For those investors who have stuck with term deposits, talk of interest rate increases might be welcome news. But don’t hold your breath – rates on term deposits are going to stay dismally low for a little bit longer.

That’s unless the Reserve Bank Governor, Dr Phillip Lowe, does something wholly unexpected following the meeting of The Bank’s Board on Tuesday. At 2.30pm AEDT, he is expected to announce the end of the Bank’s QE (quantitative easing) program – the purchase each week of $4bn of government securities.

He is not expected to announce an increase in the cash rate.

That might come as early as June (after the election), and then only from 0.1% pa to 0.25% pa, followed by another increase later in the year. Remember, he is on record as saying as recently as October last year that “it will not increase the cash rate … before 2024”. The 2024 reference was then dropped at the Board’s November meeting.

At the last Board meeting in December, Governor Lowe was still pretty strong about interest rates not going up. His statement concluded with the following:

“While inflation has picked up, it remains low in underlying terms. Inflation pressures are also less than they are in many other countries, not least because of the only modest wages growth in Australia. The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time and the Board is prepared to be patient.”

That was two months ago and the world has changed. We have seen higher inflation in the US, a higher than expected inflation result in Australia with the underlying rate hitting 2.6% (up from 2.1% at the end of the September quarter), and the US Federal Reserve saying that it will increase rates from March. Chairman Jerome Powell went on to say that: “I think there is quite a bit of room to raise interest rates without threatening the labour market.”

But despite the example of the hawkish tone of the Fed Chairman, it would be a massive call for Dr Lowe to walk away from his earlier statements, particularly the need to see wages growth that is “materially higher than it is currently”. The last reading (September quarter) showed wages growing at an annualised rate of a paltry 2.2%.

Westpac Chief Economist Bill Evans is on record saying that he expects a “gentle” 0.15% cash rate rise in August, followed by another 0.25% in October. This would take the cash rate to 0.50%. National Australia Bank sees “the first RBA rate hike occurring in November, with follow up hikes in December 2022 and February 2023. A likely move of 15bps followed by 25bp hikes at each of the next two meetings would take the target cash rate to 0.75% by February 2023”.

