Trump tariffs and fears around US inflation not permitting the Federal Reserve to cut rates as Wall Street expected has spooked stock markets. This week’s revelations will either help or hurt stock prices. And then there’ll be the latest tariff talk from the US President, which is starting to unsettle those players who had been buying into the Trump rally.

The President has revealed new 25% tariffs on all steel and aluminium imports into the U.S., on top of existing metals duties, in another major escalation of his trade policy overhaul. This isn’t great news for BlueScope, who as the AFR points out “…has $5 billion of investments in the United States and makes more than half of its overall profits from its North American operations”.

Rio also makes aluminium in Canada, which is then sold into the US.

These tariffs are becoming a headwind for investors. I want to test out whether I should remain solid with the companies that I think look like great value. Remember, I like to play the long-term contrarian and be willing to buy quality companies when the short-term driven market wants to sell off for whatever reasons.

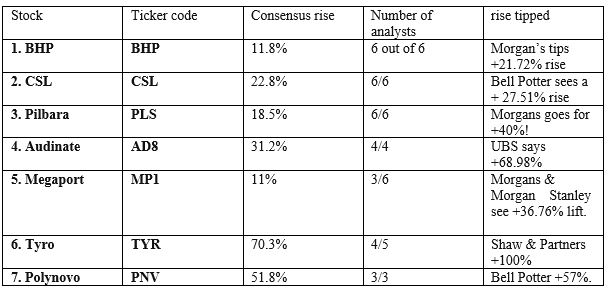

Here is my crop of quality companies that remain out of favour with the market, and beside their names I will look at the analysts’ consensus rise, the number of analysts supporting the stock and the biggest tipped rise.

So, here goes:

I could find more but this is a core of quality businesses that we need a leg up for to remain solid with them or to consider them as a worthwhile play.

- The run down on BHP

Morgans was the biggest supporters of BHP. This is what FNArena reported from the broker: “Morgans saw BHP Group releasing a strong Q2 operating performance, with multiple assets producing at the upper end of guidance. Copper South Australia is the only one for which guidance has been lowered. Jansen Stage 1 remains on schedule and on budget, the broker notes. Management’s guidance for net debt between US$11.5-12.5bn proved higher than the broker’s US$10.8bn estimate.”

The target price has increased to $49.10 from $47.90, despite lowered forecasts, compared to a current share price of $40.22.

- What about CSL?

Now to CSL, which has had trouble beating $300 for a couple of years, yet the consensus target price is $332.12, which would be a 22% rise, if the analysts are right.

Citi is a big fan. This is what FNArena told us: “Citi has used a healthcare sector preview to the February reporting season to re-iterate its Top Pick remains CSL, which is seen representing a double-digit EPS growth outlook at a reasonable valuation.

“The broker believes the risk for a guidance change is low, though FX headwinds could be stronger as USDEUR continues to strengthen. Also, the pressure is on for the new management (execution is key, says the broker) with few catalysts on the horizon outside of financial results.

Citi’s target price is $345.

- Next to Pilbara Minerals

Now to Pilbara Minerals, which is a victim of the lithium industry’s temporary challenges. Morgan’s can see a 40% rise and this is why: “Morgans assesses a “solid” 2Q operational update by Pilbara Minerals. The analyst highlights slight beats across all metrics and notes the P1000 expansion project is on track and budget with full ramp-up expected by mid-2025.

“Spodumene production of 188.2kt beat the consensus forecasts by 4%, while sales of the product were an 11% beat, and 9% ahead of the broker. FY25 production, cost and capex guidance has been maintained.

“Morgans assures investors cash flow improvements will be realised over 2025, given 2Q operating cash flow was negative when including capitalised mine development costs and sustaining capex.”

The current price for PLS is $2.25 and Morgans tips a $2.66 share price ahead.

- Comments on Audinate

Audinate is a quality tech business of the future, while the likes of Xero and NEXTDC are already there. The biggest supporter for AD8 is UBS, which sees a 69.2% rise ahead. This is how FNArena interpreted the UBS view on AD8: “UBS maintains its faith in the longer-term fundamentals of Audinate Group but recognises near-term uncertainties need to be worked through after a “soft” 1Q update by management.

“The analysts always felt Q1 would be the weakest quarter due to prior over-ordering by customers. Lower gross profit guidance was the result of ongoing challenges including softer demand, shorter lead times and increased inventory, explains the broker.

“Incremental positives, according to UBS, include Dante certification and training programs remaining strong, and 2H new AVIO products and a premium version of Dante Virtual Scorecard are expected to contribute to 2H25 earnings.”

AD8 is now at $7.21 but UBS is looking for a $12.20 target price!

- What’s the state-of-play with Megaport?

Megaport (MP1) has struggled lately but both Morgan Stanley and Morgans both see a 36.46% rise ahead. This is what Morgan Stanley thinks about MP1: “While Megaport’s FY24 revenue and earnings (EBITDA) met expectations, Morgan Stanley explains FY25 guidance for both measures missed consensus estimates by -8% and -18%, respectively.

“The broker attributes the weaker revenue outlook to zero customer logo growth, ports and services growth below expectations, and declining trends across customer cohorts.”

The target price is $12.50, while today’s share price is $10.14.

- Tyro – still waiting!

Now to the bane of my investing life — Tyro! The biggest fan is Shaw & Partners. This is what this broker thinks about TYR: “FY24 results from Tyro Payments reveal discretionary conditions continue to be challenging, although Shaw and Partners notes long-term guidance to FY27 has been provided, with EBITDA growth of 12-17%.

“The broker considers guidance conservative with upside risk should macro conditions improve. Churn remains sticky.”

I find it hard to dump this stock, with the above view and that of Macquarie, which maintains an “outperform” rating.

- More information on Polynovo

Polynovo is not one of my holdings but I am wondering if it’s a quality company at good value. The 52.6% consensus rise has got me interested, as did this from the most enthusiastic analyst for the company, namely Bell Potter. However, their view was delivered in August.

I prefer Morgan’s assessment in late November. This is what FNArena found: “Morgans notes PolyNovo’s share price has declined by -24% since 30 September, with the recent AGM trading update offering no support.

“Consensus revenue forecasts for FY25 are $135.1m, reflecting 28% growth, while Morgans projects a more modest 18.4% increase to $125.2m, weighted towards the second half, with 59% of revenue expected in 2H25 compared to 53% in 2H24.

“The broker anticipates PolyNovo can achieve 20% growth annually over the next three years, driven by expansion into new regions like India and additional use cases. The third manufacturing facility, expected to support $500m in additional sales, should be operational by the end of 2025.”

Morgans see this as a “buying opportunity.”

And finally…

I think all the companies above deserve the same “buy now and profit later” tag. Let’s keep an eye on these seven stocks.