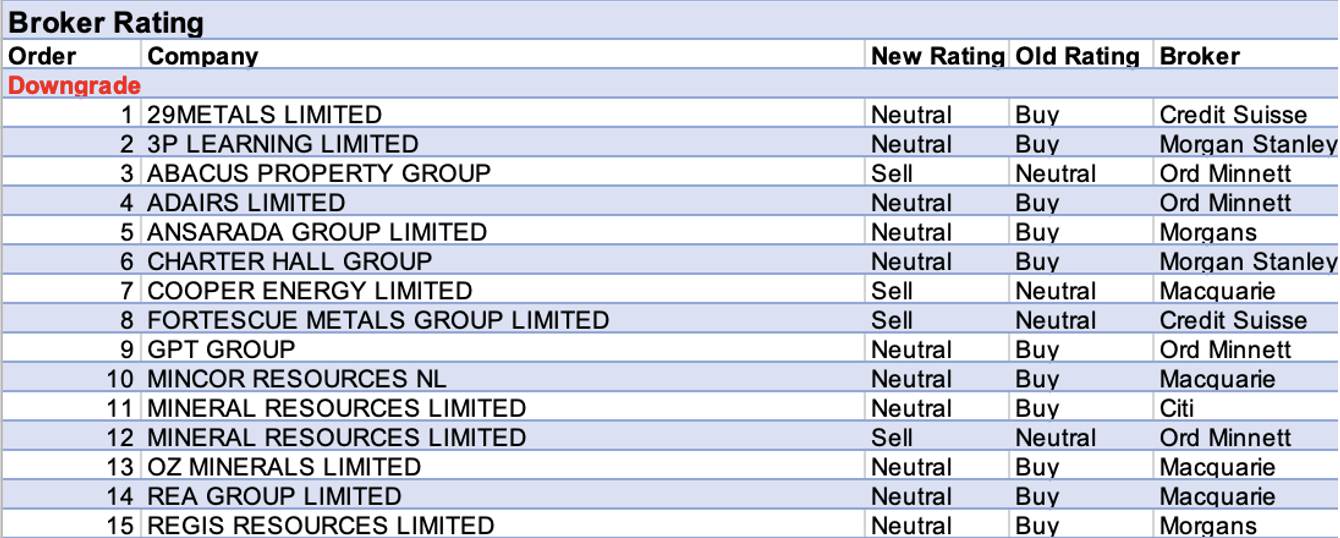

For the week ending Friday January 28, there were an equal number (fifteen) of upgrades and downgrades to ASX-listed companies covered by brokers in the FNArena database.

In the first few weeks of 2022, ASX Property sector declines outpaced a significant fall in the ASX200 due to inflationary (rising bond yield) concerns. As part of a general review of the sector, the rating for Dexus Property was upgraded to Buy from Hold by Ord Minnett and to Neutral from Sell by Citi.

Citi suggests things aren’t as bad for office properties as is feared by many, while Ord Minnett switches its preference among the diversified passive REITs from GPT Group to Dexus. For the property sector as a whole, the broker believes fundamentals remain supportive and points out real estate offers an inflation hedge.

Meanwhile, Mineral Resources had its rating downgraded by two separate brokers last week. Both Citi (Neutral from Buy) and Ord Minnett (Sell from Hold) shared valuation concerns after a recent share price rally.

However, Ord Minnett also reacted to the company’s December-quarter production report, which revealed average iron ore revenue was -43% adrift of the average spot price. In addition, spodumene shipments were an -8% miss versus the broker’s estimate.

Following a first half trading update last week, Adairs received the second largest percentage reduction in target price by brokers. Ord Minnett lowered its rating to Hold from Accumulate on concerns over supply chain costs and advertising spend, along with a possible moderation in customer traffic to stores in the second half.

On the other hand, UBS viewed the results as nothing more than a temporary set-back, while Morgans felt the update was more disappointing than disastrous, despite cutting its target price to $3.70 from $4.80.

