Percentage changes to analysts’ average 12-month target prices were evenly balanced, as can be seen in the tables below, with Sigma Healthcare registering the largest increase. At the very end of the week, management at Sigma upgraded FY25 normalised EBIT guidance to $64-70m from $50-60m due to an improved operational performance, including strong execution of the new Chemist Warehouse supply contract which commenced on July 1, 2024. Two days prior, Macquarie raised its 12-month target price by 170% to $2.68, ahead of the February 12 merger implementation date between Sigma Healthcare and major partner and shareholder Chemist Warehouse Group. While forecasting an earnings compound annual growth rate (CAGR) of circa 38% over the next three years, the broker’s valuation remained -5% below the prevailing share price, and an Underperform rating was maintained.

Next up was News Corp; receiving a nearly 12% increase in average target from brokers after first half earnings came in ahead of consensus estimates.

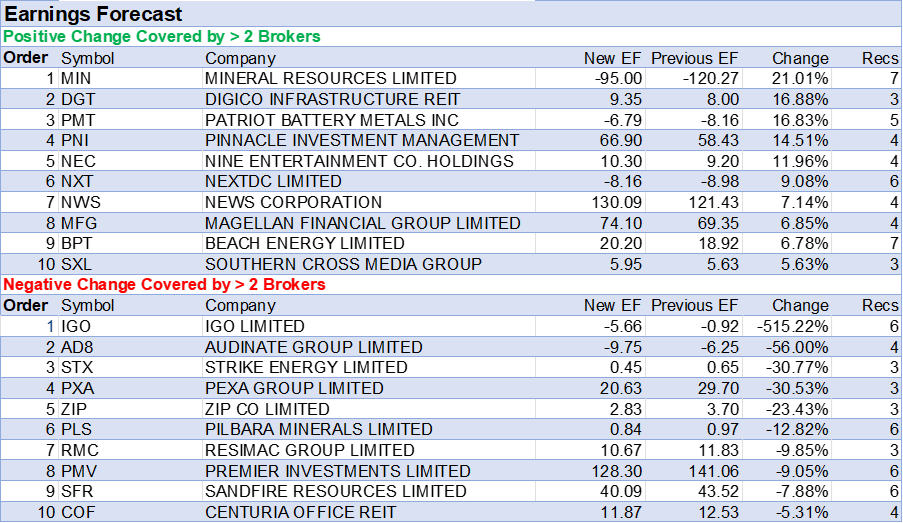

Meanwhile, some brokers are still refreshing research for December quarter operational reports in the Mining sector, with last week’s update by Bell Potter on Mineral Resources leading to the largest percentage upgrade to average earnings forecasts in the FNArena database. Management maintained production and cost guidance for all continuing operations, leading to only minor revisions to the broker’s production forecast, along with lower forecasts for the Australian dollar and lithium pricing.

In last week’s article, relating to the week ending Friday 31 January, HMC Capital received the largest percentage upgrade to average target price after UBS noted significant recent initiatives in both the digital infrastructure and energy transition space.

Regarding digital infrastructure, late last year management announced the establishment and listing of the DigiCo Infrastructure REIT, which incorporates data centres in Australia and the US.

Initiating research coverage early last week, Macquarie began with an Outperform rating and $5.33 target for DigiCo, believing risk is skewed to the upside for investors due to several positive near-term catalysts.

Critical to securing contracts with Australian government customers, management hopes for Hosting Certificate Framework (HCF) approval by mid-2025. Other catalysts include contract announcements and potential S&P Index inclusion in March 2025.

Should management execute on strategy, Macquarie forecasts double-digit earnings growth in the medium-term, underpinned by development and rent escalators.

Earnings forecast by brokers for Patriot Battery Metals also rose by nearly 17% last week after Macquarie resumed coverage following a period of research restriction.

Updating for last year’s announcement on a share placement to Volkswagen, this Outperform-rated broker arrived at a 56-cent target, down from 70 cents, after adjusting for share dilution.

Funds will be deployed into exploration, development, and feasibility studies at the hard rock lithium Shaakichiuwaanaan Project. In return, Volkswagen will be eligible for a 100ktpa, ten-year offtake agreement for its subsidiary PowerCo, including a five-year extension option.

Pinnacle Investment Management was next after releasing consensus-beating first half results, described as “flawless” by Ord Minnett. Affiliate strategies outperformed, experiencing strong inflows for fixed income, credit, and private markets.

Turning to the negative side of the ledger, here oOh!media received the largest percentage fall in average target price by analysts, followed by Aeris Resources.

Citing a decline in return on invested capital (ROIC) below cost of capital to 9%, UBS lowered its target for oOh!media to $1.25 from $1.85 and downgraded to Neutral from Buy.

