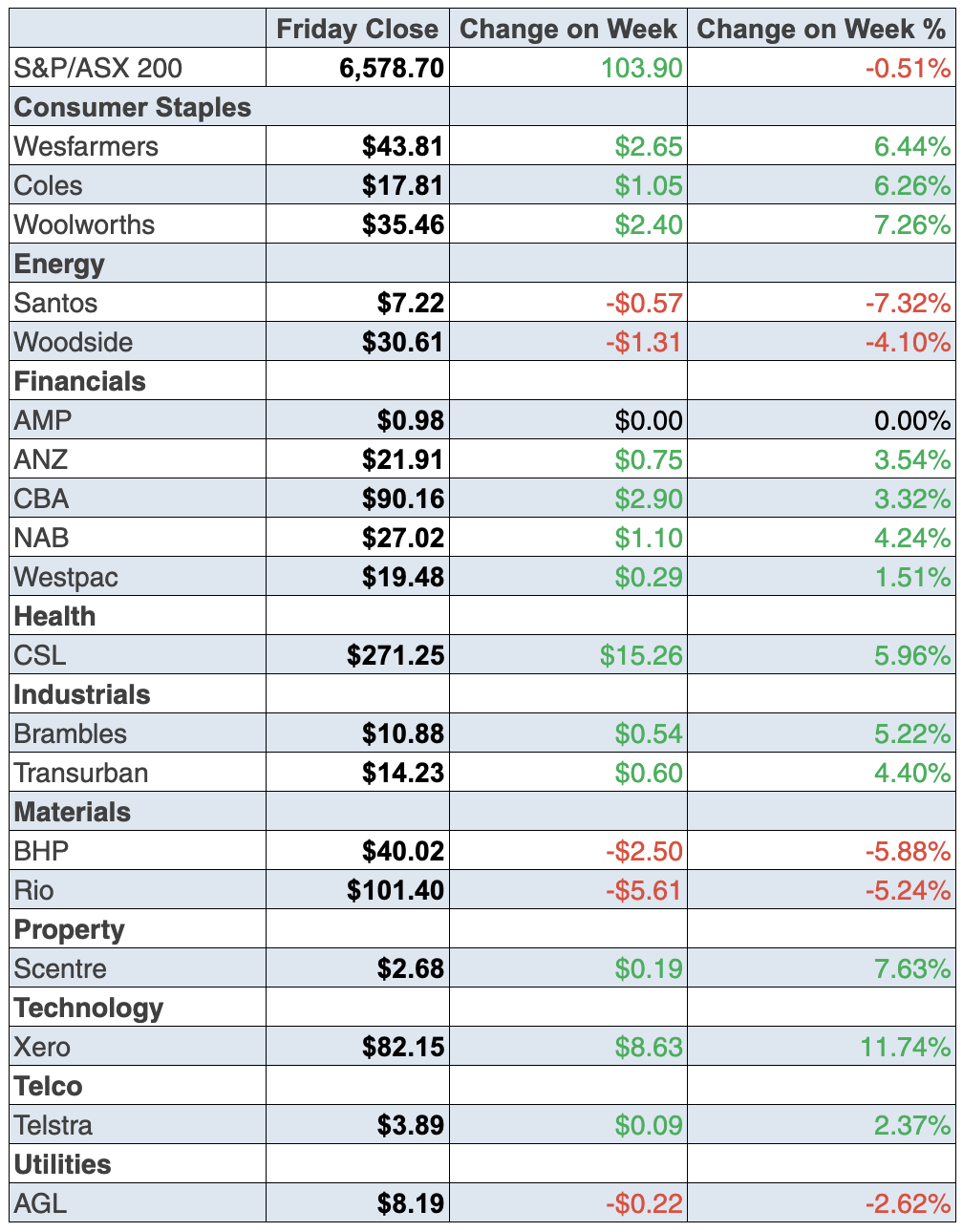

To our local trading this week and the S&P/ASX 200 was up 0.8% on Friday and 1.6% for the week, which is another nice sign. But as I said earlier, I’m not getting carried away — just happy to see it’s not all sell, sell, sell!

