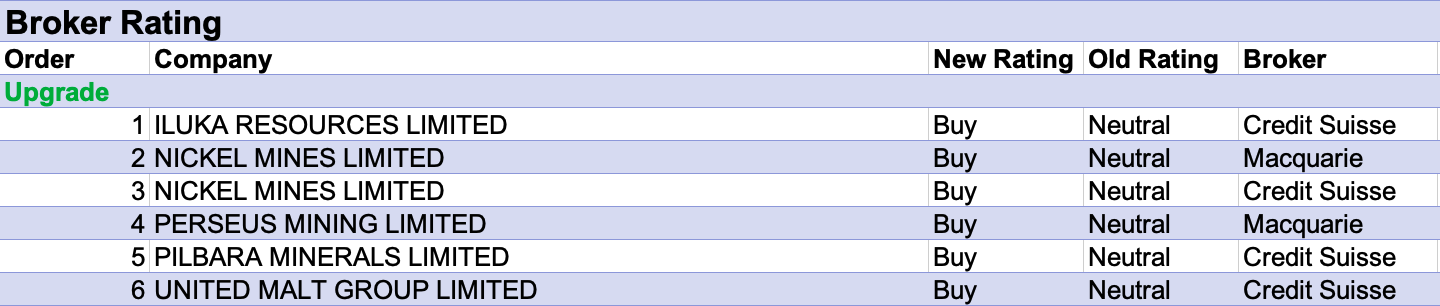

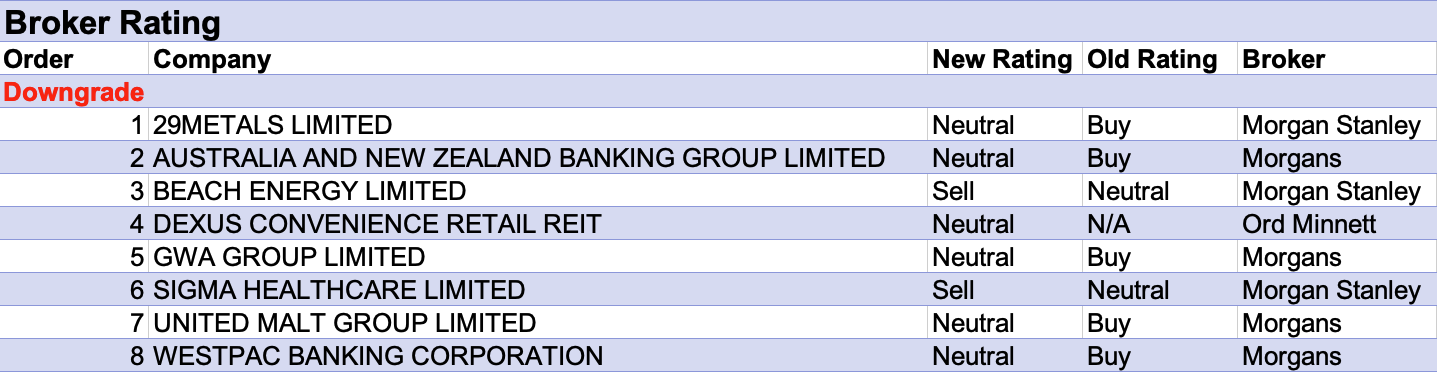

For the shortened week ending Friday April 29 there were six upgrades and eight downgrades to ASX-listed companies covered by brokers in the FNArena database.

Following March quarter results, Nickel Mines was upgraded to Outperform from Neutral by both Macquarie and Credit Suisse. Earnings were ahead of the brokers’ expectations due to lower cash costs.

Alongside an impressive cost performance, Macquarie noted the company is set to almost triple production over the next several years and raised its target price to $1.50 from $1.30. Credit Suisse’s previous concerns about costs and counterparty risk from Tsingshan have now lessened and the broker raised its target price to $1.50 from $1.35.

Meanwhile, Citi cautioned nickel prices will moderate and it is hard to forecast beyond the June quarter with lockdowns in China and the uncertain status of HPAL projects in Indonesia.

