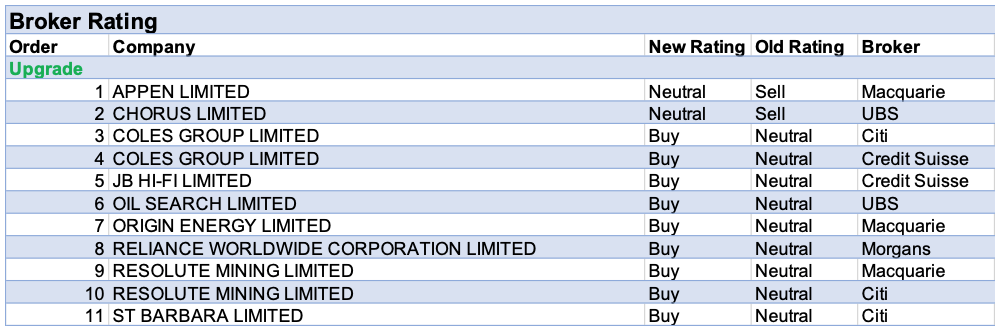

For the week ending Friday 30 April, there were 11 upgrades and 6 downgrades to ASX-listed companies by brokers in the FNArena database. Coles Group and Resolute Mining both received two upgrades to ratings from separate brokers.

In the wake of third quarter results there were signs of normalisation of consumer behaviour at Coles Group, despite weaker-than-expected sales. Citi believes there’s been an inflection point around market share and sales differentials, with the worst of the underperformance behind the retailer. Credit Suisse calculates the valuation is undemanding and notes e-commerce has accelerated in the March quarter.

Citi upgrades its rating for Resolute Mining to Buy from Neutral following life of mine guidance for Syama and Mako. This is believed to have reset expectations. Macquarie agrees and upgrades to Outperform from Neutral in the belief operational momentum at Syama sulphides has been regained.

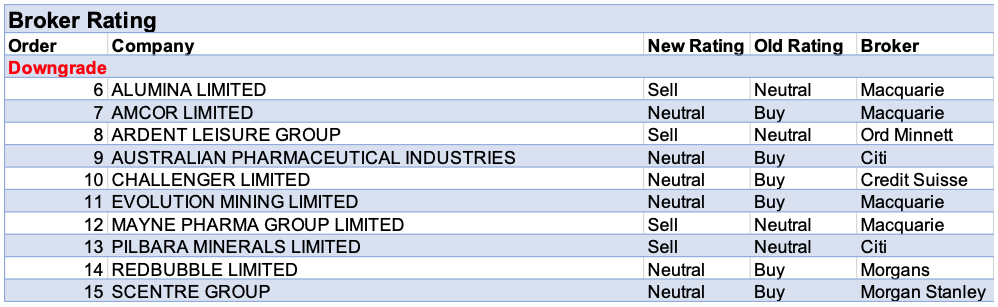

On the flipside, BlueScope Steel received downgrades to Neutral from Outperform from two brokers, despite a material upgrade to earnings guidance by management. Macquarie finds it hard to imagine the environment will become better from here, while Credit Suisse feels earnings are nearing a peak in relation to what can be achieved from the current asset base.

Megaport received the highest percentage upgrade to forecast earnings by brokers in the FNArena database. As mentioned in last week’s article, management confirmed guidance for 80m in FY21 revenue, which implies to Morgans a meaningful re-acceleration in fourth quarter sales. The broker feels this should awaken investor interest. Both UBS and Ord Minnett were less hopeful after reflecting upon third quarter results that were in-line and softer than expected, respectively, compared to in-house forecasts.

Karoon Energy was next after Morgans assessed a strong third quarter underlying field performance from the Bauna project, which could outperform expectations over the next 12 months. Morgan Stanley considers the company’s free cash flow yields from 2023 onwards are attractive. In the broker’s view, the company offers the most leverage to a rising oil price with circa 100% upside at almost US$65/bbl long-term Brent.

Audinate set a new quarterly revenue record, as mentioned last week, driven by the continued strength of chips, cards and modules. Looking forward, Morgan Stanley expects corporate to drive results and higher education to rebound.

All seven brokers in the FNArena database updated views on nib Holdings last week after the release of third quarter results. Policyholder growth is running ahead of expectations and the company guided to underlying operating profit 20% above consensus forecasts. However, a few brokers highlighted the one-off nature of the less than expected “catch-up” in treatment deferrals after the worst of covid-19 has passed.

March quarter metrics were positive for Sandfire Resources signalling the top end of FY21 guidance for copper production is within reach. Cost performance was also ahead of budget while gold production was 80% of the full year guidance.

