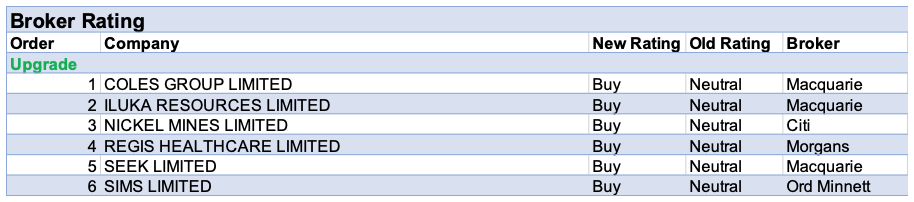

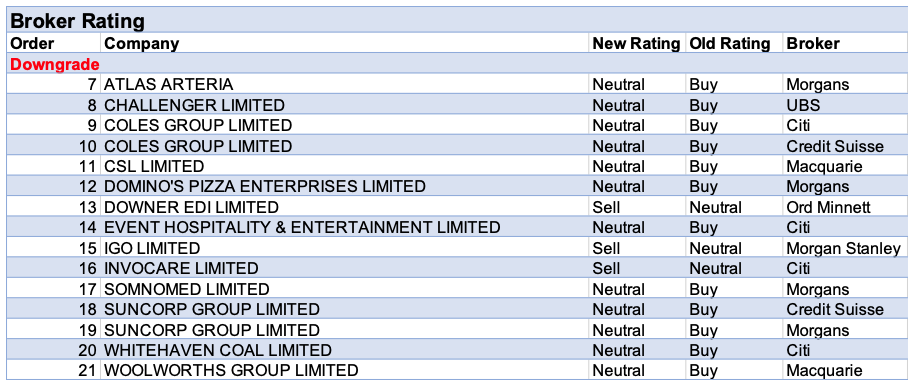

For the week ending Friday 18 June, there were 6 upgrades and 15 downgrades to ASX-listed companies by brokers in the FNArena database.

There were two downgrades to ratings by separate brokers for both Coles Group and Suncorp Group during the week.

Credit Suisse lowered its rating for Coles to Neutral from Outperform after a strong share price rally leading into a strategy update. Overall, the update was considered positive, despite the increase in depreciation guidance, which led to a reduction in the broker’s FY22/23 earnings forecasts. Citi downgraded earnings forecasts for the group by around -4% in FY22 and -8% in FY23, to account for the higher D&A and a step up in supply chain implementation opex in FY23. The rating was lowered to Neutral from Buy.

Macquarie took the opposing view by raising the rating for Coles to Outperform from Neutral. However, this was partly attributable to a timing issue, given the broker moved in anticipation of the strategy briefing. Nonetheless, the rating was held at Outperform after the briefing, partly due to the support from normalising consumer behaviour.

Following the Victorian storms and flooding, Suncorp will likely come in between $50m-$100m above its original FY21 natural hazard allowance. Morgans left forecasts unchanged, having already factored-in adverse events. However, the broker lowered the group’s rating to Hold from Add to reflect a strong share price rise over the last month. The share price also prompted Credit Suisse to downgrade to Neutral from Outperform.

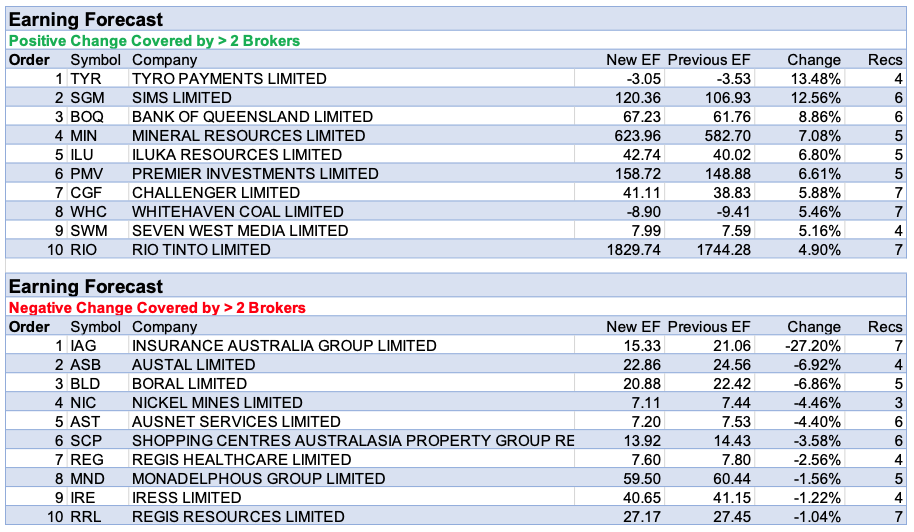

Tyro Payments had the largest percentage upgrade in earnings forecasts by brokers in the FNArena database last week. Morgan Stanley assesses the company is fighting back after its terminal outages caused havoc in January-February. The company is now considered better equipped than its competitors to deal with any future outage and this message appears to be resonating with small-medium enterprise merchants. The broker also sees potential from the deal with Bendigo & Adelaide Bank (BEN), with the rollout of hardware and software to the bank’s customers having just commenced.

Sims was next as earnings forecasts were upgraded after the company provided a strong FY21 earnings guidance update to $360-380m from $260-310m. As post-covid normalisation continues, Macquarie expects improvement should continue, given a better backdrop for scrap. Morgan Stanley cautions on how much of the trading upgrade is driven by inventory yet still raised FY21 earnings (EBIT) forecasts by around 20%. Meanwhile, Ord Minnett upgraded to Buy from Hold, believing scrap and zorba markets will remain strong in the short term.