Before turning more positive, the analysts would like to see evidence of stabilisation or reversal in the company’s significant market share losses over 2024.

For Aeris Resources, Hold-rated Ord Minnett lowered its target to 23 cents from 28 cents following “mixed” second quarter results.

While the Cracow gold mine and Mt Colin copper operations (both in Queensland) performed well, the Tritton copper mine in NSW provided a greater offset, with production and costs both missing the analyst’s forecasts by -27%.

Forecasting a more conservative long-term outlook for Tritton, Bell Potter (Buy) also lowered its target to 29 cents from 34 cents.

For the second week running, IGO Ltd received the largest percentage downgrade to average FY25 earnings forecasts by brokers, but the percentage change was exaggerated by small forecast numbers, and the average rose for FY26.

Only Bell Potter updated research on the company last week, raising its target to $4.20 from $4.00 on recent increases to spot lithium prices, while maintaining a Sell rating.

Audinate Group appears next on the earnings downgrade table below after Morgan Stanley highlighted limited transparency around key drivers for the stock ahead of upcoming first half results. More positively, the analysts consider challenges for the group are cyclical rather than structural.

Strike Energy was next after December quarter production and revenue from the company’s only producing gas field, Walyering in the Perth Basin, fell short of Bell Potter’s estimates.

The broker reduced its production estimates for Walyering, leading to a reduction in FY25 and FY26 EPS estimates by -30% and -55% respectively. The broker’s target price was lowered to 27c from 29c, and its rating was downgraded to Hold from Buy.

While we are discussing the Perth Basin, Beach Energy also reported ongoing travails at its Waitsia operations, earning two ratings downgrades from separate brokers in the FNArena database.

In the good books

Upgrades

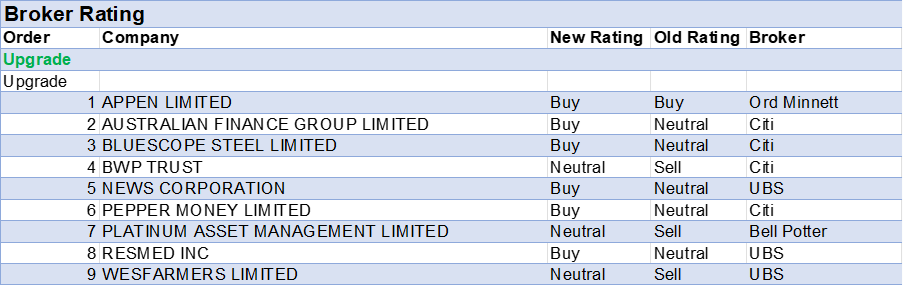

AUSTRALIAN FINANCE GROUP LIMITED ((AFG)) was upgraded to Buy from Neutral by Citi. B/H/S: 1/1/0

With earlier-than-anticipated interest rate cuts, Citi believes there is “renewed interest” in non-bank financial institutions (NBFIs).

The companies will benefit from lower interest rates, but the key factor, the broker explains, is the improving outlook for funding, irrespective of rate cuts, as the spread between wholesale and deposit funding is improving. Citi also sees increased ability for issuance at the wholesale level.

The broker upgrades Australian Finance Group to Buy from Neutral. Target price rises to $1.85 from $1.65.

APPEN LIMITED ((APX)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 1/0/0

Ord Minnett upgrades Appen to Buy from Accumulate with a higher target price of $3.30 from $2.80.

The broker believes the sell-off in the company’s share price on the day of the December quarter update, which was viewed as “robust,” had more to do with the broader sell-off in technology stocks around DeepSeek concerns.

Ord Minnett views Appen’s prospects as good, with the expected 2024 EPS loss at -0.5c to -0.7c post the update.

BLUESCOPE STEEL LIMITED ((BSL)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/1/0

Citi expresses a preference for BlueScope Steel over iron ore miners and raises its target to $24 from $21, while upgrading to Buy from Neutral.

Port Kembla exports will likely return to profit, as the broker forecasts lower iron ore prices in 2026 plus lower China steel exports/higher Asian hot rolled coil (HRC) pricing.

Citi expects China will curtail steel output and sees potential for broad-based US steel import tariffs plus an expanded US infrastructure spend.

BWP TRUST ((BWP)) was upgraded to Neutral from Sell by Citi. B/H/S: 0/3/0

Maintaining its $3.40 target, Citi upgrades BWP Trust to Neutral from Sell after assessing fair value for the REIT, following further analysis of 1H results.

The broker describes a stable growing business, supported by a strong underlying tenant covenant with Bunnings warehouses.

