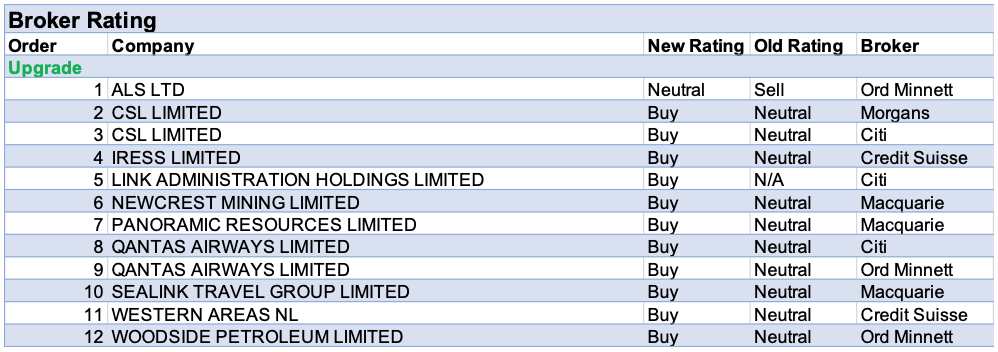

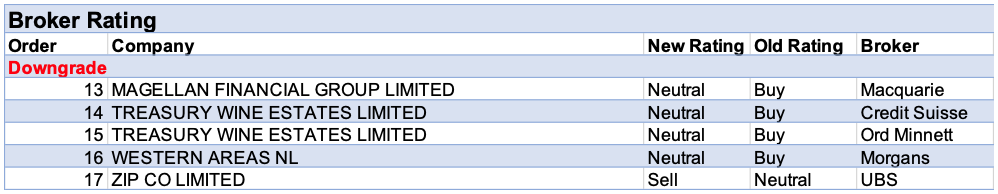

For the week ending Friday 12 March, there were 12 upgrades and 5 downgrades to ASX-listed companies covered by brokers in the FNArena database.

CSL and Qantas received two upgrades apiece to ratings by separate brokers, while Treasury Wine Estates had two downgrades.

Both Morgans and Citi homed in on the extended share price underperformance for CSL and identified the decline in plasma collections as the central concern to date. Citi believes this will normalise after the vaccine rollout while Morgans sees upside for Seqirus from the potential for a bad northern hemisphere flu season.

While both brokers agree that one billion of cost-out for Qantas is a distinct positive, Ord Minnett upgrades on the basis of a global recovery and Citi due to the increased border certainty from the Australian government’s targeted stimulus package.

Recent share price outperformance was integral to broker downgrades for Treasury Wine Estates. In addition, Credit Suisse cautions competition will intensify in Australia and Europe as grape supply previously destined for China competes in these markets.

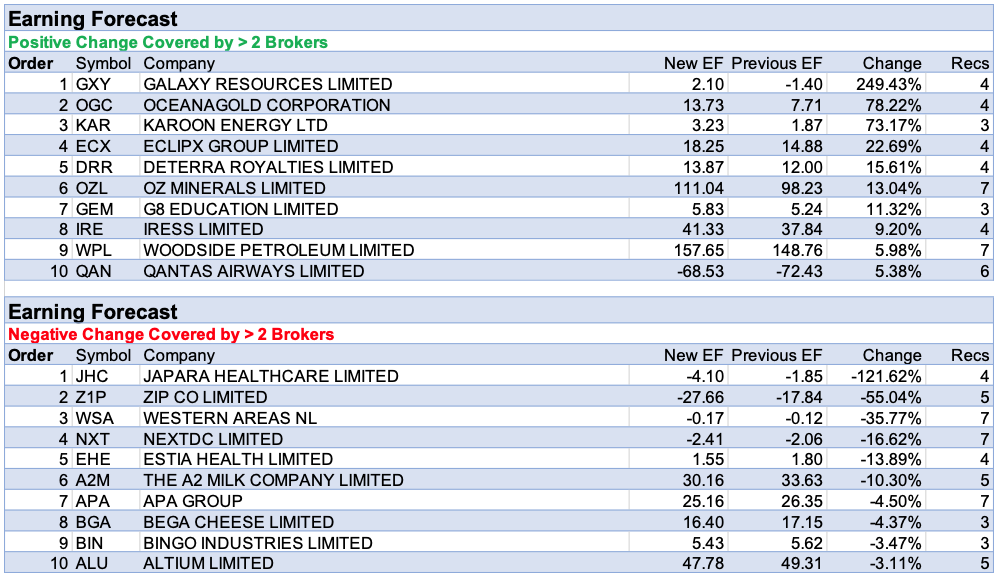

Galaxy Resources was atop the table for the largest percentage increase in earnings forecasts by brokers for the week, after an update on the James Bay lithium mine project in northern Quebec. The mine is expected to have a life of 18 years based on an average production rate of 330,000tpa.