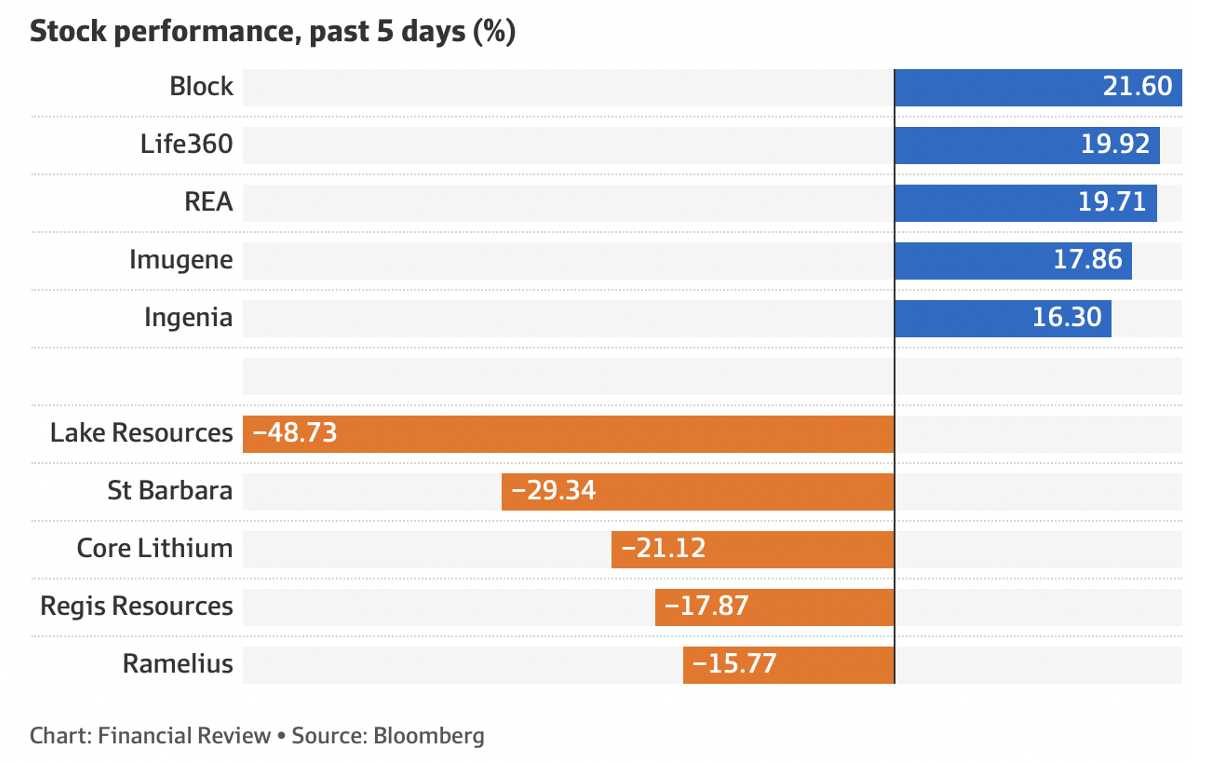

The AFR’s Alex Gluyas pointed out that it was the best five days for shares since the week ending March 18, and here are the bigger winners and losers:

Another sign that the stock market’s “risk off” theme (that has explained a lot of the recent falls of stock prices) is being questioned and is turning to “risk on” is the fact that lithium companies are again starting to find believers. Vulcan Energy was up a big 26.8% to $6.34 after European automaker Stellantis became the company’s second-biggest shareholder. Liontown Resources (up 10.8%), Pilbara Minerals (up 8.8%) and Allkem (up 4.7%) all had good days on Friday.

The badly beaten-up tech sector really had an overdue day of upside, with Zip up 21.6% but its share price is now only 53.5 cents after being over $12 in February 2021! One of my favourites Megaport had a nice rise of 15.9%, again off an unreasonably low base to finish at $5.60.

Miners had a rough week, with BHP off 4.7% to $40.02, while CBA actually rose 2.69% to $90.16.

Both these sectors will be winners when sentiment turns around for stocks and this excessive recession talk is replaced with stronger economic times in 2023, hopefully, helped by no Ukraine war and a nosediving oil price.

What I liked

- The ANZ-Roy Morgan consumer confidence index rose by 1.6% last week to 81.7 points (long-run average since 1990 is 112.4). It was the first increase in confidence in four weeks. Falling consumer confidence is needed to help reduce inflation but a small rise is OK to help us avoid a bigger slowdown that’s needed to moderate inflation.

- Total household wealth (net worth) rose by $172.8 billion (or 1.2%) in the March quarter of 2022 to a record-high $14,891 billion or $14.9 trillion. Wealth is up 16.5% on a year ago.

- Foreign investors hold a record $920.9 billion of Aussie shares, 34% of the total.