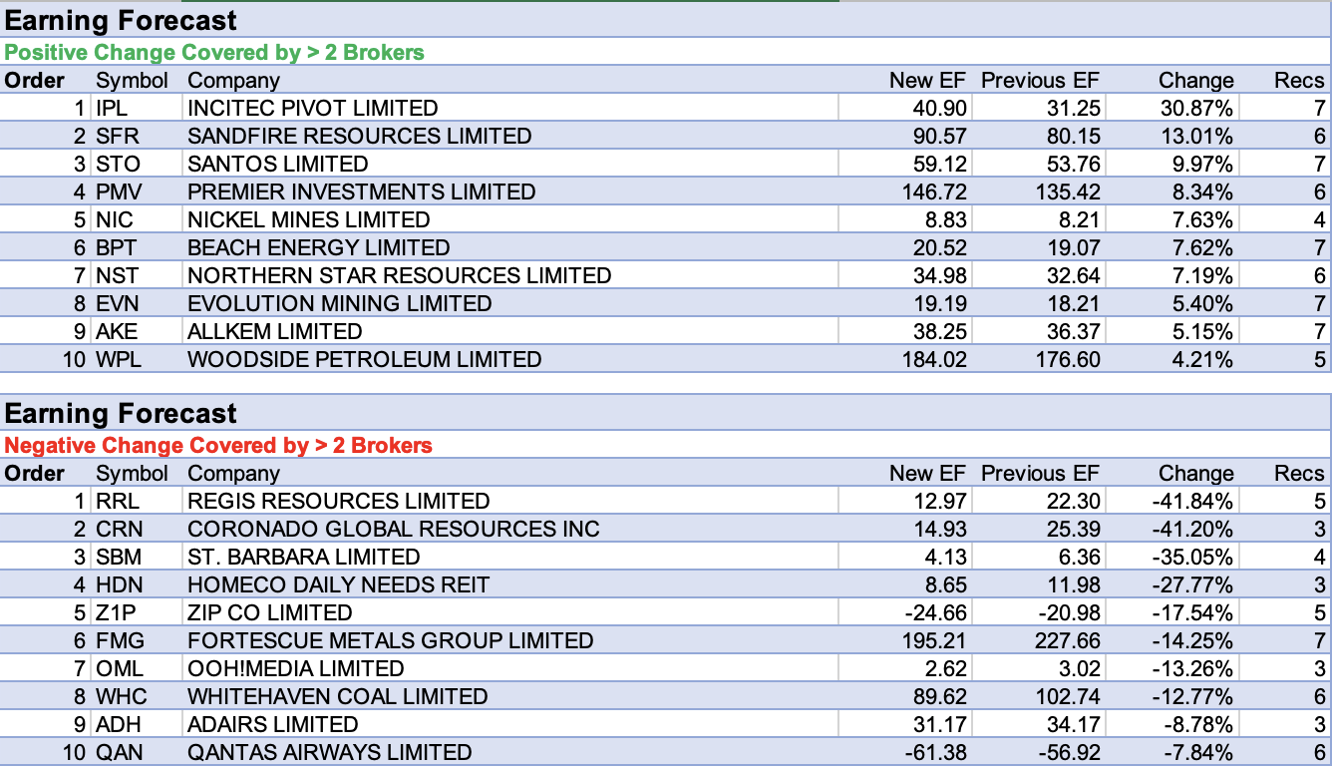

The largest percentage fall in target price was reserved for Regis Resources. The company also sat atop the table for the largest percentage decrease in forecast earnings by brokers, following downgraded production at the Rosemont open pit, resulting from a wall slip. This follows other geotechnical issues 18 months earlier.

Morgans lowered its target price to $2.00 from $3.03 and reduced its rating to Hold from Add. The broker believes negative sentiment will outlast the operational impact (six months) from issues at the Rosemont open pit, part of the Duketon Gold project. A guidance downgrade and delayed progress at McPhillamys also weighed.