Oceanagold was next after one broker, Macquarie, updated copper price forecasts in the short-term by 20% and 30% in the medium-term to incorporate energy transition-related demand. This improved outlook triggered 9-10% upgrades to earnings forecasts for the company over FY21-FY25.

As mentioned last week, earnings upgrades for Karoon Energy flowed from solid production and cash metrics which are expected to continue in FY21.

In a business update last week, Eclipx Group signalled a surge in end-of-lease income. Macquarie notes used car market conditions remain strong and higher prices have driven forecast earnings upgrades by more than 20% for FY21. However, three other brokers temper Macquarie’s enthusiasm by noting prevailing conditions are unsustainable and a reversion to mean is nigh.

Japara Healthcare suffered the largest percentage fall in forecast earnings for the week. In a review of the final report from the Royal Commission, UBS was underwhelmed by potential delays to much needed regulatory clarity until the FY22 Budget.

Zip Co was next on the table for forecast earnings downgrades after UBS reduced the rating to Sell from Neutral. While the broker remains positive about the short-term growth profile there are significant execution risks and capital requirements will continue to increase. In addition, higher bond rates may affect the cost of funding and valuation.

After six brokers assessed Western Areas in the wake of a $100m capital raise at $2.15 per share, the net result was a fall in forecast earnings. Morgans downgraded its rating to Hold from Add and now predicts more risk attached to production volumes at Forrestania than previously forecast. On the other hand, Credit Suisse considered the raise was prudent and upgraded the rating to Outperform from Neutral.

In the good books

CSL LIMITED (CSL) was upgraded to Add from Hold by Morgans B/H/S: 3/4/0

With underperformance in the shares, no structural concerns and technicals being supportive, Morgans believes the risk/reward is more attractive for CSL and upgrades the rating to Add from Hold. While identifying plasma collection as the main concern, the broker sees upside in Seqirus, on the potential for a bad northern hemisphere flu season. The recent flu respite may leave the population more vulnerable to more severe flu outbreaks over the medium/long term. Morgans makes no changes to forecasts or the price target of $301.10.

IRESS LIMITED (IRE) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/2/0

The share price has dropped to a level Credit Suisse considers compelling, upgrading to Outperform from Neutral. The broker concludes Iress has a defensible and recurring revenue base and there are several opportunities to drive modest earnings growth over time. The share price now offers a 2021 dividend yield of 5%, the broker notes, attractive in the current environment amid limited downside. Target is steady at $11. As the OneVue integration progresses, Credit Suisse believes the opportunity becomes even more attractive to investors.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was upgraded to Buy by Citi B/H/S: 1/2/0

Link Administration has been “re-initiated” at Citi, hidden in a post-February sector report, and involving an upgrade to Buy from No Rating with a $5.70 price target. On their own admission, Citi’s Buy rating is a non-consensus call and a lot seems to revolve around realised value from the equity stake in PEXA.

QANTAS AIRWAYS LIMITED (QAN) was upgraded to Buy from Neutral by Citi B/H/S: 4/1/1

With the increased border certainty from the government stimulus package, Citi upgrades to Buy from Neutral and increases the target to $6.14 from $5.47. However, a leisure led recovery is considered negative for mix, with only negligible impacts on profitability. Separately, the broker feels a -$1bn dollar cost out should be a key upside catalyst though previous transformation programs show the company struggled to hold onto past benefits.

WESTERN AREAS NL (WSA) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/3/0

Western Areas will raise $85-100m in new equity to support Odysseus. This consists of a fully underwritten placement and up to $15m in a share purchase plan. The capital raising has been motivated by balance sheet considerations, Credit Suisse notes, in order to have Odysseus fully funded from cash and debt and eliminating any future funding requirement from “at risk” cash flow from Forrestania. The broker considers the capital raising prudent and upgrades to Outperform from Neutral. Target is reduced to $2.45 from $2.60.

In the not-so-good books

TREASURY WINE ESTATES LIMITED (TWE) was downgraded to Hold from Accumulate by Ord Minnett and to Neutral from Outperform by Credit Suisse B/H/S: 0/6/1

Ord Minnett downgrades Treasury Wine Estates to Hold from Accumulate following strong share price outperformance since the first-half result, with the target price rising to $11.50 from $11. Treasury Wine Estates has entered into a long-term deal with The Wine Group to license some of Treasury’s commercial US wine brands, namely Beringer Main & Vine, Beringer Founders’ Estate, Coastal and Meridian for $100 million. Ord Minnett notes these form part of the more than -$300m identified by Treasury Wine in 2020 to be sold as the company refocuses on premium US wine brands from its cheaper offerings.

Treasury Wine has divested around -4.5m cases of commercial wine for around $100m, in line with its strategy of concentrating on premium wine. Credit Suisse points out the earnings changes are not material across the forecast horizon. The broker notes the share price has largely closed the valuation gap to peers and downgrades to Neutral from Outperform. Target is $11.30. Credit Suisse also assumes competition will intensify in Australia and Europe as grape supply previously destined for China competes in these markets.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.