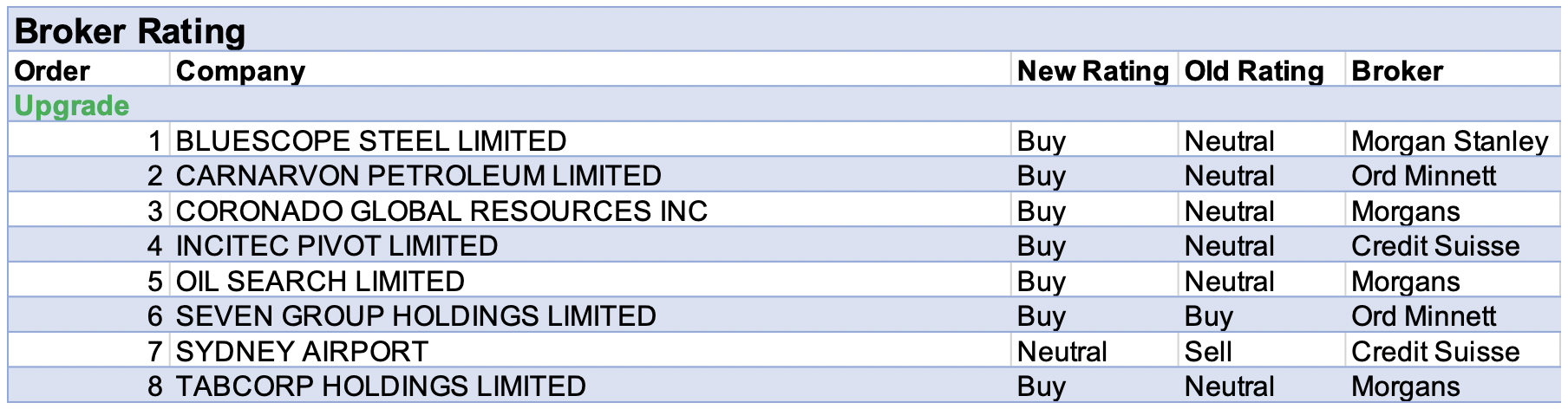

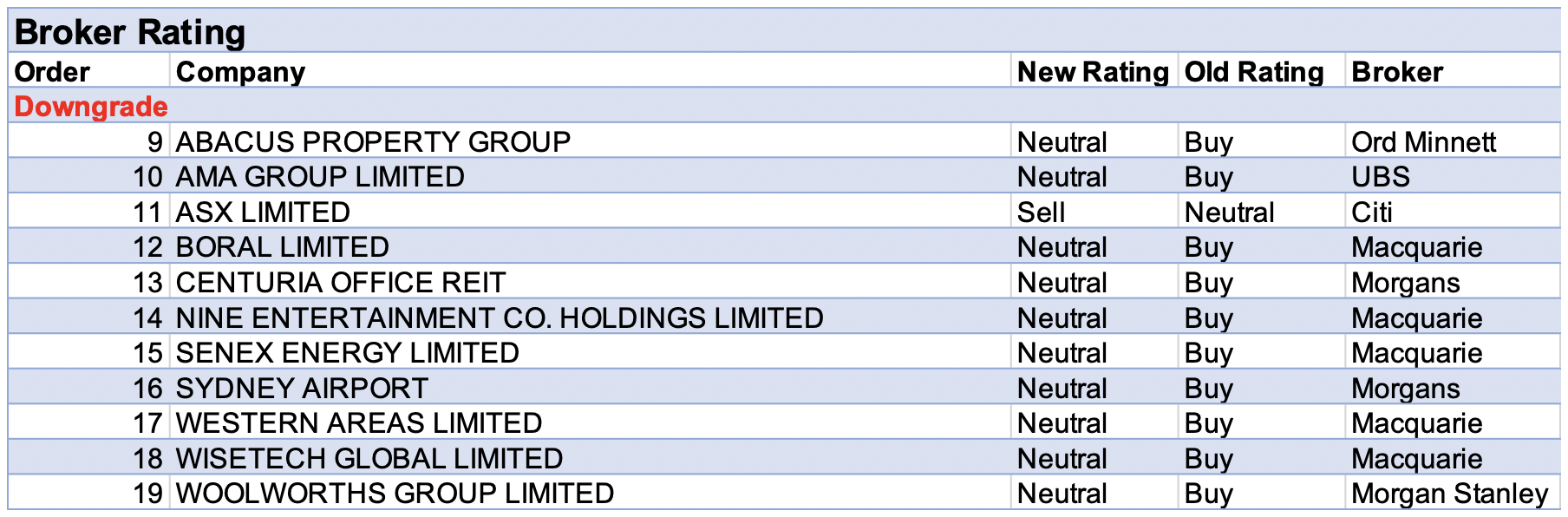

For the week ending Friday 9 July, there were 8 upgrades and 11 downgrades to ASX-listed companies by brokers in the FNArena database.

