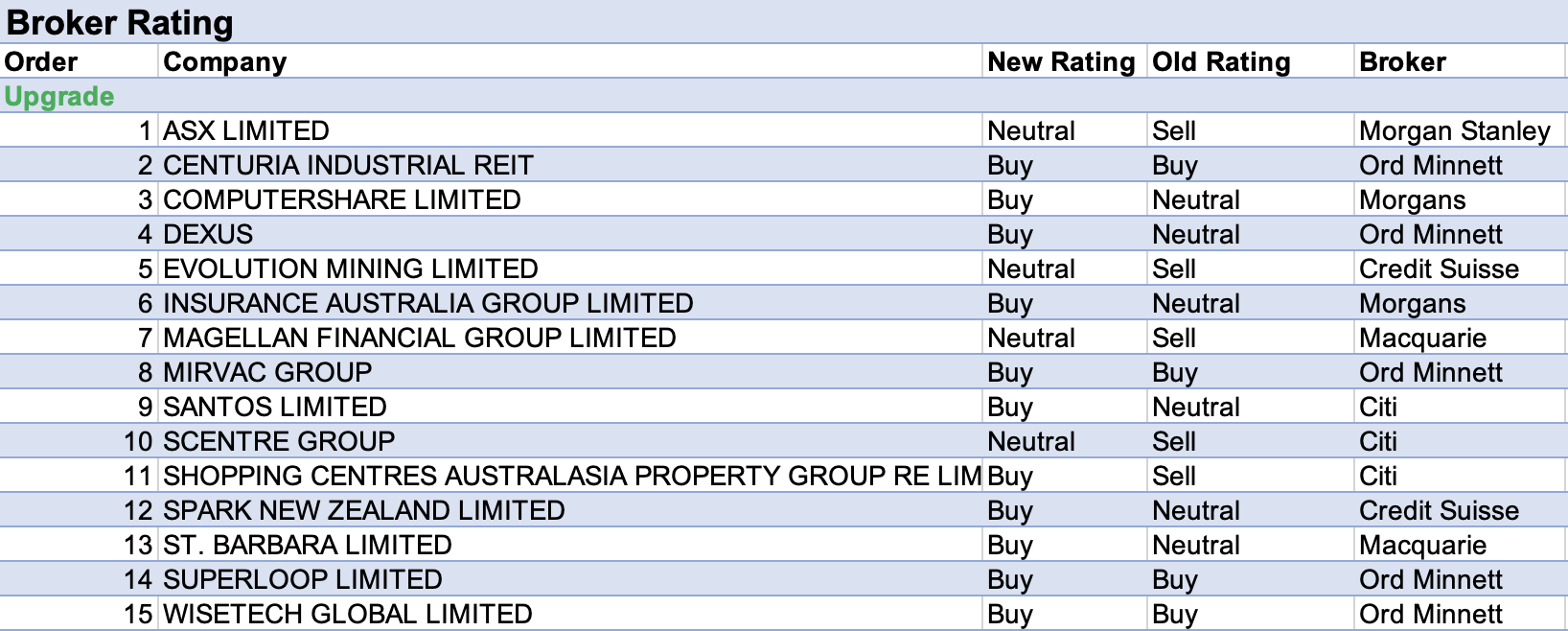

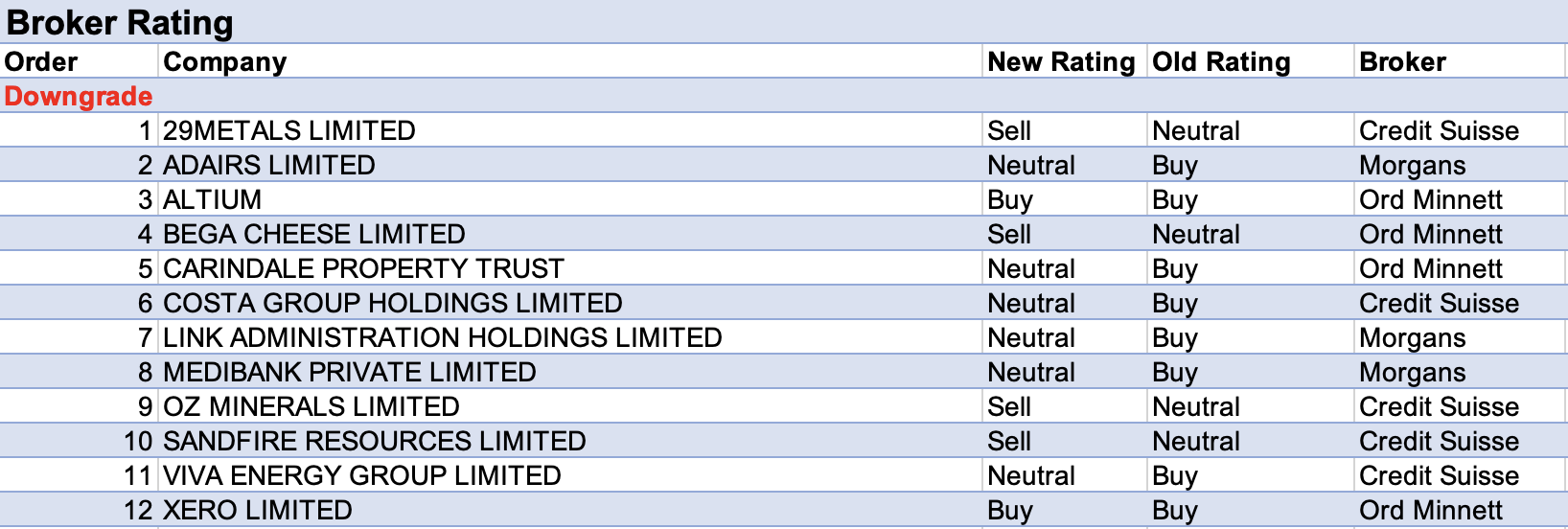

For the week ending Friday July 15 there were 15 upgrades and 12 downgrades to ASX-listed companies covered by brokers in the FNArena database.