The interim dividend of 9.20cps matched forecasts by the broker and consensus.

Citi highlights the net tangible asset (NTA) metric of $3.92 places the stock on a share price discount to NTA of around -6%, with an improving cap rate of 5.43%.

NEWS CORPORATION ((NWS)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/1/0

UBS previews stocks in the Australian Media sector ahead of February results and updates forecasts in response to ongoing weakness in December SMI TV advertising spend data.

The analyst highlights TV spending remains challenged, while Out-Of-Home advertising has performed well.

For News Corp, the broker raises its target to $64.50 from $51.00 and upgrades to Buy from Neutral, expecting recognition by the market of the Dow Jones growth profile will address current undervaluation.

PEPPER MONEY LIMITED ((PPM)) was upgraded to Buy from Neutral by Citi. B/H/S: 2/0/0

With earlier-than-anticipated interest rate cuts, Citi believes there is “renewed interest” in non-bank financial institutions (NBFIs).

The companies will benefit from lower interest rates, but the key factor, the broker explains, is the improving outlook for funding, irrespective of rate cuts, as the spread between wholesale and deposit funding is improving. Citi also sees increased ability for issuance at the wholesale level.

The broker upgrades Pepper Money to Buy from Neutral.

PLATINUM ASSET MANAGEMENT LIMITED ((PTM)) was upgraded to Hold from Sell by Bell Potter. B/H/S: 0/1/1

Bell Potter raises its target for Platinum Asset Management to 70c from 59c and upgrades to Hold from Sell after adjustments to the analysts’ financial model results in higher forecast earnings.

The broker is not getting too excited, noting revenue is still falling and new growth initiatives are yet to deliver.

RESMED INC ((RMD)) was upgraded to Buy from Neutral by UBS. B/H/S: 4/1/0

Post a better-than-expected Q2 performance from ResMed, UBS believes the market is too conservative on US device sales growth, suggesting demand could potentially return to pre-covid levels.

One suggestion made is GLP-1 and wearables are likely to drive incremental patient demand though any impact remains hard to quantify, the broker acknowledges.

It is the broker’s assessment the shares are trading at a discount to US peers, hence further EPS upgrades can trigger a re-rating.

UBS’s target is raised to US$290 from US$255. Upgrade to Buy from Neutral.

WESFARMERS LIMITED ((WES)) was upgraded to Neutral from Sell by UBS. B/H/S: 0/3/2

UBS raises its target for Wesfarmers to $76 from $69 and upgrades to Neutral from Sell due to the broker’s higher earnings (EBT) forecasts for Bunnings.

Bunnings is the key share price driver for Wesfarmers, highlights the analyst, accounting for 56% of pre-tax earnings in FY24.

Management commentary at FY24 results left the market concerned around growth at Bunnings, but the broker is now confident Bunnings’ sales growth can accelerate, and return on capital (ROC) can expand.

In the bad books: downgrades

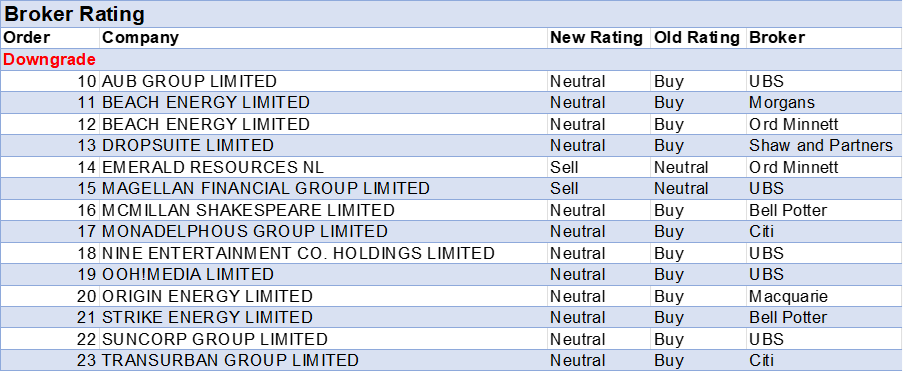

AUB GROUP LIMITED ((AUB)) was downgraded to Neutral from Buy by UBS. B/H/S: 3/1/0

UBS considers the insurance sector, highlighting global CAT rates declined by -7% at January 1 renewals, the first fall since 2017.

The broker suggests insurance pricing with Lloyd’s was most impacted in the last soft cycle between 2013-2017.

With record-high returns on equity, UBS expects pricing to slow more considerably in 2025, with a decline in Lloyd’s rates and commercial/personal rates easing to inflation levels, with further “moderation” in 2026.

