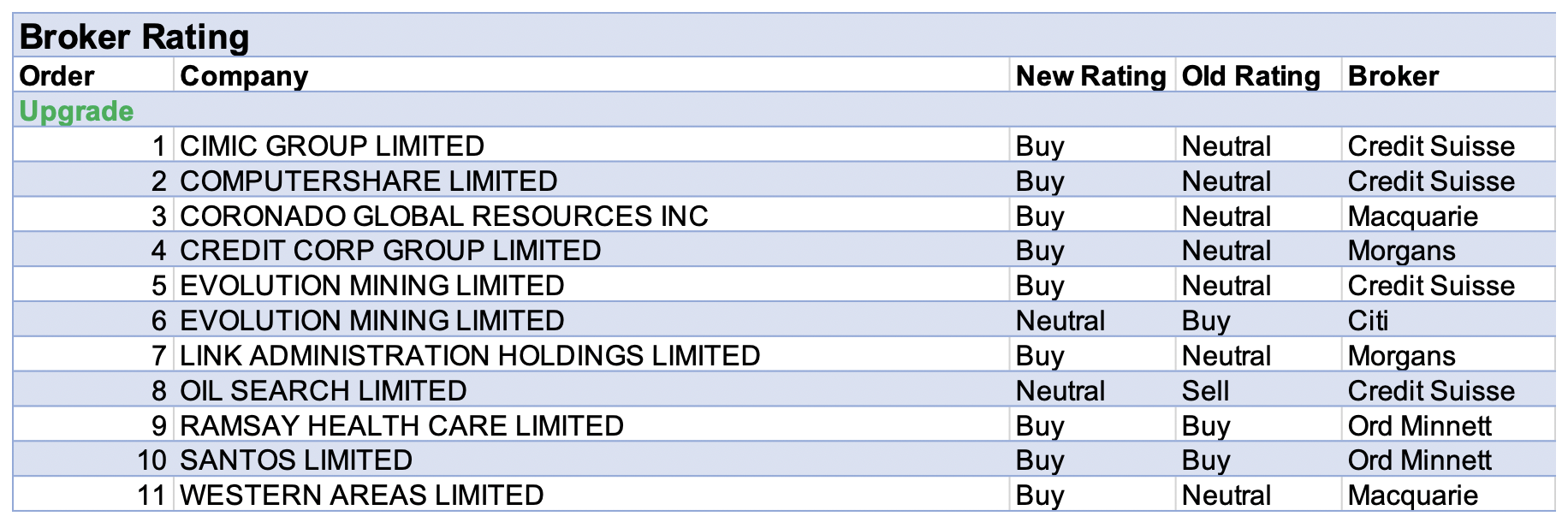

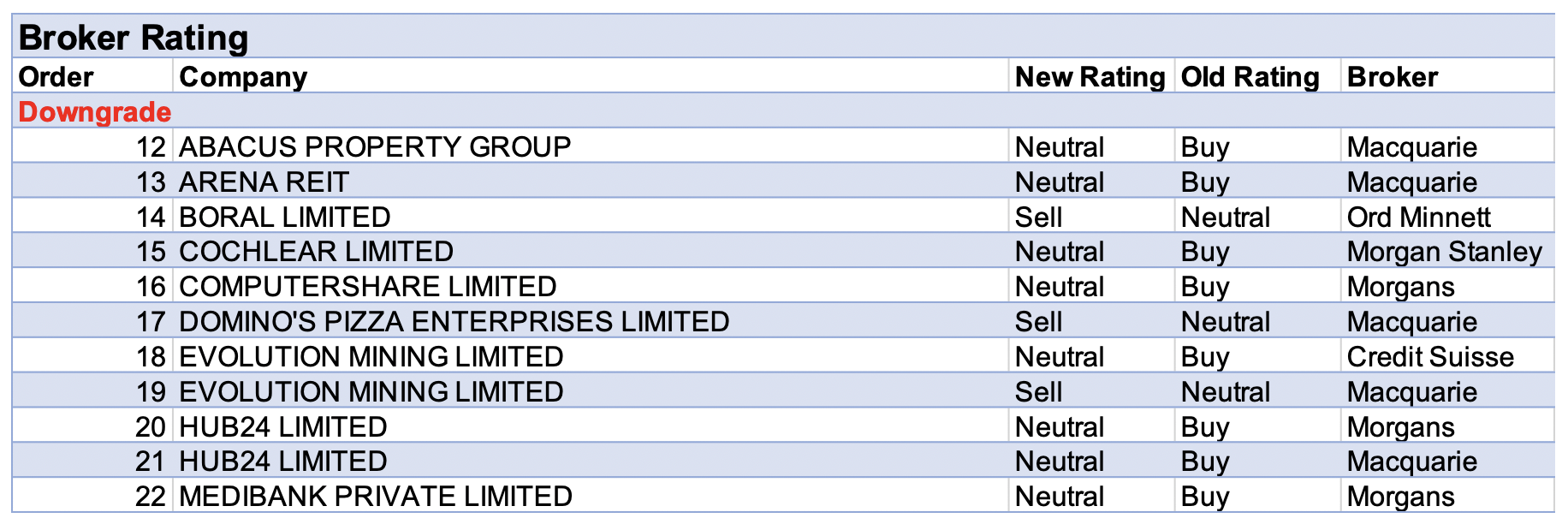

For the week ending Friday 23 July, there were 11 upgrades and 11 downgrades to ASX-listed companies by brokers in the FNArena database.

Interestingly, Evolution Mining received two rating upgrades from separate brokers and one rating downgrade from another. Credit Suisse upgraded the company to Outperform from Neutral believing the market has fully digested a disappointing multi-year outlook, and the company is set to successfully execute on its Red Lake/Cowal growth projects in a positive gold price environment. The broker was commenting after the acquisition of Northern Star’s Kundana assets for $400m, which was considered an attractive price, given the immediate synergies that will accrue.

Meanwhile, on the back of management’s fresh three-year production guidance, Citi lowered its FY21-22 earnings forecasts, yet increased forecasts for FY23-24, and then raised its rating to Neutral from Sell. Macquarie begged to differ, and lowered its rating to Underperform from Neutral, citing a materially more negative three-year outlook, with costs and capital expenditure higher than expected.

Hub24 also received ratings downgrades from two separate brokers in the FNArena database last week. With trading volumes now normalising, uncertainty around costs and the stock trading near Macquarie’s new target price of $25.75, the analyst downgraded the rating to Neutral from Outperform.

Morgans also lowered its rating to Hold from Add, on the potential for short term volatility after August 24 results, which may create a better entry point. Longer-term, the broker believes there will be scale efficiencies, a material market share increase and benefits from industry consolidation.

