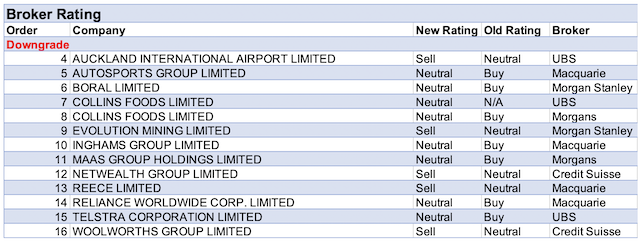

Two separate brokers downgraded the rating for Collins Foods. UBS continues to like the story though downgraded the rating to Neutral from Buy, given a few concerns including the recent share price rise and the current lockdowns during school holidays. Morgans decided to lower the rating to Hold from Add. Contributing to the downgrade was management’s guidance for a higher D&A expense. Additionally, the broker feels FY22 growth for KFC Australia will be more modest, after effectively delivering two years of growth in FY21.

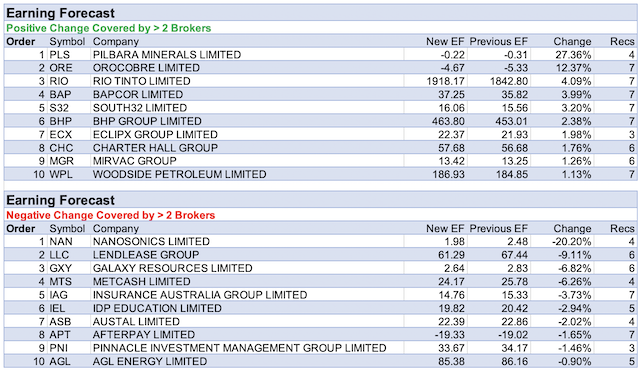

Credit Suisse lifted near-term lithium pricing forecasts, incorporating exponential lithium demand for EV batteries. This resulted in both Pilbara Minerals and Orocobre sitting atop the table for largest percentage increase in broker forecast earnings estimates in the FNArena database last week.

The broker notes lithium prices have risen sharply since February and doesn’t believe this is temporary. Pilbara Minerals remains Credit Suisse’s top pick in the sector for many reasons including management’s track record and a simpler hard rock resource.

Apart from the new lithium price forecast from Credit Suisse, Orocobre benefited from the agreed merger with Galaxy Resources, from which the broker sees ample value upside.

Nanosonics had the largest percentage fall in forecast earnings. Mind you, only one broker in Morgans updated research, and even then sounded slightly upbeat. The broker feels the company’s investment in R&D is delivering, after the launch a new digital platform, AuditPro. The analyst had already allowed for a second instrument-disinfection product in FY23 forecasts, so makes no adjustments. However, FY21 forecasts were lowered to reflect an exchange rate adjustment to consumables.

Finally, Lendlease was next in terms of a percentage fall in earnings by broker in the FNArena database. Long-suffering shareholders were told by management that estimates for FY21 profit will be -13%-20% below consensus estimates, due to project delays and profit write-backs in London.

Morgan Stanley describes near-term profitability as appearing to be murky, and suspects current consensus estimates will have to come down materially, to reflect the uncertain earnings in the near term. Credit Suisse is more sanguine. While still awaiting more detail, the broker doesn’t feel the company’s Construction and Investment segments are going to be materially worse than expected.

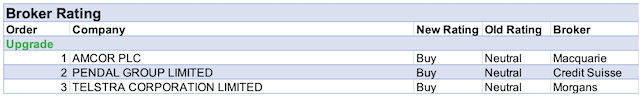

In the good books

AMCOR PLC (AMC) was upgraded to Outperform from Neutral by Macquarie B/H/S: 5/2/0

Macquarie is forecasting a solid FY21 result for Amcor, with the company guiding to a 14-15% earnings per share increase. The broker believes the growth cycle has peaked, meaning the company will be facing more volatility and lower equity returns in a slowing cycle. Despite this, Macquarie notes Amcor has generally performed well in a volatile market and continues to guide to a solid FY22 result. Macquarie has also highlighted Amcor has improved raw materials management, and attributes this to the company being more proactive regarding emerging markets. The rating is upgraded to Outperform and the target price increases to $16.56 from $16.42.

