In the first week of the reporting season ending Friday February 9, 2024, there were three rating upgrades and nine downgrades to ASX-listed companies by brokers covered daily by FNArena. Percentage downgrades by brokers to average earnings forecasts were broadly similar to upgrades. Positive and negative adjustments to 12-month target prices were also fairly even, as can be seen in the tables below.

CSR was the only company in the FNArena database to receive more than one change to rating, with Morgans downgrading to Hold from Add, and UBS to Sell from Buy, as the share price had rallied by 26% over the prior six months.

UBS cautioned over near-term sales volumes as it’s unlikely soft housing, as well as weak alterations and additions works, will be offset by non-residential strength.

At the same time, the broker raised its full year earnings per share forecast by 17% after management explained settlement of Stage 3B at the company’s Horsley Park industrial estate has occurred a few months earlier than expected, due to faster completion of development works.

Over the development’s lifespan, Morgans notes CSR has achieved a 74% increase in the average sale rate, indicating the business could be delivering around 60% earnings (EBIT) margins at West Schofields and Badgerys Creek, when they are developed in coming years.

CSR also received the second-largest percentage increase to average earnings forecast by brokers last week as a result of the Horsley Park update.

The largest earnings upgrade went to Chalice Mining after Macquarie incorporated second quarter results into forecasts. Due to weak market conditions, management at Chalice has reduced 2024 expenditures by around -40% relative to 2023.

The company has indicated it continues to progress potential strategic partners for the Gonneville nickel-copper-platinum project in Western Australia and is aiming to identify a preferred partner in early-2024.

Macquarie also altered its assumed equity raising for Gonneville development to $700m at 85cps from $700m at $1.55cps. The broker’s target was reduced by -33% to $2.00.

The average target price in the database for Pinnacle Investment Management increased by over 11% last week. While the first half profit result missed the consensus forecast by -7%, Neutral-rated UBS noted strong revenue momentum at the end of the half.

This broker explained funds under management (FUM) of $100bn at year’s end was 9% higher than the first half average, and there were stronger net inflows in retail and international. Inflows related to Emerging Markets (Aikya), Alternatives (Coolabah) and Private Credit (Metrics).

Morgans (Buy) suggested a step-up in FY25 and FY26 earnings for Pinnacle could arise from multiple sources including improved flows, and material operating leverage on improved FUM.

Management noted ongoing investment in medium-term opportunities has moderated short-term profits, but also anticipated investment costs will reduce in the second half, allowing revenues to build.

News Corp was next, with an average target price increase over 9%, after brokers reviewed first half results showing an earnings beat of 6.2% against the consensus forecast.

Morgan Stanley highlighted an impressive ongoing turnaround for Books, the strong cyclical recovery underway at REA Group, and ongoing solid growth for Dow Jones.

Macquarie was more upbeat on the Dow Jones unit, describing it as “firing on all cylinders”, as the digital information businesses continue to perform.

Management alluded to advanced discussions with AI providers around receiving monetisation for the company’s content, which the broker interpreted as presenting upside risk for earnings.

After raising its News Corp’s target to $41.85 from $37, Macquarie upgraded its rating to Outperform from Neutral.

Ord Minnett (Lighten) sits in the sceptical camp due to valuation concerns, especially given the recent rally for technology stocks is behind much of the recent strong rise in News Corp’s share price.

Average FY24 earnings forecasts in the database for Transurban Group fell last week after brokers reviewed the latest operational update. Traffic growth is tracking below Citi’s expectations, which management attributed to construction impacts on toll roads. Ord Minnett noted like-for-like traffic has recovered to pre-pandemic levels, except for Sydney, due to the construction issue.

A lack of upgrade for dividend guidance disappointed, but Macquarie assumed it reflects the impact of roadworks continuing to have a drag on organic growth, and the pressure from refinancings adding to interest expense. Citi continues to see upside to Transurban’s full year dividend guidance.

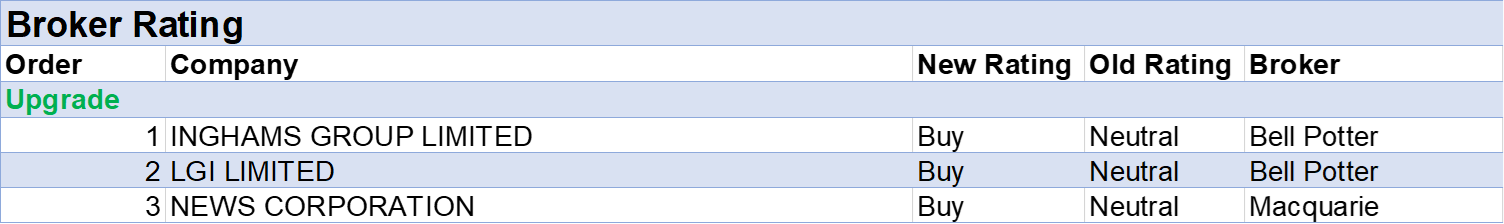

In the good books: upgrades

1. INGHAMS GROUP LIMITED ((ING)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 2/3/0Bell Potter anticipates the recent decline in grain and soymeal prices will prove an emerging tailwind for Inghams Group in FY25. The broker points out given grain prices lead feed costs by around 6-9 months, the benefits are likely to be seen in the coming financial year.