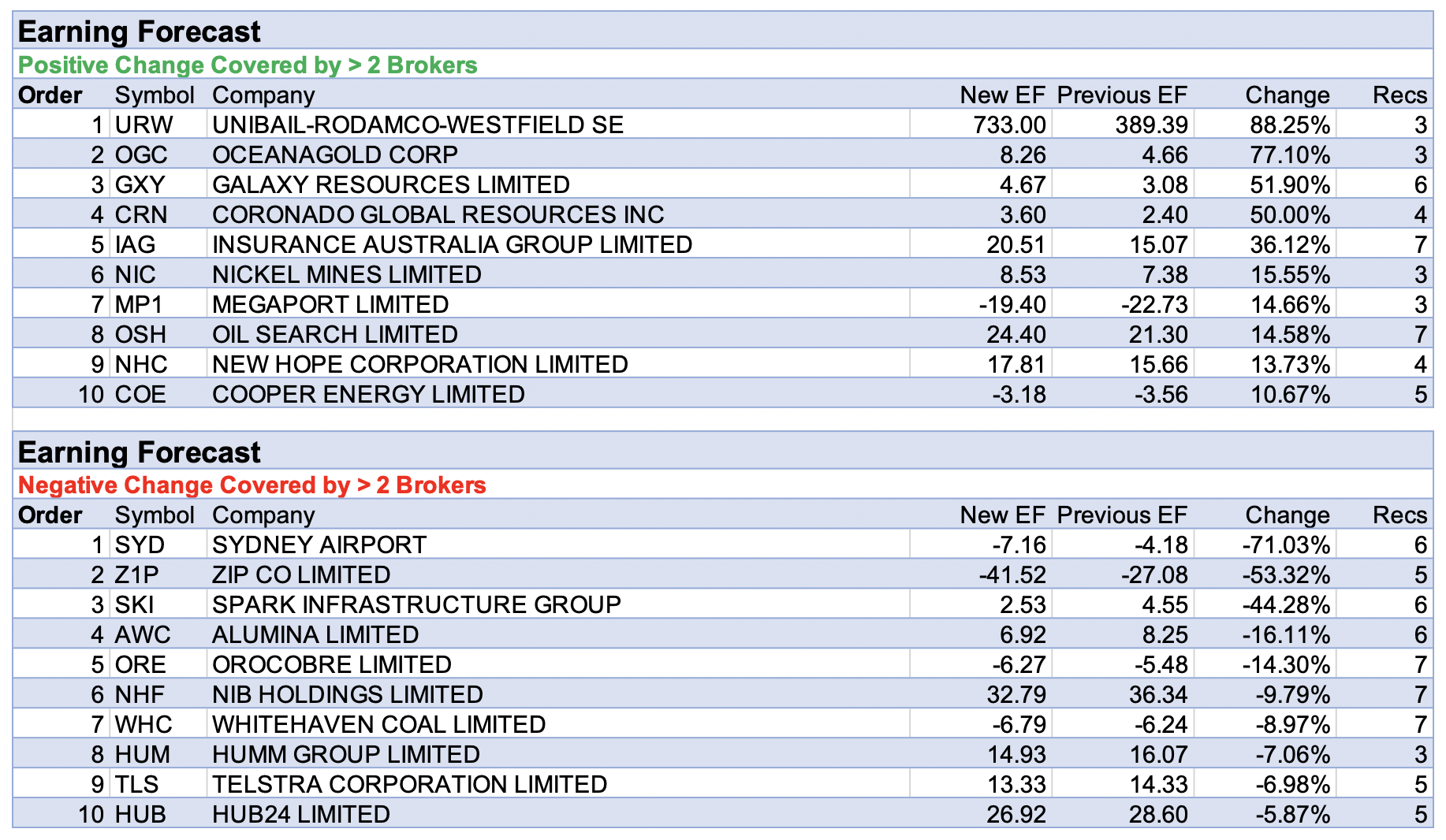

While takeover talks remain the main talking point, Sydney Airport had the largest percentage fall in earnings forecast by brokers in the FNArena database last week. Morgans downgraded after June passenger data was weaker than expected, impacted by recent lockdowns. Ord Minnett expects a broad-based recovery in domestic passenger numbers in 2022, by which time the majority of the population is expected to be vaccinated, while a recovery in international passengers is likely to be more prolonged.

Next up was Zip Co, after opinions varied across four different brokers following a fourth quarter trading update last week. Morgans homed in on slightly-reduced sequential revenue growth in A&NZ, as the introduction of ‘Tap and Zip’ resulted in a mix change. While increases in volume were strong, they were accompanied by declining average transaction values. Also, Ord Minnett increased cost estimates in the US, despite being generally happy with the performance of QuadPay.

As mentioned in last week’s article, a consortium has made a takeover approach for Spark Infrastructure Group. Ord Minnett feels management may come under pressure to engage though it doesn’t recommend investors buy the stock in anticipation of a higher bid price. The broker estimates there’s potentially around -14% downside to the consensus valuation and the offer price appears fair.

The table for the largest percentage rise in earnings forecast by brokers in the FNArena database was headed by OceanaGold. (It’s best to ignore Unibail-Rodamco-Westfield’s leading position on the table, due to an incorrect entry).

OceanaGold’s preliminary June quarter production and costs were in-line with Macquarie’s expectation. However, the broker now incorporates into its forecasts a one-off revenue boost of US$57m for the sale of copper concentrate, held at Didipio since 2019.