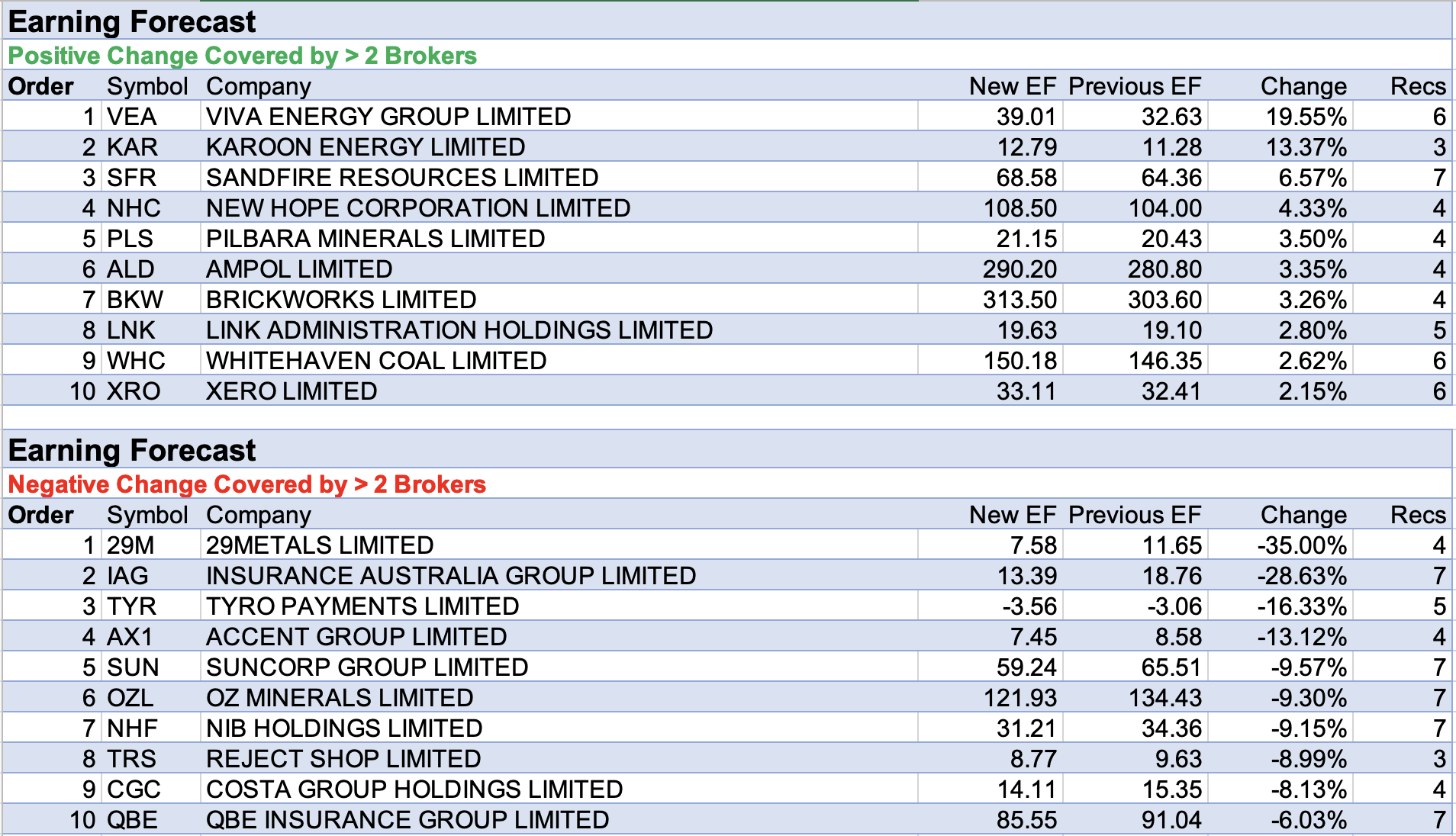

As the tables below illustrate, broker target prices and earnings forecasts continue in a firm downtrend. The only material upgrades to earnings forecasts related to the Energy sector.

An operational update by Viva Energy revealed a 25% beat for first-half earnings over the forecasts by UBS and consensus, largely due to a higher Geelong refiner margin. The broker predicted upside to forecasts should refining margins remain at current levels.

However, towards the end of the week, Credit Suisse observed that market sentiment for the company had declined following weaker refinery margins in the first week of July.

Given the current market focus on the recessionary environment, the broker downgraded its rating to Neutral from Outperform. Regardless, Viva Energy received the largest percentage upgrade to earnings forecasts by brokers in the FNArena database.

Karoon Energy received the next largest percentage earnings upgrade after Morgans increased its oil price forecasts across FY22-26 and lifted its long-term real price estimate to US$65/bbl from US$62/bbl. As a result, the broker lifted its target price to $3.15 from $2.70 for its top small-cap pick in the sector.

Meanwhile, 29Metals headed up the table for the largest percentage decrease in forecast earnings. Credit Suisse lowered its target to $1.15 from $2.85 and reduced its rating to Underperform from Neutral. This followed a general review of base metal stocks under coverage and a marking-to-market of current forecasts.

The broker repeated its prediction that copper and nickel prices will fall on excess supply, with the potential for copper to decline to pre-covid levels. In addition, it’s thought the Golden Grove project will continue to face headwinds and underperform management’s optimistic operating and cost assumptions.

More positively, 29Metals doesn’t have any major capex spend over the next two years, explained the analysts, and has more balance sheet flexibility versus peers, with relatively low gearing.

Earnings forecasts for Insurance Australia Group also suffered last week after several brokers marked to market prior forecasts. Macquarie also noted heavy catastrophe impacts which could drag on second-half dividends.

After a review of the Diversified Financials sector, Morgans downgraded its FY22 EPS estimate for the group by -19% on negative mark-to-market investment impacts, though the FY23 EPS forecast was increased by 5-6% due to the benefits of higher interest rates.

The broker increased its rating to Add from Hold, as there is now more than 10% upside to its new target of $5.09, up from $4.99.

