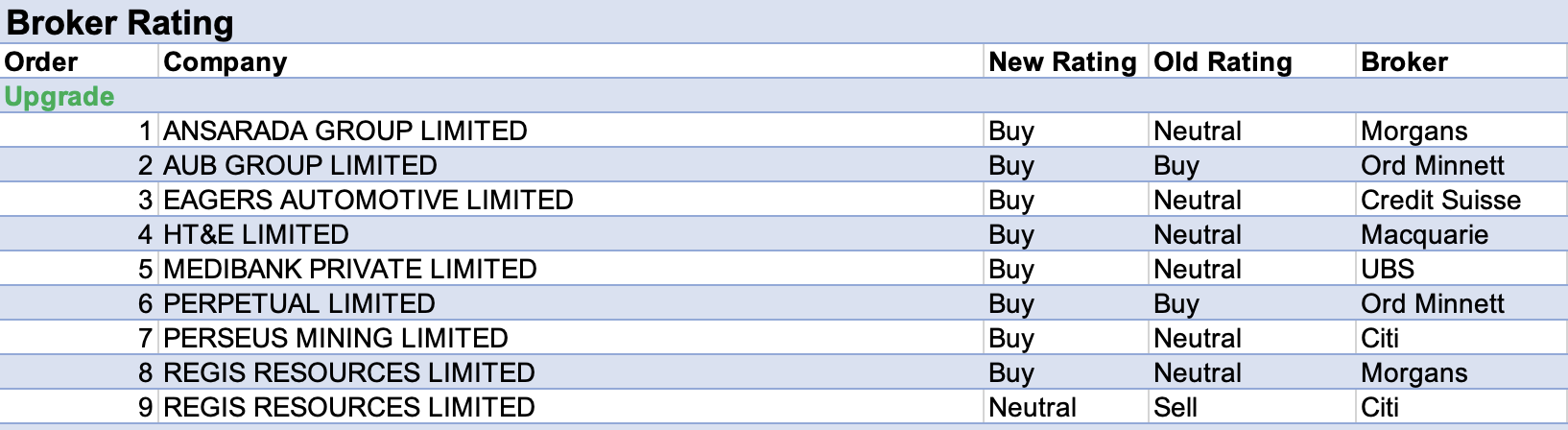

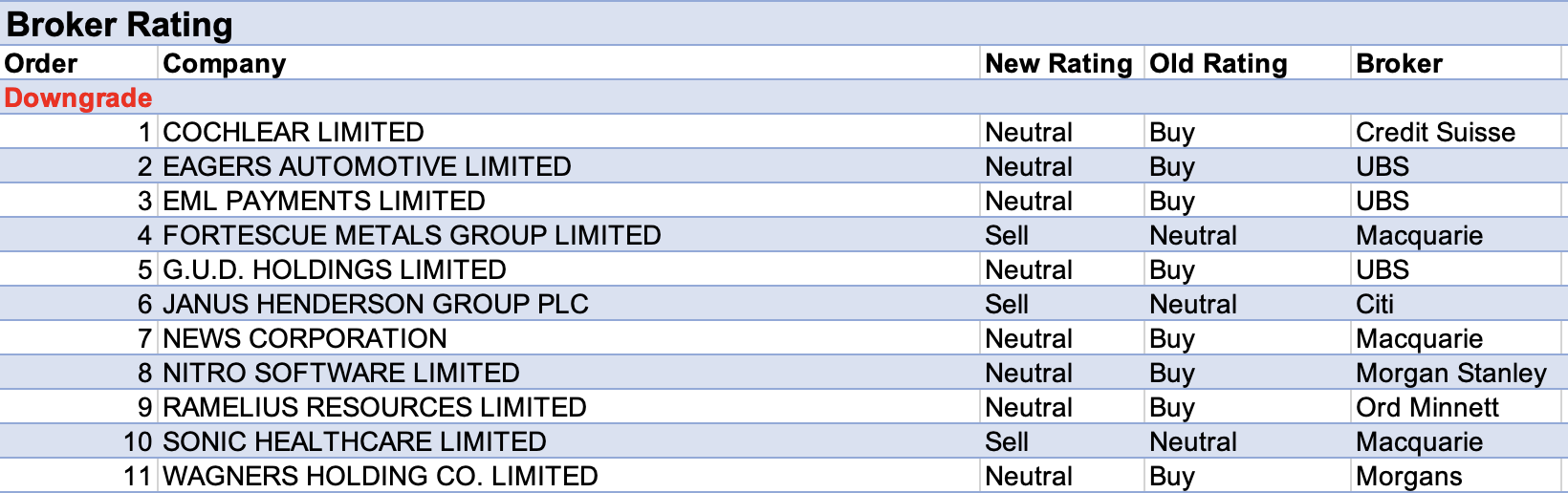

For the week ending Friday July 29 there were 9 upgrades and 11 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Wagners Holdings received the largest percentage decrease in the average target price set by brokers last week. Morgans saw the potential for underwhelming FY22 results and noted uncertainty around growth prospects for the Composite Fibre Technologies (CFT) division and for the company’s Earth Friendly Concrete (EFC) product.