- The preliminary S&P Global Australia Composite Purchasing Managers’ index (PMI) eased from 52.9 in May to 52.6 in June, a five-month low. Readings above 50 indicate an expansion in activity.

- In the past, it has been notable that the ‘top end’ of the housing and car markets have led movements in the broader market. The same trend is occurring now. And there are signs that Aussie consumers are now embracing overseas travel in preference to buying cars or spending money on the home. This is a helpful trend to bring down inflation.

- According to CoreLogic, national home prices fell by 0.1% in May, the first fall in 20 months. Home prices fell 0.8% at the ‘top end’ but prices rose 1% for lower-valued properties. The RBA will like seeing this. If the trend continues, it could moderate its interest rate rises.

- Existing home sales fell by 3.4% in May to a 5.41 million annual rate (survey: 5.4 million). The Chicago Federal Reserve national activity index fell from 0.40 to 0.01 in May (survey: 0.32). These normally would be “what I disliked” but we need to see the US economy slow down to think inflation will soon fall.

- The S&P Global manufacturing index fell from 57 to 52.4 in June (survey: 56) and the services index dropped from 53.4 to 51.6 (survey: 53.3). The Kansas City Fed factory index dipped from 23 to 12 in June (survey: 10). These falls are good for inflation control but bad for those not wanting a recession, but on balance these readings are OK.

- European Central Bank (ECB) Chief Christine Lagarde reaffirmed plans to raise interest rates twice over the coming months, which is a measured way to talk to spooked financial markets.

What I didn’t like

- In testimony to the US House Financial Services Committee, US Federal Reserve chair Jerome Powell reiterated that the central bank is “strongly committed” to bringing down inflation. He also noted that a recession is a “possibility”. I don’t like Powell being objective — he has to avoid a recession!

- This from CommSec’s Ryan Felsman: “The defensive S&P 500 utilities (up 2.4%), consumer staples (up 2%) and healthcare (up 2.2%) sectors countered declines in the energy (down 3.8%) and materials (down 1.4%) sectors amid growing worries about a possible US recession.”

- The Bureau of Statistics (ABS) today reported that 31% of all Aussie businesses experienced difficulty finding suitable staff in June 2022, up from 27% a year ago. Staff shortages are most acute in Accommodation and Food Services (51%) and Education and Training (47%).

- In May 2022, 664,300 employed Aussies indicated that they were in the process of changing jobs or seeking other employment, below the record high of 709,500 “job switchers” seen in November 2021.

Keeping it real

The fear index (or VIX) in the US is hovering in the high 20s, staying in the “on alert but not panicking” zone, which is good to see but it’s still high. A reading of 10 or 12 means it’s “risk on” and stocks are on the rise, so I’m expecting a real test of this nice rally this week. But if the economic data dribbles in telling us that rate rises are working and no serious recession threatens, then the bottoming process will give way to a nice surge for stocks. And boy I hope Marko Kolanovic is right on the money!

The week in review:

- This week in the Switzer Report, I share why I like stocks that defy big sell-offs. Given the ability of these stocks to defy the gravity of a very negative market, I assess if there are any other trends that recommend these 5 stocks I’ve selected from the table.

- Paul (Rickard) takes to his crystal ball to determine the future of Australia’s oldest energy company AGL under majority stakeholder Mike Cannon-Brookes and whether he thinks it is currently a buy. Later in the week, Paul took a deep dive into the infrastructure sector, which has been one of the best-performing assets in recent times. Paul says you can still invest in infrastructure and shows you how to do it and which fund he prefers.

- Tony Featherstone goes through three stocks tipped to gain as rising inflation and interest rates force more consumers to switch to cheaper products and services.

- After a brutal seven-year bear market, James Dunn says that many factors are coalescing into strong drivers for uranium. Australia has more than one-third of the world’s total reserves and is the third-largest producer. James goes through three companies (one in Australia and two overseas) that he thinks look like great speculative buys at these prices.

- In Buy, Hold, Sell — Brokers Say, there were 7 upgrades and 9 downgrades in the first edition and 6 upgrades and 3 downgrades in the second edition.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks you should keep your eye on Commonwealth Bank (CBA).

- And finally, in Questions of the Week, Paul (Rickard) answers subscribers’ queries about how long bear markets typically last? Is ACDC a good way to play the EV/lithium boom? Why have the prices on bank hybrid securities fallen? And how do I claim a tax deduction for making a personal super contribution?