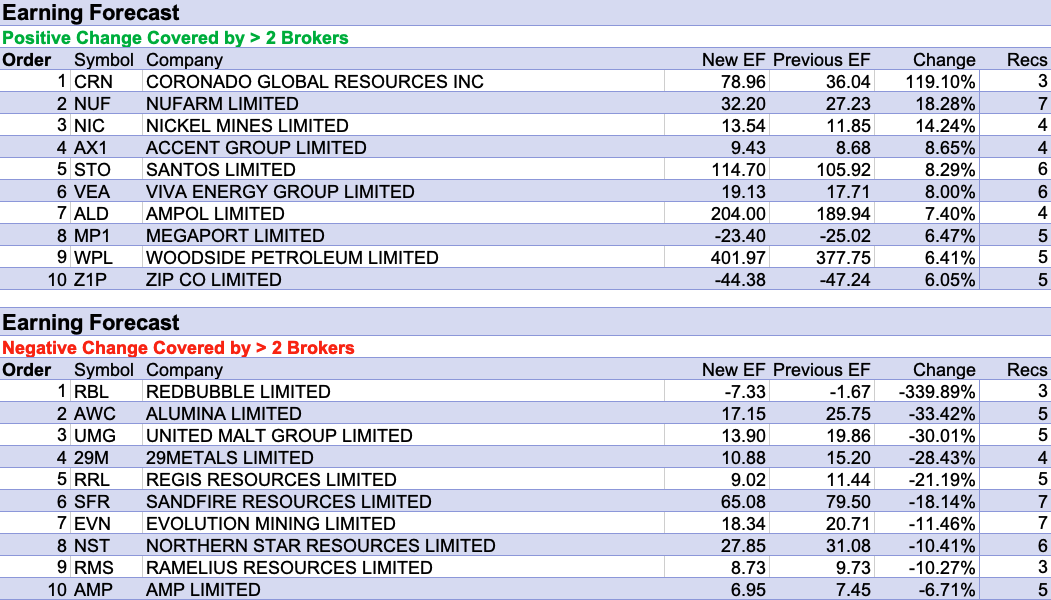

Nickel Mines also came third on the table for the largest percentage increase in forecast earnings last week. Coronado Global Resources was the leader despite revealing slightly softer March quarter production than was generally expected.

After Morgans materially upgraded its coking coal price assumptions and included a premium for further upside risk, its target price for Coronado jumped to $2.73 from $1.96. While current prices may not be sustainable, Credit Suisse noted rising geopolitical tensions are exacerbating supply tightness, and elevated thermal coal prices will continue to support firm metallurgical coal prices into the medium term.

Management has committed to additional shareholder returns as strong cash flows continue to strengthen the balance sheet. Morgans predicted upside risk for dividends, and felt there’s capability to both fund organic growth/improvement and build reserves for potential M&A.

Brokers also upgraded earnings forecasts for Nufarm after management raised first half guidance. UBS pointed to good agricultural conditions and favourable commodity prices, while Credit Suisse found the outlook is supported by a more sustainable cost base. Also, it’s thought a pulling forward of volumes will result in a greater than usual skew in profit to the first half.

On the flipside, United Malt Group received the largest percentage downgrade to forecast earnings last week, following materially weaker than expected first half guidance. Despite this, Macquarie believes the share price will be supported and notes the potential for corporate interest.

Morgans downgraded its rating to Hold from Add and lowered its forecast earnings due to inflationary pressures, a lower contribution from the company’s new Scottish plants and lower transformation benefits. Credit Suisse adopted an opposing stance and raised its rating to Outperform from Neutral as the industry enters a period of tight supply and increasing malt prices.

Broker earnings forecasts were also downgraded for 29Metals last week. According to Morgan Stanley, one-off impacts contributed to weak production in the March quarter and full year production is now anticipated at the lower end of guidance for copper, gold and silver. The broker downgraded its rating to Equal-weight from Overweight in response.

Nonetheless, Macquarie remains attracted to the company’s free cash flow yield and the tailwind of 60% production growth out to 2024, while Citi expects copper and zinc prices to continue to enjoy near-term and structural support.

Regis Resources came third on the list of largest percentage earnings downgrades last week. Production at Garden Well and Tropicana in the March quarter missed Credit Suisse’s expectations, while plant modifications at Duketon were impacted by delays to the reopening of the WA border. Nonetheless, management anticipates a strong fourth quarter at the Duketon operations.

Absenteeism and labour availability issues also impacted production, according to Citi, while Morgans felt lower grades processed at Tropicana were largely responsible though expects grades to improve over 2022. Overall production guidance was unchanged though management signalled the top end of guidance for costs.

Finally, while copper and zinc grades at Sandfire Resources’ MATSA operation beat Ord Minnett’s forecasts, the analyst downgraded its earnings forecasts due to another round of cost increases. However, Morgans perceived FY22 cost guidance was better than the market had feared and other brokers generally found positive takeaways from the March quarter production report.

Citi retained its Buy rating and considered the share sell off since March has been overdone. At the same time, market strategists at the broker believe copper is structurally challenged, while zinc is being traded as a play on the continuation of the European energy shortage.

Total Buy recommendations take up 59.54% of the total, versus 34.25% on Neutral/Hold, while Sell ratings account for the remaining 6.21%.