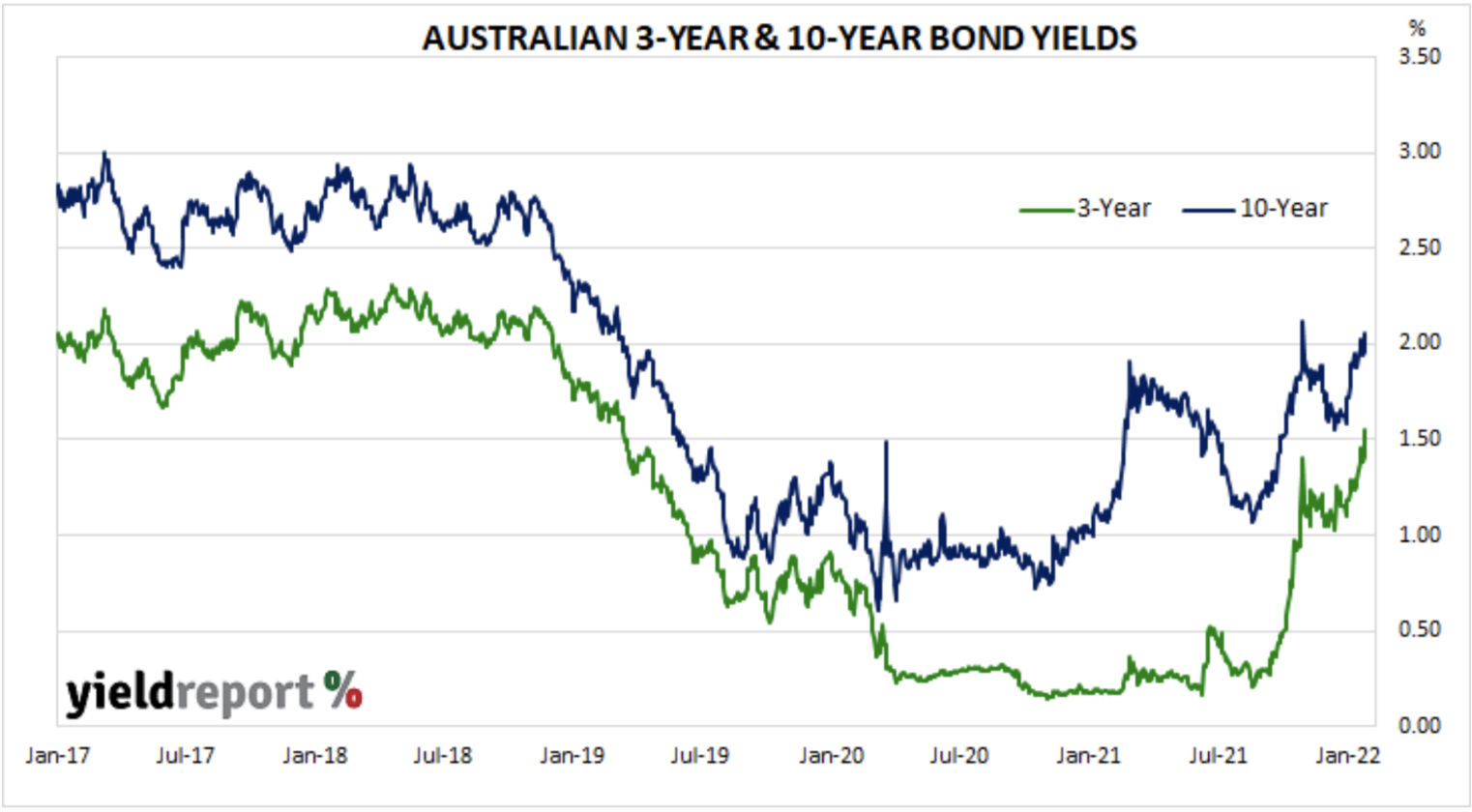

Apart from the cash rate, the other factors that affect term deposits rates are demand for funds by the banks (and competition), and the relative cost compared to funding in the wholesale and offshore markets. In regard to the latter, while swap rates have been moving higher, the spread to the government bond rate has been falling. The three-year government bond yields around 1.47%, and the swap rate around 1.67%.

On the demand side, although private credit growth grew by 6.6% in the year to November, the banks are awash with liquid funds and aren’t needing to pay up to get term deposits.