Regarding Galaxy Resources, Macquarie believes the merger with Orocobre, expected to complete on 25 August, presents a key catalyst for the company. Ord Minnett agrees, and sees a solid growth pipeline, optimisation options and a strong lithium market outlook for the merged entity. Separately, Morgan Stanley noted strong June quarter production with spodumene production 23% above estimates.

In the wake of June quarter results, Macquarie explained a rally in coal prices has driven earnings upside momentum for Coranado Global Resources, with earnings forecasts more than doubling in a spot price scenario. The broker lifted its rating to Outperform from Neutral. Credit Suisse also remains positive, and suggests potential further upside from US domestic contract prices (US$87/t for calendar year 2021). The next round of negotiations will start in the September quarter.

Finally, all seven brokers in the FNArena database had an opinion on Insurance Australia Group last week, which lifted forecast earnings. This came after the sale announcement of the group’s 49% stake in the Malaysian joint venture AmGeneral Holdings. A sale would take the group one step closer to exiting Asia, noted Macquarie, however, brokers generally agreed the sale price was a tad underwhelming. Despite this, Credit Suisse welcomes the additional capital, and believes some of it may find its way to shareholders via either a special dividend in FY22 or an on-market buyback.

In the good books

CIMIC GROUP LIMITED (CIM) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/1/0

First half results were below Credit Suisse forecasts at the revenue line while underlying net profit was in keeping with estimates. Improved trading conditions characterised the half-year with new work accelerating to above pre-pandemic levels. Project momentum appears to be building and the broker suspects this will continue into the second half. Yet, in NSW, while the state government committed to recommence construction activities from July 31, a two-week extension of the ban could further affect net profit by -$15-20m, the broker estimates. Credit Suisse upgrades to Outperform from Neutral and raises the target to $23.60 from $21.90.