Tyro Payments was also swept up in Morgans Diversified Financials sector review and came second on the list for earnings forecast downgrades last week. The target price also fell to $1.62 from $2.68 to allow for the de-rating of peer multiples since the broker last updated its research on the company.

Next up was Accent Group after Morgans lowered its FY23 earnings estimates across its coverage of the Retail sector by -5.6%, due to inflationary impacts on household budgets. It’s noted retailers are also experiencing significantly higher costs from labour, energy, and many key inputs.

While the analyst likes Accent Group’s network growth strategy, concerns related to gearing levels (by comparison to peers) and the over-diversity of the brand portfolio.

29Metals also headed up the list for the largest percentage decrease in target prices set by brokers last week. Second on the list was Costa Group.

At the beginning of last week, Credit Suisse lowered its rating for the company to Neutral from Outperform and reduced its target price to $2.80 from $3.70 on lower forecasts for citrus and avocado revenues. This proved timely as a subsequent first-half trading update caused other brokers to also set lower targets.

Neutral-rated UBS lowered its target to $2.85 from $3.35 after downgrading forecast earnings to incorporate lower citrus and Morocco blueberry returns, while Macquarie set a $3.42 target, down from $3.80.

Outperform-rated Macquarie was more upbeat and highlighted the full impact of quality issues for the weather-impacted citrus portfolio won’t be fully known until the season is further progressed, and half-year results are expected to be in line with previous guidance.

Finally, Morgan Stanley lowered the multiple used in its financial model for Evolution Mining to reflect a general fall in price for gold equities, and set a target price of $2.40, down from $4.60. Credit Suisse also set a lower target of $2.50, down from $2.70 as part of its general review of the Gold Sector.

While Credit Suisse upgraded its rating on Evolution Mining to Neutral from Underperform, Northern Star Resources is its preferred sector exposure among stocks under coverage.

In the good books

ASX LIMITED (ASX) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 1/3/3

Morgan Stanley upgrades its rating for the ASX to Equal-weight from Underweight on a solid EPS growth outlook. The leap to an Overweight rating was prevented by operational challenges and a stretched valuation. The target rises to $80.50 from $74.00.

After a subdued 1H, the broker sees improvements in listings, the cash market and volumes for futures. Leverage to rising rates and a more active commodity market is also expected. Industry view: Attractive.

CENTURIA INDUSTRIAL REIT (CIP) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/3/0

The REIT sector appears oversold to Ord Minnett, despite an 8% bounce off its mid-June lows as the 10-year bond yield has retraced -80bps from its peak of 3.40%.

The analyst lifts its interest rate assumptions due to high inflation, though points out rent reviews allow an inflation pass-through for what are considered high-margin businesses.

The broker increases its rating for Centuria Industrial REIT to Buy from Accumulate and lowers its target price to $3.80 from $3.90.

DEXUS (DXS) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 3/2/0

The REIT sector appears oversold to Ord Minnett, despite an 8% bounce off its mid-June lows as the 10-year bond yield has retraced -80bps from its peak of 3.40%.

The analyst lifts its interest rate assumptions… (see CIP above).

The broker raises its rating for Dexus to Buy from Hold and decreases its target to $11.50 from $12.00.

EVOLUTION MINING LIMITED (EVN) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 2/5/0

In reviewing its base metals coverage and marking to market its current forecasts, Credit Suisse reiterates it anticipates copper and nickel prices to fall as the market is oversupplied, predicting copper prices could fall to pre-covid levels.

The broker expects another challenging quarter is ahead for gold and copper miners, and while it upgrades its rating on Evolution Mining, of the gold producers in its coverage Credit Suisse prefers Northern Star Resources (NST).

The rating is upgraded to Neutral from Underperform and the target price decreases to $2.50 from $2.70.

MIRVAC GROUP (MGR) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 5/1/0

The REIT sector appears oversold to Ord Minnett, despite an 8% bounce off its mid-June lows as the 10-year bond yield has retraced -80bps from its peak of 3.40%.

The analyst lifts its interest rate assumptions… (see CIP above).