As per Bell Potter, an improved outlook for the upcoming winter crop may also suggest a slightly more bullish feed costs forecast might be supported.

With the stock having de-rated -10% from pre-covid prices while improving business performance and prospects, the broker sees it as an opportunity to gain exposure to the sector.

The rating is upgraded to Buy from Hold and the target price increases to $4.90 from $3.95.

2. LGI LIMITED ((LGI)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/1/0

LGI has announced a long-term gas management agreement with Bingo Industries for the installation of landfill gas extraction infrastructure, and the installation, operation, and ownership of a 4m watt renewable on-site power station.

Under an initial 15-year agreement, electricity generated on site will be sold to Bingo Industries, but Bell Potter points out options for two 5-year extensions on the contract.

The company has outlined intentions to develop this project in two stages, starting with the installation of the power station. Capital expenditure is estimated at -$16.5-18.5m over the next fifteen months and will be funded by existing and new debt facilities.

Phase one investment is expected to return annual earnings between $3.0-3.5m, which Bell Potter expects to impact from FY26. The rating is upgraded to Buy from Hold and the target price increases to $2.55 from $2.32.

3. NEWS CORPORATION ((NWS)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 3/0/0

News Corp’s Dec Q earnings were a 22% beat to Macquarie forecasts and are labelled as strong across all businesses. Advertising exposure and consumer-facing subscriptions were more resilient than expected, and cost discipline helped operating leverage.

The digital information businesses continue to perform, the broker notes, with Dow Jones “firing on all cylinders”. News Corp indicated it is in advanced discussions with AI providers around receiving monetisation for its content, which suggests upside risk.

Rolling forward reduced balance sheet risk and earnings changes leads to a target increase to $41.85 from $37.00, and an upgrade to Outperform from Neutral.

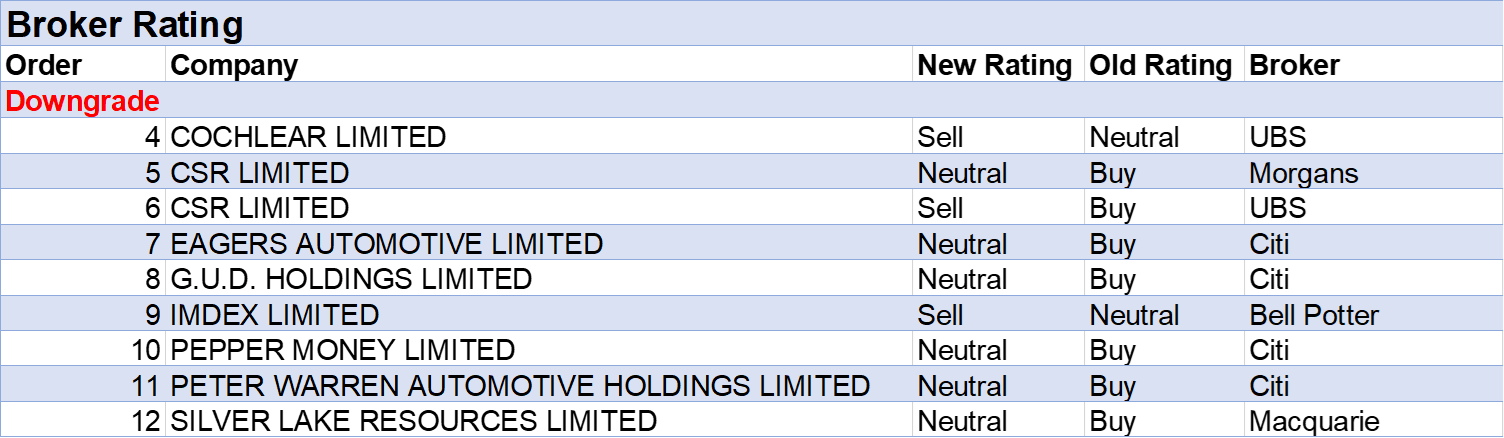

In the not-so-good books: downgrades

1. COCHLEAR LIMITED ((COH)) was downgraded to Sell from Neutral by UBS. B/H/S: 1/0/5

UBS has downgraded Cochlear to Sell from Neutral while lowering its price target to $240 from $260. The move is related to Moderna’s mRNA-1647 vaccine, still in phase III trials but any success is expected to impact on Cochlear’s business/growth.