COMPUTERSHARE LIMITED (CPU) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/3/1

Credit Suisse anticipates the Computershare share price could double in the next 3-5 years and upgrades to Outperform from Neutral. Earnings are expected to increase on the back of the CTS acquisition and associated synergies, as well as from higher margin income as cash rates are increased. Cost reductions are also expected amid modest organic growth. Higher interest rates are a major part of the broker’s investment view and yet, even without these, Credit Suisse finds a case for 10% growth in earnings per share per annum. Target is raised to $23.20 from $13.90.

CORONADO GLOBAL RESOURCES INC (CRN) was upgraded to Outperform from Neutral by Macquarie B/H/S: 4/0/0

Macquarie upgrades its rating to Outperform from Neutral and raises its target price to $1.20 from $0.80, after higher realised prices drove stronger second quarter revenue. The broker explains a rally in coal prices has driven earnings upside momentum, with earnings forecasts more than doubling in a spot price scenario. Metallurgical coal realised pricing of US$105/t was above the analyst’s expectations, as the Chinese premium paid for American coal continued and seaborne met coal prices from Australia recovered.

EVOLUTION MINING LIMITED (EVN) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/3/3

Evolution Mining has agreed to acquire Northern Star’s (NST) Kundana assets for $400m and cites proximity to the company’s existing Mungari mill as the primary rationale for the transaction. Credit Suisse observes that the $400m transaction price implies $166/oz of Resource or $691/oz of Reserve. The broker notes once the immediate synergies are considered, it becomes clear that $400m is an attractive price from Evolution’s perspective. With the disappointing multi-year outlook now fully digested by the market, Credit Suisse moves back to an Outperform rating from Neutral. The broker believes Evolution will successfully execute on its Red Lake/Cowal growth projects, and that this, overlaid with a positive gold price outlook, should drive positive returns to investors. The broker’s earnings per share estimates increase 10-13% following the acquisition. Target price increases to $4.70 from $4.45.

OIL SEARCH LIMITED (OSH) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 3/4/0

The Santos disclosure of a proposal to acquire Oil Search has meant merger prospects have eventuated. Credit Suisse observes the market is now pricing in a 4% premium to the offer. The broker envisages logic to the merger because of cost synergies, the alignment in PNG and a more diversified portfolio run by better regarded Santos management. The main risks, in the broker’s view, are that the board of Oil Search may not engage seriously, particularly if it has high value expectations and Santos may be reluctant to materially increase the offer. Credit Suisse upgrades to Neutral from Underperform on valuation grounds and as the M&A potential is now more tangible. Target is raised to $3.86 from $3.61.

RAMSAY HEALTH CARE LIMITED (RHC) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 3/3/0

Following a period of research restriction, Ord Minnett moves to a Buy recommendation from Accumulate, with a target price of $72.50, down from $73.50 previously. The broker cuts the FY22 EPS forecast by -7% to allow for the Australian lockdowns. Ord Minnett feels the company is unlikely to have given up on its Spire Healthcare offer, given its typically patient approach. As vaccination rates in the UK and France are close to world-leading, the analyst is hopeful for a period of elevated activity in the months ahead.

SANTOS LIMITED (STO) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 4/2/0

While the market’s focus will likely be on Santos’ approach to acquire Oil Search (OSH), Ord Minnett assesses a strong June-quarter production report, with all key metrics above expectations. Attributable production of 22.5mmboe was -9% below the previous quarter. Management increased both production and sales volume guidance for the full year to the top-end of its previous range. The broker raises its rating to Buy from Accumulate and lifts its target price to $8.15 from $8.10. The broker estimates Santos could pay up to 0.69x for Oil Search, albeit an acquisition is likely to be EPS-dilutive, given Oil Search’s assets are longer-dated.

WESTERN AREAS LIMITED (WSA) was upgraded to Outperform from Neutral by Macquarie B/H/S: 3/4/0

The Macquarie commodities team expects the nickel market to move into deficit, as a result of strong stainless steel demand, combined with a weaker supply response. Upgrades of 3-12% to quarterly nickel price forecasts by the broker over the next 18 months, translates to 4% and 8% upgrades to Macquarie’s 2021 and 2022 nickel price forecasts. Macquarie lifts the rating for Western Areas to Outperform from Neutral and increases its target price to $2.70 from $2.60, after lifting FY22 and FY23 by 69% and 20%.

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 1/2/1

Ord Minnett has downgraded Boral to Lighten from Hold. The broker believes there is risk for a share price correction once the current deadline for the $7.40 per share offer beckons on 29 July. Ord Minnett still is not a great believer in management’s transformation program. More selling could follow if/when the stock loses more of its index weighting, seen as another potential risk. Target price unchanged at $6.70.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

he above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.