The broker increases its rating for Mirvac Group to Buy from Accumulate and retains its $2.50 target price.

SANTOS LIMITED (STO) was upgraded to Buy from Neutral by Citi, B/H/S: 7/0/0

With Santos’ shares retracing recently, alongside a higher for longer gas price outlook, Citi now sees a stronger valuation case for the stock.

The broker has lifted its gas price expectations, driving its net profit forecasts up 24% and 72% for 2022 and 2023, anticipating production will remain as forecast but ongoing supply restrictions will continue to support elevated pricing.

The rating is upgraded to Buy from Neutral and the target price increases to $8.60 from $8.31.

In the not-so-good books

29METALS LIMITED (29M) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 2/1/1

In reviewing its base metals coverage and marking to market its current forecasts, Credit Suisse reiterates it anticipates copper and nickel prices to fall as the market is oversupplied, predicting copper prices could decline to pre-covid levels.

Credit Suisse is cautious on 29metals’ Golden Grove project, expecting the company is likely to downgrade full-year guidance with its June quarter results, as the project continues to face headwinds and underperform aggressive operating and cost assumptions.

The broker does note the company’s limited capital expenditure spend over the next two years, and balance sheet flexibility compared to peers.

The rating is downgraded to Underperform from Neutral and the target price decreases to $1.15 from $2.85.

BEGA CHEESE LIMITED (BGA) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 0/2/0

While Bega Cheese left FY22 normalised earnings (EBITDA) guidance unchanged, guidance for FY23 was lower than for FY22. Due to persistent cost pressures, Ord Minnett decreases earnings forecasts materially, and the rating falls to Lighten from Hold.

The analyst explains the company is facing significant cost pressures in FY23 as farmgate milk prices increase well above last year’s. Management indicated these increases reflect strong competition amongst milk processors.

The broker feels offsetting price increases will take time to implement and take effect, while supply chain challenges are likely to continue. The target price falls to $3.10 from $4.10.

CARINDALE PROPERTY TRUST (CDP) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 0/1/0

The REIT sector appears oversold to Ord Minnett, despite an 8% bounce off its mid-June lows as the 10-year bond yield has retraced -80bps from its peak of 3.40%.

The analyst lifts its interest rate assumptions… (see CIP above).

The broker lowers its rating for Carindale Property Trust to Hold from Buy and decreases its target to $5.00 from $5.20.

OZ MINERALS LIMITED (OZL) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 3/2/1

In reviewing its base metals coverage and marking to market its current forecasts, Credit Suisse reiterates it anticipates copper and nickel prices to fall as the market is oversupplied, predicting copper prices could decline to pre-covid levels.

The broker sees fewer near-term operating headwinds for OZ Minerals compared to other copper miners, but notes costs and capital expenditure are likely to increase.

The rating is downgraded to Underperform from Neutral and the target price decreases to $13.00 from $20.00.

SANDFIRE RESOURCES LIMITED (SFR) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 5/0/2

In reviewing its base metals coverage and marking to market its current forecasts, Credit Suisse reiterates it anticipates copper and nickel prices to fall as the market is oversupplied, predicting copper prices could decline to pre-covid levels.

The broker raised concerns around Sandfire Resources’ cash generation, and ability to service debt in the next 6-12 months, and believes the company is likely to suffer funding challenges if commodity prices continue to decline.

The rating is downgraded to Underperform from Neutral and the target price decreases to $2.70 from $6.10.

VIVA ENERGY GROUP LIMITED (VEA) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 4/2/0

Credit Suisse notes market sentiment for Viva Energy has declined following a weakening in refinery margins in the first week of July. The broker expects, given the recessionary environment is a focus of the market, it will be difficult for the stock to achieve share price performance in the near term.

Marking to company guidance, the broker’s FY22 earnings forecast is lifted, but its refining production yield assumptions for FY23 and FY24 are reduced. The broker notes supply remains constrained, and perceived demand risks have also impacted weakening sentiment.

The rating is downgraded to Neutral from Outperform and the target price decreases to $2.77 from $3.17.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.