Incitec Pivot received the largest percentage increase in forecast earnings. With fertiliser prices on the rise, UBS lifts its FY22 earnings estimate by 25%.

The broker believes management might be able to consider capital management options by the end of FY22 and raises its price target to $3.95 from $3.60.

Total Buy recommendations take up 57.57% of the total, versus 35.59% on Neutral/Hold, while Sell ratings account for the remaining 6.84%

In the good books

CHARTER HALL GROUP (CHC) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/3/0

Ord Minnett revises property share recommendations after the sector posted a -10.4% decline compared to the S&P/ASX200’s -6.5% fall in the first few weeks of 2022.

Rate fears and the associated expectation of higher long bond yields drove the fall but Ord Minnett believes fundamentals remain sound after the re-rating, that real-estate offers an inflation hedge, and that conditions support earnings growth.

The broker upgrades Charter Hall Group to Buy from Accumulate. Target price steady at $23.

CENTURIA CAPITAL GROUP (CNI) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 2/1/0

See Charter Hall Group above for Ord Minett’s comments on the sector. The broker upgrades Centuria Capital Group to Buy from Accumulate. Target price steady at $3.70.

DEXUS (DXS) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 4/2/0

See Charter Hall Group above for Ord Minett’s comments on the sector. The broker upgrades Dexus to Buy from Hold. Target price steady at $12.00.

EVOLUTION MINING LIMITED (EVN) was upgraded to Add from Hold by Morgans, B/H/S: 4/3/0

As Evolution mining’s share price fell hard on the release of 2Q production results, Morgans decides to upgrade its rating to Add from Hold, while lowering its target price to $4.21 from $4.54.

The market was rattled by concerns around the long-promised turnaround at Red Lake, believes the broker, as both tonnes and grades at the project were below the analyst’s expectations.

Management’s overall production guidance was reaffirmed, at the bottom end of the range.

HOTEL PROPERTY INVESTMENTS LIMITED (HPI) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 2/0/0

See Charter Hall Group above for Ord Minett’s comments on the sector. The broker upgrades Hotel Property Investments to Buy from Accumulate. Target price steady at $4.

NEARMAP LIMITED (NEA) was upgraded to Buy from Neutral by Citi, B/H/S: 2/1/0

Following Nearmap’s recent market update, Citi sees a buying opportunity (recent share price underperformance) as management guidance appears conservative. Thus, the rating lifts to Buy from Neutral. The target price falls to $2.10 from $2.20.

The analyst estimates FY22 will be the peak year for cash burn. This issue is believed to be one of the key investor concerns held by the wider market.

OZ MINERALS LIMITED (OZL) was upgraded to Buy from Neutral by Citi, B/H/S: 2/3/1

Following 4Q results, Citi assesses a solid 2021 from OZ Minerals, despite a higher medium-term cost outlook for Carrapateena. After a recent share price fall, the broker lifts its rating top Buy from Neutral and raises its target to $29.10 from $27.

The analyst likes the both the company’s growth options and low-risk asset locations though concedes the stock is not a free cash flow yield story, due to capex requirements.

See downgrade below.

PREMIER INVESTMENTS LIMITED (PMV) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/2/0

First half earnings (EBIT) guidance for Premier Investments was materially above the Credit Suisse’s forecast.

The broker lifts its rating to Outperform from Neutral in the belief the market is under-estimating the benefits of higher-margin online growth. The target price rises to $29.16 from $28.71.

FY23 gross margins will return towards pre-covid levels, estimates the analyst.

In the not-so-good books

3P LEARNING LIMITED (3PL) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 0/1/0

Incorporating the acquisition of Blake eLearning into 3P Learning’s outlook, Morgan Stanley expects a 60-70% revenue benefit to FY22 and FY23 forecasts. The deal will see a simplification of the company’s accounts, a positive for investors.

While the broker notes progress in execution it has issued a downgrade to the company’s rating given its premium compared to peers as 3P Learning nears a twelve-month trading high.