As a result, the broker lowered its rating to Hold from Add and reduced its target to $1.45 from $2.20. The opportunity in Europe for the EFC product is well appreciated though hard to quantify.

Last week UBS lowered its target price for EML Payments to $1.05 from $2.10 and reduced its rating to Neutral from Buy. In an ongoing saga, the Central Bank of Ireland (CBI) has sought more remediation/controls and assurances, which is expected to extend the process into 2023.

The delay will have an impact on sales growth for the company and lead to a deferral of the company’s switch from cash to bonds to benefit from higher interest rates, explained the analyst.

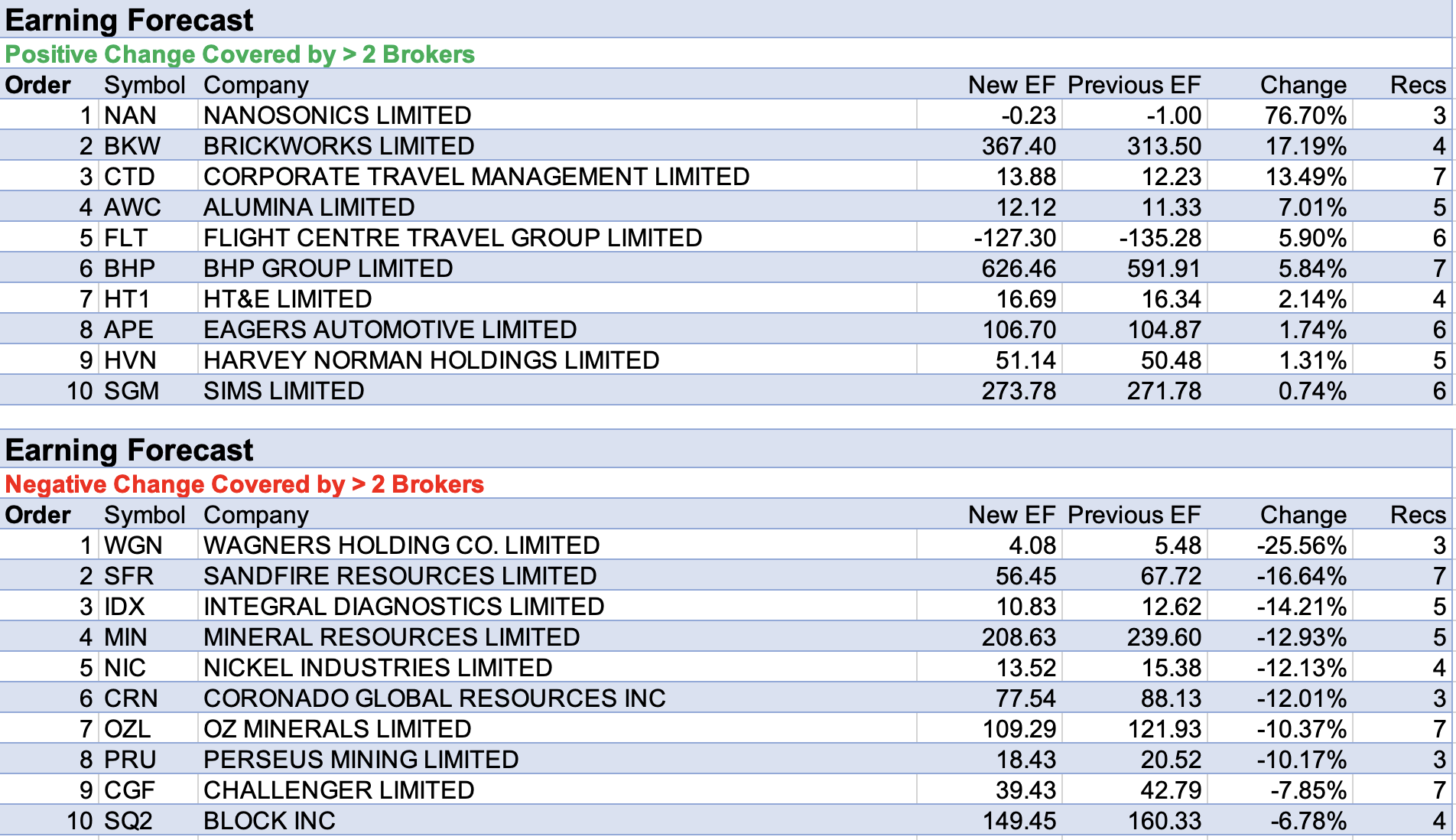

Wagners also headed the list for the largest percentage fall in forecast earnings last week. Coming second was Sandfire Resources, despite a strong June-quarter performance, in which copper production beat the high end of guidance.