St Barbara received the unenviable highest percentage downgrade to forecast earnings by brokers in the FNArena database. March quarter production was less than broker forecasts while costs were higher. Several brokers highlighted a very strong fourth quarter will be required to meet full year guidance that is looking increasingly stretched. Citi was the only upbeat broker and upgraded to Buy from Neutral on the basis of the recent share price fall.

Finally, Nickel Mines followed behind St Barbara in terms of earnings downgrades as first quarter results generally disappointed. The impact on cash margins was amplified by a decline in the realised nickel price. However, the company’s structural low-cost position should sustain margins and cash flow under a range of Credit Suisse’s nickel price scenarios.

In the good books

COLES GROUP LIMITED (COL) was upgraded to Buy from Neutral by Citi and to Outperform from Neutral by Credit Suisse B/H/S: 4/3/0

According to Citi, Coles Group has reached an inflection point around market share and sales differentials with the worst of the underperformance behind the retailer. While like-for-like sales growth should continue to be volatile due to covid, the broker believes a faster than expected fall in covid costs will act as a hedge to operating deleverage. Citi upgrades to Buy from Neutral with the target dropping to $18 from $19.

Credit Suisse observes early signs of sales stabilising and some normalisation of consumer shopping behaviour. This means greater frequency, increased Sunday shopping and a better performance at shopping centre stores. E-commerce also accelerated in the March quarter. The broker maintains a two-year cumulative growth rate of 8% for supermarkets, noting that inflation has now normalised to a two-year cumulative rate of around 1%. Valuation is undemanding and the broker upgrades to Outperform from Neutral. Target is reduced to $18.19 from $19.04

JB HI-FI LIMITED (JBH) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/5/1

The March quarter was surprisingly strong and Credit Suisse notes the CEO transition will be as smooth as could be expected as Richard Murray moves to Premier Investments (PMV) and is replaced by Terry Smart. The broker believes the market is underestimating the momentum that still exists in the household goods market. Risks are now sufficiently to the upside that the rating is upgraded to Outperform from Neutral. Credit Suisse upgrades FY21 estimates on the basis of a stronger March quarter sales result and also marginally increases fourth quarter sales forecasts. Target is raised to $57.39 from $57.03.

RESOLUTE MINING LIMITED (RSG) was upgraded to Outperform from Neutral by Macquarie and to Buy from Neutral by Citi B/H/S: 2/0/0

Resolute Mining’s March quarter production was -11% below Macquarie’s forecast and costs 8% higher. FY guidance has nonetheless been retained. Importantly for the broker, Resolute seems to have regained operational momentum at Syama sulphides, posting the highest production since 2016. The oxide operation is also expected to improve in the June quarter with an extension of the Tabakoroni pit. Target unchanged at 60c, rating upgraded to Outperform from Underperform on valuation.

Resolute Mining’s Gold output for the quarter was 85.7koz @ AISC US$1239/oz, a less productive period than the December 2020 (90koz @ US$1002/oz) but within 5% of Citi’s estimates on gold and costs. Resolute has reaffirmed CY21 guidance of 350-375koz @ US$1200-1275/oz. While only one quarter in, Citi expects 361koz @ US$1215/oz. Citi believes the valuation disconnect on Resolute Mining’s is due in part to Syama’s inconsistent operational performance, plus the company’s disputed US$70m Malian tax balance and now uncertainty over whether Bibiani can be divested. Following life of mine (LOM) guidance for Syama and Mako, which Citi believes has reset expectations (i.e Sulphide recoveries of 80%) the broker moves back to Buy from Neutral, but has trimmed the price target $0.70 from $0.75.

ST BARBARA LIMITED (SBM) was upgraded to Buy from Neutral by Citi B/H/S: 4/1/0

Citi upgrades St Barbara to Buy from Neutral with the target rising to $2.40 from $2.30. St Barbara’s March quarter gold production at 82.3koz missed Citi’s expectations by -19% while costs were 17% higher than expected. Gwalia mine’s production remained steady but was still -10% below Citi’s forecast led by lower milled grades. Impacted by covid, Simberi mine’s production fell to a 5-year low and costs increased considerably while Atlantic mine also delivered below expectations. On a risk-reward basis, Citi finds St Barbara more attractive following the recent -8% selloff and views the outlook for Gwalia, Australia’s deepest trucking mine, to be improving.

In the not-so-good books

PANORAMIC RESOURCES LIMITED (PAN) was downgraded to Hold from Add by Morgans B/H/S: 1/1/0

Morgans downgrades to Hold from Add. However, the target price is increased to $0.18 from $0.16, partly due to positive metal prices. Management announced the restart of the Savannah Nickel Mine with forecast costs of $6.36/lb payable nickel, compared to spot pricing over $10/lb. A US$45m loan facility with offtake partner Trafigura fills the funding gap without shareholder dilution, explains the broker. The analyst sees the use of contractors for mining (and the new equipment they bring) as a big positive for production.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.