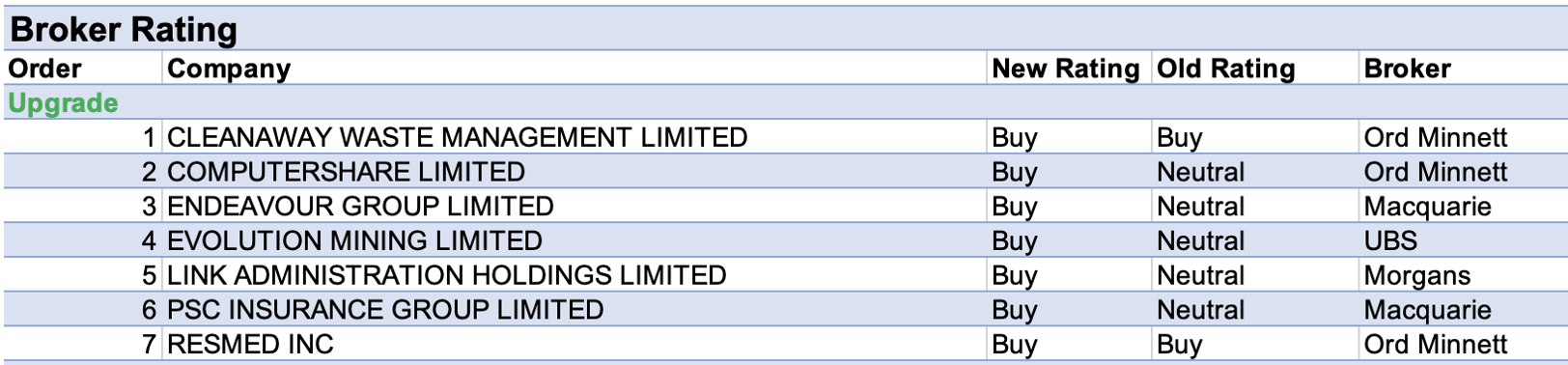

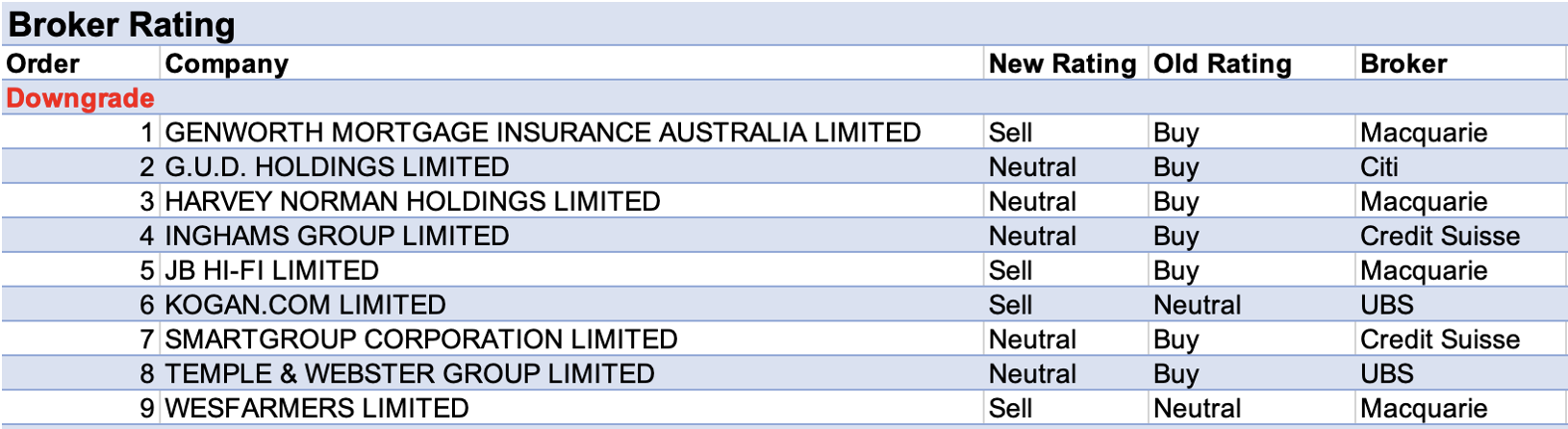

For the week ending Friday June 17 there were 7 upgrades and 9 downgrades to ASX-listed companies covered by brokers in the FNArena database.