While UBS retained a positive view on the company and noted shares are trading at too wide a discount to peers, its target fell to $6.20 from $7.35 after higher costs were considered.

Costs and Capex missed at the MATSA copper operations in Spain when compared to Ord Minnett’s forecasts. Costs were also a -12% miss at the DeGrussa copper-gold operations in Western Australia, though the Sell-rated broker left its $3.80 target unchanged.

Integral Diagnostics also had a bad week in terms of earnings forecasts, and three of four brokers that were updated in the FNArena database set reduced 12-month price targets. These changes followed unaudited FY22 results that fell short of expectations.

Citi downgraded its FY22-FY24 EPS forecasts by -28%, -25% and -15%, respectively, as the FY22 margin fell around -20% compared to FY21. Morgan Stanley attributed the lower margin to negative fixed cost leverage, increased employee costs and an elevated consumables cost.

Both Mineral Resources and Nickel Mines also appeared on the list for material falls in broker earnings forecasts after issuing June quarter activities reports.

Iron ore production for Mineral Resources was a miss versus Overweight-rated Morgan Stanley’s forecast, while production at Mt Marion was -10% below expectation as the company battled covid absenteeism and some operational difficulties.

Outperform-rated Credit Suisse noted Nickel Mines’ record earnings were driven by a 57% increase in nickel sales though volume growth was partially offset by a 21% increase in unit cash costs, leading to the overall margin falling -9% short of the broker’s forecast.

On the flip side, Nanosonics led the table for the largest percentage increase in earnings forecasts.

Ord Minnett raised earnings forecasts and lifted its target to $3.70 from $3.50 after a business update showed the switch to direct distribution boosted sales and average prices.

The broker retained its Lighten rating given the recent sharp rally in the share price. While Sell-rated Citi raised its target price to $3.85 from $3.65, concerns remain that material profits won’t be generated until FY25.

Brickworks was next on the table after its June-half trading update pleased Ord Minnett. A strong housing pipeline is expected to drive continued earnings growth in Australia, while an uptick in non-residential construction in North America should lend support.

Management upgraded earnings guidance, thanks to completions of the Oakdale and Rochedale estates.

Total Buy recommendations take up 59.29% of the total, versus 33.76% on Neutral/Hold, while Sell ratings account for the remaining 6.95%.

In the good books

ANSARADA GROUP LIMITED (AND) was upgraded to Add from Hold by Morgans, B/H/S: 1/0/0

At the 4Q trading update, Ansarada Group guided to a “positive outlook for FY23, with Q1 underpinned by contracted revenue and solid pipeline”. Morgans assesses a strong end to the year, which was broadly in line with forecasts.

The broker upgrades its rating for the company to Add from Hold as there is now more than 10% upside to the new $1.85 target price, down from $2.03. The target was lowered on lower peer multiples and lower medium-term free cash flow.

HT&E LIMITED (HT1) was upgraded to Neutral from Outperform by Macquarie, B/H/S: 3/0/1

On June 1, Macquarie downgraded its view on the media sector to Underweight from Neutral, with the broker’s macro strategy team putting a 60% probability of a mild recession and that does not bode well for media companies across the board.

So far, advertising volumes are holding up, but Macquarie thinks it is but a matter of time before the trend turns negative.

HT&E’s FY22 result is anticipated to beat market consensus in August. Outperform rating retained. Amidst cuts to forecasts across the sector, estimates for HT&E have been left untouched.

Price target has declined to $1.40 from $1.70.

In the not-so-good books

EAGERS AUTOMOTIVE LIMITED (APE) was downgraded to Neutral from Buy by UBS, B/H/S: 5/1/0

UBS has used a general sector update to lower its price target for Eagers Automotive, now at $12.90 versus $17.50 previously.

The broker’s rating has been downgraded to Neutral from Buy.

UBS has taken the prognosis on board that new car sales will drop -15% peak-to-trough on the expectation that house prices will drop -10% and the historical correlation between the two remains intact.