Our videos of the week:

- What is a cytokine storm and how is it connected to COVID-19? | The Check Up

- What stocks could benefit from higher interest rates? + Paul Rickard’s winning and losing stocks! | Switzer Investing (Monday)

- Will inflation really head up to 7%? + two end-of-year tax tips! | Mad about Money

- ST Wong looks at 3 interesting stocks! + Is rising interest rates an opportunity for investors? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 23 June 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday June 28 – Weekly consumer confidence index (June 26)

Tuesday June 28 – National, state and territory population (Dec 2021)

Wednesday June 29 – Preliminary retail trade (May)

Thursday June 30 – Job vacancies (May)

Thursday June 30 – Engineering construction activity (March quarter)

Thursday June 30 – Private sector credit (May)

Friday July 1 – CoreLogic Home Value index (June)

Friday July 1 – Manufacturing purchasing managers’ index (June)

Overseas

Monday June 27 – China industrial profits (May)

Monday June 27 – US durable goods orders (May)

Monday June 27 – US pending home sales (May)

Monday June 27 – US Dallas Fed manufacturing index (June)

Tuesday June 28 – US Advance goods trade balance (May)

Tuesday June 28 – US home prices (April)

Tuesday June 28 – US Conference Board consumer confidence (June)

Tuesday June 28 – US Richmond Fed manufacturing index (June)

Wednesday June 29 – US economic growth, GDP (March quarter)

Thursday June 30 – China purchasing managers’ indexes (June)

Thursday June 30 – US personal income and spending (May)

Thursday June 30 – US PCE core deflator (May)

Friday July 1 – China Caixin manufacturing index (June)

Friday July 1 – US construction spending (May)

Friday July 1 – US ISM manufacturing index (June)

Food for thought: “Invest for the long haul. Don’t get too greedy and don’t get too scared.” – (Shelby M.C. Davis)