G.U.D. Holdings received the largest percentage reduction in average target price set by brokers last week as FY22 earnings (EBITDA) guidance was reduced to $147m from $155-$160m.

Following the company’s acquisition of ASX-listed AutoPacific Group earlier this year, the delivery of OEM vehicles into Australia has fallen due to supply chain pressures. There’s now considered to be risk to the second half component of AutoPacific’s guidance.

While Citi considers the company a higher quality business compared to before the acquisition, the broker’s rating is lowered to Neutral from Buy to reflect increased uncertainty about an earnings recovery that is relying on a normalisation of vehicle supply. Moreover, the weaker outlook, combined with inventory being higher for longer (due to Chinese lockdowns), suggests the balance sheet could take longer to de-gear.

Despite UBS being only one of four brokers in the FNArena database that currently update daily on Temple & Webster, the broker’s new target price of $4.25 (down from $8.20) was enough to achieve the second-largest reduction in average target price last week.

In addition, UBS downgraded its rating for the company to Neutral from Buy on downside risk to medium-term earnings expectations. It’s believed to be too early to turn positive on the online retail sector as unit economics are generally worse now than before the pandemic. Moreover, it’s thought the tough macroeconomic outlook for discretionary expenditure, as well as supply chain pressures, will continue to weigh.

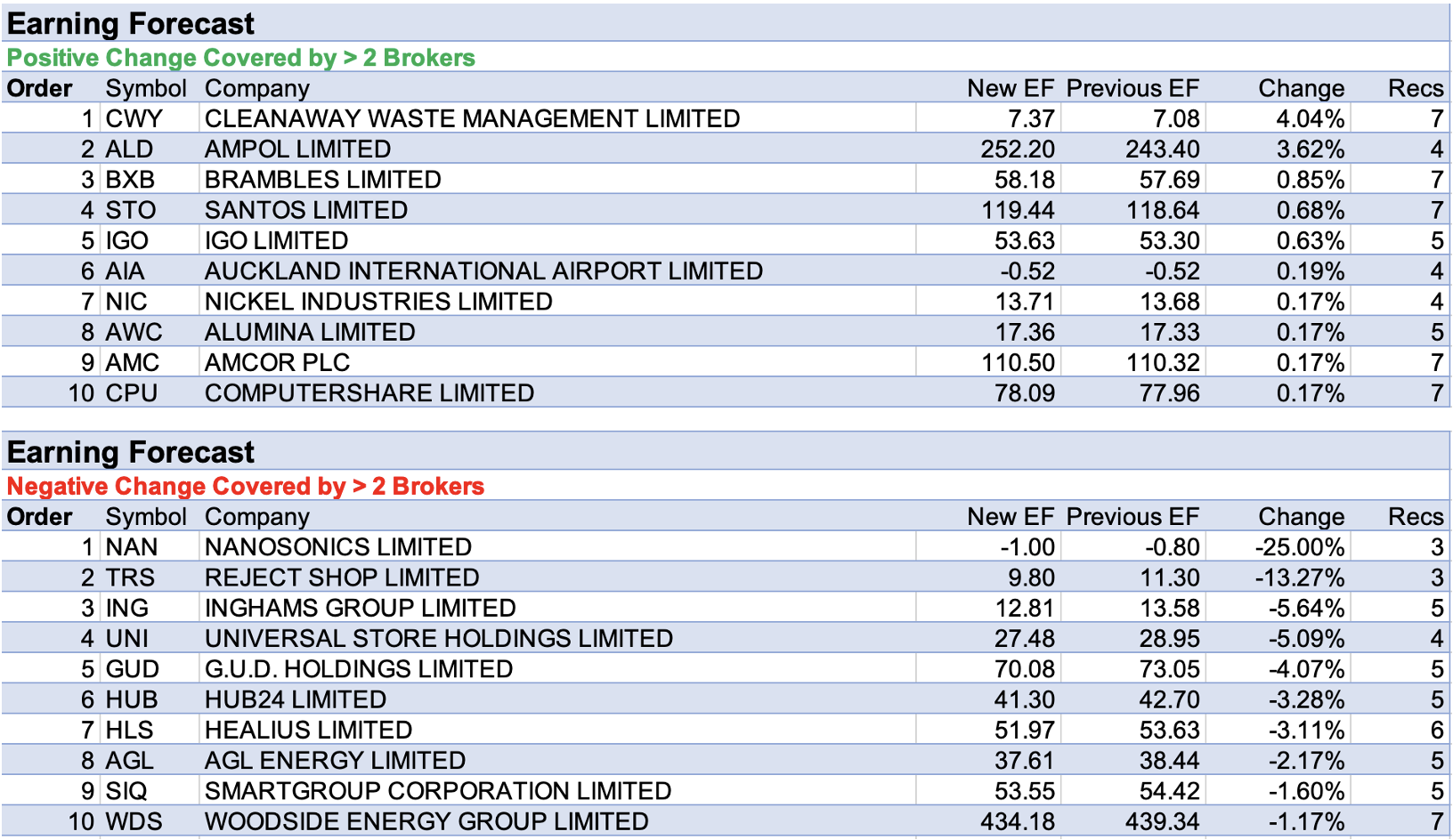

As far as broker earnings forecasts went last week, Nanosonics headed the table for the largest percentage downgrade in the FNArena database. Morgans reviewed its thesis for the company and decided to downgrade FY23 and FY24 forecasts after an increase in cost assumptions and a decrease in forecast European growth rates. The expected revenue contribution from the new CORIS product was also deferred to FY24 from FY23.

While the broker’s target price was reduced to $4.86 from $5.43 the Add rating was retained after a significant share price fall. Also, the business is expected to be on a more normal footing from FY23.

Finally, the Reject Shop indicated last week that current trading was consistent with consensus estimates of FY22 pre-ASSB-16 earnings (EBIT) of $6.5m. Unfortunately, Ord Minnett’s prior forecast has assumed $8.9m and the broker reacted by lowering its earnings estimates for FY22 and FY23 by -28% and -41%, respectively and reducing its target to $3.80 from $6.40.