The rating is downgraded to Equal-weight from Overweight and the target price increases to $1.80 from $1.60. Industry view: In-Line.

ABACUS PROPERTY GROUP (ABP) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 1/2/0

See Charter Hall Group above for Ord Minett’s comments on the sector.The broker downgrades Abacus Property to Lighten from Hold. Target price rises to $3.30 from $3.20.

ANSARADA GROUP LIMITED (AND) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

A big increase in average revenue per account (ARPA) was the key highlight for Morgans when reviewing Ansarada Group’s better-than-expected 2Q result.

Despite strong business momentum, the share price is now on par with the broker’s unchanged $1.93 target price and the rating is decreased to Hold from Add.

COOPER ENERGY LIMITED (COE) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 1/2/2

Macquarie has downgraded Cooper Energy to Underperform from Neutral due to perceived poor risk/reward. Cooper benefits much less from higher oil prices than other small-medium gas peers, the broker notes.

Macquarie suggests it’s hard to see investors being adequately rewarded for the high operational risk (sour gas) and financial risks (levered balance sheet). Improved Orbost production won’t immediately solve balance sheet issues.

This implies required recapitalisation. The purchase of Orbost from APA Group ((APA)) could be strategically positive but would require major funding. Target falls to 24c from 28c. The broker prefers Santos (STO) in big caps and Karoon Gas (KAR) in small.

FORTESCUE METALS GROUP LIMITED (FMG) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 1/2/4

Credit Suisse downgrades Fortescue Metals Group to Underperform from Neutral, noting the company is trading at a significant premium to peers (whose valuations the broker considers to be stretched), and to reflect a -8% decline on December actuals and a weaker June half price realisation.

Target price rises to $14 from $13.50 to reflect stretched valuations but remains below the Fortescue share price

The broker notes spending on Fortescue Future Industries is rising and the broker spies a near-term thematic opportunity here but believes it is premature to ascribe value just yet.

GPT GROUP (GPT) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 0/6/0

See Charter Hall Group above for Ord Minett’s comments on the sector. The broker downgrades GPT Group to Hold from Accumulate, and switches favour to Dexus (DXS). Target price steady at $5.70.

MINCOR RESOURCES NL (MCR) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/0

Mincor Resources remains strongly funded to complete its return to producer status, Macquarie notes, which is forecast to occur in the June quarter FY22. Exploration results at Hartley and Golden Mile continue to present upside risk to the broker’s production scenario.

But the share price has run up 40% in two months, implying a lack of further upside. Hence a downgrade to Neutral from Outperform. Target rises to $1.70 from $1.55.

MINERAL RESOURCES LIMITED (MIN) was downgraded to Neutral from Buy by Citi and to Sell from Hold by Ord Minnett, B/H/S: 2/1/2

Following Mineral Resources’ 2Q production report, Citi lifts its target price to $61 from $57. Despite raising FY22 and FY23 spodumene price forecasts by 42% and 30%, the broker reduces its rating to Neutral from Buy after a recent share price rally.

The analyst expects lithium deficits in the coming few quarters.

Meanwhile, Citi points out low-grade iron ore discounts remained elevated.

Mineral Resources’ December-quarter production report disappointed Ord Minnett on several counts and the broker downgrades from Hold to Sell, noting the share price is trading 30% ahead of the broker’s target.

While iron ore production met expectations, the company reported average iron ore revenue was -43% below the average spot price and spodumene shipments missed the broker’s forecast by -8%.

Ord Minnett shaves its target price to $45 from $46.

OZ MINERALS LIMITED (OZL) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/3/1

OZ Minerals’ December quarter was weak, Macquarie suggests, with higher cash costs more than offsetting a mixed production result. Group guidance for 2022, and in the medium term, for Carrapateena, was weaker than the broker had expected.

Lower guidance and the removal of CentroGold from valuation has driven material cuts to earnings forecasts. Downgrade to Neutral from Outperform, target falls to $26 from $33.

See upgrade above.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.