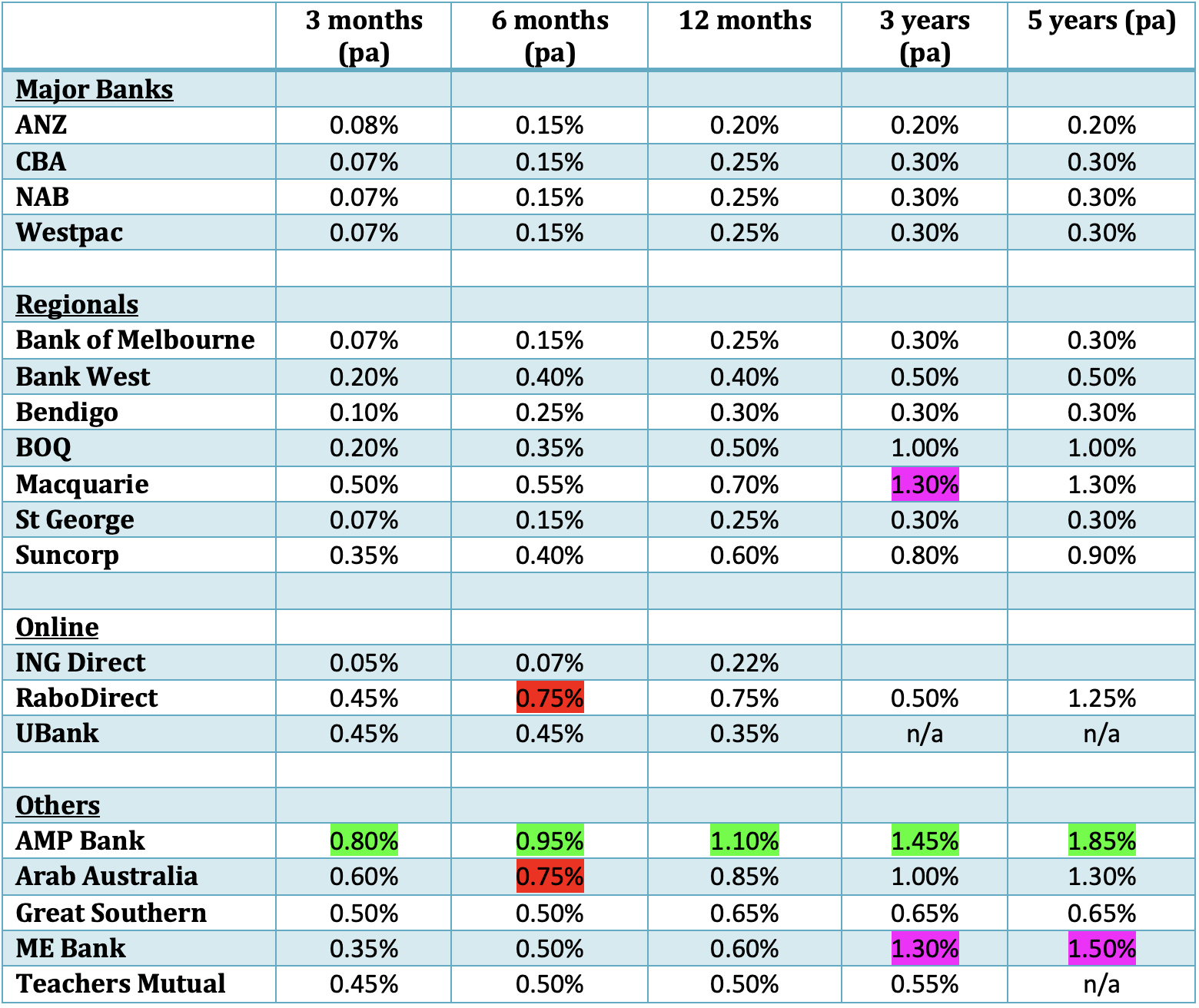

So in the short term, there is unlikely to be much upward pressure on term deposit rates. If the first RBA rate rise isn’t till August, there won’t be any major movement in 90 to 180 day TD rates. Longer-term deposit rates will rise in due course in line with the bond rate, but there is already huge variability on what is being paid in the market with the major banks only offering a paltry 0.30% for 5 years whereas one bank is paying 1.85% for the same term (see Table below).

My advice to investors who have funds maturing in the near term is to roll over for 6 to 9 months and play for a higher rate once the RBA has commenced its tightening cycle.

The best term deposit rates

With more than 140 ADIs (Authorised Deposit-taking Institutions) covered by the Government Guarantee on depositors’ funds, it can pay to shop around to secure the best rate. Don’t be put off by security concerns because with the effective Commonwealth Government guarantee on deposits of $250,000 on a per client per financial institution basis through the Financial Claims Scheme, Bank A is as good as Bank B up to $250,000.

Listed below are rates on offer for the popular terms of 3 months, 6 months, 1 year, 3 years and 5 years. Rates are current as of 31 January and are based on a deposit of $50,000 with interest paid on maturity or annually for terms of 3 or 5 years.

Rates are shown for the four major banks and 15 regional/significant/online/other banks. The major banks typically pay lower rates than the online banks and the regional banks.

AMP Bank is offering the best rates across all terms (highlighted in green). Macquarie and ME bank have attractive rates for 3 years, while ME bank also comes in second-best for a 5-year term (highlighted in pink). RaboDirect and Arab Bank are each offering 0.75% for six-month terms (red).

Some banks, such as UBank, reward loyalty by paying an additional 0.10% pa when an investor rolls over the full amount of a term deposit to a new deposit term.

Rates as at 31 January 2022 for deposits of $50,000 and upwards. Interest paid on maturity, or annually for 3- and 5-year terms. Advance notice (31 days) products selected when offered. Teachers Mutual is “customer” rate, members get an extra 0.05%.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.