In the near term, the analyst forecasts a rising cost base, in the form of higher cost of goods sold, higher freight charges and higher wage costs. On a more positive note, management is currently assessing an on-market share buy-back, with a decision expected to be made in July/August.

Ord Minnett maintained its Hold rating for the company and assumed a 10% share buy-back, which would still leave the company with excess cash, given a strong balance sheet.

As shown in the tables below, earnings forecasts are now in a firm downtrend, with only a small number of companies still enjoying upgrades that are worth paying attention to. This translates into only two companies receiving a lift in price targets for the week; both are minimal adjustments only.

In contrast, the negative side for changes in price targets starts off on double digits.

Total Buy recommendations take up 59.80% of the total, versus 33.31% on Neutral/Hold, while Sell ratings account for the remaining 6.89%. Except for Europe’s Grexit problem period in 2011-2012, total Buy ratings have never been higher post-2006.

In the good books

CLEANAWAY WASTE MANAGEMENT LIMITED (CWY) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/3/1

The strategy briefing from Cleanaway Waste Management presented no major surprises to Ord Minnett. As landfill levies rise and resources recovery becomes more economically attractive, the company, as the largest participant in the industry, is considered well-placed.

Industry returns continue to move further downstream where barriers to entry become increasingly higher and returns more “infrastructure-like”, in the broker’s view

Rating is upgraded to Buy from Accumulate and the target reduced to $3.20 from $3.30.

EVOLUTION MINING LIMITED (EVN) was upgraded to Buy from Neutral by UBS, B/H/S: 1/4/2

UBS upgrades Evolution Mining to Buy from Neutral. Despite the operating risks, the broker finds more value in the ASX gold sector and a higher need to hedge the rest of the portfolio.

The weak start to FY22 has pressured the June quarter, with up to 30% improvement in quarterly performances required to get some gold stocks to the lower end of their guidance.

The broker expects there will be a keen focus on operations such as the company’s Red Lake. Target is $4.05.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was upgraded to Add from Hold by Morgans, B/H/S: 2/3/0

Morgans feels the recent fall in Link Administration’s shares is overdone despite the ACCC raising “significant preliminary concerns” on the Dye and Durham takeover of the company. As a result, the rating is lifted to Add from Hold on valuation grounds.

The target price falls to $4.33 from $5.50 due to uncertainty around the takeover (the analyst notes it’s difficult to know if the ACCC’s concerns can be overcome).