COCHLEAR LIMITED (COH) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 2/4/0

Globally, healthcare staff shortages have continued to impact the recovery of surgical volumes following covid disruptions in 2020-21.

The Credit Suisse monthly hospital survey suggests sluggish US surgical volume growth in recent months for both inpatient and outpatient surgeries.

Given hospital staffing constraints are impacting surgeries globally, the broker has lowered its cochlear implant sales forecast by -6% in FY23, not expecting any significant change in the operating environment in 1H23 relative to 2H22.

Credit Suisse downgrades Cochlear to Neutral from Outperform and cuts its target to $232 from $240.

FORTESCUE METALS GROUP LIMITED (FMG) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 0/5/2

Macquarie viewed the 4Q22 results update from Fortescue Metals as solid across the board with volumes, costs and prices coming in within expectations. Capital expenditure guidance was noticeably higher than anticipated.

Accounting for the adjustment in capital expenditure guidance of US$2.7bn to US$3.1bn and higher unit costs, Macquarie reduces the estimated free cash flow forecast by -25% in FY23.

Earnings forecasts are adjusted for a -15% decline in free cash flow each year in the medium term and FY23 earnings estimates are reduced by -5%.

Macquarie’s earnings forecasts are -3% lower than the FY22 Bloomberg consensus and -16% below FY23 and the broker points out the estimates could be too low with higher iron ore spot prices.

Macquarie downgrades the stock to Underperform from Neutral and the price target is lowered by -11% to $16.00.

G.U.D. HOLDINGS LIMITED (GUD) was downgraded to Neutral from Buy by UBS, B/H/S: 3/2/0

UBS has used a general sector update to lower its price target for G.U.D. Holdings, now at $9.10 versus $13.30 previously.

The rating for G.U.D. Holdings has been downgraded to Neutral from Buy.

UBS has taken the prognosis on board that new car sales will drop -15% peak-to-trough on the expectation that house prices will drop -10% and the historical correlation between the two remains intact.

JANUS HENDERSON GROUP PLC (JHG) was downgraded to Sell from Neutral by Citi, B/H/S: 0/3/1

Underlying, comment Citi analysts, the Q2 flows for Janus Henderson look even worse than expected. The broker concludes any new strategy will require time before generating concrete impact.

Forecasts have been further trimmed. Price target drops to $31.60 from $33.90. Downgrade to Sell from Neutral.

Janus Henderson, exclaims the broker, is strongly leveraged to any potential rebound in financial markets. In the absence of such a rebound, it seems shareholders may need to be very patient, suggests Citi.

NEWS CORPORATION (NWS) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 3/1/0

On June 1, Macquarie downgraded its view on the media sector to Underweight from Neutral, with the broker’s macro strategy team putting a 60% probability of a mild recession and that does not bode well for media companies across the board.

So far, advertising volumes are holding up, but Macquarie thinks it is but a matter of time before the trend turns negative.

News Corp is expected to release a rather weak FY22 report in August. Macquarie downgrades to Neutral from Outperform.

Target price falls to $21.10.

RAMELIUS RESOURCES LIMITED (RMS) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 2/1/0

After incorporating Ramelius Resources’ 4Q result into forecasts and downgrading the outlook on higher costs, Ord Minnett lowers its target price to $1.10 from $1.35. The rating also falls to Hold from Accumulate.

However, the broker believes the downside to the share price is protected by balance sheet strength. Costs are expected to improve in FY24

with a higher contribution from the Penny Project, though production will likely plateau.

SONIC HEALTHCARE LIMITED (SHL) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 3/2/1

Macquarie assesses the growth drivers for Sonic Healthcare and downgrades the company to Underperform from Neutral.

The broker spies only slight organic growth and notes the company is relying on acquisitions to meet Macquarie’s EPS forecasts, which are already below consensus. Consensus forecasts 6.8% EPS growth to FY26, compared with Macquarie’s 4.4%.

Macquarie raises its EPS forecasts by 3% for FY23 and 4% for FY24 to reflect covid-19 earnings and acquisition earnings.

Target price falls to $32 from $38.45 to reflect higher risk-free rates and lower long-term growth assumptions.

WAGNERS HOLDING CO. LIMITED (WGN) was downgraded to Hold from Add by Morgans, B/H/S: 2/1/0

Morgans sees potential for Wagners Holding Co to produce underwhelming FY22 results and notes uncertainty around growth prospects for the Composite Fibre Technologies (CFT) division and the EFC division’s product.

As a result, the rating falls to Hold from Add and the target to $1.45 from $2.20.

The broker likes the opportunity in Europe for the Earth Friendly Concrete-Low Carbon Technologies (EFC) division, though finds it hard to quantify.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.