Insurance Australia Group had the only material downgrade to earnings after six brokers in the FNArena database updated forecasts last week. Morgans lowered the FY21 EPS forecast by around -9% following the Victorian storms and flooding, as the group will likely come in between $50m-$100m above its original FY21 natural hazard allowance. Additionally, ongoing market share contraction in the group’s most profitable products leads Macquarie to believe the company may turn to M&A to fill the gap.

In the good books

NICKEL MINES LIMITED (NIC) was upgraded to Buy from Neutral by Citi B/H/S: 3/0/0

Nickel Mines Ltd has underperformed the London Metal Exchange nickel price by around 10% in the past six months. Citi highlights that expansion of nickel pig iron production in Indonesia has seen the company’s realised pricing average around 83% of the London Metal Exchange pricing over the last year. The broker reduces assumed realisation versus London Metal Exchange by 6% accordingly, reducing FY22 sales forecast by around 6%. Nickel Mines has also signed a memorandum of understanding with Shanghai Decent Investment to modify two RKEF lines to produce matte. Citi notes this is an imminent market challenge. The rating is upgraded to Buy and the target price decreases to $1.30 from $1.50.

In the not-so-good books

CHALLENGER LIMITED (CGF) was downgraded to Neutral from Buy by UBS B/H/S: 1/6/0

UBS considers an otherwise positive sales story at the investor day was offset by management lowering the long-term return on equity (ROE) target. It’s the second rebase in two years. The company re-affirmed FY21 profit (NPBT) guidance at the ‘lower end’ of $390-440m and provided a maiden FY22 guidance of $430-480m. UBS lowers the rating to Neutral from Buy and the target price to $5.80 from $7. This largely reflects the lower cost of equity (COE) spread margin outlook, and the path back towards the lower ROE target, explains the broker.

COLES GROUP LIMITED (COL) was downgraded to Neutral from Outperform by Credit Suisse and Downgrade to Neutral from Buy by Citi B/H/S: 3/4/0

Despite the increase in depreciation guidance which led to a reduction in FY22/23 earnings forecasts, Credit Suisse regards Coles Group’s strategy update, in which it reaffirmed a commitment to pressing ahead with investment as broadly positive. Commenting on the update, the broker notes Coles plans to accelerate e-commerce performance and maintain momentum on store renewals take on added importance. The broker believes lower population growth is likely to make market share an even more important differentiator of relative performance near term. Credit Suisse believes upgraded capital expenditure guidance enables all of those variables to be managed alongside peak expenditure in FY22 for warehouse automation. In the latest update, 60% of capital expenditure is being directed towards efficiency and growth initiatives. Given that Coles had a net cash position at the end of first half FY21, Credit Suisse notes funding is not a constraint. Despite higher reinvestment the broker has not materially changed outer year earnings forecasts. The broker downgrades Coles to Neutral from Outperform and lowers the price target to $17.16 from $18.19.

Coles’ capital expenditure to sales has risen to around 2.6%, compared to 2.0% pre-covid. Citi notes the company was under invested pre-covid compared to Woolworths, and implications of this and subsequent catch-up spend will be less severe if a rational market persists. Higher capital expenditure has been invested in supply chain and online improvements. Citi expects return on capital expenditure to be invested rather than flow to underlying earnings, and that expenditure will moderate at around $1.5bn by FY24. Earnings are downgraded for FY22 and FY23 by 4% and 8% respectively. The rating is downgraded to Neutral and the target price decreases to $17.20 from $18.00.

CSL LIMITED (CSL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 4/3/0

Foot traffic at CSL’s US collection centres continues to increase, but the pace has slowed somewhat from the burst in April/May, Macquarie notes. Consensus earnings forecasts have risen modestly, while CSL has outperformed the index by 7%. This implies a level PE multiple expansion that the broker finds stretched. On a forecast total shareholder return now of only 4.4%, Macquarie pulls back to Neutral from Outperform. Target unchanged at $312.

EVENT HOSPITALITY & ENTERTAINMENT LIMITED (EVT) was downgraded to Neutral from Buy by Citi B/H/S: 1/1/0

Citi has cited the weaker-than-expected Chinese box office performance during the Dragon Boat Festival as a driver of increased uncertainty around the sustainability of the cinema recovery. The broker predicts Event Hospitality & Entertainment’s cinema revenues will not recover to pre-covid levels by FY25. China’s box office revenue reached a seven-year low during the Dragon Boat Festival, down 40% on the 2019 festival. The rating is downgraded to Neutral and the target price increases to $12.80 from $12.25.

INVOCARE LIMITED (IVC) was downgraded to Sell from Neutral by Citi B/H/S: 1/3/2

InvoCare management have highlighted a road to recovery, but Citi notes it will be difficult, estimating the company have lost around 260 basis points market share between 2015 and 2020. This is despite the $455m spent on acquisition and capital expenditure during that time. The company has set a target of continued annual capital expenditure at around $35m going forward. Death rate remains below trend for 2021 to date, presenting a challenging near-term outlook. Citi downgraded earnings per share forecasts for FY21, F22 and FY23 by -29%, -13% and -15% respectively. The rating is downgraded to Sell and the target price decreases to $10.00 from $11.50.

SUNCORP GROUP LIMITED (SUN) was downgraded to Hold from Add by Morgans B/H/S: 3/4/0

Following the Victorian storms and flooding, the group will likely come in between $50m-$100m above its original FY21 natural hazard allowance. Morgans forecasts are unaltered, having previously catered for natural hazard costs $80m above allowances. The broker lowers the rating to Hold from Add to reflect a strong share price rise over the last month. The price target of $11.44 is unchanged.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.