AUB Group is downgraded to Neutral from Buy with a lower target price of $33.30 from $36.80. The company has the highest exposure to Lloyd’s among companies under coverage at 24%.

UBS lowers EPS estimates by -3.5% in FY25 and -4.7% in FY26.

BEACH ENERGY LIMITED ((BPT)) was downgraded to Hold from Add by Morgans and to Hold from Buy by Ord Minnett. B/H/S: 2/3/2

Morgans believes Beach Energy reported “disappointing” 1H25 earnings, with the dividend announced lower than expected and ongoing travails with Waitsia. The broker believes the narrowing of FY25 production guidance could result in consensus downgrades.

The dividend came in at 11% of pre-tax free cash flow, well below management’s 40%-50% payout target, the analyst states. With increased spending expected in 2H25, Morgans believes the company will face pressure to increase the dividend over the period into softer free cash flow.

Morgans highlights concerns over the reserve life at just over seven years.

The broker downgrades Beach to Hold from Add and lowers the target price to $1.55 from $1.75.

Ord Minnett downgrades Beach Energy to Hold from Buy, with the target price falling to $1.75 from $1.85 due to concerns over dividend policy and expansion plans.

The broker believes Beach announced a “disappointing” 1H25 result, with a lower-than-expected dividend at a 16% payout ratio compared to the usual 40%-50% payout ratio of cash flow, ex-capex. This is not viewed positively by the analyst.

Management reduced the upper end of FY25 guidance due to a lower contribution from Otway and nothing from Waitsia, the analyst explains, and also suggests the final dividend would increase the payout ratio to meet its historical policy.

This conflicts with the view by Ord Minnett that management has held back on the 1H25 dividend, sustaining cash on hand of $150m for possible M&A or for Otway.

DROPSUITE LIMITED ((DSE)) was downgraded to Hold from Buy by Shaw and Partners. B/H/S: 0/2/0

A proposed takeover by NinjaOne LLC for Dropsuite was announced with the company’s 4Q24 update.

Shaw and Partners notes the company’s 4Q annual recurring revenue advanced 37% in USD terms, and users grew 42% year-on-year. The company ended the period with almost 5,000 indirect partners generating an average US$6,300 per annum, the broker states.

Rating moves to Hold from Buy, High Risk, with the analyst bemoaning the loss of ASX tech stocks acquired over the past few years. The target rises to $5.90 to align with the proposed cash offer.

No change to earnings forecasts.

EMERALD RESOURCES NL ((EMR)) was downgraded to Sell from Hold by Ord Minnett. B/H/S: 0/0/1

Emerald Resources is downgraded to Sell from Hold with an unchanged target price of $3.50 by Ord Minnett, as much of the “investment attraction” is discounted in the share price, the analyst states.

The company’s 2Q25 update met the pre-released numbers on January 6, with the Cambodian mine Okvau continuing to perform well.

Management is expected to announce a final investment decision on Dingo Range (WA) and the Memot project in Cambodia in 2025, with a target of raising gold output to more than 300kozpa in five years from 100koz per annum currently, the broker explains.

Sell rated. Target price $3.50.

MAGELLAN FINANCIAL GROUP LIMITED ((MFG)) was downgraded to Sell from Neutral by UBS. B/H/S: 0/2/2

UBS lowers its target price for Magellan Financial to $10.30 from $10.90 and downgrades to Sell from Neutral, citing the likely review by rating agencies and consultants following Gerald Stack’s departure as Head of Investments in July.

Stack led Magellan’s Listed Infrastructure business for 18 years, and the broker now sees an increased risk of outflows, which could impact management fee revenue and funds management profit (PBT) by -6% and -10%, respectively.

MCMILLAN SHAKESPEARE LIMITED ((MMS)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 4/1/0

With more challenging comps to recycle from a year earlier and increasing risks of slowing volumes and a reversal in EV sales, Bell Potter downgrades McMillan Shakespeare to Neutral from Buy with a lower target price of $15.80 from $21, as earnings risks rise.

While recent car sales data support sales growth for the company in 1H25, the analyst’s attention is focused on the order book and cost management, which are believed to be approaching an inflection point.

Bell Potter lowers EPS forecasts by -13% and -10% for FY25/FY26, respectively.

MONADELPHOUS GROUP LIMITED ((MND)) was downgraded to Neutral from Buy by Citi. B/H/S: 1/4/0

Citi anticipates Monadelphous Group’s 1H results will reflect a favourable environment for contractors, with revenue forecast to rise by 4.8% and the earnings (EBITDA) margin to improve by 30 basis points to 6.4%.