PENDAL GROUP LIMITED (PDL) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/1/0

As a sector, Credit Suisse estimates asset managers are trading at a -20% discount (near all-time lows) to the market and upgrades earnings by 1-2% on average. Sector flows have improved and are now less negative, but the price earnings discount has persisted. The broker upgrades Pendal Group to Outperform from Neutral, given it is trading at a P/E discount to three prominent peers, yet its flows are tracking better than all three. There’s considered scope for both a P/E re-rate and upside risk to earnings should flows further accelerate from this point, explains the analyst. The target price is raised to $8.90 from $7.90, and the stock is now Credit Suisse’s most preferred in the sector.

TELSTRA CORPORATION LIMITED (TLS) was upgraded to Add from Hold by Morgans B/H/S: 4/1/0

Telstra surprised Morgans with the early divestment of a 49% stake in its InfraCo towers business. Bids were due by December 2021 but the deal will be consummated in 1H22. It’s considered a good deal for shareholders as Telstra keeps control and a high price was attained. It also shows management is serious about taking steps to continue releasing value, points out the broker. The rating is upgraded to Add from Hold and the target price rises to $4.19 from $3.33. The company will use roughly 50% of the proceeds to pay down debt. The balance (around 11cps) will be returned to shareholders. The analyst has consistently said shares are worth circa $4.50 per share if the sum of the parts is able to be realised.

See downgrade below.

In the not-so-good books

AUCKLAND INTERNATIONAL AIRPORT LIMITED (AIA) Downgrade to Sell from Neutral by UBS B/H/S: 1/3/1

In light of the Auckland International Airport’s enterprise value having recovered to pre COVID-19 levels, and the unlikely return to unrestricted international travel before FY24, 12 months longer than market expectations, UBS has lowered the company’s rating to Sell from Neutral. The broker has pushed back the start of NZ border re-opening by 3 months to mid-2022, reflecting a slower-than-expected vaccine rollout. To reflect a slower-than-expected recovery in international passengers, UBS has lowered net profit forecasts by -54%, and -17% in FY23 and FY24, well below market consensus. UBS has incorporated an extended period of retail rental abatements, deferral of aeronautical PSE4 reset until FY24, and a substantial reduction in capital expenditure from pushing back the new domestic terminal and second runway. Price target is lowered to NZ$6.65 from NZ$7.30.

COLLINS FOODS LIMITED (CKF) was downgraded to Neutral from Buy by UBS B/H/S: 0/2/0

A strong first half result by Collins Foods beat UBS’s profit estimate by 8%, driven by impressive like-for-like sales in KFC Australia. However, the result was considered to not have benefited from as much potential 2H21 operating leverage, given the strong top line. The broker considers KFC Europe was challenging, however, post the Dutch acquisitions (8 stores), the business is well placed for the recovery over the next 12-24 months. The analyst continues to like the story though downgrades the rating to Neutral from Buy, given a few concerns including the recent share price rise and the current lockdowns during school holidays. The target price rises to $12.85 from $11.65.

NETWEALTH GROUP LIMITED (NWL) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 2/2/1

Following an around 25% appreciation in share price over the last quarter, Credit Suisse lowers Netwealth Group’s rating to Underperform from Neutral, solely on valuation grounds. The target price rises to $16 from $14.40. The company continues to attract significant flows and grow market share, and the broker expects this to continue.

TELSTRA CORPORATION LIMITED (TLS) was downgraded to Neutral from Buy by UBS B/H/S: 4/1/0

With the key catalysts to UBS’ Buy rating having played out through rational competition in mobile, the TowerCo sale, and no further dividend cut, the broker has lowered the rating on Telstra Corp to Neutral. Telstra plans to return half the proceeds to shareholders, invest -$75m in regional connectivity, with the remainder earmarked to pay down debt. Key upside risks noted by UBS include even more favourable mobile market conditions, 5G use case upside, further corporate activity around Telstra’s Infrastructure assets, and more cost initiatives. The TowerCo sale drives earnings per share upgrades of around 1%, and the price target increases to $3.90 from $3.70.

See upgrade above.

WOOLWORTHS GROUP LIMITED (WOW) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 1/2/1

Credit Suisse assesses Woolworths is trading at around a 36% fair value premium to Coles Group (COL). Furthermore, the combined market value of Woolworths and Endeavour Group (EDV) post demerger is around 4.5% higher than the June 23 closing price. The broker downgrades Woolworths to Underperform from Neutral on the basis of valuation. Trends in supermarkets/grocery expenditure are yet to normalise and Credit Suisse is forecasting trend growth of 8% in the fourth quarter of FY21 from a 2019 base. Target is unchanged at $32.92.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.