PSC INSURANCE GROUP LIMITED (PSI) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/0/0

Macquarie resumes coverage of PSC Insurance with an Outperform rating, up from Neutral, due to the defensive characteristics of Insurance Brokers and upside from potential acquisitions. The $4.75 target price is unchanged.

The broker also sees potential upside from the non-binding Memorandum of Understanding to acquire a 50% stake in Tysers UK retail division.

Should the proposed joint venture be executed in the 1H of 2024, the analyst estimates sufficient capacity to secure the remaining 50%.

RESMED INC (RMD) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 5/1/0

Ord Minnett asserts the strategic rationale for ResMed’s acquisition of Medifox Dan is consistent with its intentions to expand the SaaS offering but the price is very high, given the current market de-rating.

The broker recognises the opportunities are limited but believes, given rising interest costs, the timing is to the vendor’s advantage. Still, the core sleep business appears to be picking up and the broker upgrades to Buy from Accumulate based on valuation. Target is unchanged at $35.

In the not-so-good books

GENWORTH MORTGAGE INSURANCE AUSTRALIA LIMITED (GMA) was downgraded to Underperform from Outperform by Macquarie, B/H/S: 0/0/1

Genworth Mortgage Insurance Australia has flagged unchanged guidance for FY22, with a normalisation of long-term claims experiences expected in FY23.

Nonetheless, Macquarie updates its forecasts to include a more bearish economic environment, accounting for a 60% probability of a US recession and a “near miss” in Australia in 2023.

The broker does not include the additional 60m share buyback because of the deteriorating economic outlook. Target is reduced to $1.95 from $3.50 and the rating is downgraded to Underperform from Outperform.

G.U.D. HOLDINGS LIMITED (GUD) was downgraded to Neutral from Buy by Citi, B/H/S: 4/1/0

Despite downwardly revised guidance for FY22, Citi continues to assess G.U.D. Holdings as a higher quality business compared to before the APG acquisition.

Yet the stock has received a downgrade to Neutral from Buy to reflect increased uncertainty about an earnings recovery that is relying on normalising supply.

All up, the broker considers the FY23 earnings risk is skewed to the downside and demand could soften amid higher interest rates.

Moreover, the weaker outlook combined with inventory being higher for longer because of Chinese lockdowns suggests the balance sheet could take longer to de-gear. Target is reduced to $9.95 from $15.60.

INGHAMS GROUP LIMITED (ING) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 1/4/0

Rapid and material rises in input costs, particularly feed, mean Inghams Group needs to pass this through in meaningful price increases. Uncertainty over the timing and extent to which the company can achieve price increases warrants caution, Credit Suisse asserts.

Downside risks stemming from price rises being insufficient to fully offset these costs lead the broker to downgrade to Neutral from Outperform. Target is reduced to $2.90 from $4.05.

KOGAN.COM LIMITED (KGN) was downgraded to Sell from Neutral by UBS, B/H/S: 0/0/2

UBS believes it is too early to turn positive on the online retail sector as unit economics are generally worse now than before the pandemic and there is a tough macro-outlook for discretionary expenditure. Moreover, supply chains remain challenging.

Kogan.com could benefit from a “trade-down” effect, the broker suggests, but concerns exist around inventory levels which in turn will weigh on margins. Rating is downgraded to Sell from Neutral and the target reduced to $2.90 from $4.30.

SMARTGROUP CORPORATION LIMITED (SIQ) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 1/4/0

Credit Suisse lowers its rating for Smartgroup Corp to Neutral from Outperform. This follows the announced contract loss of a top 20 client, the Department of Education and Training Victoria.

While management estimates an FY23 revenue impact of less than -5%, the announcement was a surprise for the broker given long-standing salary packaging contracts rarely change hands. Nonetheless, no additional risk is inferred.

The target price is lowered to $7.05 from $8.58 on the contract loss and the application of a lower market multiple by the analyst.

TEMPLE & WEBSTER GROUP LIMITED (TPW) was downgraded to Neutral from Buy by UBS, B/H/S: 2/2/0

UBS believes it is too early to turn positive on the online retail sector as unit economics are generally worse now than before the pandemic and there is a tough macro-outlook for discretionary expenditure. Moreover, supply chains remain challenging.

The broker envisages downside risk to medium-term earnings expectations for Temple & Webster and downgrades to Neutral from Buy. Target is reduced to $4.25 from $8.20.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.