Moderna’s vaccine-in-development potentially addresses CMV, a virus transmitted in utero that accounts for an estimated 20% of childhood deafness, the broker explains.

As the broker has taken the view that 5-6% of top line growth for Cochlear could be at risk, future growth projections have been halved; to circa 6.5% growth per annum.

With the market yet to catch up on this freshly emerging risk, UBS has decided to shift to Sell. Ironically, short-term forecasts have been lifted.

2. CSR LIMITED ((CSR)) was downgraded to Sell from Buy by UBS and to Hold from Add by Morgans. B/H/S: 0/5/2

UBS has downgraded to a Sell rating on CSR following the stock’s share price performance, lifting 26% in the past six months. The broker considers the stock a high quality exposure to Australian residential housing, but believes risk now outweighs reward.

According to the broker, risk remains around near-term sales volumes, and it is unlikely soft housing and alterations and additions works will be offset by non-residential strength.

The broker does lift its full year earnings per share forecast 17% on the announced increased contracted property earnings. The rating is downgraded to Sell from Buy, and the target price increases to $6.60 from $6.50.

Settlement of Stage 3B at CSR’s Horsley Park industrial estate has occurred a few months earlier than expected due to faster completion of development works resulting in lower site development costs, explains management.

Over the development’s lifespan, Morgans notes CSR has achieved a 74% increase in the average sale rate.

This news suggests to Morgans the business could be delivering around 60% earnings (EBIT) margins at West Schofields and Badgerys Creek, when they are developed in coming years.

As the share price has rallied by around 18% since last-November, the broker lowers its rating to Hold from Add. The target rises to $6.90 from $6.75.

3. EAGERS AUTOMOTIVE LIMITED ((APE)) was downgraded to Neutral from Buy by Citi. B/H/S: 3/4/0

Increased supply and slowing demand are starting to adversely impact margins in the A&NZ Auto Parts & Equipment space, cautions Citi. In particular, it’s felt those companies exposed to new car sales are likely to encounter challenging operating conditions in 2024.

The broker’s rating for Eagers Automotive is downgraded to Neutral from Buy due to downside risks should consensus estimates be revised down on a softer outlook for dealership margins.

The target falls to $13.25 from $17.90. The analysts feel profit (PBT) margins could be impacted by a raft of issues including greater discounting intensity across brands, increasing reliance on fleet sales and lower finance penetration.

4. G.U.D. HOLDINGS LIMITED ((GUD)) was downgraded to Neutral from Buy by Citi. B/H/S: 4/1/0

Increased supply and slowing demand are starting to adversely impact margins in the A&NZ Auto Parts & Equipment space, cautions Citi (see Eagers Automotive above

The broker downgrades its rating for G.U.D. Holdings to Neutral from Buy on lower car sales estimates, though the current valuation appears undemanding. Trading-down by customers and deferral of purchases are considered areas of concern.

The target falls to $12.90 from $13.57.

5. IMDEX LIMITED ((IMD)) was downgraded to Sell from Hold by Bell Potter. B/H/S: 3/0/1

Bell Potter expects ongoing weakness in global exploration activity, in part due to waning junior exploration activity, and downgrades its rating for Imdex to Sell from Hold.

Ongoing price declines for lithium and nickel are not helping exploration activity by major and junior customers, explain the analysts, and could lead to lower near-term instrument demand.

The target falls to $1.50 from $1.60.

6. PEPPER MONEY LIMITED ((PPM)) was downgraded to Neutral from Buy by Citi. B/H/S: 0/2/0

Despite a less than compelling fundamental outlook, there has been a strong rally on the ASX for shares prices of non-banking financial institutions (NBFI) in the lead up to the results season, observes Citi.

The broker points out this uplift for share prices is a replay of the past four reporting seasons, all of which have resulted in disappointment and retracement for share prices upon the released results. It’s felt history may repeat.

While the rating for Pepper Money is downgraded to Neutral from Buy on valuation, Citi still believes shares are cheap relative to peers. Target $1.40.

This research was released yesterday by Citi.

7. PETER WARREN AUTOMOTIVE HOLDINGS LIMITED ((PWR)) Downgrade to Neutral from Buy by Citi. B/H/S: 3/1/0

Increased supply and slowing demand are starting to adversely impact margins in the A&NZ Auto Parts & Equipment space, cautions Citi (see Eagers Automotive above

The broker downgrades its rating for Peter Warren Automotive to Neutral from Buy and the target falls by -28% to $2.50 on lower earnings forecasts. The analyst also applies a greater relative valuation discount due to the company’s geographic locations and smaller scale.