Secured work for FY25 stands at approximately $1.7bn, already covering 78% of the broker’s full-year revenue forecast, with further upside potential from ongoing contract wins.

Management has guided to a 1H profit of $40-43m, including a $7m post-tax uplift from non-operating items, which Citi considers largely one-off.

The target rises to $16.30 from $16.20 on a valuation roll-forward, but Citi downgrades to Neutral from Buy in the belief upside is largely captured in the current share price.

NINE ENTERTAINMENT CO. HOLDINGS LIMITED ((NEC)) was downgraded to Neutral from Buy by UBS. B/H/S: 2/2/0

UBS previews stocks in the Australian Media sector ahead of February results and updates forecasts in response to ongoing weakness in December SMI TV advertising spend data. The analyst highlights TV spending remains challenged, while Out-Of-Home advertising has performed well.

The broker lowers the target for Nine Entertainment to $1.45 from $1.65 and downgrades to Neutral from Buy, noting a tricky combination of escalating content costs and a very challenging macroeconomic advertising environment.

One potential upside risk is the current strategic review by management, which, UBS suggests, could help unlock value within the Domain ((DHG)) ownership.

OOH! MEDIA LIMITED ((OML)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/2/0

UBS previews stocks in the Australian Media sector ahead of February results and updates forecasts in response to ongoing weakness in December SMI TV advertising spend data.

The analyst highlights TV spending remains challenged, while Out-Of-Home advertising has performed well.

The broker downgrades oOh!media to Neutral from Buy, citing a decline in return on invested capital (ROIC) below the cost of capital to 9%. The target price is lowered to $1.25 from $1.85.

UBS seeks evidence of stabilisation or reversal in the company’s significant market share losses in 2024 before turning more positive.

ORIGIN ENERGY LIMITED ((ORG)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 3/1/1

Macquarie downgrades Origin Energy to Neutral from Outperform on the back of a weaker 2Q25 production outlook from APLNG, the analyst explains.

The broker points to 2Q25 production and sales for APLNG as “sound,” with improved pricing assisting, but the company flagged lower production, and overall performance has not recovered post recent shutdowns.

Management flagged higher tax, but it was more elevated than the analyst expected. Octopus has won more customers, some 0.68m compared to 1Q25; better than anticipated.

Macquarie notes customer numbers in the energy market were “reasonable.”

The broker lifts EPS forecasts by 5.3% in FY25 and 5.7% in FY26, and the target price slips to $10 from $10.35 due to tax and lower APLNG expectations.

STRIKE ENERGY LIMITED ((STX)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 1/2/0

Strike Energy’s 2Q25 production of 2.13PJe from its only producing field Walyering and revenue of $18m fell short of Bell Potter’s estimates of 2.55PJe and $18m respectively.

The broker notes management’s announcement that current project developments, in particular South Erregulla and West Erregulla, would not be impacted by the strategic review process. However, all options are on the table and divestments will be considered.

The broker has moderated its base case for Walyering production estimates, leading to a reduction in FY25 and FY26 EPS estimates by -30% and -55% respectively. Target price cut to 27c from 29c, and rating downgraded to Hold from Buy.

SUNCORP GROUP LIMITED ((SUN)) was downgraded to Neutral from Buy by UBS. B/H/S: 3/3/0

UBS considers the insurance sector, highlighting global CAT rates declined by -7% at January 1 renewals, the first fall since 2017.

The broker suggests insurance pricing with Lloyd’s was most impacted in the last soft cycle between 2013-2017.

With record-high returns on equity, UBS expects pricing to slow more considerably in 2025, with a decline in Lloyd’s rates and commercial/personal rates easing to inflation levels, with further “moderation” in 2026.

Suncorp Group is downgraded to Neutral from Buy. Target price lifts to $20.70 from $20.20.

The group is trading at a 13% premium to the 10-year average valuation. The broker lowers EPS estimates by -1.3% in FY25 and lifts FY26 by 0.7%.

UBS’ sector preference is for QBE Insurance.

TRANSURBAN GROUP LIMITED ((TCL)) was downgraded to Neutral from Buy by Citi. B/H/S: 2/4/0

Citi believes the macro overview for infrastructure is being positively influenced by the prospect of lower interest rates, so company-specific “bottom-up” analysis will be important.

The broker downgrades Transurban Group to Neutral from Buy due to concerns over the NSW toll review and possible litigation consequences for ConnectEast, with scope to affect 1H25 results.

Target price is lowered to $13.80 from $14.20.

In the sector, Auckland International Airport ((AIA)) is the top pick and Buy rated with upside potential to earnings, followed by Atlas Arteria ((ALX)), Buy rated/High risk. Transurban Group is the least preferred stock.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.