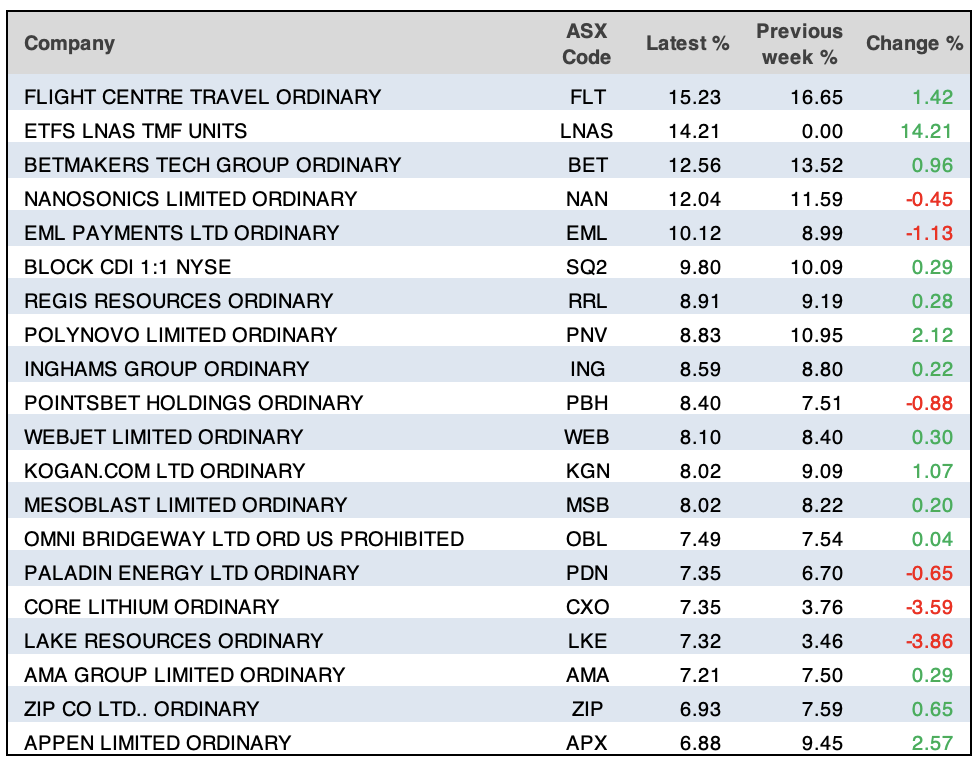

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

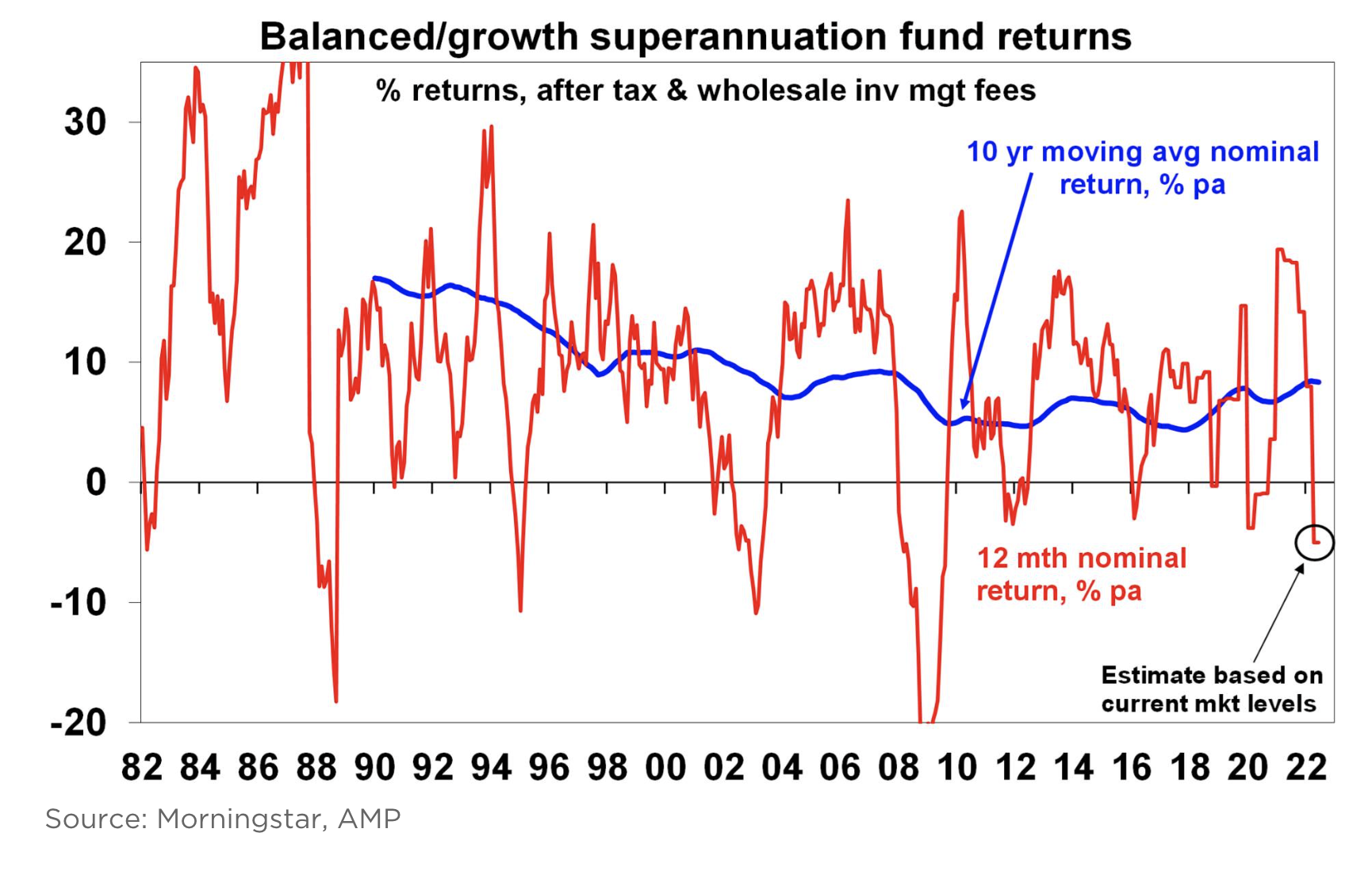

Chart of the week:

In our chart of the week, Shane Oliver of AMP Capital presents how Australian super funds are coping with the share market correction. Safe to super has seen better days

“Reflecting the sharp falls in share markets and in fixed interest investments (which suffer a capital loss as bond yields rise) balanced growth superannuation funds are down by 5% or so for this financial year to date and are on track for their first financial year loss since 2019-20 (due to the pandemic) [and] their worst financial year loss since the GFC,” Shane said.

Top 5 most clicked:

- What stocks are defying the sell-off? – Peter Switzer

- What is the future for AGL? – Paul Rickard

- 3 speculative uranium stocks – James Dunn

- My 3 stocks that flourish under inflation & rates rise conditions – Tony Featherstone

- You can still invest in infrastructure – here’s how – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.