8. SILVER LAKE RESOURCES LIMITED ((SLR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/1/0

Macquarie expects shares of Silver Lake Resources will now trade in line with those of Red 5 ((RED)) now that the two companies will merge via a scheme of arrangement.

The rating is downgraded to Neutral from Outperform and the target falls to $1.20 from $1.50, while the analyst’s forecasts remain unchanged.

In the broker’s view, the merger will create a gold business of notable scale capable of producing 400koz per annum.

The scheme will see shareholders of Silver Lake emerge with 48.3% of the merged entity and Red 5 shareholders the balance.

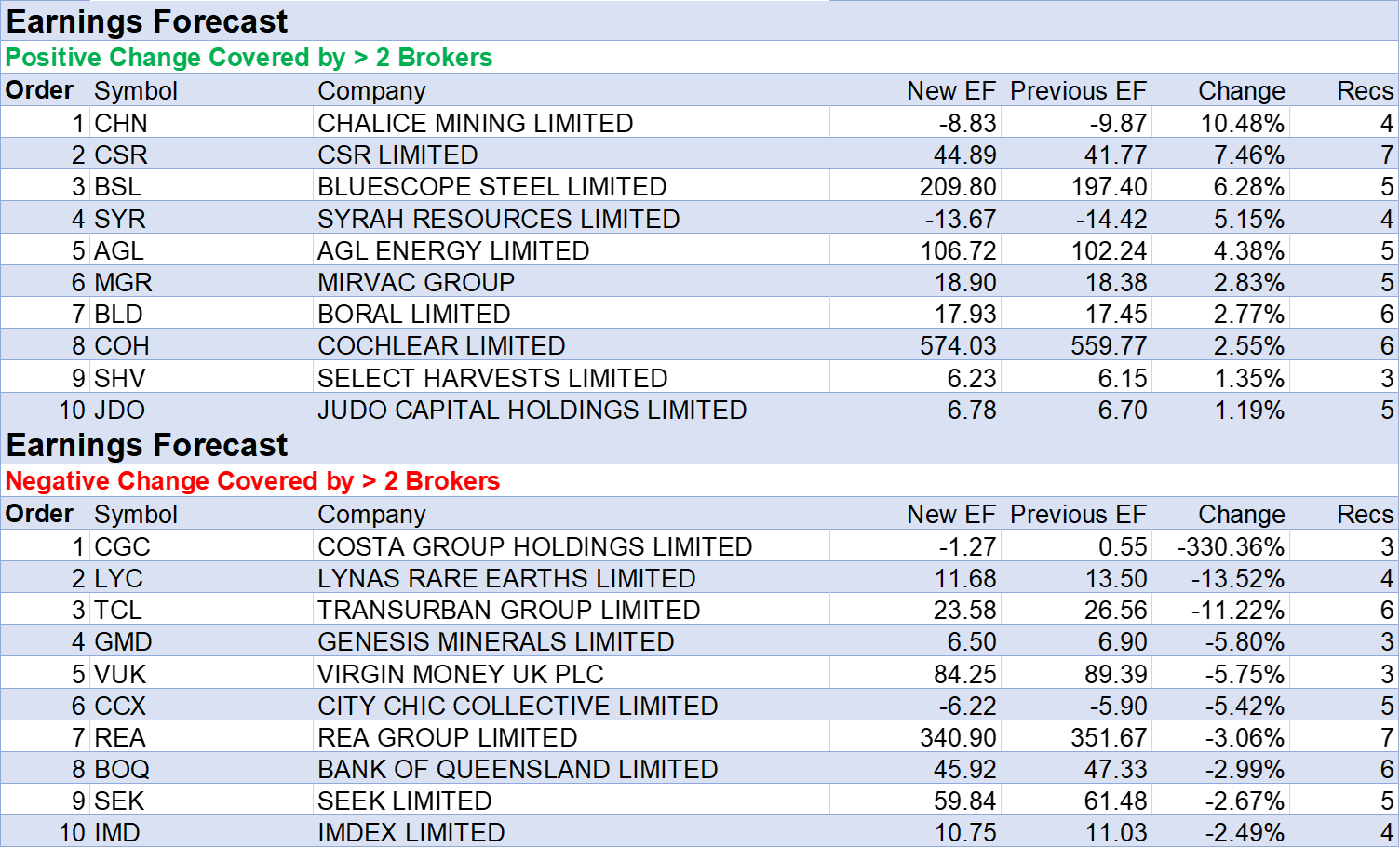

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.