In the good books

ILUKA RESOURCES LIMITED (ILU) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/2/1

March quarter production was in line with expectations. Taking into account current price increases and supply disruptions as well as the uncertainty in the macro environment Credit Suisse lifts mineral sands price forecasts for 2022 and 2023, while maintaining a downward price trend from 2022.

Several catalysts are lining up for the second half with the next big decision being a mine at Balranald which could refresh the ageing operations.

The broker assesses the recent sell-off opens up some value and upgrades to Outperform from Neutral. Targets raised to $13.20 from $13.00.

NICKEL MINES LIMITED (NIC) was upgraded to Outperform from Neutral by Credit Suisse and to Outperform from Neutral by Macquarie, B/H/S: 3/1/0

Margins and earnings were ahead of expectations in the March quarter following small price increases and slightly reduced cash costs. Specifically, Credit Suisse had expected higher smelting and reductant costs following a significant rise in the benchmark coal price.

Having been concerned about costs and counterparty risk at Tsingshan, the resilience reflected in the results means thee concerns have dissipated and Credit Suisse upgrades to Outperform from Neutral. Target is raised to $1.50 from $1.35.

March quarter results revealed lower cash costs which drove a beat to Macquarie’s expectations for operating earnings (EBITDA). The broker incorporates lower costs into the medium term, partially offset by reduced price realisations.

Nickel Mines is expected to almost triple production over the next several years and, supported by the impressive cost performance, the broker upgrades to Outperform from Neutral. Target is raised to $1.50 from $1.30.

PILBARA MINERALS LIMITED (PLS) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/0/0

March quarter production results have underscored the continued momentum in price. Credit Suisse believes there is further upside to the current industry average contract prices that management signalling are ranged between US$4300-4700/dmt.

The broker notes the share price has declined along with the global macro sell-off and upgrades to Outperform from Neutral on valuation grounds.

The prospect for dividends in the next 12 months has been flagged which the broker suggests could attract yield investors onto the register. Target is reduced to $3.70 from $3.90.

In the not-so-good books

29METALS LIMITED (29M) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 2/2/0

One-off impacts have contributed to weak production in the March quarter and full year production is now anticipated at the lower end of guidance, for 39-46,000t copper, 27-34,000 ozs gold, 55-65,000 ozs zinc and 1.37-1.64m ozs silver.

Morgan Stanley downgrades to Equal-weight from Overweight on valuation yet continues to believe the stock is a good zinc/copper exposure. Target is reduced to $3.20 from $3.40. Industry view: Attractive.

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ANZ) was downgraded to Hold from Add by Morgans, B/H/S: 5/2/0

While rising interest rates will benefit net interest margins, Morgans adopts a more cautious stance on the banking sector as the new environment will also introduce some risks. These include deteriorating asset quality and reduced attractiveness of dividend yields.

In addition, rising interest rates will mean term deposit rates normalise and Term Funding Facility (TFF) drawdowns are refinanced with conventional sources of funding, explains the analyst. It is thought deposits in general may also flow out of the banking system.

The broker downgrades its rating for ANZ Bank to Hold from Add as growth in home lending continues to disappoint mainly due to lower margin loans. The target price falls to $26 from $30.

National Australia Bank (NAB) is now Morgans preferred big four bank exposure.

DEXUS CONVENIENCE RETAIL REIT (DXC) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 1/1/0

Ord Minnett believes the main risk to service station A-REITs is softening capitalisation rates. The company is well-positioned in this regard, the broker adds, because of the location of assets. as well-located assets with exposure to high vehicle traffic continue to be well bid.

Still, taking a more conservative stance in light of current market conditions the broker downgrades Dexus Convenience Retail REIT to Hold from Accumulate. Target is reduced to $3.73 from $3.90.

SIGMA HEALTHCARE LIMITED (SIG) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 0/3/1

Morgan Stanley points out the FY22 result reflected material benefit from testing throughout the pandemic and this masks the underlying challenges for Sigma Pharmaceuticals.

A deterioration in operating performance was also coupled with the resignations of both the CEO and the CFO.

The new ERP system has been singled out as the key reason for the material disruption and Morgan Stanley believes FY23 will now be the true test for new management to restore profitability levels.

The broker downgrades to Underweight from Equal-weight. Target is reduced to $0.43 from $0.48. Industry view is In-Line.

WESTPAC BANKING CORPORATION (WBC) was downgraded to Hold from Add by Morgans, B/H/S: 2/5/0

While rising interest rates will benefit net interest margins, Morgans adopts a more cautious stance on the banking sector as the new environment will also introduce some risks. See ANZ above.

Morgans lowers its rating for Westpac to Hold from Add. Remediation issues are thought to be crimping the bank’s Australian business loan growth (high-margin loans), and generally distracting the business bankers.

The target price is reduced to $23.90 from $29.50. National Australia Bank ((NAB)) is now Morgans preferred big four bank exposure.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.