Crown Resorts had the largest negative percentage change in forecast earnings by brokers in the FNArena database last week. The broker expects revenue from the company’s domestic business in Melbourne and Perth to be trading above pre-covid levels by FY23. However, it’s believed that there will be a lag in underlying earnings, driven by higher costs and reduced VIP volumes.

While Sydney Airport came second on the table for percentage earnings downgrades, broker commentary centred on an indicative and non-binding $8.25 bid from a consortium of infrastructure investors. Morgans feels a higher bid may emerge, given the significant dry powder sitting in infrastructure funds globally that is looking for investment opportunities. Citi concurs and believes such a unique asset is likely to appeal to a range of infrastructure bidders.

Next was Western Areas, which posted a mixed June quarter production report, with nickel production 7% higher than Macquarie forecast though shipments were -5% lower. Given Flying Fox continues to underperform expectations, the ability to deliver a replacement source is now considered a key catalyst going forward. Based on the trend evident from the June quarter, the broker cuts earnings forecasts, and now expects the miner to report a small loss at its FY21 result release.

As mentioned last week, Morgans lowered FY21 earnings forecasts for Nanosonics to reflect an exchange rate adjustment to consumables. Despite this, the broker feels the investment in R&D is delivering, after the launch of a new digital platform, AuditPro. However, the analyst had already allowed for a second instrument-disinfection product in FY23 forecasts, so makes no adjustments in that period.

Finally, two additional brokers updated forecasts for Lendlease last week, after a trading update on July 1 revealed estimates for FY21 profit will be -13%-20% below consensus estimates. This was largely due to project delays and profit write-backs in London.

Morgan Stanley believes a review of the company’s profit recognition strategy is the first part of the new CEO’s reset. While volatility may result from re-prioritising 23 urbanisation projects and announcing plans to divest more non-core businesses, the broker feels a successful cost reduction program could be the remedy. Meanwhile, Macquarie suggests value is emerging though negative earnings momentum needs to be dealt with and visibility needs to improve. The broker suspects there could be more negative news before the market can focus on the medium-term growth outlook.

In the good books

In the not-so-good books

ABACUS PROPERTY GROUP (ABP) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 1/3/0

Abacus Property has acquired a $160m portfolio of self-storage assets in Sydney’s northern suburbs. Ord Minnett assumes the initial yield on the transaction is very tight, at around 3-3.5%, reflecting the premium locations. The acquisition is included in modelling and has meant Abacus Property has fully utilised its December capital raising. Ord Minnett downgrades to Hold from Accumulate, given the recent run up in the share price. Target is $3.20.

CENTURIA OFFICE REIT (COF) was downgraded to Hold from Add by Morgans B/H/S: 0/3/1

There were upward revaluations as at June 2021 14 of 22 properties, due to a mix of leasing outcomes and cap rate compression, explains Morgans. The portfolio is now valued at $2bn, with a weighted average cap rate of 5.81%. The REIT announced $405m in debt refinancing, increasing the weighted average debt expiry to 4.3 years. Given recent share price strength, the broker moves to a Hold rating from Add, with a revised price target of $2.49 from $2.33. The REIT is considered to offer an attractive distribution yield for income focused investors.

SENEX ENERGY LIMITED (SXY) was downgraded to Neutral from Outperform by Macquarie B/H/S: 4/2/0

Senex Energy’s share price has risen 123% since May 2020. Macquarie continues to see coal seam gas production expansion ahead but delivery will take time, so suggests for now investors may find better returns available elsewhere. The broker will continue to monitor valuation upside but on the re-rating has pulled back to Neutral from Outperform. Target unchanged at $3.85.

WESTERN AREAS LIMITED (WSA) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/5/0

Western Areas posted a mixed June quarter production report, with nickel production 7% higher than Macquarie forecast but shipments -5% lower. Given Flying Fox continues to underperform expectations, the ability to deliver a replacement source is now a key catalyst. The broker has cut forecasts on the June quarter trend and now expects the miner to report a small loss at its FY21 result release. Target falls to $2.60 from $2.70, downgrade to Neutral from Outperform.

WISETECH GLOBAL LIMITED (WTC) was downgraded to Neutral from Outperform by Macquarie B/H/S: 1/3/0

Factoring in the latest container volumes statistics, Macquarie lowers the FY21-23 EPS forecasts by -6%,-1% and -3%, respectively. With limited visibility on catalysts in the coming six months Macquarie downgrades to Neutral from Outperform, ahead of the company’s results. The broker lowers the target price to $33 from $34, adjusting for the weaker-than-expected container volumes. Longer-term drivers such as a rebound in roll-out global customer growth and Cargowise Neo are considered to remain intact.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.